Our Experts Have the Specific Experience You Need When Hiring a Transaction Advisor

Whether you are looking to expand horizontally or vertically, Kaufman Hall's M&A team brings its expertise from hundreds of transactions to help you understand, structure, negotiate, and optimize your opportunities.

Connect with Our Advisory Team dialog with form

All trademark rights reside with their respective owners.

Inclusion within this material does not imply the trademark owner’s affiliation with or endorsement of Kaufman, Hall & Associates, LLC.

How We Help

Our M&A team helps structure innovative transactions that address our clients' strategic initiatives, grow their business, facilitate entry into new markets, or enhance their product and service offerings.

Sell-side Services

Our sell-side approach pairs in-depth, deal-specific experience with an appreciation that each client's journey is unique. We recognize that each organization defines success differently. That's why the first question we always ask is, "What are your goals?"

We'll coordinate the solicitation process, develop key terms, coordinate due diligence, and lead negotiation of definitive agreements. Our deep and diverse experience in M&A and strategic partnerships sets us apart from our competitors and allows us to address any issue that arises and rigorously defend the interests of our clients. As appropriate, we also have access to numerous other Kaufman Hall executives whose expertise in other disciplines can inform the transaction decision.

Facilitated Partnerships

Our team has unparalleled business intelligence and insights in the healthcare space--enabling us to function as true thought partners with our clients. Working with our clients and their partners, we design and support a transaction process that focuses on development of business rationale, confirmation of strategic benefit, structuring of the transaction, and construction of the partnership agreements. In facilitated discussions, our team often acts as the lead, working collaboratively with the parties in the transaction to evaluate and successfully complete the partnership. At each step, our focus is your strategic interests, compatibility of cultures, and a vision for how the partnership will function.

Buy-side Services

We provide expert transaction advisory solutions specific to your needs as you seek to partner with or acquire another organization. We help our clients assess the strategic and financial impact of a potential opportunity and determine the right form and structure for a transaction, because we've been there before.

This approach empowers you to assess whether a potential partner is the right fit and enables you to make a competitive offer. Our tailored, client-based approach ensures we aggressively represent your best interests at all times.

Affiliations and Joint Ventures

Creative affiliations and joint ventures play a larger role in meeting the strategic needs and financial demands of healthcare organizations. Our tailored approach is to provide objective advice, the best possible information, and a strategic advantage in decision-making. And we can do this because we have deep experience in these types of deals. We combine M&A, financial and capital planning, and corporate finance advisory to bring a breadth of capabilities, expertience, and an unparalleled depth of healthcare industry knowledge to these transactions, giving our clients a leg up at the negotiation table.

Clients We Advise

We are the most active M&A advisor in the healthcare industry.

Our experience spans the healthcare industry, including hospitals and health systems, physician groups, specialty provider organizations, health plans, and private equity and venture capital firms. This unparalleled experience gives our clients an advantage when exploring and implementing strategic partnerships and M&A transactions.

Large Health Systems

We advise large health systems, including leading national organizations, regional organizations spanning multiple markets and states, and leading local health systems

Academic Medical Centers

We advise academic medical centers with multifaceted operations that often include the tripartite mission of delivering healthcare services, providing medical education and training, and leading clinical research.

Community Hospitals

We advise community hospitals ranging from multisite facilities to single hospital locations, including:

- Sole Community Providers

- Safety Net Hospitals

- Urban and Suburban Hospitals

- Rural Hospitals

- Critical Access Hospitals

Religious Sponsored Hospitals & Systems

We advise mission-driven, religious-sponsored hospitals & health systems operating across multiple regions or in a single facility or market.

Other Diverse Healthcare Service Providers and Sponsors

We advise a diverse array of organizations in the healthcare space, including:

- Physicians and Physician Groups

- Homecare, Hospice, and Post-Acute Services

- ASCs, Specialty, and Outpatient Surgery

- Laboratory and Diagnostic Services

- Health Plans and Managed Care Organizations

- Financial Sponsors and Lenders

Sectors We Serve

Our Experience: Our experience with physician groups ranges from primary care organizations to single-specialty practices to multispecialty and accountable care organizations and groups.

Understanding the Situation: We have extensive experience in structuring optimized partnership strategies that enable physician practices to generate new revenue, recruit and retain new providers, increase scale, and manage costs to compete more effectively and deliver the best care to patients.

Changes to traditional delivery models present new opportunities for multispecialty and specialty physician groups to use partnerships in achieving their strategic and financial goals.

Physicians and Physician Groups

An optimized partnership strategy can enable physician practices to generate new revenue, recruit/retain providers, increase scale, and manage costs to compete more effectively and deliver the best care to patients. Changes in the traditional model of healthcare delivery for physicians present new opportunities for multispecialty and specialty physician groups to use partnerships in achieving their strategic and financial goals.

Our experience with physician groups spans from primary-focused to single-specialty practices, as well as multispecialty and accountable care organizations and groups.

Homecare, Hospice and Post-Acute Services

Our Experience: We understand the unique dynamics of the post-acute sector and have the expertise and experience to develop optimal partnerships, including fully integrated solutions like buying or selling, as well as affiliations with strategic or financial partners.

Understanding the Situation: We understand the impact of major industry trends--including the shift to value-based payment models and growth in alternative on-premise and virtual sites of care and new care delivery models--on post-acute care. Our insights help shape how we partner with clients in this sector.

ASCs, Specialty and Outpatient Surgery

Our Experience: We have deep experience advising independent, physician-owned, and system-affiliated organizations on a broad range of strategic options and transaction structures.

Understanding the Situation: With this experience, we know that finding the right setting for elective surgeries is essential to delivering optimal clinical outcomes in a cost-effective manner across multiple specialties. We help our clients find the right option that is best for their patients and their organization's culture.

Laboratory and Diagnostic Services

Our Experience: We work with hospital-based and independent labs across the country to assess their market positions and determine the optimal transaction strategy.

Understanding the Situation: The clinical lab industry is increasingly challenged by escalating costs, disruptive innovation, and the need for scale. In-reach/outreach platforms launched at health systems across the country historically enjoyed healthy margins, but lower volumes, lower rates, and cost structure impacts threaten those margins. These trends will lead to continued consolidation and partnerships for laboratory and diagnostic services providers as organizations explore sales, partnerships, and other affiliations as a way to scale up and become more competitive.

Health Plans and Managed Care

Our Experience: We work with health plans and managed care organizations seeking to develop new products or expand into new markets. Our experience also includes provider partnerships that can enhance member offerings and growth to improve health outcomes and reduce costs.

Understanding the Situation: We factor in the ongoing shift to value-based care, as well as the ability to improve population health management through new and innovative risk-based partnerships.

Hospitals and Health Systems

Our Experience: We are the top strategic advisor to health systems seeking partnerships, mergers, acquisitions, and divestures. We lead large and often complicated mergers and combinations, developing acquisition growth strategies and advising on divestures of existing business units or service lines.

We are the most active advisor to community hospitals seeking to strengthen their market position through partnerships and M&A transactions--implementing growth strategies, organizing systems of care, structuring focused service line and business unit collaborations, and facilitating discussions with financial and strategic partners.

Understanding the Situation: Evolving delivery models, changes to the payment, regulatory, and policy environment, and the focus on delivering value while optimizing volume shape the transaction landscape and inform how our team crafts tailored strategies for our hospital and health system clients.

Our reputation is built on achieving exceptional outcomes for you.

Our strategic advisors are skilled in sell-side, buy-side, facilitated partnerships, provider affiliations, and joint ventures across the full range of organizations in the healthcare transaction landscape.

With our deep and diverse experience, we understand that each of our clients has unique goals and definitions of success and we center these at the start of all our relationships. With these factors at the forefront, we are able to craft the right approach to partnership for each and every one of our clients.

Why healthcare strategic partnerships fail: lessons from the deal table

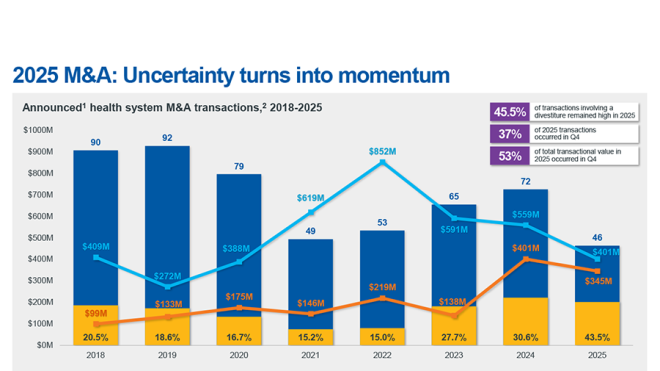

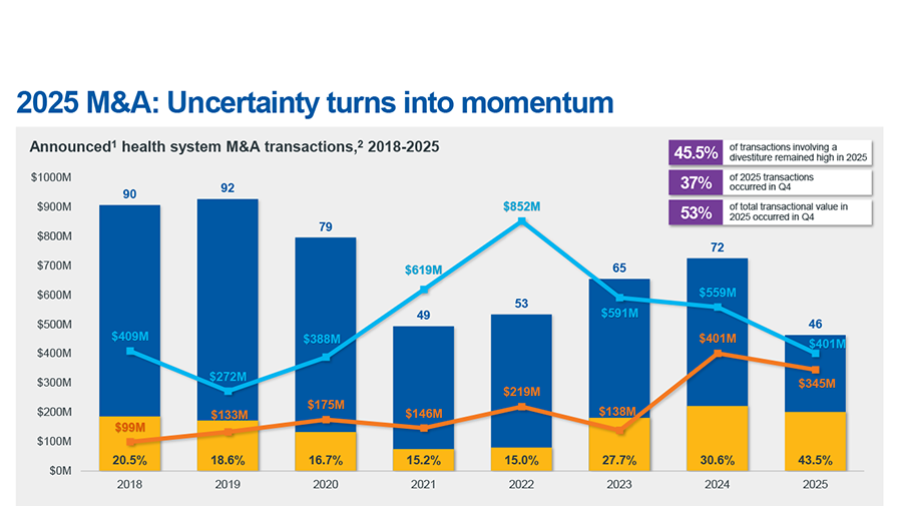

2025 M&A: From uncertainty to momentum

Hospital and health system M&A in review: Uncertainty transitions to continued momentum in 2025

Gist Weekly: December 19, 2025

We seek candidates who have an insatiable curiosity, high emotional intelligence, strong leadership skills, and a shared passion for doing what is right for every client. We value those who make us greater than the sum of our parts, and we recognize team members who consistently demonstrate our values.