Hospital and Health System Transactions

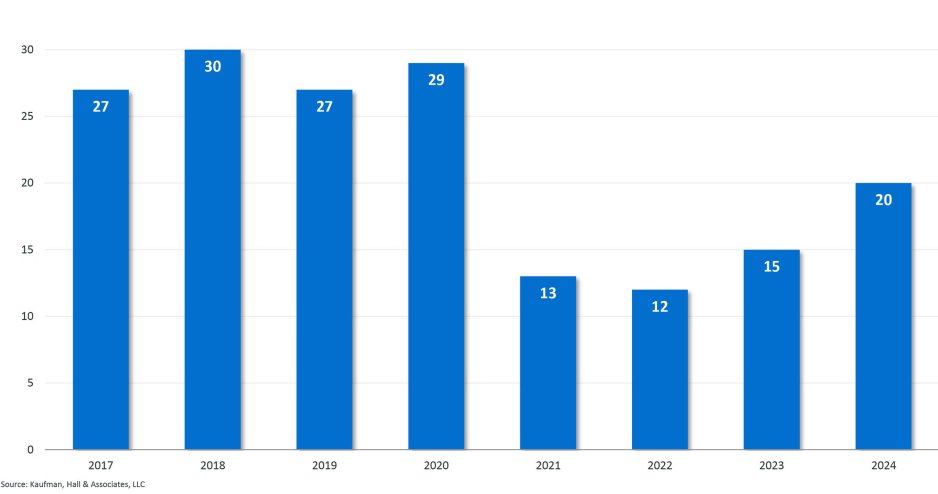

With 20 announced transactions, Q1 2024 showed a significant uptick in M&A activity and represents the strongest Q1 we have seen since 2020.

Of the 20 announced transactions, four were “mega mergers” (transactions in which the smaller party has annual revenues of $1 billion or more).[1] This is one of the highest numbers of mega mergers we have seen and contributed to average seller size and total transacted revenue figures that remain at historically high levels.

Academic health systems also had an active quarter, acting as the acquirer (or larger party) in six of the 20 announced transactions.

Overview of Q1 Activity

The 20 transactions announced in Q1 2024 continued a steady climb out of the slowdown in activity experienced during the Covid pandemic, significantly exceeding the number of transactions announced in Q1 of 2021, 2022, and 2023.

Figure 1: Number of Q1 Announced Transactions by Year, 2017 – 2024

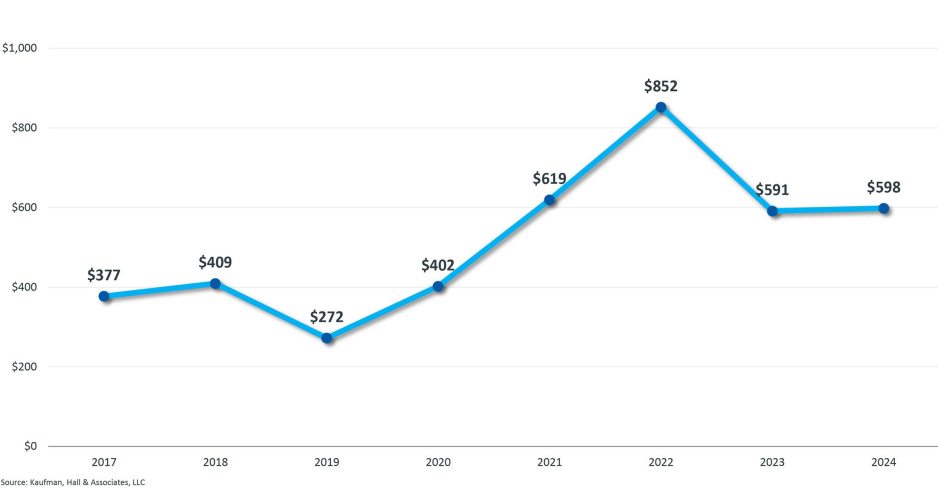

With four mega mergers among the 20 announced transactions, the average size of the seller (or smaller party) remained at a high level of $598 million, exceeding the year-end averages for every year since 2017 except for 2021 and 2022.

Figure 2: Average Seller Size ($s in Millions), Q1 2024 Compared with Year-End Averages 2017 – 2023

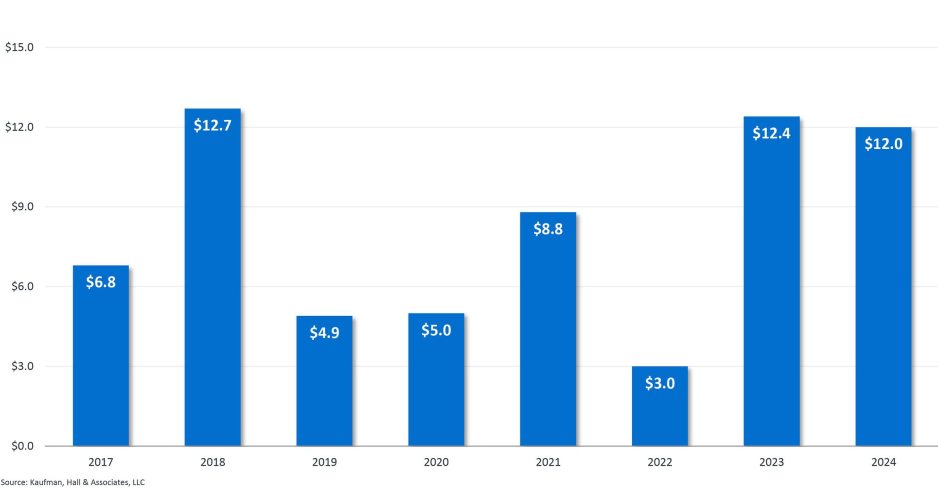

Total transacted revenue for the quarter also remained near historically high levels of $12 billion, reflecting the influence of both the four mega mergers and the higher number of transactions for the quarter. The Q1 2024 total was the third highest total since 2017.

Figure 3: Total Q1 Transacted Revenue ($s in Billions) by Year, 2017 – 2024

There was one transaction with a for-profit health system acquirer in Q1 2024. Of the remaining 19 transactions, academic or university-affiliated health systems were the acquirer in six, religiously affiliated health systems were the acquirer in two, governmental health systems were the acquirer in two, and other not-for-profit health systems were the acquirer in nine.

Q1 Transactions Show Variety, Continuation of Major Trends

There was a wide variety of transactions in Q1 and, while no theme was dominant, we saw a continuation of several trends in this quarter that we have been communicating in recent reports and evidence of emerging trends that we had predicted.

Cross-market transactions

The most notable example of a cross-market transaction was the announcement that Connecticut-based Nuvance Health plans to join New York-based Northwell Health, forming “a new integrated regional health system serving communities across two states.”[2] Combined, the system will have a network of 14,500 providers at more than 1,000 sites of care, including 28 hospitals.

Although the two health systems are in separate markets, they operate in nearby regional geographies. The transaction reflects a trend toward regional market development that we highlighted in our 2023 year-end report. This approach enables systems to diversify revenue sources and types with the ability to respond agilely and bring complementary resources and capabilities to a broader regional footprint.

Community health systems seek larger partners

In our 2023 year-end report, we predicted that 2024 would see continued movement toward partnerships by independent community health systems—including those that have historically maintained strong financial health—as market headwinds continue to reduce the margin of error for smaller organizations. Two examples of such transactions in Q1 2024 included St. Peter’s Healthcare System’s announcement of its plan to join Atlantic Health System and Evangelical Community Hospital’s announced plan to join WellSpan Health.

Immediate financial pressures were not the sole driver of these transactions; St. Peter’s, for example, received a rating upgrade from Moody’s Investors Service in September 2023. But both organizations pointed to trends affecting long-term independent viability in their transaction announcements. Evangelical Community Hospital President and CEO Kendra Aucker noted the “strong financial and workforce headwinds” the industry faces,[3] and Leslie D. Hirsch, President and CEO of St. Peter’s, said that “although St. Peter’s is stronger than ever, throughout this journey it has become clear that to assure our future success, we need a strategic partner whose resources, capabilities and values are aligned with our mission.”[4]

Portfolio realignment

Large health systems, both for-profit and not-for-profit, continued to realign their portfolios.

In two separate transactions, Tenet Health sold six hospitals and related operations in California.[5] Four of the hospitals, located in Los Angeles and Orange counties, were sold to UCI Health, and the other two, located in San Luis Obispo, were purchased by Adventist Health. Also this quarter, Tenet closed on its sale of three South Carolina hospitals to Novant Health, a transaction that was announced in Q4 2023.[6] In all cases, the sales involved high-quality assets in strong markets, with higher than recently observed market valuations. The transactions also all included contracts for revenue cycle management services from Conifer Health Solutions, a Tenet subsidiary. Tenet plans to use proceeds from the sales to improve its leverage position and, presumably, fund further growth in its United Surgical Partners International (USPI) chain of ambulatory surgery centers.

While Tenet was the most active system in portfolio realignment efforts, other large health systems selling hospitals and related operations in Q1 included Quorum Health (two divestitures), HCA Healthcare (one divestiture), CommonSpirit Health (divestiture of two hospitals in one transaction), and Ascension (two divestitures). In total, approximately 40% of the Q1 2024 transactions involved portfolio realignments.

A new partnership model

Our 2023 year-end report also predicted a new wave of creative partnership models, and in January, the first signs of that wave appeared with the announcement that Akron, Ohio-based Summa Health would be acquired by General Catalyst’s Health Assurance Transformation Company (HATCo). Under the model, Summa will become a for-profit, wholly owned subsidiary of HATCo, while a new community foundation will be created to advance Summa’s mission to improve the health of its region.

General Catalyst formed HATCo in October 2023. One of the announced three focuses for HATCo was “to acquire and operate a health system for the long term” to demonstrate a blueprint for transformation of the healthcare delivery system. HATCo’s planned acquisition of Summa Health is intended to help create that blueprint.[7]

Academic health systems build community networks

In a trend we last commented on in our Q3 2023 report, academic health systems were again active in Q1 2024 as they continued to develop networks of community-based hospitals. Academics were the acquirers in approximately 30% of this quarter’s announced transactions. As we noted in 2023, academic health systems have continued to see high occupancy rates, and developing a network of high-quality community hospitals enables the academic flagship to shift treatment of lower acuity patients to the community setting. This can alleviate occupancy pressures at the academic flagship, while providing expanded opportunities for residency programs, clinical research trials, and access to tertiary and quaternary services in the community hospitals.

Looking Forward

There are signs in the Kaufman Hall National Hospital Flash Report that industry performance may be stabilizing. At the same time, a recent analysis by our colleagues Ken Kaufman and Erik Swanson of the “numbers behind the numbers” in our Flash Reports showed that 40% of American hospitals continued to lose money into 2024. Stability, in other words, may not be enough to ensure long-term sustainability, and we anticipate that continued financial headwinds will be a significant factor in M&A activity going forward.

Select Transactions in Which Kaufman Hall Served as an Advisor:

Co-contributors:

Anu Singh, Managing Director and Mergers & Acquisitions Practice Leader, asingh@kaufmanhall.com

Nick Bidwell, Managing Director, nbidwell@kaufmanhall.com

Kris Blohm, Managing Director, kblohm@kaufmanhall.com

Nick Gialessas, Managing Director, ngialessas@kaufmanhall.com

Nora Kelly, Managing Director, nkelly@kaufmanhall.com

Eb LeMaster, Managing Director, elemaster@kaufmanhall.com

Courtney Midanek, Managing Director, cmidanek@kaufmanhall.com

Chris Peltola, Senior Vice President, cpeltola@kaufmanhall.com

Rob Gialessas, Vice President, rgialessas@kaufmanhall.com

Media Inquiries: Please contact Haydn Bush at hbush@kaufmanhall.com.

[1] Our mega merger count includes Tenet Health’s sale of four California hospitals to UCI Health, which Tenet notes “generated revenues of approximately $1 billion” in 2023, right at the mega merger threshold. Tenet Health: “Tenet Advances Portfolio Transformation and Previews Strong 2023 Results.” Press release, Feb. 1, 2024. https://investor.tenethealth.com/press-releases/press-release-details/2024/Tenet-Advances-Portfolio-Transformation-and-Previews-Strong-2023-Results/default.aspx

[2] Northwell Health: “Nuvance Health to Join Northwell Health.” Press release, Feb. 28, 2024. https://www.northwell.edu/news/the-latest/nuvance-health-to-join-northwell-health

[3] WellSpan Health: “WellSpan Health and Evangelical Community Hospital Announce Definitive Agreement to Combine Health Systems.” Press release, Feb. 26, 2024. https://www.wellspan.org/news/story/wellspan-health-and-evangelical-community-hospital-announce-definitive-agreement-to-combine-health-systems/N13174

[4] St. Peter’s Healthcare System: “Atlantic Health System and St. Peter’s Healthcare System Announce Plans to Seek Partnership.” Press release, Jan. 31, 2024. https://www.saintpetershcs.com/news/2024/atlantic-health-s-and-saint-peter%E2%80%99s-announce-plans-to-seek-partnership

[5] Tenet Healthcare Corporation: “Tenet Completes Sale of Six Hospitals in California.” Press release, April 1, 2024. https://investor.tenethealth.com/press-releases/press-release-details/2024/Tenet-Completes-Sale-of-Six-Hospitals-in-California/default.aspx

[6] Tenet Healthcare Corporation: “Tenet Advances Portfolio Transformation and Previews Strong 2023 Results.” Feb. 1, 2024.

[7] General Catalyst: “Our Acquisition of Summa Health: Coming Together to Transform Healthcare.” Announcement, Jan. 17, 2024. https://www.generalcatalyst.com/perspectives/our-acquisition-of-summa-health