Hospital and Health System Transactions

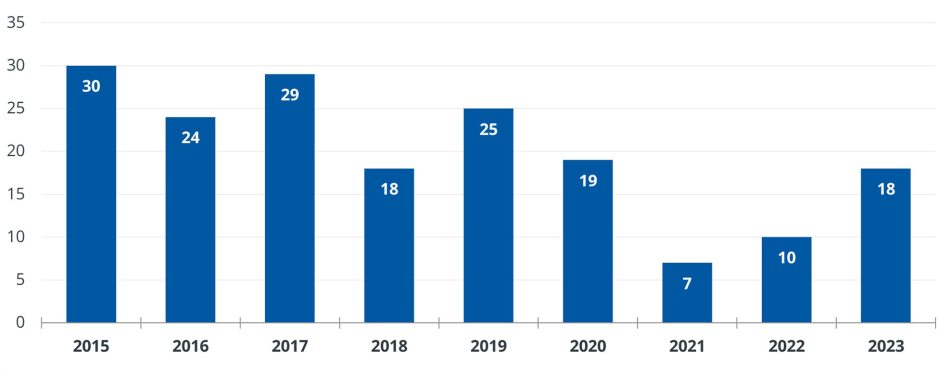

Announced transaction activity remained high in Q3 2023, continuing this year’s trend of activity returning to pre-pandemic levels. Eighteen transactions were announced, well above the seven transactions announced in Q3 2021 and the 10 transactions announced in Q3 2022.

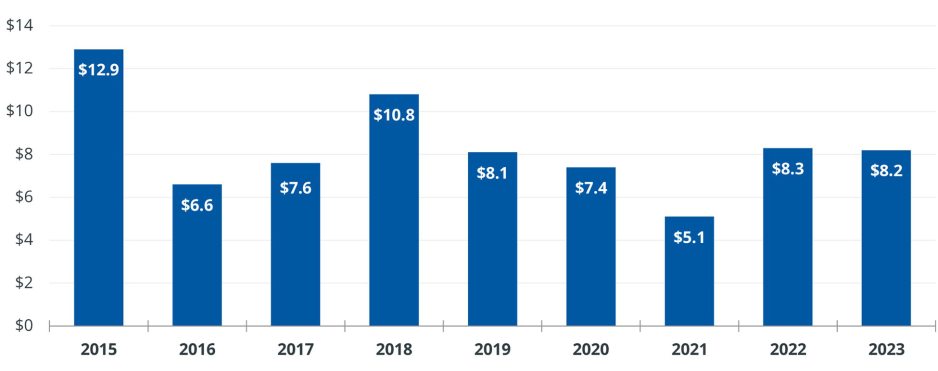

With only one “mega merger” transaction (a transaction in which the smaller party has annual revenues above $1 billion),[1] both average size of the seller (or smaller party) and total transacted revenue were below recent quarters, when a smaller number of total transactions and a higher percentage of mega mergers drove these metrics up. However, the Q3 figures remain well above historical levels.

The financial challenges of the last two years were apparent in one striking metric for Q3: over one-third of the announced transactions involved a party for which financial distress was cited as a driver for the transaction, also well above historical benchmarks.

Overview of Q3 Activity

The 18 announced transactions in Q3 were significantly above the numbers for Q3 2021 and 2022 and at par with the number of transactions announced in Q3 of 2018 and 2020. Throughout the year, we have seen transaction activity regaining momentum, a trend we anticipated in our 2022 year-end report.

Figure 1: Number of Q3 Announced Transactions, by Year

Source: Kaufman, Hall & Associates, LLC

The average size of the seller or smaller party, as measured by annual revenues, was $453 million. This was closer to—but still above—pre-pandemic historical year-end averages, which ranged from $272 million to $409 million from 2017 through 2019.

Figure 2: Average Seller Size by Revenue ($ in Millions), Q3 2023 Compared with Year-end Averages

Source: Kaufman, Hall & Associates, LLC

Total transacted revenue was $8.2 billion, which is on the higher side of recent historical numbers for Q3. This figure was down significantly from Q2 2023, which had $13.3 billion in total transacted revenue, driven primarily by the three announced mega mergers in Q2, compared to just one in Q3. When removing the mega mergers from each quarter, the average revenue in Q3 was actually significantly higher than that of Q2, at $243 million and $159 million respectively, demonstrating the significant uptick in activity in sizeable independent hospitals seeking out partnerships with larger organizations.

Figure 3: Total Q3 Transacted Revenue ($ in Billions), by Year

Source: Kaufman, Hall & Associates, LLC

Not-for-profit health systems were the acquiring or larger party in 14 of Q3’s 18 announced transactions, with for-profit systems acting as the acquiring party in the remaining four transactions. Of the 14 not-for-profit acquirers, seven were academic/university-affiliated organizations (see discussion below) and one was a religiously affiliated organization. The four transactions in which a for-profit system acted as acquirer focused primarily on smaller, financially distressed organizations: three of the four acquired organizations were financially distressed.

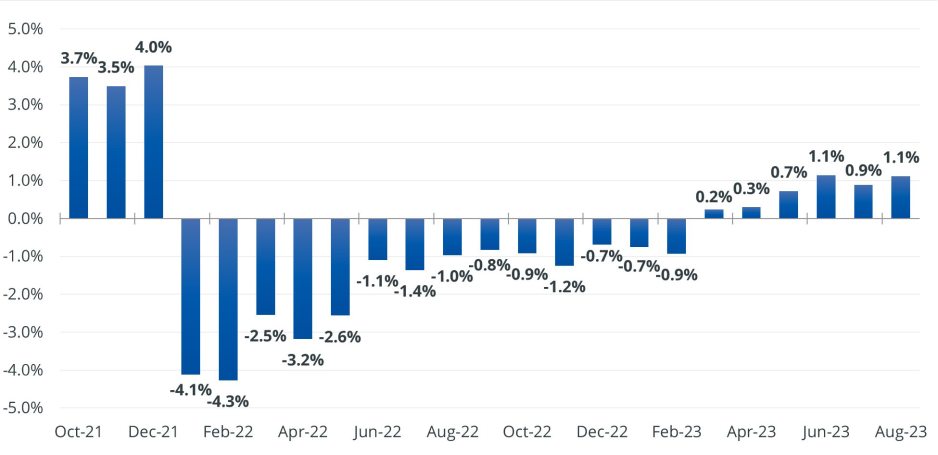

Financial Challenges Emerge as a Key Transaction Driver

As has been noted in Kaufman Hall’s monthly National Hospital Flash Report, hospitals and health systems have been under extreme financial pressure since 2022, when median operating margins remained in negative territory for the full year. The situation has improved somewhat in 2023, with year-to-date median operating margins now slightly above 1%, but this figure is well below the 3% or higher operating margin that is necessary for long-term financial sustainability (Figure 4). These challenges are reflected in the 39% percent of announced transactions in Q3 in which a party has cited, or publicly available information has enabled Kaufman Hall to infer, an element of financial distress as a transaction driver.

Figure 4: U.S. Hospital Year-to-Date Operating Margin Index, September 2021-August 2023

Source: Kaufman, Hall & Associates, LLC. The Kaufman Hall Hospital Operating Margin and Operating Margin Index is composed of the national median of our dataset adjusted for allocations to hospitals from corporate, physician, and other entities.

For many smaller to medium-sized health systems, the upward reset in fixed costs—including both labor and non-labor expenses—is a particularly acute problem. Their relative size constrains their ability to spread these costs across a larger number of facilities and services. We are seeing continued activity among systems with annual revenues in the range of $250 million to $750 million that have sought a partner. What is new in recent quarters is the number of larger systems—those with annual revenues of $1 billion or more—that also are citing financial distress as a driver for their decision to partner.

Academic Health Systems Seek Community Partners

Fourteen of the 18 announced transactions in Q3 2023 involved not-for-profit acquirers, and of those 14, 50% were academic or university-affiliated health systems.

Whereas volumes have been slow to recover to pre-pandemic levels at many health systems, academic health systems are seeing significantly higher occupancy levels. A recent analysis of Kaufman Hall National Hospital Flash Report data showed a median inpatient occupancy rate of 70% at academic health centers, compared to a 53% occupancy rate at acute-care hospitals generally.

Aligning an academic health system with a community-based health system provides the opportunity to relieve some of the occupancy pressures at the academic flagship hospital by utilizing available space in high-quality community hospitals to treat lower acuity patients. An academic/community health system pairing also offers expanded opportunities for residency programs, clinical research trials, and patient access to tertiary and quaternary services.

Participatory Partnership Structures

Health systems are also engaging in creative transaction structures that allow partners to maintain their independence while building strategic alliances that enhance access to care. Announced transactions in Q3 included UVA Health’s acquisition of a 5% ownership interest in Riverside Health System as part of a strategic alliance designed “to expand patient access to innovative care for complex medical conditions, transplantation, and the latest clinical trials.”[2] In a similar transaction, Novant Health acquired a 30% minority stake in Conway Medical Center in Conway, South Carolina. This alliance is intended to address the healthcare needs of residents in the Grand Strand and Pee Dee regions of South Carolina, which are seeing rapid population growth.[3]

Looking Forward

While partnership, merger, and acquisition activity is returning to pre-pandemic levels, regulatory scrutiny of these transactions is also increasing. New proposed merger guidelines were issued by the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in July, and a lawsuit filed in September by the FTC against U.S. Anesthesia Partners in Texas is seen as an early test of the proposed guidelines, targeting physician practice roll-up transactions. State attorneys general are also being given expanded authority to review proposed transactions. There are many compelling reasons for hospitals, health systems, and other healthcare organizations to seek new alliances and partnerships in the current operating environment. The effect of new guidelines on these transactions will remain unknown until they have been tested in the federal and state judicial systems.

Select Q3 Transactions in Which Kaufman Hall Served as an Advisor

Co-contributors:

Anu Singh, Managing Director and Leader of the Partnerships, Mergers & Acquisitions Practice, asingh@kaufmanhall.com

Kris Blohm, Managing Director, kblohm@kaufmanhall.com

Nora Kelly, Managing Director, nkelly@kaufmanhall.com

Eb LeMaster, Managing Director, elemaster@kaufmanhall.com

Courtney Midanek, Managing Director, cmidanek@kaufmanhall.com

Rob Gialessas, Vice President, rgialessas@kaufmanhall.com

Chris Peltola, Vice President, cpeltola@kaufmanhall.com

For media inquiries, please contact Haydn Bush at hbush@kaufmanhall.com.

[1] The one mega merger transaction for Q3 2023 was the announced combination of Oregon Health & Science University and Legacy Health in the Portland, Ore., metropolitan area.

[2] University of Virginia School of Medicine: “UVA Health, Riverside Health System Form New Strategic Alliance.” Press release, July 12, 2023.

[3] Conway Medical Center: “Conway Medical Center, Novant Health Announce Plans to Expand Access to Quality Care on the Coast.” Press release, August 1, 2023.