Hospital and Health System Transactions

A significant increase in the number of announced transactions in Q2 2023—20, as compared to 15 transactions announced in Q1 2023—brought the quarter in line with pre-pandemic activity levels. This was true not only with respect to the number of announced transactions, but also with respect to the total transacted revenue for the quarter. The average size of the smaller party by annual revenue remained elevated, although the higher number of total transactions slightly diluted the impact of three “mega mergers” announced in the quarter (transactions in which the seller or smaller party has annual revenues in excess of $1 billion).

The three “mega merger” transactions announced in Q2 2023 included the following:

- Froedtert Health and ThedaCare announced a letter of intent to combine as a single organization in Wisconsin (April 11, 2023)

- Kaiser Foundation Hospitals and Geisinger Health announced the launch of Risant Health, a not-for-profit organization created by Kaiser Foundation Hospitals, with Geisinger as its first member (April 26, 2023)

- BJC HealthCare and St. Luke’s Health System signed a non-binding letter of intent to form an integrated, academic, Missouri-based health system (May 31, 2023)

Overview of Q2 Activity

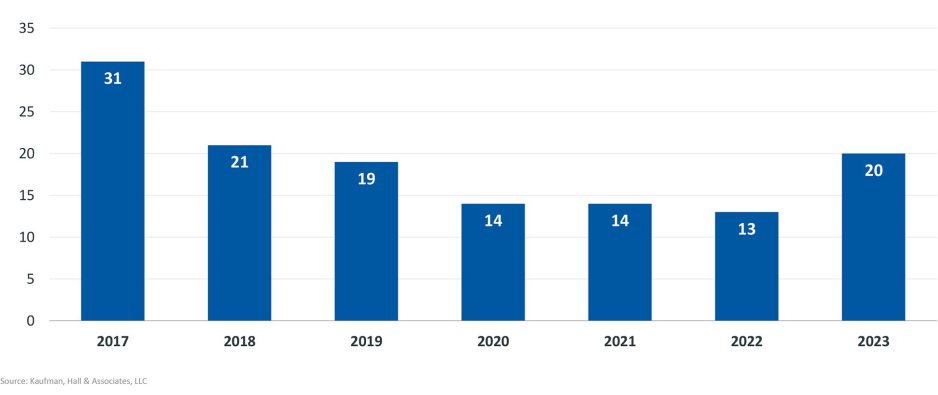

The 20 announced transactions in Q2 2023 represented the highest number seen since Q1 2020, when the COVID pandemic began, and were on par with the 19 transactions announced in Q2 2019 and the 21 transactions announced in Q2 2018 (Figure 1). Our 2022 year-end report noted that transaction activity appeared to be regaining momentum, and that trend held true for Q2 2023.

Figure 1: Number of Q2 Announced Transactions, by Year

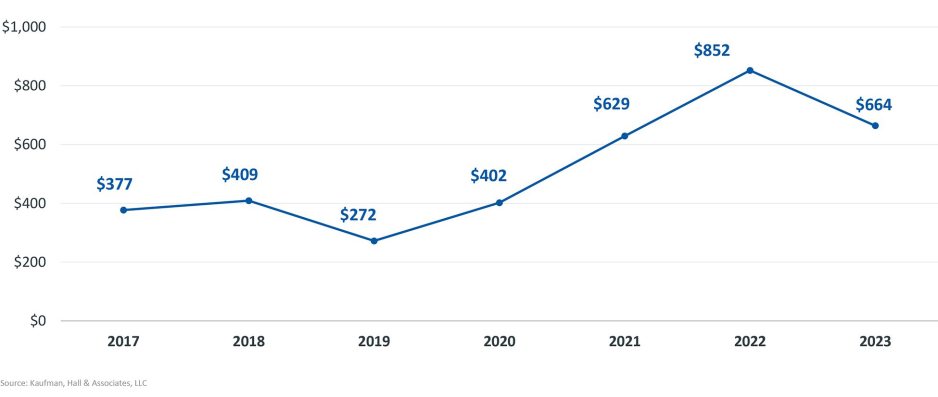

The average size of the seller or smaller party, as measured by annual revenues, remained high by historical standards at $664 million. This was down from the record-breaking 2022 year-end average of $852 million, reflecting the impact of a higher total number of announced transactions in the quarter (Figure 2).

Figure 2: Average Seller Size by Revenue ($ in Millions), Q2 2023 Compared with Year-end Averages

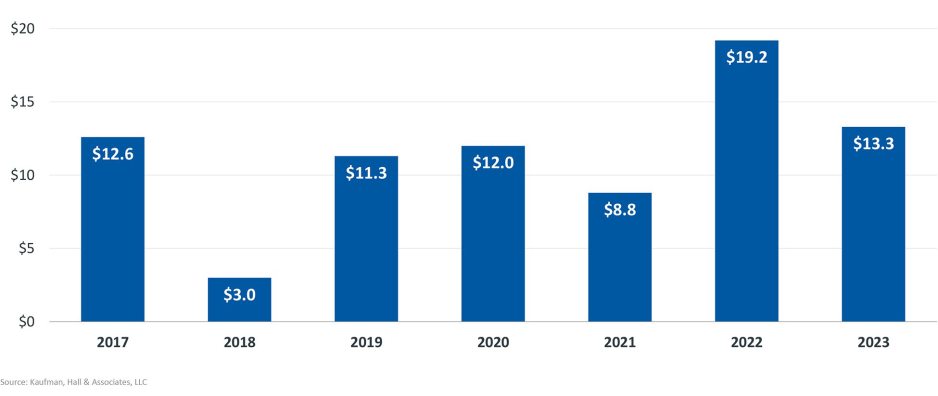

With $13.3 billion in total transacted revenue, Q2 2023 was down from the very high $19.2 billion we saw in Q2 2022, but above pre-pandemic levels for the second quarter of 2017, 2018, 2019, and 2020 (Figure 3).

Figure 3: Total Q2 Transacted Revenue ($ in Billions), by Year

The acquiring or larger party in Q2’s 20 announced transactions included:

- 8 not-for-profit health systems

- 4 investor-owned health systems

- 2 religiously affiliated organizations

- 4 academic/university-affiliated organizations

- 1 governmental organization

- 1 academic organization partnering with multiple not-for-profit organizations

A Focus on Capabilities

In last quarter’s report, we noted that a major driver in recent large system transactions has been the intent to combine, complement, expand, and optimize organizational capabilities. That trend is evident in two of the largest transactions in Q2: the combination of Froedtert Health and ThedaCare in Wisconsin and the creation of Risant Health by Kaiser Hospital Foundation with the acquisition of Risant’s first member, Geisinger Health.

Froedtert Health, through its alliance with the Medical College of Wisconsin, is the leading provider of academic medicine in the Milwaukee metropolitan area. ThedaCare has long been recognized for its accomplishments in regional community health and population health management. The two systems have already partnered on initiatives to expand access to quaternary care in central and northeast Wisconsin and to develop two new health campuses in Oshkosh and Fond du Lac, markets that lie south of ThedaCare’s headquarters in Appleton, WI, and north of Froedtert’s headquarters in Milwaukee. The CEOs of the two systems clearly noted that their combination is not the product of financial pressures, but instead an opportunity to combine the best of both systems in a way “that makes both of us better to deliver health care in Wisconsin and the communities we serve.”[1]

In what is the most unique of Q2’s announced transactions, Kaiser Hospital Foundation has created Risant Health, a not-for-profit organization focused on expanded access to value-based care in communities across the country. The announcement of Risant Health’s creation was accompanied by another announcement that, subject to regulatory approvals, Geisinger Health will become its first member through an acquisition. The long-term goal of Risant is expansion of value-based care by “acquiring and connecting a portfolio of like-minded, nonprofit, value-oriented community-based health systems anchored in their respective communities.”[2] Geisinger, which is one of the country’s longest established integrated delivery systems—with deep expertise in both clinical care and health plan management—brings the capabilities necessary for Risant to accomplish its goals and will be further supported by Kaiser’s own deep expertise in building value-based care delivery models.

Organizing Regional Markets

The focus on expanding current or accessing new capabilities in many of the largest transactions represents a movement that redefines the notion of scale within the increasingly prevalent form and type of transaction activity. While traditional forms of scale may still deliver incremental gains as health systems work to organize regional markets through combinations of systems in adjacent geographies, it is increasingly clear that healthcare has also experienced an inflection point over the past few years. The combination of surging labor expenses, continued movement of care into outpatient settings, and reduced operating margins continue to squeeze health system finances. By organizing regional markets, health systems can reposition with complementary capabilities to deliver on expanded and more coordinated care across a combined system.

BJC HealthCare and St. Luke’s Health System, which have collaborated on cost-saving measures for years as members of the BJC Collaborative, note that their combination will create “an even stronger financial foundation,” enabling the systems to “further invest in our teams, advance the use of technologies and data to support our providers and caregivers, and improve the health of our communities.”[3] In West Virginia, Vandalia Health—formed by the 2022 merger of Mon Health and Charleston Area Medical Center—is working to build a statewide network, most recently announcing a non-binding letter of intent for Davis Health System in West Virginia’s Potomac Highlands region to join Vandalia Health.[4]

Portfolio Rationalization Continues

We are continuing to see large regional and national health systems—both not-for-profit and for-profit—reposition their portfolios through divestitures. Announced transactions in Q2 include Community Health System subsidiaries’ sale of the Medical Center of South Arkansas to South Arkansas Regional Hospital (a joint venture between University of Arkansas Medical Sciences and several local not-for-profits)[5] and two sales by Ascension: Ascension Providence Hospital will be sold to the University of South Alabama, based in Mobile, and Binghamton, NY-based Our Lady of Lourdes Memorial Hospital will be sold to the Pennsylvania-based Guthrie Clinic.[6]

We anticipate more portfolio optimization from large, multi-market health systems as they look across the geographies in which they operate and determine where scarce resources can be best deployed.

Looking Forward

As capabilities become an increasingly compelling factor in partnerships and mergers, hospitals and health systems should focus on developing unique capabilities that would make them a strong partner, whether or not they are currently seeking a partnership. This strategy will help organizations differentiate themselves within an increasingly competitive healthcare market and enhance their options as that market continues to evolve.

Additional Note

Kaufman Hall is excited to welcome the Ponder & Co. mergers and acquisitions team to our firm. We look forward to adding their expertise and insights to our quarterly and year-end reports.

Co-contributors:

Anu Singh, Managing Director and Leader of the Partnerships, Mergers & Acquisitions Practice, asingh@kaufmanhall.com

Kris Blohm, Managing Director, kblohm@kaufmanhall.com

Nora Kelly, Managing Director, nkelly@kaufmanhall.com

Eb LeMaster, Managing Director, elemaster@kaufmanhall.com

Courtney Midanek, Managing Director, cmidanek@kaufmanhall.com

Rob Gialessas, Vice President, rgialessas@kaufmanhall.com

Chris Peltola, Vice President, cpeltola@kaufmanhall.com

For media inquiries, please contact Haydn Bush at hbush@kaufmanhall.com.

[1] Kirchen, R.: “Froedtert Health to Merge with ThedaCare in Fox Valley.” Milwaukee Business Journal, April 11, 2023.

[2] Kaiser Permanente: “Risant Health Launches with Geisinger.” Press release, April 26, 2023.

[3] St. Luke’s Health System: “BJC HealthCare and St. Luke’s Health System Sign Letter of Intent to Form Integrated Missouri-based Health System.” Press release, May 31, 2023.

[4] Vandalia Health: “Vandalia Health Signs LOI with Davis Health System.” Press release, June 1, 2023.

[5] Ponder & Co., which has now merged with Kaufman Hall, served as an advisor to one of the not-for-profit partners in this transaction.

[6] Kaufman Hall served as buy-side advisor for Guthrie Clinic in this transaction.