From the Gist Weekly team at Kaufman Hall

Greetings! It has definitely been a busy week for healthcare news! We hope the Gist Weekly is a helpful summary to ensure you know the “gist.” Please subscribe to receive Gist Weekly via email.

In the News

What happened in healthcare recently—and what we think about it.

- FTC bans noncompete agreements. On Tuesday, the Federal Trade Commission (FTC) voted 3-2 to finalize a rule, first proposed in January 2023, that will bar employers from including noncompete clauses in employment contracts. The rule bans new noncompetes for all workers and limits the enforcement of existing noncompetes to certain employees “in policy-making positions” who earn more than $151K annually. The FTC estimates that about 30M people, almost one fifth of the US workforce, have noncompetes, which limit employees’ ability to work for a local competitor. Noncompetes are particularly common in healthcare, affecting between 37 and 45 percent of physicians. The US Chamber of Commerce and other business groups have already filed suit to block the ban, and there are questions about the FTC’s jurisdiction to enforce it on not-for-profit entities, which includes most health systems. The rule is scheduled to go into effect in four months unless legal challenges delay implementation. Noncompetes tied to the sale of a business, for example a physician practice, are not part of this ban.

- The Gist: The ultimate impact on healthcare organizations of this sweeping ban depends on the FTC’s approach to enforcement and may be delayed for years due to legal challenges, if implemented at all. Although not-for-profit organizations fall outside of the FTC’s traditional jurisdiction, the agency has indicated a willingness to reevaluate an entity’s not-for-profit status and stated that “some portion” of tax-exempt hospitals likely fall under its jurisdiction, and therefore the final rule’s purview. If most health systems end up being subject to the ban, it could significantly shift bargaining power in the healthcare sector in favor of physicians, allowing them the opportunity to move away from their current employers while retaining local patient relationships. The competitive landscape for provider talent may change dramatically, particularly for revenue-driving specialists, who could have far greater flexibility to move from one organization to another, and to push aggressively for higher compensation and other benefits. Regardless of how the ban plays out, this rule should serve as a catalyst for health systems’ continued efforts to strengthen provider relationships.

- CMS imposes minimum staffing levels for nursing homes. On Monday, the Centers for Medicare and Medicaid Services (CMS) published a final rule that sets a minimum staffing standard for nursing homes and other long-term care facilities. It requires facilities to provide a minimum of 3.48 hours of nursing care per patient per day, with 33 minutes of that care from a registered nurse, at least one of whom must be always on site. The required nursing time is higher than the proposed rule’s minimum of three hours of nursing care per resident per day. The rule also strengthens standards for facilities to regularly assess the care needs of each resident. KFF estimated that at least 80 percent of nursing homes would have to hire additional staff to meet these requirements, and industry trade groups found that nursing homes would need to employ an additional 100K workers nationwide. The Biden administration has pledged to help fund the initiative, including a $75M campaign to increase nursing home staff, but estimates for the total cost of implementation range from $4B to $6.8B. The rule will go into effect in two years for urban nursing homes and three years for rural nursing homes, with some facilities able to apply for hardship exemptions.

- The Gist: The Biden administration is delivering on its promise to enforce stronger nursing home staffing standards, after more than 170K nursing home residents died from COVID and nursing home employment levels declined by almost 250K in recent years. However, many long-term care facilities will struggle to meet these new standards, which will likely raise the cost of nursing home care while also increasing competition for nursing talent across the healthcare industry. Facilities that decide to close, rather than comply, will impact other parts of the care continuum, including exacerbating acute care hospital discharge delays.

- HHS finalizes revised dispute resolution process for 340B program. Late last week, the Department of Health and Human Services (HHS) published a final rule establishing a new administrative dispute resolution process for the 340B drug discount program. A panel, composed of government experts from the Office of Pharmacy Affairs, will resolve claims raised by covered entity providers about drugmakers overcharging them for 340B drugs, as well as claims from pharmaceutical companies that covered entities are diverting or duplicating discounts improperly. The new process, which will go into effect in mid-June, allows the panel to review claims on issues related to those pending in federal court. It's intended to be “more accessible, administratively feasible, and timely” than a prior process established by HHS in 2020 that was paused after legal challenges.

- The Gist: This new 340B dispute resolution process is likely to see extensive use, as battles between providers and drugmakers over the drug discount program have heated up significantly in recent years. There are more than 50 ongoing court cases related to the program, many of which concern actions taken by at least 20 major drugmakers to restrict 340B sales to contract pharmacies. Although this new process may provide more effective dispute resolution, none of its decisions can be considered final until courts have settled the myriad cases before them.

Plus—what we’ve been reading.

- Cancer-detecting blood tests advancing. Published in the Washington Post last week, this piece details recent developments in blood tests that can measure the presence of biological substances shed by cancers. There are about 20 of these tests in various development states. Although none have received final Food and Drug Administration approval, some are available as “lab-based” tests under regulations that permit their use in specific settings. The article highlights optimism from test users who received correct cancer diagnoses, while warning that these blood tests are currently not as reliable as traditional methods of cancer screening, particularly for early-stage detection.

- The Gist: Although patients may dream of “one test that can pick up all the different kinds of cancers,” widespread use of cancer-detecting blood tests is still likely years away. Given the importance of early-stage cancer detection, these tests should be seen as complements, not replacements to standard-of-care cancer screenings like mammograms, colonoscopies, and Pap smears. As these tests increase in popularity, providers will play a key role in communicating with patients about their utility as well as the risks of false positives and false negatives.

Graphic of the Week

A key insight illustrated in infographic form.

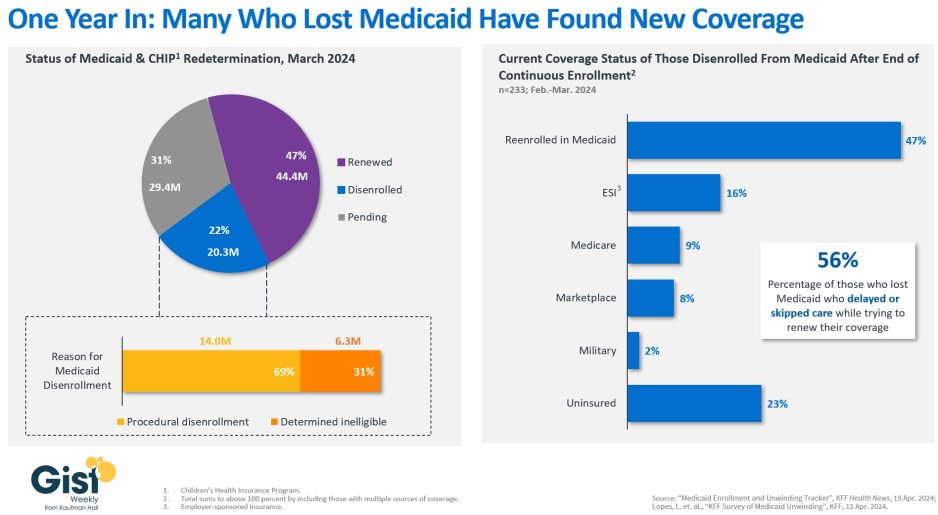

Medicaid redeterminations one year in

In this week’s graphic, we highlight recent KFF data showing the current state of Medicaid redeterminations, about one year after the end of continuous enrollment. In response to the pandemic, federal policy prohibited states from conducting eligibility checks on Medicaid enrollees until April 1, 2023, leading the program to swell to a record 94.5M enrollees in March 2023. As of mid-April 2024, almost half of enrollees have had their Medicaid coverage renewed, enrollment is still pending for 31 percent, and 22 percent—about 20M Americans—have been disenrolled from Medicaid. Despite millions of cases still pending, we have already surpassed the 15M disenrollments projected last year by the Department of Health and Human Services based on historical patterns of coverage loss. More than two-thirds of those who were disenrolled were removed due to procedural reasons, meaning they did not complete the renewal process. Procedural disenrollments can happen when the state has outdated contact information, or the enrollee doesn’t properly submit necessary paperwork. A recent KFF survey found that nearly half of those who were disenrolled were eventually able to reenroll in Medicaid, and more than a quarter were able to find coverage elsewhere.The remaining 23 percent of those who were disenrolled report that they are currently uninsured. Although most of those who were disenrolled now have insurance, gaps in coverage have led the majority who lost Medicaid coverage, even if briefly, to delay or skip care. With Medicaid redeterminations for nearly 30 million Americans still pending, this overall picture will continue to evolve.

On the Road

What we learned from our work in the real world. This week from John Poziemski, Managing Director, at Kaufman Hall.

Admitting the need for post-merger value realization

“We didn’t get it right,” a health system CEO admitted to me recently. “We had a lot of good reasons for this acquisition, but between you and me, I have to say we kind of botched parts of the integration process. What can we do now to realize the value that we initially identified?”

Having helped this system with strategic acquisition planning, but not the integration process, I assured the CEO that it’s not too late to correct course. Even with the best intentions, the operational inertia of existing teams, gaps in strategic vision between senior leaders and the rest of the organization, and time pressures to label an integration as complete can reduce the amount of merger value that is initially realized. Now that short-term integration efforts have been executed, we discussed the need to focus on a second phase of value realization. The first step is recognizing the problem, followed by understanding what went wrong. From there, a lot of work remains, but this effort is necessary, not only to reap the full value of the merger but also to make sure the same mistakes don’t happen again with a future acquisition. This is especially important in today’s current economic environment when growth is not assured and it’s more essential than ever to realize the full return on strategic investments. If your organization is experiencing similar growing pains following a merger, I welcome you to reach out to discuss.

On Our Podcast

Gist Healthcare Daily—all the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

In addition to the news discussed above, our Gist Healthcare Daily podcast covered many of the week’s other big stories, including United’s ransom confirmation, EMTALA in front of the Supreme Court, the launch of a new antitrust reporting portal for the public.

To stay up to date, be sure to tune in each weekday morning. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

We appreciate you joining us for another week, and we’ll see you back here next Friday! In the meantime, if you’d like to peruse past editions of this newsletter, please visit our archive.

Best regards,

The Gist Weekly team at Kaufman Hall