The many operational and financial headwinds that are buffeting health systems should prompt leadership teams to revisit the strategic direction, goals, and performance of their service lines and clinical programs.

There have been significant—and likely permanent—structural shifts in operating costs, staffing, and the options for where many procedures can be delivered. Health systems must address the reality of scarcities in financial resources, human resources, and time. Those resources must be focused in areas where they can generate the best return.

In recent years, health systems have pursued service line strategies that were intended to drive differentiation and growth. The problem is that, in competitive markets, everyone was doing the same thing. This has created a “trench warfare” environment, where a small gain in market share for one service line is often matched by a loss in market share in another. Organizations must determine where they offer a truly differentiated service line or clinical program that has real growth potential.

Given the magnitude and speed of change in the operating environment, these decisions cannot be made over the span of years. Service line strategy must be adapted to new realities, combining operational expertise with strategic vision to move quickly and tactically toward a sustainable portfolio of service lines and clinical programs.

Identifying opportunities for differentiation, growth, and optimization

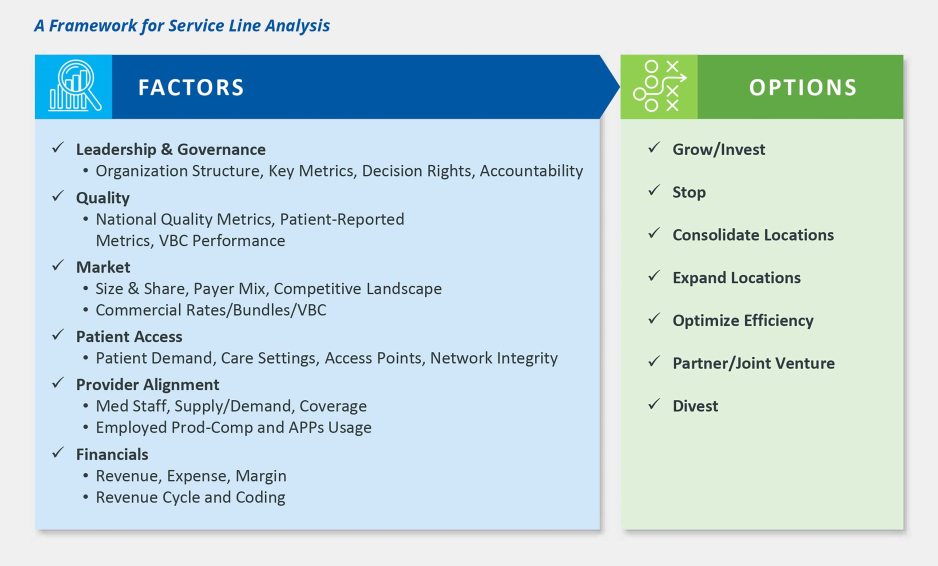

The best understanding of opportunities will come from an analysis of performance across an organization’s full portfolio of service lines and clinical programs, with a focus on the following factors:

- Leadership and Governance. Are the right people making decisions for the service line, and are they accountable for the decisions they make? Are they using the appropriate metrics?

- Quality. How is the service line performing against national quality metrics? Against patient-reported metrics?

- Market. What is the size of the market and current market share? Who are the competitors? What is the payer mix for the service line?

- Patient Access. What is the level of patient demand for the service? How accessible are care settings for the service?

- Provider Alignment. Is there sufficient medical staff to support demand for the service line’s offerings? Are advanced practice providers being appropriately utilized?

- Financials. What are the current revenues, expenses, and operating margins for the service line? Are revenue cycle and coding functions accurately capturing and billing for the services provided?

By applying similar factors across the full portfolio, leadership can isolate and understand factors that may be driving or hindering a service line’s performance. Perhaps a service line is underperforming, but improved utilization of advanced practice providers could produce a positive margin. Maybe improved access and more convenient locations would help a service line increase market share. Giving decision-making authority—and compensation-based accountability—to physician leaders might improve performance. The point is to give leadership better insight into why certain service lines are thriving, which appear to be truly underperforming, and which may not be achieving their full potential because of issues within the organization’s control.

Considering the options

When the service line analysis is complete, leadership faces more difficult decisions: how to address the problems that have been identified. In not-for-profit healthcare, those decisions are made even more complicated by commitment to mission, especially where the health system is maintaining an underperforming service line for which there is a vital community need.

For service lines that are performing well, the question is whether they might perform at an even higher level. Is there sufficient market demand to justify additional staffing? Should additional locations be considered to meet demand? Could access and margins be enhanced by appropriately giving more responsibilities to advanced practice providers?

Other service lines may be on the edge but could likely produce positive margins if underlying issues are resolved. Perhaps, for example, the health system sees opportunities to improve coding and revenue cycle functions or realizes that it has duplicated the locations at which the service is provided and could consolidate into fewer locations.

The great challenge will be with service lines that are underperforming because of lack of market demand, inadequate payment structures, inadequate accountability, or other factors that lie beyond the health system’s control. This is where considerations of mission come to the forefront. Is there a specialized, skilled operator that the health system could partner with to continue providing the service at a lower cost? Could the health system divest the service line to another provider? If there are no other options, is it better for the community to continue to have access to this service (at increased cost or challenged quality) or for the health system to stop providing it so it can invest resources into services where there is a greater community need?

Avoiding the sunk cost fallacy

In today’s challenging environment, the biggest error health system leadership could make is succumbing to the sunk cost fallacy: the reluctance to reconfigure or close a service line or clinical program because of past investments that have been made in it. The past is the past; the crucial focus is on today. Are there efficiencies that could move an underperforming service line to a positive margin? Are there others who could provide the service more efficiently? If not, how would a decision to continue sinking costs into the service line affect the ability to provide other services to the community? Asking and answering these difficult questions will guide a service line strategy that sets a future course in present-day realities.

For more information, please contact Matthew Bates (mbates@kaufmanhall.com), Walter Morrissey (wmorrissey@kaufmanhall.com), or Amanda Steele (asteele@kaufmanhall.com).