From the Gist Weekly team at Kaufman Hall

If this email was forwarded to you, please sign up to receive it in directly in your inbox (nearly) each week.

In the News

What happened in healthcare recently—and what we think about it.

- Cyberattack on Change Healthcare disrupting network services. Last Wednesday, UnitedHealth Group (UHG)’s Change Healthcare took its systems offline after becoming aware of an ongoing cybersecurity incident. Change, which was acquired by UHG for $13B in 2022, processes insurance claims for thousands of hospitals, physician groups, and pharmacies, handling around 15B transactions a year and touching one in three US patient records. The outage has disrupted some patients’ abilities to use their insurance, especially at pharmacies, but Change shared that most affiliated pharmacies have found ways to continue filling prescriptions. As part of its public updates on the incident, Change identified the group responsible as ALPHV/Blackcat, which was behind recent cyberattacks on MGM Resorts and Caesars Entertainment. The hackers claimed to have stolen millions of sensitive patient records; however, this has not been verified. Other UHG operations and information systems appear thus far to be unaffected by the hack.

- The Gist: This incident is the latest of many warning signs that healthcare organizations are particularly vulnerable to cybersecurity attacks by malicious actors. The number of healthcare data breaches has risen sharply in recent years, driven by the proliferation of electronic health records, the high value of stolen patient data, and the industry’s often outdated IT infrastructure. While the full extent of this hack may not be known for months, its impact is magnified by the massive reach of an organization like Change.

- Justice Department conducting antitrust probe against UnitedHealth Group. The Department of Justice (DOJ) has been investigating UHG for anticompetitive behavior since last October, as first revealed by the Examiner News earlier this week and subsequently confirmed by the Wall Street Journal. The DOJ is reportedly interested in Optum’s acquisitions of physician groups and how their relationships with UHG’s health plans affects competition. The probe appears to be wide-ranging, but there are no indications of if or when the DOJ plans to file charges. UHG is no stranger to antitrust attention: the DOJ failed in its challenge to block UHG’s purchase of Change Healthcare in 2022, and UHG’s planned acquisition of home healthcare company Amedisys is still subject to a federal probe.

- The Gist: The Biden administration has made antitrust scrutiny a key plank of its policy platform, having recently launched high-profile investigations into several large companies including Apple, Amazon, and Google. Although these probes span major sectors of the US economy, healthcare consolidation has been a particular focus for the White House. As the nation’s both largest employer of physicians and largest health insurance company, UHG is an unsurprising target within the healthcare industry. Recently finalized federal merger guidelines have changed how the DOJ and Federal Trade Commission (FTC) gather M&A information, but not the laws or legal precedent upon which cases are ruled, so it remains to be seen if regulators’ new approach will translate into stronger enforcement.

- US Anesthesia Partners settles with Colorado regulators. Dallas, TX-based US Anesthesia Partners (USAP), one of the nation’s largest providers of anesthesia services, reached a settlement with the Colorado Attorney General’s Office, which had alleged that USAP engaged in anticompetitive behavior in the state. Although it denies any wrongdoing, USAP agreed to relinquish exclusive contracts with five Colorado hospitals and revise its practice of adding noncompete agreements to its physician contracts. This settlement is separate from the similar FTC suit against USAP and its creator-turned-minority owner, private-equity (PE) firm Welsh, Carson, Anderson, and Stowe. That suit, filed in federal district court in Texas in September 2023, alleges that USAP monopolized the Texas anesthesiology market in order to drive up prices unlawfully.

- The Gist: USAP isn’t the only large anesthesia group in the news this week for allegations of anticompetitive behavior—hospitals in New York and Florida are suing North American Partners in Anesthesia, claiming it stifles competition by forcing its physicians to sign noncompete agreements. Health systems and regulators are increasingly dissatisfied with the highly concentrated anesthesia provider market, which has become dominated by large, PE-backed groups. Because the Colorado case was settled out of court, no precedent has been established for antitrust enforcement, but the result of the ongoing FTC suit against USAP may have significant ramifications for other large, PE-backed physician organizations.

Plus—what we’ve been reading.

- Drug pipeline filled with psychiatric breakthroughs. Published this week in Stat, this piece delves into the current state of psychotropic drug development, which is poised to deliver new blockbuster treatments for the first time in decades. Once the likes of Zoloft and Prozac went generic in the 2000s, investment in behavioral health drug research dried up as companies struggled to find the next “one pill for millions and millions of people,” as a former lead researcher at Pfizer put it. Mirroring recent trends across the pharmaceutical industry, the new crop of psychiatric treatments is finding success with targeted approaches for specific diseases that affect more select groups of patients. Garnering excitement from investors and acquisition interest from big pharma companies, smaller biotech firms have led the way, advancing drugs for bipolar depression, schizophrenia, and narcolepsy into late-stage trials ahead of potential federal approval.

- The Gist: Given our nation’s growing mental health crisis, this next generation of psychiatric medications is coming at a critical time. However, unlike antidepressants—the majority of which are relatively cheap and prescribed by primary care providers—these new drugs are likely to command high price tags and may require greater access to mental health specialists. Although the Biden administration recently acted to shore up mental health treatment parity rules for insurers, it remains the case that many patients with the greatest need of psychiatric care are among the least able to access and afford it.

Graphic of the Week

A key insight illustrated in infographic form.

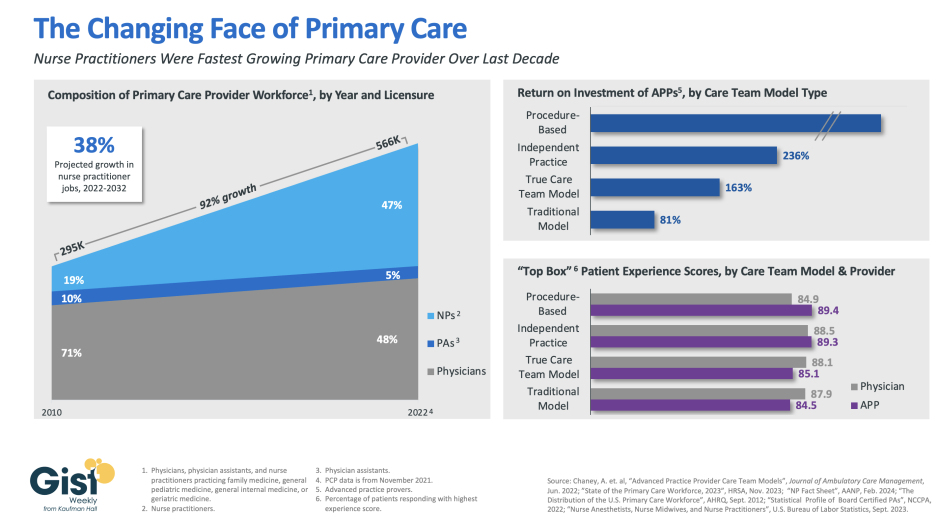

Nurse practitioners fueling primary care workforce growth

In this week’s graphic, we highlight how the primary care provider workforce has evolved over the past decade in both the pursuit of team-based care models and value-based care, as well as in response to rising labor costs and physician shortages. In 2010, physicians made up more than 70 percent of the primary care workforce. But over the next 12 years, the number of primary care providers nearly doubled, largely driven by immense growth of nurse practitioners in the workforce. As of 2022, more than half of primary care providers were advanced practice providers (APPs), who continue to have a strong job outlook across the next decade (especially nurse practitioners). This shift has been beneficial to many provider organizations. In a study from the Mayo Clinic, the return on investment was positive across a variety of APP practice models, especially in procedural-based specialties but across both independent practice models and full care team models as well. APPs also receive similar patient experience scores as their physician counterparts. Continued integration of APPs in team-based care models remains a key strategy for health systems seeking to improve access while lowering costs, especially in primary care.

On the Road

What we learned from our work in the real world. This week from Matthew Bates, Managing Director, at Kaufman Hall.

Chasing downstream margin over downstream revenue

A recent engagement with a health system executive team to discuss an underperforming service line uncovered a serious issue that’s becoming more common across the industry. “Our providers are more productive than ever,” the CFO informed our team, “and yet we keep losing money on the service line.” After digging into their physician compensation model, we came upon one source of the system’s issue. Because it was incentivizing physician RVUs equally across all payers, its providers responded, quite rationally, by picking up market share where growth was easiest: Medicaid patients, who weren’t generating any margin. “We recognize that we’ve been employing these physicians as loss leaders in order to generate downstream revenue,” the CFO shared, “but what’s the point of that revenue if there’s no longer any downstream margin?”

The economics of physician employment becomes a tough conversation very quickly; it’s a sensitive topic to many, and one with myriad facets. But the loss leader physician employment model obviously only works when it produces positive downstream margins. We’re in a critical window of time, where hospital margins are just beginning to recover as volumes return—but those volumes are not necessarily in the same places as before. The opportunity is ripe for systems to work closely with their aligned physicians to reexamine the post-pandemic margin picture for individual service lines and ensure incentives are aligning all parties to hit operating margin goals. Are these kinds of conversations taking place at your health system? I welcome you to reach out to share and discuss.

On Our Podcast

Gist Healthcare Daily—All the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

Last Monday, we heard an encore episode of J. Carlisle Larsen’s conversation with Steven Lane, MD, Chief Medical Officer of the data sharing platform Health Gorilla, where they discuss consumers’ concerns about the privacy of their health data.

This Monday, the podcast looks at how workforce challenges are prompting hospitals and health systems to find creative ways to build up their talent pipelines. JC speaks with Celina Cunanan, Chief Diversity, Equity & Belonging Officer at University Hospitals in Cleveland, about its initiatives to engage youth in the community to consider careers in healthcare.

And be sure to tune in every weekday morning to stay abreast of the day’s biggest healthcare news. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

Thanks for reading another edition; we look forward to being back in your inboxes next week!

Best regards,

The Gist Weekly team at Kaufman Hall