Technically, healthcare issuance is up year-over-year, but recent activity remains modest, and markets remain challenging. Volatility is the word and inter-day swings can be extraordinary. The new issues that have come recently have met with mixed investor reception and credit spreads remain under pressure. Flexibility is critical, as is building investor engagement and broad distribution.

|

1 Year |

5 Year |

10 Year |

30 Year |

|

|

May 20 – Treasury |

2.07% |

2.80% |

2.79% |

3.00% |

|

v. May 6 |

+7 bps |

-25 bps |

-34 bps |

-22 bps |

|

May 20 – MMD* |

1.93% |

2.53% |

2.93% |

3.29% |

|

v. May 6 |

-4 bps |

-1 bp |

+8 bps |

+12 bps |

|

May 20 – MMD/UST |

93.24% |

90.36% |

105.02% |

109.67% |

|

v. May 6 |

-5.26% |

+7.08% |

+13.96% |

+11.22% |

|

*Note: MMD assumes 5.00% coupon |

||||

SIFMA reset this week at 0.82%, which is approximately 84.23% of 1-Month LIBOR and represents a +22 basis point adjustment versus the May 4 reset.

Troubled Waters

Since the credit crisis I’ve had this running internal debate about whether the Chairman of the Federal Reserve is the Captain Stubing or Cruise Director Julie McCoy of the “Love Boat” that is the global capital markets. The Julie McCoy argument holds that until recently the Fed Chair’s job description seemed to be doing whatever was needed to make sure investors were having a great time. The Stubing argument is grounded in the fact that the Fed has become the “price determinant” presence in the markets; every asset class and investor follows the Fed first and everything else second.

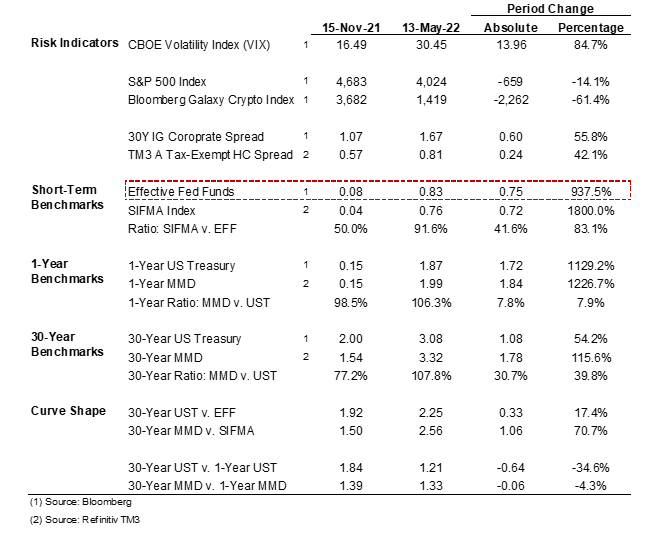

Either way, we’ve reached that part of the episode where things get serious, and we find ourselves in need of a captain more than a cruise director. The last six months offered a widespread repricing of risk but remember that all the turbulence captured in the table is set against the fact that so far, the Fed has increased short rates by only 75 basis points. The current Fed Funds target rate is between 0.75% and 1.00% and the ranges being floated as necessary to bring inflation under control are anywhere from 3.00% to 4.00%. Markets are pricing in both these future rate hikes as well as the potential consequences, including slower growth and a recession. The path from here is likely more volatility as we figure out whether the market’s rolling anticipatory pricing is too much, too little, or just right.

While 2020 and 2021 were incredibly challenging, the capital structure playbook was easy: issue long duration natural fixed rate debt in the public markets. This trend has held so far in 2022, but as rates and spreads increase, different parts of the playbook may need to change. Topics to watch include:

- Funding Channels: For taxable issuers, an important emerging question is whether private options will offer better execution. The taxable private placement market provides access to deep institutional capital pools and benefits like streamlined execution, enhanced structuring flexibility (both amortization and funding of the loan), or simplified disclosure. It is important to test this channel versus public options to fully gauge the relative cost-benefit, but there are periods when private markets outperform and circumstances where they better respond to specific needs or constraints. This thought extends to non-traditional or specialty asset funding channels such as real estate. The point is that funding channels and execution options may need to adjust as we move through periods of heightened public market volatility.

- Return on Risk: As rates increase, the natural question will be whether to retain capital structure risk by issuing floating rate debt or using intermediate structures (Floating Rate Notes or Put Bonds). This assessment must always be grounded in “return on risk,” or the anticipated benefit attached to issuing something other than committed capital; and part of this calculus must be how the capital structure return on risk compares against other risk-return levels across the enterprise. As the chart above demonstrates, the total municipal curve (SIFMA to 30-year) has steepened to over 250 basis points—suggesting an attractive return on risk—but the increases have been concentrated in the less than 1-year part of the curve (the 1-year to 30-year curve flattened by 6 basis points). This makes sense because SIFMA and other money market rates follow the actual Fed Funds Rate while the further points on the curve price in anticipated Fed actions. While pricing differentials are usually the main consideration, more qualitative benefits such as position management flexibility can be important as well. Also, there are different ways of taking capital structure risk. Municipal ratios have elevated significantly, which creates a basis swap opportunity that can only be accessed by tolerating a different form of risk. The point is that return on risk is nuanced and the fixed versus floating question is going to be an important topic until the risk environment stabilizes.

- Credit-Liquidity Cost: Most healthcare issuers rely on credit-liquidity facilities provided by bank partners to gain access to capital structure risk products. Most of the current headwinds—geopolitical dislocations, inflation, the Fed reducing liquidity, the prospect of recession—may eventually translate into strains on the pricing or availability of bank credit-liquidity. As of today, bank partners seem stable and access to very well priced bank credit-liquidity remains strong, but this may change as growth slows and the Fed removes liquidity.

The external funding environment will be challenged for the foreseeable future, but capital still needs to be raised and balance sheets need to be managed. The mantra remains: assemble a great team to identify and test the options available in each business vertical (operations, strategy, debt, investments), but then pair that with a framework that helps you make the best risk-resource allocation choices across the total enterprise. The best response to volatility is excellent resource allocation.

Trending in Healthcare Treasury and Capital Markets is a biweekly blog providing updates on changes in the capital markets and insights on the implications of industry trends for Treasury operations, authored by Kaufman Hall Managing Director Eric Jordahl.