Not-for-profit healthcare issuance remains light across all public and private funding channels. Rates remain relatively attractive, but uncertainty about the depth and breadth of the new issue healthcare markets persists.

|

1 Year |

5 Year |

10 Year |

30 Year |

|

|

Sep 9—UST |

3.66% |

3.44% |

3.31% |

3.45% |

|

v. Aug 19 |

+41 bps |

+33 bps |

+33 bps |

+23 bps |

|

Sep 9 – MMD* |

2.28% |

2.40% |

2.74% |

3.50% |

|

v. Aug 19 |

+13 bps |

+20 bps |

+26 bps |

+39 bps |

|

Sep 9—MMD/UST |

62.3% |

69.8% |

82.8% |

101.4% |

|

v. Aug 19 |

-3.9% |

-1.0% |

-0.4% |

4.9% |

|

*Note: MMD assumes 5.00% coupon |

||||

SIFMA reset this week at 1.39%, which is approximately 50.4% of 1-Month LIBOR and represents a -40 basis point adjustment versus the August 17 reset.

The Fed Fights On

The next Fed policy meeting is scheduled for September 21-22 and the expectation is another 75 basis point rate hike, which will put the Fed Funds target range between 3.00%-3.25%. The European Central Bank raised its target by 75 basis points earlier this week, prioritizing inflation concerns despite the overhang of severe challenges from acute energy market disruptions across the region. In the U.S., the expectation is for two additional rate increases by year-end, resulting in an ending target range of 4.00%-4.25% (we started 2022 at a 0.00%-0.25% range). The Fed continues to pursue two objectives:

- Use the available policy levers to create a set of financial conditions—mortgage rates, bond and lending rates, stock prices, etc.—that are tight enough to curb the spending, hiring, investing and other activities that drive growth and fuel inflation; and

- Pair resolve in executing these policy actions with hawkish rhetoric to manage expectations such that the array of individual financial decisions and transactions occurring across the economy generally line up with what the Fed is trying to do.

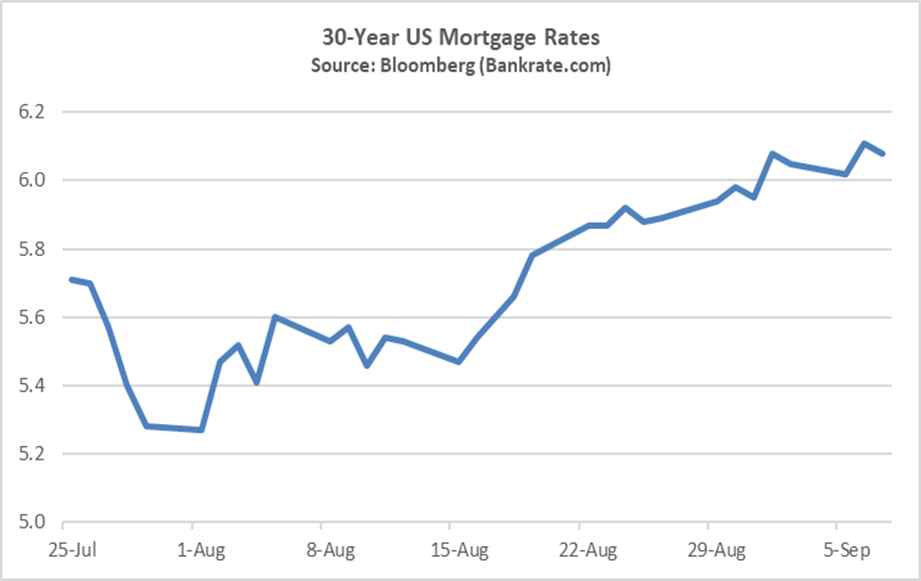

The chart showing 30-year US Mortgage rates from July 25th to present highlights the Fed’s expectations management challenge. After the last Fed meeting in late July where the Fed Funds rate was increased by 75 basis points, credit markets rallied (mortgage rates declined by over 40 basis points), in part because Chairman Powell made the generic post meeting comment that at some point rate increases will moderate. The markets—because it’s more fun when asset prices move higher—read this as the Fed communicating an expectation that rates won’t need to go as high or stay high for as long as expected, which justified a buying party that wound up partially diluting the 75 basis point tightening. The Fed regained control of the narrative during August, culminating with their Jackson Hole gathering where the team reiterated the view that rates need to move higher as well as their commitment to stay in the inflation fight for the duration. Mortgage and other rates have marched higher in response, but there is a strangely familiar dynamic to it all: Mom and Dad want order and the kids keep testing resolve.

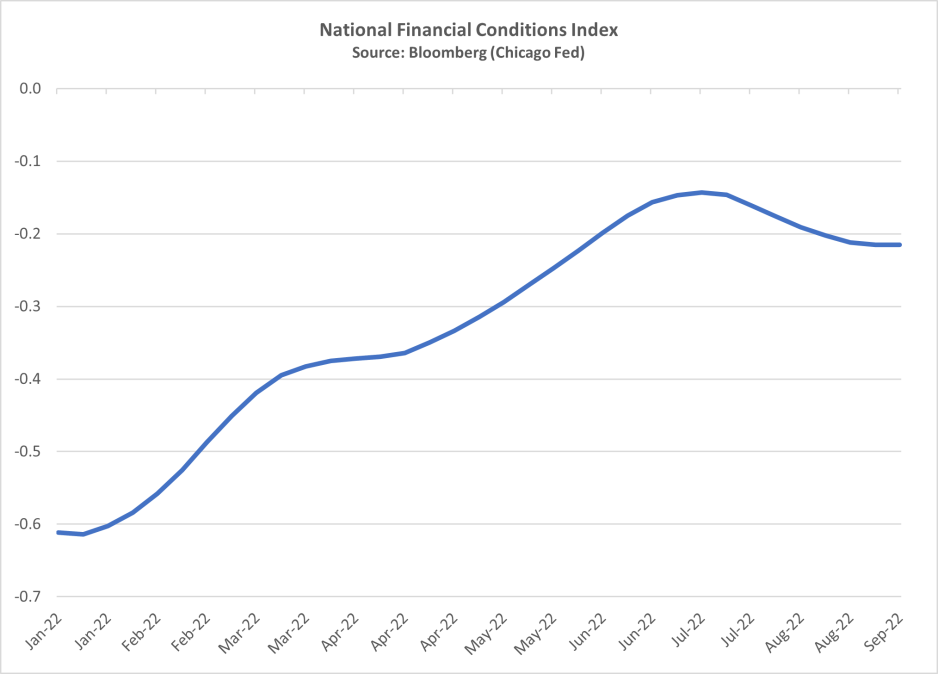

The other interesting indicator is the Chicago Fed’s National Financial Conditions Index, which measures risk, credit, and leverage conditions across the financial markets. Index values greater than zero reflect tighter than average conditions while index values below zero reflect looser than average conditions. Since the early 2022 launch of the Fed’s anti-inflation policies, the index shows tightening, but it remains below zero. From June of 1978 through the end of 1982—the back part of the “Great Inflation”—this index averaged plus 1.99.

It is still difficult to parse whether the Fed is ahead or behind on inflation, which forces us to anticipate a wide range of potential outcomes across liabilities and financial assets. What is clearer—though no less distressing—is the headwinds rippling across operations. Our latest National Hospital Flash Report indicates a deterioration in margin during July based on ongoing labor pressures, acuity strains, and declining outpatient activity (at least within a hospital setting). Multivariable dislocations will continue, and the only path forward is integrating the management of the three disciplines that define every not-for-profit healthcare organization:

- A mission-driven Operating Company that needs to focus on business model strategic repositioning and performance improvement.

- A complex Financing Company that needs to optimize liquidity sizing and management while positioning access to external capital through traditional and non-traditional channels.

- A complex Investment Company that needs to position its resources at a point on the resiliency versus return continuum that appropriately responds to the enterprise’s risk capacities.

Ultimately, operating performance will define every outcome. But between here and operating stability, the threshold question is whether to position balance sheet resources to prioritize return (in hopes of offsetting operating losses) or resiliency and liquidity. These two bookends lead to profoundly different resource management strategies, but both are grounded in defining, tracking, and managing the organization’s relationship with risk and return. There is no absolute right or wrong landing point on the continuum; the only definitive wrong is expecting that you can successfully navigate a deeply dislocated environment using fragmented decision-support.

Trending in Healthcare Treasury and Capital Markets is a biweekly blog providing updates on changes in the capital markets and insights on the implications of industry trends for Treasury operations, authored by Kaufman Hall Managing Director Eric Jordahl.