Current Rate Environment

December’s 6.5% CPI print offered good news on the inflation front; but 6.5% is still high, so the job isn’t done and the blunt instrument of Fed tightening in pursuit of economic contraction will roll on, albeit maybe at a slower pace. Markets raised their predictable cheer at the prospect of easier money, grounded in their enduring hope that we’re on a trend line back to the Fed’s 2.0% target. The central 2023 question for both the larger U.S. economy and the specifics of healthcare credit and capital positioning remains: is inflation on the way out, or are we at a pause before we progress, stall, or even reverse?

|

1 Year |

5 Year |

10 Year |

30 Year |

|

|

Jan 13 —UST |

4.70% |

3.61% |

3.51% |

3.62% |

|

v. Dec 30 |

-3 bps |

-41 bps |

-37 bps |

-34 bps |

|

Jan 13 – MMD* |

2.43% |

2.18% |

2.31% |

3.24% |

|

v. Dec 30 |

-43 bps |

-34 bps |

-32 bps |

-34 bps |

|

Jan 13 —MMD/UST |

51.70% |

60.39% |

65.81% |

89.50% |

|

v. Dec 30 |

-8.76% |

-2.30% |

-1.97% |

-0.90% |

|

*Note: MMD assumes 5.00% coupon |

||||

SIFMA reset this week at 2.50%, which is approximately 56% of 1-Month LIBOR and represents a -116 basis point adjustment versus the December 28, 2022, reset.

Winston Churchill and 2023: If You’re Going Through Hell, Keep Going

If Dante had been an economist, inflation would have been one of the circles of Hell. So, let’s start our journey into 2023 with a reflection on three inflation-fueled carryovers from 2022:

- Internal and external capital formation fell sharply. 2022 not-for-profit healthcare debt issuance came in at $28 billion, down sharply from the $46 billion trailing two-year average or the $39 billion 10-year average; other external channels, like leasing, were down as well. Concurrently, core cash flow generation was sharply lower based on the unprecedented margin compression that defined the year. Capital is healthcare’s oxygen, and last year hospitals nearly ran out of breath.

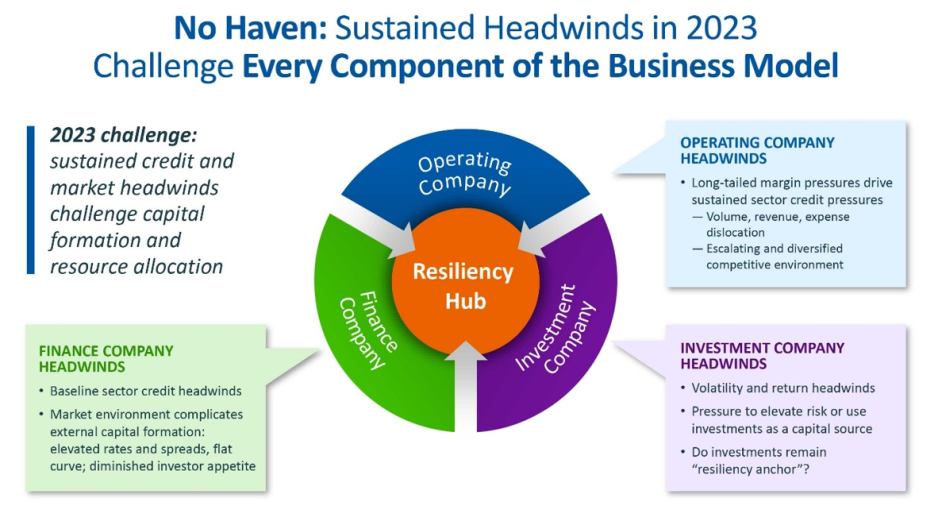

- For the first time in a long time—maybe ever—all three components of the not-for-profit healthcare company experienced significant and sustained dislocation. Whether these multi-variable headwinds hold or ease will define the credit and capital formation capacity of the not-for-profit healthcare sector in 2023 and beyond.

- Noticeable gaps emerged between how key components of the healthcare sub-economy (i.e., labor and wage pressures) work versus other parts of the U.S. economy; these gaps suggest that healthcare might experience monetary or fiscal tightening quite differently than sectors like tech or manufacturing or financial services.

The general expectation for 2023 is more of the same—more Fed tightening, more fiscal tightening (withdrawal of pandemic-era support programs), more expense challenges, with everything leading to a recession. All of this suggests a continued negative tilt to healthcare’s ability to generate capital from internal or external sources: operations may improve but margins are expected to remain relatively compressed; rating agency credit outlooks are negative; rates and credit spreads are elevated; and investment expectations don’t suggest the kind of balance sheet recovery that might offset the operating challenges.

While base expectations are discouraging, there are scenarios where the credit and capital formation picture gets better or worse. If you start listing the upside/downside drivers, it becomes clear that any lift to healthcare resources is more likely to come from better-than-expected investment or funding environments than from operations. Operating challenges are likely to take time to resolve, whereas the pace and scale of balance sheet recovery (or deterioration) will respond to whether the Fed engineers an inflation landing in 2023 and whether that landing is soft or hard. A soft landing might unleash balance sheets; a hard landing probably leads to unpleasant debt and investing outcomes; and no landing likely means volatility and generally mediocre balance sheet performance.

|

Potential Headwinds |

Potential Tailwinds |

|

|

Monetary Policy |

Intractable inflation pressures shift expectations to a sharper and longer tightening regime

• Markets deteriorate based on the form and severity of the pressures; balance sheets deflate further; debt markets remain unattractive • Consumers opt to moderate healthcare consumption or a rise in bad debt ensues |

Inflation moderates enough for the Fed to reduce the pace or expected duration of rate hikes

• Markets rally, allowing balance sheets to inflate and more favorable financing options

• Confidence and resources lead consumers to fully engage with the healthcare system |

|

Economic Growth |

Worsening financial conditions cause faster or deeper erosion in healthcare resource pools

• Federal: divided government and an emerging fiscal restraint wing

• States: weaker income or capital gain tax receipts

• Commercial: reduced tolerance for rate increases or early contract renegotiation

• Uninsured: weaker consumer financial and credit resiliency |

Better than expected financial conditions protect healthcare resource pools

• State: stronger income and/or capital gain tax receipts

• Commercial: willingness to give higher rate increases or entertain mid-year renegotiations

• Uninsured: smaller pool armed with greater financial capacities |

|

Healthcare Volume |

• Volume pressures escalate in response to forces ranging from consumer behavior to increased competition |

• Volume pressures ease, both in terms of absolute levels and composition; upside realization dependent on care infrastructure |

|

Healthcare Labor |

• Inability to make meaningful progress in securing human or technology resources needed to drive required cash flow |

• Faster than anticipated progress in rebuilding and restructuring workforce; multiplier effect from volume recovery |

The defining characteristic of January 2023 is the multi-variable set of high-impact unknowns; and the only way to push back is to bridge the management of scarce resources across the very different operating, financing, and investing functions that define every not-for-profit healthcare organization. Risk management is vitally important, as are strategic, financial, performance improvement, debt, and investment management plans. But the aggregate imperative for 2023 is connecting all these initiatives and being truly excellent in the accumulation, positioning, and allocation of all available and accessible resources. Churchill’s admonition to “keep going” through hell isn’t about being passive, and our continued advocacy for great resource allocation is because it’s the best way we know to take the fight.