From the Gist Weekly team at Kaufman Hall

Please sign up to receive Gist Weekly directly in your inbox (nearly) each week.

In the News

What happened in healthcare recently—and what we think about it.

- Federal agencies offering support to providers in response to Change hack. This week, the Department of Health and Human Services (HHS) and the Centers for Medicare and Medicaid Services (CMS) unveiled new flexibilities and assistance for providers in the wake of the ongoing outages at Change Healthcare following a recent cyberattack. Change has disabled several key services since it detected the breach on February 21, including many related to billing, prescription fulfillment, eligibility checks, and prior authorization requests. As a result, some provider organizations have faced cash-flow challenges. HHS and CMS said they will expedite the process for providers to switch claims processors, ensure providers can submit Medicare bills on paper, and encourage private health plans to relax utilization management requirements and offer advanced funding to providers. The American Medical Association called these actions “a welcome first step,” but urged the government to go further by promising advanced Medicare payments for providers, which CMS said would be evaluated on an individual basis. UnitedHealth Group, Change’s parent company, has also offered a temporary funding assistance program to providers, though the American Hospital Association has criticized it for being inadequate.

- The Gist: Due to the singular reach of Change’s services nationwide, this cyberattack is affecting providers and patients in unprecedented ways, even drawing comparisons to COVID. Change has announced that it expects its systems to be back next week, but some physician groups and health systems, asked to deliver care without full reimbursement, risk running out of cash while waiting to be made whole.

- House passes funding bill easing provider cuts. On Wednesday, the US House of Representatives approved a $460B spending bill to fund about half the federal government through the fall. The bill, which the Senate is expected to pass shortly, would delay the $8B pay cut for disproportionate share hospitals (DSH) for a year, offset most of the 2024 Medicare physician pay cut, and extend federally qualified health center funding for another four years. This bill must be signed by President Biden on Friday before a midnight deadline to avert a partial government shutdown. Congress also faces the task of passing a second round of spending bills, including funding for HHS, by March

- The Gist: Although welcome news to providers, these measures are only temporary relief against the backdrop of ongoing Medicare belt-tightening, which Congress has been unwilling to address head on. Other key healthcare policy items, including reforms targeting pharmacy benefit managers and Medicare Advantage plans, were left out of the spending bill and likely face uphill legislative battles, especially in an election year.

- New White House task force to examine healthcare costs. Ahead of President Biden’s State of the Union address on Thursday, his administration announced a new task force, co-chaired by the Justice Department (DOJ) and the Federal Trade Commission (FTC), that will focus on “unfair and illegal pricing” in sectors across the economy, which it says are keeping prices high for American consumers. Specifically related to healthcare, the administration cites the high cost of prescription drugs and says the new task force builds upon its ongoing work to make healthcare markets more affordable and competitive. In related news, the DOJ and FTC, along with HHS, announced a joint inquiry into private equity and other corporate owners of healthcare services to understand aspects of their increasing influence over healthcare, including their impact on the affordability of healthcare services.

- The Gist: With eight in ten American voters saying that it is “very important” for the 2024 presidential candidates to talk about the affordability of healthcare, it’s no surprise the Biden administration is doubling down on the issue as the president’s reelection campaign gears up. Although the average voter may be unaware of the intricacies of the myriad contributors to America’s high healthcare prices and costs, nearly half of US adults say it is difficult to afford healthcare costs, and one in four say they have skipped or postponed care because of cost.

Plus—what we’ve been reading.

- What counts as tech “disrupting healthcare”? Published last month in the Harvard Business Review, this article outlines why tech innovators are unlikely to displace healthcare incumbents, no matter how “ripe for disruption” the industry may appear to be. According to the authors, healthcare is too fragmented, locally controlled, and slow-moving for digital disruptors to replicate their success upending industries like commerce, television, and transportation. However, the authors argue that health systems should not refuse to transform themselves, and that they will have to turn to the resources and solutions of digital innovators to continue to survive.

- The Gist: “Disruption” does not mean “displacement” and, importantly, disruption is not always a bad thing. To succeed in the years ahead, health systems will need to continue to embrace new ways to tackle the many challenges they face, especially around reducing costs and expanding access. The most successful systems will keep leveraging innovations and partnerships—with digital tech companies, as well as with others—in order to bolster their efforts.

Graphic of the Week

A key insight illustrated in infographic form.

Looking beyond the median hospital

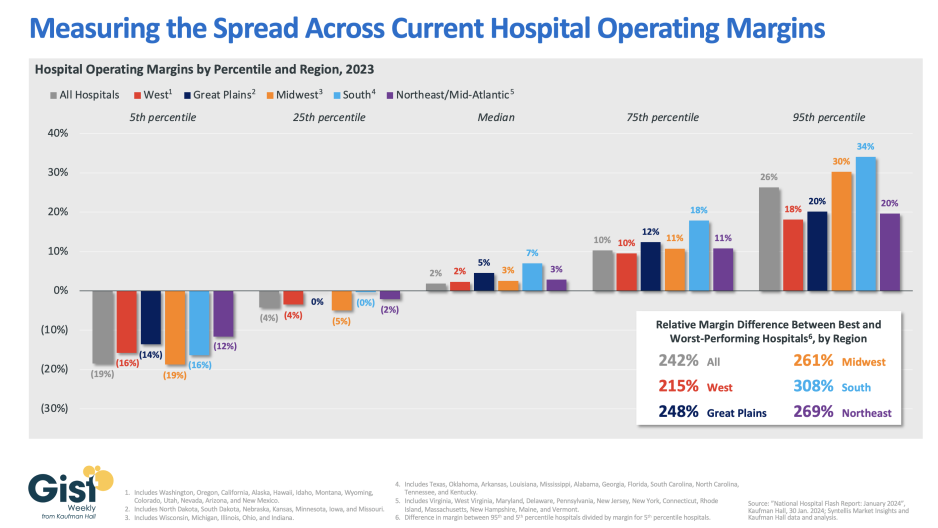

In this week’s graphic, we use data from Kaufman Hall’s National Hospital Flash Report and Syntellis Market Insights to assess the current state of hospital operating margins. While the median hospital operating margin rose to nearly two percent in 2023, there is a widening gap between the operating margins of the highest- and lowest-performing hospitals: nationwide, hospitals in the 95th percentile posted operating margins around 26 percent, while those in the bottom fifth percentile saw operating margins of around negative 19 percent. There is also fairly significant variation at the regional level. In general, hospitals in the West and Northeast struggled more across 2023, stemming in part from higher labor costs, some of which can be attributed to differences in state regulations. Hospitals in the South saw the largest gap in relative margin difference between their best and worst-performing hospitals. We expect the margin spread between the highest- and lowest-performing hospitals to continue to widen, as systems with stronger financials fund outpatient service expansion and strike new partnerships in their quest for continued growth and profitability, while hospitals with weaker financials are unable to reinvest in themselves and struggle to keep their doors open.

On the Road

What we learned from our work in the real world. This week from Erik Swanson, Senior Vice President, at Kaufman Hall.

The diverging fortunes of today’s hospitals

While presenting at a conference a few weeks ago, I received a comment about our National Hospital Flash Report that’s been cropping up more and more. “It’s great that the median hospital is doing much better these days,” a health system leader pointed out, “but that hasn’t been the case in our market. We’re still operating in the negative most months.” But, in other recent meetings, hospital leaders have told me, “It’s far from doom and gloom around here—our margins are strong, much higher than the national median.”

Certainly, some of these comments concern the nature of medians, which never tell the full story, but it’s also increasingly apparent that hospitals seem to be on pretty divergent tracks right now (as shown in the graphic above). On one end are the slowest-recovering hospitals, most of which continue to lose money on operations. Many find themselves still reliant on contract labor, in regions with declining populations, or just generally poorly positioned within their markets. But on the other end are hospitals that have emerged from the pandemic seemingly unscathed, if not better than ever. By and large, these hospitals have managed to reduce their labor spending significantly, embrace the outpatient shift, and keep their average length of stay from rising. Today’s high margin performers also often benefit from being the dominant health system in a high population growth region.

While the median US hospital is currently seeing an operating margin of just above two percent, around four in ten hospitals continue to operate in the red. Headlines of a hospital industry recovery are short sighted—what matters most right now are these “numbers behind the numbers” as my colleague Ken Kaufman and I recently wrote more about. If you’d like more detail on the larger picture here, I invite you to reach out.

On Our Podcast

Gist Healthcare Daily—All the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

Last Monday, the podcast looked at how workforce challenges are prompting hospitals and health systems to find creative ways to build up their talent pipelines. Host J. Carlisle Larsen spoke with Celina Cunanan, Chief Diversity, Equity & Belonging Officer at University Hospitals in Cleveland, about its initiatives to encourage youth in the community to consider careers in healthcare.

This Tuesday, we listen to the second part of their conversation. They’ll discuss how University Hospitals’ efforts to diversify its talent pipeline—and by extension, its workforce—benefits both the system and the community as a whole.

And be sure to tune in every weekday morning to stay abreast of the day’s biggest healthcare news. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

Thanks for reading another edition; we look forward to being back in your inboxes next week!

Best regards,

The Gist Weekly team at Kaufman Hall