by The Gist Weekly Team at Kaufman Hall

We’ll be resuming our regular publishing schedule, delivering executive-level commentary and insights directly to your inbox (nearly) every Friday afternoon. We greatly appreciate your continued subscribership, and encourage you to share this email with colleagues and friends—be sure to tell them to subscribe as well!

In the News

What happened in healthcare recently—and what we think about it.

- General Catalyst to buy Summa Health. Last week, venture capital firm General Catalyst announced its plan to acquire Summa Health, an Akron, OH-based integrated delivery system with three hospitals, a large medical group, a health plan, and an annual revenue of around $2B. The terms of the deal were not disclosed, though General Catalyst previously indicated it aimed to spend $1-3B to acquire a health system. Pending regulatory approval, Summa will convert to a for-profit entity and become a fully owned subsidiary of General Catalyst’s recently launched Health Assurance Transformation Corporation (HATCo). HATCo, under the leadership of former Intermountain Health CEO Marc Harrison, was founded with the intention of acquiring a health system to serve as a blueprint for General Catalyst’s vision of healthcare transformation.

- The Gist: While there’s a dearth of evidence for what kind of health system makes a good venture capital investment, Summa’s concentrated footprint of integrated delivery assets, robust Medicare Advantage plan, and position in an aging, yet competitive, market certainly seem attractive given HATCo’s stated goals. If it closes, the partnership will provide Summa with an influx of capital and General Catalyst with a “proving ground” for both its vision of healthcare transformation and its portfolio of technology solutions. But while it’s one thing to get Summa’s board to sign on, General Catalyst will now have to reckon with other important stakeholders. Summa’s physicians will be the gatekeepers of change at the local level, and their buy-in will be required for any continued push toward value-based care or successful product roll-out. And, behind the scenes, General Catalyst will have to convince its investors that this longer-term play to rethink care delivery will offer financial returns worth the wait.

- Intermountain’s Saltzer Health seeks buyer or risks closure. Saltzer Health, a Meridian, ID-based multispecialty group with over 100 providers that’s been owned by Intermountain Health since 2020, shared this week that it will shut down if it cannot find a buyer within the next two months, due to its ongoing financial and economic challenges. Beyond the rising costs of care that have plagued provider organizations across the country, Saltzer leaders pointed to a lack of progress around contracts and market relationships in its Boise, ID service area as contributing factors. The group announced that it’s in active negotiations with other healthcare companies potentially interested in purchasing some of its assets, and is optimistic it can avoid full closure. Saltzer has experienced several ownership changes in recent years: Intermountain bought the group from development firm Ball Ventures Ahlquist in 2020, which had purchased it from Change Healthcare in 2019. Change acquired it two years prior after a Federal Trade Commission (FTC) challenge led to Saltzer’s divestment from St. Luke’s Health System.

- The Gist: It’s notable that Intermountain appears uninterested in continuing to grow its presence as a provider in the Boise market, suggesting the system is opting to instead focus its resources on faster growing markets like Denver, which it unlocked through its purchase of SCL Health in 2022. Given that the FTC previously signaled opposition to Saltzer’s acquisition by a local health system, and a dominant regional integrated delivery system is no longer interested in the group, a nontraditional buyer—like a vertically integrated payer—may use this as an opportunity to enter the Treasure Valley and attempt to steal market share from Intermountain’s Select Health insurance arm.

- Health systems partnering with high schools in workforce pipeline program. Bloomberg Philanthropies recently announced a $250M pledge to fund an initiative for high schools students in ten urban and rural communities to graduate directly into high-demand healthcare jobs at 13 large health systems—including Mass General Brigham, Atrium Health, Baylor Scott & White Health, Northwell Health, and Ballad Health. The money will support increased enrollment and improved resources at these public high schools, and paid internships for students that aim to prepare and certify them for well-paid, full-time jobs at partner health systems upon graduation. The new curricula, co-designed by the health systems, will encourage students to choose a specialty area after tenth grade, training them for roles such as surgical technologists or respiratory therapists. The program will also provide subsidies to students who opt for post-secondary education upon graduation.

- The Gist: With two million healthcare jobs currently unfilled, and an additional two million new healthcare jobs expected across the next decade, this program targets the industry’s most pressing concern: its staffing crisis. While health systems have long worked to establish workforce pipelines in their communities, this initiative is unique in scale and ambition—aiming to lift high school graduates past entry-level healthcare jobs directly into middle-class careers that begin their first day on the job.

- Plus—what we’ve been reading: Big pharma entering the direct-to-consumer (DTC) prescription fray. Recently published in Stat, this article outlines how the launch of telehealth platforms by pharmaceutical companies, most notably Eli Lilly’s LillyDirect, portends a game changer for DTC prescription marketing. Spurred by the escalating demand for Eli Lilly’s Zepbound and Mounjaro GLP-1 drugs, LillyDirect connects consumers with a third-party telehealth provider for prescriptions, an online pharmacy for fulfillment, and in-house payment support through streamlined coupon applications and prior authorization troubleshooting. In exchange, Eli Lilly gets access to reams of patient data, in addition to boosted sales. Pharma companies insist that the platforms have proper firewalls in place, as no money directly changes hands between them and their affiliated telehealth providers.

- The Gist: With so many other companies hopping on the GLP-1 virtual prescription bandwagon, it’s no wonder why pharma companies are opting to enter the market directly. What LillyDirect offers is not fundamentally different than platforms like Ro or Teladoc: using telehealth to blur the lines between prescription and over-the-counter medications by empowering consumers to seek out the care they want. However, Eli Lilly’s control of the drug supply, ability to offer coupons, relationships with pharmacy benefit managers, and inherent brand association with the drugs give it a leg up on the competition. By replacing “talk to your doctor about” with “visit our website for”, these consumer-focused platforms perpetuate the ongoing fragmentation of care and risk tapping into the potentially harmful side of consumerization in healthcare.

Graphic of the Week

A key insight or teaching point from our work with clients, illustrated in infographic form.

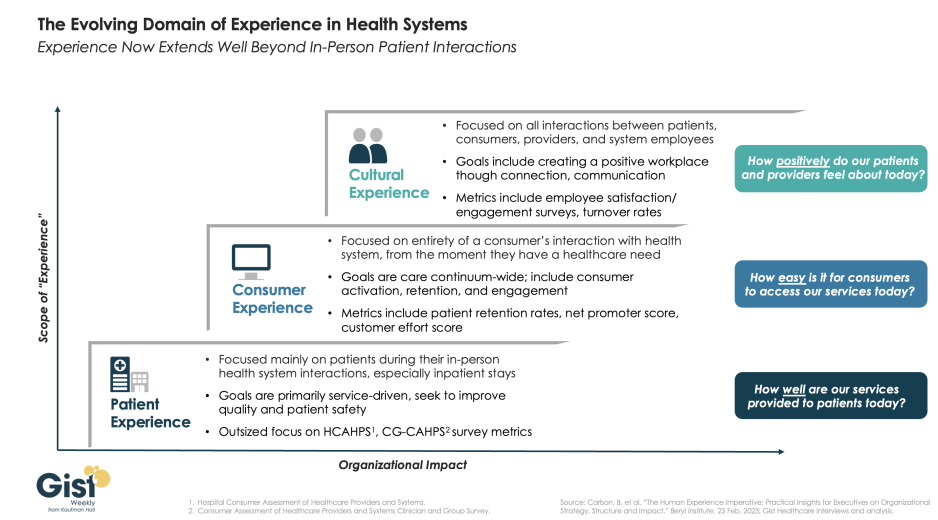

Expanding beyond patient experience

In this week’s graphic, we highlight the importance of broadening the domain of health system experience initiatives beyond patients to include consumers and even employees. While reimbursements tied to HCAHPS (Hospital Consumer Assessment of Healthcare Providers and Systems) and CG-CAHPS (Clinician and Group Consumer Assessment of Healthcare Providers and Systems) scores have made patient experience a main focus for years, an increasingly consumer-driven healthcare industry means that health systems must consider the experience of all consumers in their markets, with the hopes of meeting their needs and eventually welcoming them as new—or returning—patients. Embracing this mindset requires focusing on the entirety of a consumer’s interactions with the health system and the tracking of non-traditional metrics that measure the strength and value of their relationship to the system. Some systems are expanding their experience purview even further by also focusing on the working conditions and morale of their providers and other staff, as a healthy workplace environment serves to better both the patient and consumer experience. Easily accessible services and positive interactions with providers and other staff can determine a consumer’s view of their experience before any care is actually delivered. Cultural and strategic shifts that integrate experience from the top down into all operational facets of the health system will ultimately strengthen consumer loyalty, employee retention, and the financial health of the system.

On the Road

What we’ve been learning from our work in the real world.

Is our collaborative culture slowing down our ability to act quickly?

“We have a collaborative culture; it’s one of our system’s core values. But it takes us far too long to make decisions.” A health system CEO made this comment at a recent meeting, giving voice to a dilemma many system executives are no doubt facing. Of course, leaders want their teams to collaborate—in any important decision, we want to hear different voices, consider diverse points of view, and incorporate various areas of expertise. On the other hand, collaboration takes time, which we don’t have right now. It also can add complexity, be the enemy of clear direction, and muddy accountability. This CEO went on to make an essential connection: “My concern is that this protracted decision making isn’t just a process problem, but that it’s showing up in our results. Take performance improvement—we all quickly agreed we need to cut costs, but it’s taking far too long for us to act, and I fear we’ll have trouble holding the new line over time.” She further mused “I wonder if this problem is, at least in part, due to how we make decisions. We don’t make them quickly enough, they aren’t clear enough, and we don’t have the most effective system of accountability.”

On one hand, traditional hospital culture is rightly grounded in the safety, hierarchy, and tradition of a do-no-harm world. But on the other hand, today’s economic, technological, and competitive environments require an approach to operations, revenue, and growth that has the aggressiveness of a Fortune 50 company. This should not be an either-or situation. Health systems can uphold a culture of safety while also fostering nontraditional values that will drive the organization assertively toward the future – all while committing to change.

How has your organization evolved its decision-making process to balance the benefits of collaboration with the business realities of needing quick and impactful actions? We’re interested in hearing more about what has worked well, and what you’re still struggling with. Reach out to Amanda Steele, Managing Director at Kaufman Hall, to discuss.

On our Podcast

Gist Healthcare Daily—All the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

Last Monday, JC spoke with Carol Skenes, Principal Strategist at Turquoise Health, to learn more about how compliant were hospitals and health insurers with posting their prices last year, and what 2024 may bring for price transparency.

This Monday, she speaks with Matthew Fiedler, Senior Fellow at the Brookings Institution, about how the No Surprises Act’s independent dispute resolution process has worked—and faltered—since it launched in April 2022.

And be sure to tune in every weekday morning to stay abreast of the day’s biggest healthcare news. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

That’s all for this week, thank you for tuning in. Our team is happy to be back! We welcome your comments, feedback, and suggestions—just reply to this email. As always, please let us know how we can be of assistance in your work.

Best regards,

The Gist Healthcare Team at Kaufman Hall