Current Rate Environment

Healthcare transactions continue to enter the markets, but still at a relatively slow pace. The experience continues to be generally strong investor support and favorable execution. Funds flows and supply pressures remain favorable but inflation and general economic indicators remain unsettled, so anticipate volatility.

|

1 Year |

5 Year |

10 Year |

30 Year |

|

|

Feb 10—UST |

4.90% |

3.92% |

3.74% |

3.83% |

|

v. Jan 27 |

+22 bps |

+30 bps |

+22 bps |

+19 bps |

|

Feb 10–-MMD* |

2.61% |

2.12% |

2.24% |

3.28% |

|

v. Jan 27 |

+28 bps |

+7 bps |

+5 bps |

+8 bps |

|

Feb 10—MMD/UST |

53.27% |

54.08% |

59.89% |

85.64% |

|

v. Jan 27 |

3.48% |

-2.55% |

-2.32% |

-2.27% |

|

*Note: MMD assumes 5.00% coupon |

||||

SIFMA reset this week at 3.74%, which is approximately 82% of 1-Month LIBOR and represents a 208 basis point adjustment versus the January 25, 2023, reset.

A Bumpy Ride

On Wednesday, February 1, the Fed increased short term rates by another 25 basis points to set a new target range of 4.50-4.75%. While the absolute increase seemed small relative to the 50 and 75 basis point moves that characterized much of 2022, the ending target range is the highest since 2007.

On Friday, February 3, the U.S. Labor Department released its January jobs report that showed nonfarm payrolls up 517,000 and the unemployment rate falling to 3.4%, which is the lowest for that indicator since 1969. Not only was the January performance way better than expectations, but the release also included upward revisions to prior reported levels, suggesting that the U.S. economy has been adding jobs at a faster clip than everyone thought. Offsetting all the very visible layoffs in tech, big gains were seen across leisure and hospitality, professional and business services, and healthcare.

On Tuesday, February 7, Fed Chairman Jerome Powell gave a talk at the Economic Club of Washington, D.C., and offered up our remarks of the week: “[Getting back to a target rate of 2.00% inflation] is likely to take a long time. It’s not going to be, we don’t think, smooth…it’s probably going to be bumpy.”

Chairman Powell and other Fed representatives keep emphasizing that rates need to move higher, and the consensus is that the Fed Funds Rate will move well above 5.0% during 2023; our central bankers remain committed to using the one blunt instrument they have, with a goal of retarding private sector growth and job creation, especially in the services sector. But there are these nagging tension points that continue to cloud the plan:

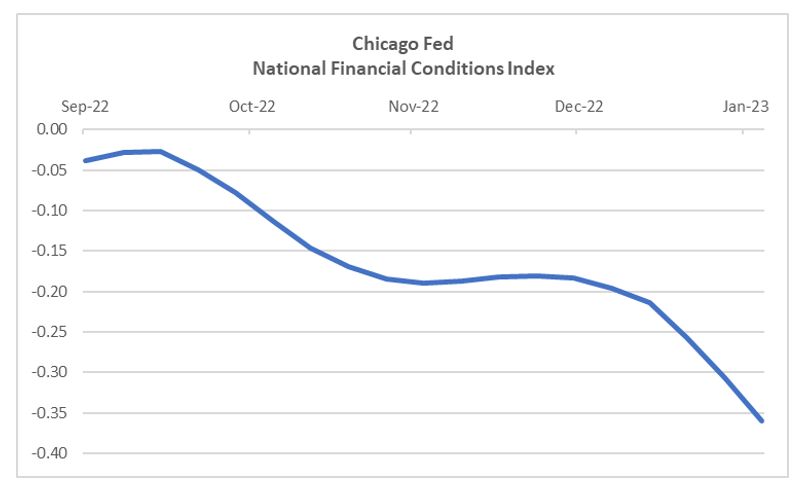

- Financial Conditions: The Chicago Fed’s National Financial Conditions Index indicates that financial conditions have loosened over the past several months (note that negative Index readings indicate easier conditions). Despite the Fed’s hawkish words and deeds, financial conditions have generally become more accommodative.

To put a finer point on it, the year-to-date performance across different key indicators measured as of the close on the day of Powell’s Economic Club comments were: 10Y UST yield, 20 bps lower; 30Y UST yield, 25 bps lower; 30-year mortgage rates, 13 bps lower; DJIA, 1,009 higher; S&P 500, 325 higher.Image

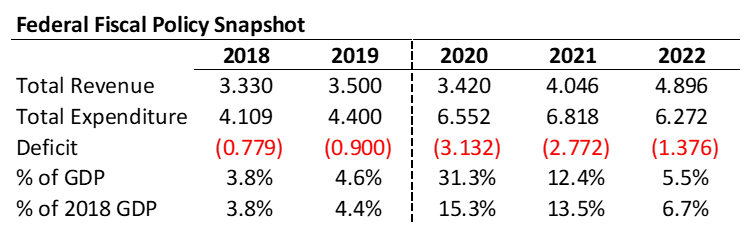

- Fiscal Policy: The pandemic era seems to have resulted in a fundamental reset in the arc of accommodative federal spending. Our political elites have launched this year’s riff on the WWF cage match that is otherwise known as the debt ceiling debate. The certain outcome of the match will be much drama with villains and heroes depending on which side you favor; the other likely outcome is market volatility, especially if the match is protracted. But history suggests that the least likely outcome will be any meaningful reset in the pace or composition of deficit spending—party on, Garth, and another sorry to the kids.

Image

It feels like we’re living our own weird triangle of sadness: the private side of the economy desperately wants to grow but the public side of the economy wants to keep pouring massive amounts of money into the system, which creates excesses that lead our central bank to pursue policies designed to shut down private sector growth. On the one hand, this is nuts; on the other hand, maybe this is the logical outcome of the last 15 years.

The inflation crisis may be moderating, although paying attention to the 1960s and 1970s suggests it isn’t over until it’s actually over. But, as with its parent COVID, what lies beyond the crisis is a stabilization process with a wide distribution of outcomes (potential relapses, ripple dislocations, and time to resolution). Healthcare balance sheets have recovered some during the first months of 2023, and they remain the essential bridge over operating instability. In our last blog, we talked about the importance of a “responsive” balance sheet because volatility across every activity—operating, financing, investing—will likely define the next several years. In the press of working to mitigate operating dislocation, it is imperative to spend equal energy and focus on positioning the balance sheet in the way that best aligns with your organization’s total needs and goals. In Jerome Powell’s bumpy financial asset world, the balance sheet bridge might seem more like one of those rickety rope things from an Indiana Jones movie, but this just elevates the importance of paying attention and figuring out how to make it is as much of a stabilizing resource as possible. If the right destination is a responsive balance sheet, the journey must be all about becoming excellent at strategic resource allocation.