Happy New Year and high hopes for a healthy, happy, and successful 2022; the one certainty is that it won’t be uneventful.

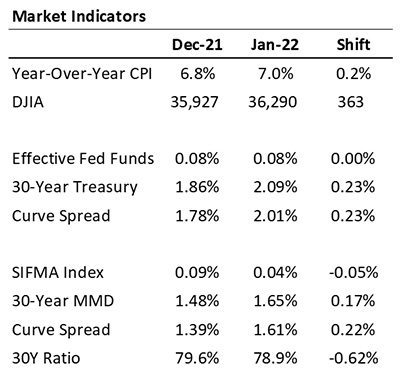

Let’s kick off this year’s discussion with a level-setting comparison of some key market indicators as of January 12, 2022, versus December 15, 2021. Noteworthy is the shift in long rates and curve steepening; despite these elevated levels, 30-year Treasury rates remain 36 bps below the 12-month trailing high. For the time being, the de-risking beat goes on: low rates, relatively flat curves, and continued support for issuing long duration natural fixed.

Resiliency 2022 Style

COVID continues to shape-shift and batter the care delivery system, but increasingly attention is turning to living with it versus trying to hide. Improvising on the construct Allison Schrager offered in her March 23, 2020, Wall Street Journal article, we are moving out of the realm of uncertainty (the unmanageable challenge of responding to unknowns) and into the realm of risk (the managed response to an identifiable challenge). Unfortunately, stabilization does not mean the absence of turbulence; in fact, the stabilizing process is about traversing the middle ground between the dislocation and fear of a crisis and the systemic calm of a steady state. The aftershocks of an earthquake are the tectonic plates settling into a new normal; the aftershocks of COVID (which include the residual of 2008) will shape, complicate, and unsettle our stabilization journey.

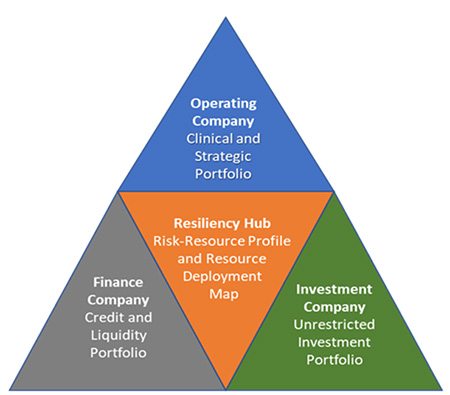

The central theme of this series is the thesis that during crisis and stabilization, healthcare leaders should focus on resiliency. Achieving resiliency requires a lot of steps but three core things:

- Understanding the risks and resources embedded in the three functions of every not-for-profit healthcare company: mission-based operations, financing, and investing

- Using that profile to assess your organization’s resiliency position (whether risks and resources are in or out of balance)

- Using that resiliency position to guide where your organization needs to be on a risk-return continuum and then integrating the management of the component activities to support that unified enterprise goal

During the crisis stage of COVID, the threshold resiliency test was whether an organization’s finance and investment companies could assemble enough liquidity to make internal and external constituents feel like the enterprise could weather the array of revenue dislocation and operating company chaos. Success was meeting this liquidity crisis standard.

As we head into stabilization, having strong liquidity isn’t going to be enough. Instead, attention is going to shift back to the reality that healthcare is an operating-company-led sector. If this is right, then credit conversations in 2022 will start to focus on how the organization is positioned to deal with the twin challenges of lingering volume-revenue headwinds paired with a significant and now structural resetting of the expense base; and there is likely to be decreasing patience with organizations that don’t have solid answers. The process will be complicated by variability in margin performance across the sector and by potential divergence against historical indicators, such as rating medians. Stabilization may lead us to a normal that is different from what we knew before COVID, which means our industry GPS system may be less reliable for some period.

The first wild card is whether volatility will be limited to operations or extend into balance sheets. The Fed is expected to transition to some degree of monetary tightening, which will result in the removal of liquidity (aka, financial oxygen) from the markets. If this shift is well managed and investors stay on board, it will work fine and borrowing costs or investment returns won’t become a major headwind. If this goes sideways, then those parts of the healthcare business that have been the resiliency anchors of the last two years (finance and investment arms) will themselves become the source of incremental stress on total returns, credit position, and resource generation.

The scarier wild card is that we may not be done with uncertainty. This is the scenario where a $9 trillion Federal Reserve balance sheet and a $30 trillion U.S. budget deficit turn out to be the mother of all bubbles; where liquidity withdrawals are accelerated with more severe consequences than most experts hope or expect. Draconian scenarios seem unlikely, but like any good dystopian novel they are grounded in a reasonable base. For our purposes, this base is that at some point the liquidity-stimulus spigot must get turned off, at which point the financial markets and healthcare economy will enter a period of scarcity. Unfortunately, there is no guidance around all sorts of “what, when, and how” questions when the central bank that controls the world’s reserve currency has a balance sheet that is almost 40% of its home country’s GDP and resides in a country whose national debt-to-GDP is over 120%. This mix is a significant risk with a wide dispersion of possible outcomes (magnitude and timing).

2022 is going to be about traveling from COVID to a different place. As we start out, arguably the liability or finance company component is in the best shape, given the amount of portfolio de-risking that has gone on over the past several years. But the need for external capital is relentless, and eventually the finance company will bump up against any emerging credit pressures or financial market dislocations. So, there is no haven, and the only response option is to approach stabilization as an active exercise in resiliency that requires the tightly integrated management of risks and resources across operations, financing, and investing.

Trending in Healthcare Treasury and Capital Markets is a biweekly blog providing updates on changes in the capital markets and insights on the implications of industry trends for Treasury operations, authored by Kaufman Hall Managing Director Eric Jordahl.