Higher education is facing a very real crisis of confidence in the value of a college degree, and this crisis has very real risk implications for future enrollments, tuition pricing, and capital spending.

One of our firm’s founders, Mark Hall, often compared the timing of institutional decision-making with the fate of the Exxon Valdez, the oil tanker that ran aground on March 24, 1989, on Bligh Reef in Prince William Sound, Alaska, resulting in a catastrophic spill of approximately 11 million gallons of crude oil. There were many factors that contributed to the spill, but among them were the crew’s decision to stray out of the main traffic lanes through the sound in hopes of avoiding ice that would have required the ship to reduce speed, and the fact that the ship’s radar—which could have warned of the imminent collision with the reef—was broken and had been disabled for more than a year before the disaster.

Mark’s point was that, with foresight (e.g., an operating radar system), the ship’s crew could have made minor adjustments to the ship’s heading, completely avoiding the collision that otherwise was inevitable. The farther out from the risks you are, the more incremental those adjustments can be. Closer in, more drastic adjustments will be required and the ability of those adjustments to avoid disaster will be increasingly less certain. And to the extent you have strayed out of traditional traffic lanes, the risks will be more varied and higher, requiring more and broader information and measurement and more sharply honed forecasting of the magnitude of the potential risks.

There are clear risks looming for higher education:

- According to the results of a survey released in March 2023 by the Wall Street Journal and NORC at the University of Chicago, a majority of Americans now do not think a college degree is worth the cost. There has been an erosion of 11 percentage points between the percentage of Americans who thought a college degree was worth the cost in 2013 (53%) and the percentage who think it is worth the cost today (42%).

- A recent article in the New York Times notes that the percentage of high school graduates going straight to college is now at 62%; it was at 70% as recently as 2016. The article also reports that the percentage of young adults who say that a college degree is very important has fallen from 74% to 41% over the course of a decade.

- A Wall Street Journal report on 50 public flagship universities across the U.S. describes an “unfettered spending spree,” which has not necessarily produced desired enrollment gains. While the median increase in spending at these universities was 38%, median enrollment has increased by only 21%. Students are being increasingly asked to fund these spending increases in the form of higher tuition and fees. As the report notes, the combination of spending and higher tuition “is inextricably linked to the nation’s $1.6 trillion federal student debt crisis.”

These trends point to several key risks that should be on the radar for higher education: softening student interest in—and demand for—a college degree; the increasing likelihood of a ceiling on further tuition increases (tuition discount rates at private institutions have already reached record highs in 2023); and the possibility that high spending rates—combined with the first two risks—are setting institutions up for a budgetary catastrophe.

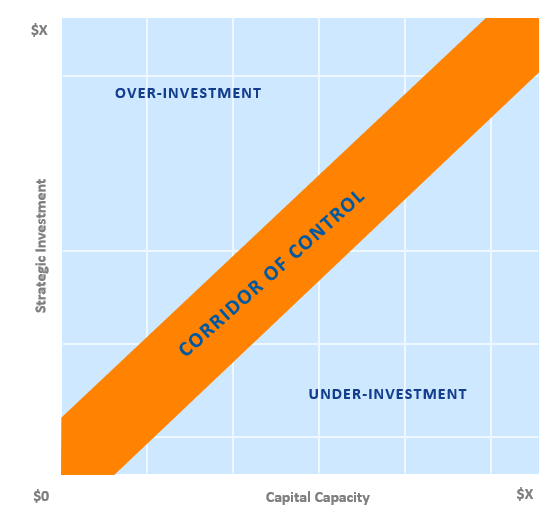

Avoiding these risks begins with purposeful analysis to find and quantify the appropriate “corridor of control” for your institution: a foundation on which to build a strategic financial plan. The corridor of control represents the level of performance required to achieve balance between two opposing objectives that almost every college or university must reconcile:

- The goal to compete as effectively as possible within an increasingly competitive and dynamic higher education marketplace. Such positioning can require aggressive investment of capital along with commitment of operating dollars to support successful implementation of strategies and related investments, and

- The need to respect the fiduciary role of leadership and the board of trustees to maintain the institution’s capital capacity and ensure its long-term financial integrity.

The Corridor of Control

To return to the Exxon Valdez analogy, the corridor of control represents an established traffic lane: on one side lies the risk of over-investment in strategy and growth, the consequences of which tend to be obvious and explicit. On the other side lies the risk of under-investment which, while not as spectacular, can undermine the ability of the institution to support continued growth and financial sustainability. Many institutions have been compelled to move out of the traffic lane in recent years, tending toward over-investment risk. That can be a valid short-term decision, but eventually the institution needs to find its way back to the equilibrium that the traffic lane represents. Whether through a greater focus on cost management or through a more measured and balanced portfolio of short- and longer-term strategies, travelling in the traffic lane of the corridor of control is the only way to ensure the institution’s long-term financial integrity.

Strategic financial planning is the tool that can help institutions understand the parameters of their corridor of control and guide themselves back into equilibrium. By linking desired spending on strategy and growth with a grounding in the financial resources that the institution has available today, and is projected to generate over the coming years, leadership can identify, well before the risk of collision, the adjustments necessary to steer back into the traffic lane. Some institutions are getting close to the reef; others have more time to change course. But in all cases, strong financial planning will help determine how quickly and to what extent a course correction must be made.