by The Gist Weekly Team at Kaufman Hall

Welcome back to Gist Weekly, where we distill the latest healthcare news, trends, and our conversations with industry leaders into actionable guidance for CEOs and senior executives. We’re happy to have earned a place in your inbox, and welcome you to share this email with friends and colleagues—be sure to tell them to subscribe as well!

In the News

What happened in healthcare recently—and what we think about it.

- Cigna to sell Medicare business as Medicare Advantage (MA) outlook declines for other big payers. On Wednesday, Bloomfield, CT-based Cigna announced a definitive agreement with Chicago, IL-based Health Care Service Corporation (HCSC), a large Blue Cross Blue Shield insurer, to sell its 600K-member MA business, as well as its Medicare prescription drug plan and Medigap offerings, for $3.3B. The two insurers also agreed to a four-year services agreement where Cigna’s Evernorth Health Services subsidiary, which includes Express Scripts, will continue to provide pharmacy benefit services to the Medicare businesses. While Cigna is exiting the MA market, other major payers—including UnitedHealth and Humana—are seeing their MA profits drop amid an increase in utilization, according to analysis from Moody’s Investors Service.

- The Gist: While it initially appeared that Cigna’s divesture of its MA business would position it to combine more smoothly with Humana, this deal with HCSC makes sense even in the wake of that reportedly called off merger. Cigna has been a bit player in MA for years, covering only two percent of MA lives in 2023, and the shrinking pie of MA profits will discourage all but the most successful or uniquely positioned payers. But while increasing utilization rates are contributing to a declining outlook for payers, MA is still a solidly profitable business, covering over half of Medicare beneficiaries and still growing by millions of lives each year. The MA payers that last are going to have to work harder at integrating their various care and data assets, and more carefully manage spend for an aging cohort of seniors with increasingly complex needs.

- Fitch says lower operating margins may be the new normal for nonprofit hospitals. On Monday, Fitch Ratings, the New York City-based credit rating agency, released a report predicting that the US not-for-profit hospital sector will see average operating margins reset in the one-to-two percent range, rather than returning to historical levels of above three percent. Following disruptions from the pandemic that saw utilization drop and operating costs rise, hospitals have seen a slower-than-expected recovery. But, according to Fitch, these rebased margins are unlikely to lead to widespread credit downgrades as most hospitals still carry robust balance sheets and have curtailed capital spending in response.

- The Gist: As labor costs stabilize and volumes return, the median hospital has been able to maintain a positive operating margin for the past ten months. But nonprofit hospitals are in a transitory period, one with both continued challenges—including labor costs that rebased at a higher rate and ongoing capital restraints—and opportunities—including the increase in outpatient demand, which has driven hospital outpatient revenue up over 40 percent from 2020 levels. While the future margin outlook for individual hospitals will depend on factors that vary greatly across markets, organizations that thrive in this new era will be the ones willing to pivot, take risks, and invest heavily in outpatient services.

- CMS to negotiate sickle cell treatment prices for state Medicaid programs. On Tuesday, the Centers for Medicare and Medicaid Services (CMS) announced that it will use its Cell and Gene Therapy (CGT) Access Model, unveiled in Feb. 2023, to negotiate outcomes-based pricing arrangements with the manufacturers of recently approved, high-cost sickle cell treatments on behalf of state Medicaid programs. These drugs, BlueBird Bio’s Lyfgenia and Vertex Pharmaceutical’s Casgevy, use gene-editing technology to offer a first-ever functional cure for sickle cell disease that costs between $2-3M per treatment. Starting in 2025, state Medicaid agencies can sign up for the CGT program, which offers them the federally negotiated pricing arrangement, additional subsidies, standardized access, and fertility preservation services (as one side effect of treatment can be infertility). Medicaid covers a majority of the 100k Americans with sickle cell disease, and the FDA estimates that about 20K people nationwide will be eligible for the new therapies.

- The Gist: High-cost drugs pose a problem for public insurance programs, which often must limit access to remain solvent. For example, rheumatoid arthritis drug Humira accounts for over 10 percent of all prescription drug spending for private insurers, but only one percent of Medicaid’s total. This CMS payment model seems well poised to address this issue by amassing leverage for stronger negotiations with drugmakers and providing further support to states to ease the financial burden. If it proves successful, more Americans who most stand to benefit from these new sickle cell treatments will be able to access them and more high-cost, gene-editing drugs in the pipeline could be ripe for inclusion.

- Plus—what we’ve been reading: Making the case for the liberal arts education of physicians. Published recently in Stat, this opinion piece argues that the changing nature of the practice of medicine should be reflected in the ways future physicians prepare to enter the medical field. Amid the well documented and much discussed decline of the humanities in higher education, prospective physicians are committing to increasingly narrow pre-med tracks that neglect the development of important skills, like empathetic communication and tolerance for ambiguity, which are vital to the practice of medicine.

- The Gist: With the rise of artificial intelligence and the unprecedented rate at which medical information is increasing, theproviders of tomorrow will have to rely less on the body of knowledge they accumulated in school and more on their ability to process and interpret new information, a hallmark skill of a liberal arts education. Medical schools themselves will also need to evolve in order to better prepare future physicians for the realities of life as a healthcare provider today, including incorporating a greater focus on the business side of healthcare, healthcare policy, and how providers can advance health equity.

Graphic of the Week

A key insight or teaching point from our work with clients, illustrated in infographic form.

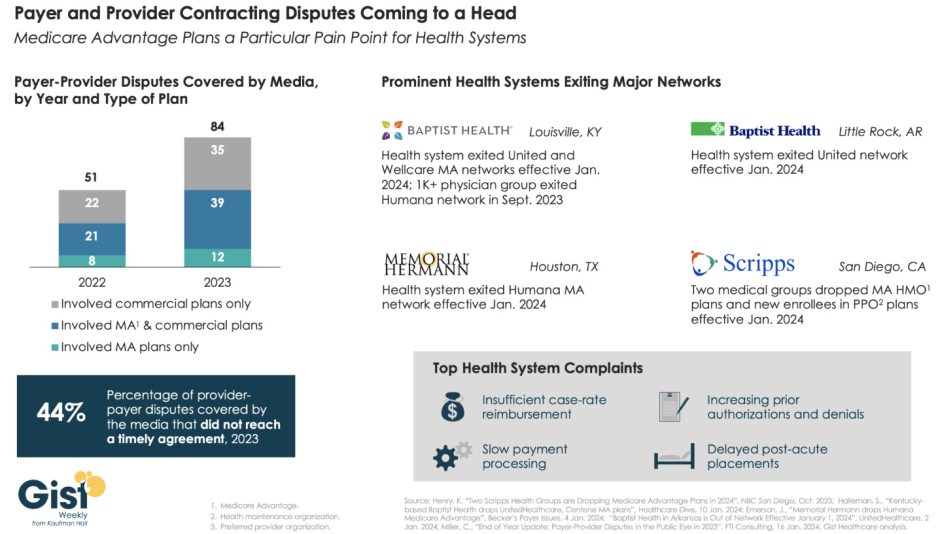

Providers exiting insurance networks over contracting impasses

In this week’s graphic, we highlight new data on the increase in payer-provider contracting disputes covered by the media. From 2022 to 2023, there was a 69 percent increase in the number of payer-provider contracting disputes that received media coverage. Nearly half of last year’s disputes did not reach agreement and resulted in network exits. Large provider organizations—including Louisville, KY-based Baptist Health, Little Rock, AR-based Baptist Health, Houston, TX-based Memorial Hermann Health System, and two large medical groups affiliated with San Diego-based Scripps Health—dropped Medicare Advantage (MA) plans from at least one major payer, like United or Humana, as of Jan. 1, 2024. Some dropped the payer’s commercial plans as well. Provider organizations leaving these networks have cited insufficient reimbursement rates and unsatisfactory business practices that drive up their cost of care delivery, especially around increased prior authorization requirements. While contracting disputes will ultimately be influenced by the competitive strength of a given provider and payer in a particular market, it’s important for both sides to recognize that the patients in the middle of these disputes can be the ones most harmed when they can no longer see their trusted physicians.

On the Road

What we learned this week from our work in the real world.

Keeping employers in the health benefits business

"What if 10 percent, or even five percent, of the employers in our market decide to stop providing health benefits?” a Chief Strategy Officer (CSO) at a midsized health system in the Southeast recently asked. “Their health insurance costs have been growing like crazy for 20 years. Some of these companies could easily decide to just give their employees some amount of tax-advantaged dollars and let them do their own thing.” An emerging option for employers is the relatively new individual coverage Health Reimbursement Arrangement (ICHRA), which allows employers to give tax-deductible contributions to employees to use for healthcare, including purchasing health insurance on an exchange. According to the CSO, “What happens is this: We’ll go from getting 250 percent of Medicare for beneficiaries in a commercial group plan to getting 125 percent for beneficiaries in a market plan. I don’t know any provider with the margins to withstand that kind of shift without significant pain—certainly not us.”

The conversation shifted to a discussion about treating employers like true customers that pay generously for healthcare services, which involves increasing engagement with them and better understanding their specific problems with their employees’ healthcare. What complaints are they hearing about their employee’s difficulties with things like making timely appointments or finding after-hours care? Provider organizations can help keep employers in the health insurance market by regularly checking in with them about their healthcare challenges, meaningfully focusing on mitigating their pain points, and exploring new kinds of mutually beneficial partnerships. They should also carefully monitor the employer market in their region and create financial assessments of the potential impact of employers shifting employees to health insurance stipend arrangements.

How is your organization keeping tabs on—and meeting—the changing needs of the employers in your market? Are you exploring new ways of partnering with employers? Reach out to Joyjit Saha Choudhury, Managing Director at Kaufman Hall, to discuss.

On Our Podcast

Gist Healthcare Daily—All the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

Last Monday, JC spoke with Matthew Fiedler, Senior Fellow at the Brookings Institution, about how the No Surprises Act’s independent dispute resolution process has worked—and faltered—since it launched in April 2022.

This Monday, she speaks with Anu Singh, Managing Director and Practice Leader of the Partnerships, Mergers & Acquisitions Practice at Kaufman Hall, about the state of healthcare M&A in 2023 and what may be in store for the year ahead.

And be sure to tune in every weekday morning to stay abreast of the day’s biggest healthcare news. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

That’s it for this week, but look for us in your inboxes again next Friday afternoon for more of our commentary and insights on the healthcare world. We welcome your comments, feedback, and suggestions—just reply to this email. As always, please let us know how we may be able to help you.

Best regards,

The Gist Weekly Team at Kaufman Hall