Anyone unfamiliar with the financial structure of not-for-profit colleges and universities may question why these organizations often carry significant financial reserves on their balance sheets. The answer is straightforward: with limited sources of funding, colleges and universities rely on financial reserves to maintain their financial stability and support their growth. Financial reserves ensure that these institutions can continue to serve their various constituents through good times and bad and can continue to invest in the highly skilled professionals, technologies, and programs that define modern higher education.

Not-for-profit colleges and universities have essentially two consistent sources of funding: they either earn revenue from operations and investments (e.g., tuition, fees, grants, contracts, and endowment income) or they borrow funds through issuance of debt in the bond markets or other forms of borrowing (e.g., bank lines of credit). Philanthropy is, of course, a third source of funding, but it can be unpredictable and is often restricted by the donor for specific purposes. Unlike for-profit organizations, not-for-profit institutions do not have access to equity markets. Also, unlike for-profit organizations, they are not obligated to shareholders who expect that excess funds will be distributed as dividends. Instead, not-for-profit colleges and universities have an obligation to their mission, their students, their alumni, and the broader communities they serve. Strong financial reserves help ensure that they can meet this obligation even in times of operational disruption and financial distress.

With no immediate end in sight to the operational and financial pressures colleges and universities are facing, organizations will have to rely on their financial reserves to carry them through until conditions improve, or until institutions can adapt to a potential new reality of decreased revenue, increased expenses, and increased competition.

Financial reserves and resilience

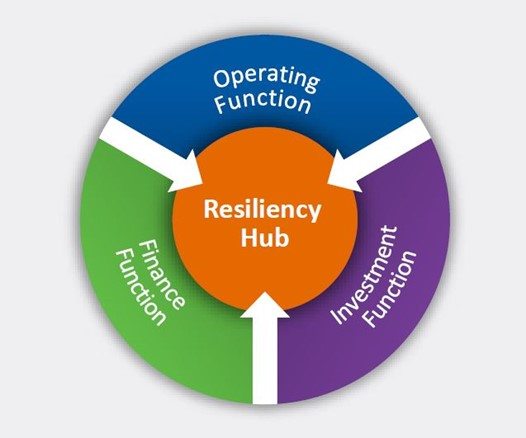

Not-for-profit colleges and universities rely on three interdependent functions to contribute to their financial resilience: namely, the ability to withstand adverse changes to these core functions and continue to support the organization’s mission.

- The Operating Function: The Operating Function focuses on management of the portfolio of academic programs and strategic initiatives that define the mission of the institution. Academic programs (the products of colleges and universities) generate tuition and fee revenue, and if that revenue creates a positive margin (i.e., exceeds expenses), that excess is available to be invested back into the institution. Operating margins are, on average, very low in not-for-profit colleges and universities. For example, for the private, not-for-profit colleges and universities rated by Moody’s Investors Service, median operating margins from 2017 – 2021 ranged between 3.0% and 4.5%, with a three-year average of 3.3% as of 2021. Even this figure can be a bit misleading: in 2021, both small private colleges and mid-sized private universities had negative median operating margins when gifts were excluded (-6.1% and -1.7%, respectively). Only comprehensive private universities had a positive median operating margin of 1.5% when gifts were excluded.[1] These rated organizations represent only a few hundred of the thousands of colleges and universities in the country and are among the most financially healthy.

- The Finance Function: Because the positive margins generated by the Operating Function are rarely enough to support the intensive strategic and capital needs of maintaining and improving teaching and recreational facilities, growing academic programs, and implementing technology, not-for-profit colleges and universities rely on the Finance Function for internal and external capital formation. The Finance Function builds unrestricted cash reserves and secures external financing (e.g., bond proceeds, bank lines of credit) to support the capital spending needs of the institution. The unrestricted cash reserves maintained by the Finance Function also help the institution meet daily expenses at times when expenses exceed revenues.

- The Investment Function: Not-for-profit colleges and universities will also endeavor to invest their cash reserves (both restricted and unrestricted) to generate returns that, first, act as an additional hedge against potential risks that could disrupt operations or cash flow, and second, generate accessible, independent returns. Any independent returns generated potentially provide an important supplement to revenues generated through the Operating Function.

The three functions described above are common to all not-for-profit organizations. The main differences are mostly within the Operating Function. In higher education, tuition is often the major source of revenue. As a result, while higher education doesn’t experience the daily and monthly volume and labor swings typical of an industry like healthcare, it does still carry real enterprise risk.

Financial reserves include all liquid cash resources and unrestricted investments held in the Finance and Investment Functions that are accessible to support the broad-based strategic and operational needs of the institution. These reserves are equivalent to the emergency funds individuals are encouraged to maintain to help them meet living expenses for six to twelve months in case of a job loss or other disruption to income.

There is another important point of differentiation for not-for-profit colleges and universities, where a significant portion of investments are held as endowments or donor-restricted funds by virtue of historical fundraising and advancement efforts. For these types of funds, the ability of management and/or the Board to access them as true financial reserves is limited to annual draws on endowment income at pre-established levels and within the use(s) defined by the donors. As a result, the utility of these investments as true financial reserves can be limited. Colleges and universities should follow the lead of their healthcare “cousins” over the last two decades and encourage unrestricted gifts in lieu of endowment or donor-restricted support to increase the flexibility available to deploy the corpus and income from investments to address unexpected needs.

In last month’s blog, we noted the need for an institution to invest the time to understand its potential for ongoing success and to define its path forward. As importantly, an institution’s planning should build time to enable the institution to weather the impact of a few failed efforts as it makes its way forward in an increasingly challenged operating environment. This is another way to define institutional resilience, and true financial reserves are a key element that can help create the cushion of time and incremental support for the occasional failure. A strong balance sheet forms the bridge that can span short-term adversity to enable an institution to reach its future destination.

This is the first in a series of blogs that will look at the role of financial reserves in not-for-profit higher education.

[1] Moody’s Investors Service, “Medians – Private Universities Helped by Federal Aid, Investment Returns in Fiscal 2021,” May 4, 2022.