The broader banking industry continues to feel financial pressure, and with that pressure came an August surprise: targeted bank downgrades from Moody’s and S&P. Banks were downgraded for a variety of factors, including deposit outflows and overall profitability, which are tied to market disruptions from earlier in the year along with continued uncertainty around future Federal Reserve interest rate activity.

Recent ratings downgrades are an indication that the balance sheet stress in place when Silicon Valley Bank failed in March is still in play. The FDIC recently published its second quarter banking summary, in which it reported that unrealized losses on investment securities at U.S. banks increased quarter-on-quarter by $43 billion to $558 billion (Figure 1).

Figure 1: Unrealized Gains (Losses) on Investment Securities at U.S. Banks

Source: FDIC.

Note: Insured Call Report filers only. Unrealized losses on securities solely reflect the difference between the market value as of quarter end and the book value of non-equity securities.

Of note, the 10-year U.S. Treasury rate was 3.84% at Q2 versus 3.47% at Q1. As we approach the end of Q3, the 10-year UST is around 4.3%, indicating that the unrealized losses will grow even further. As long as banks can hold these bonds until maturity—or until rates fall—without having to liquidate for funding needs, all is well. A scenario can be imagined, however, where deposit outflows increase and banks face no alternative but to sell underwater bonds and realize losses, challenging their capital structure. While unlikely due to various backstops that have been implemented since March, there is still counterparty risk.

As treasury departments continue to monitor the performance of key financial partners, it is important not only to track the key components of counterparty risk but also to ensure that the organization has an actionable framework for making proactive decisions.

Measuring counterparty risk

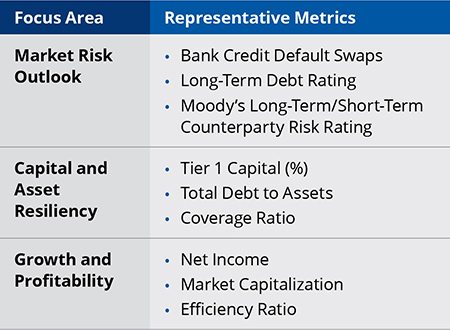

Various methods are available to measure counterparty risk. Within a changing macroeconomic environment, analysis of three primary focus areas will provide the most comprehensive view of risk. These three focus areas include (Figure 2):

- Market risk outlook. This outlook combines debt ratings and long- and short-term counterparty risk metrics along with an understanding of country risks for banks not headquartered in the United States.

- Capital and asset resiliency. The quality of bank assets and liabilities is evaluated to measure balance sheet strength throughout the business cycle.

- Growth and profitability. The overall performance of the banking partner is measured to understand the systemic importance of the institution and how well it is positioned for long-term growth.

Representative metrics for each of these three focus areas are provided in Figure 2.

Figure 2: Metrics for Measuring Counterparty Risk

A strong counterparty risk model will account for these primary drivers of financial health and provide a weighted score for evaluating banking partners and understanding their overall financial health. In some instances, an organization may wish to do additional research to ensure that it has a complete picture of the banking partner’s financial health.

Understanding counterparty risk helps ensure business continuity

With the recent high-profile downgrades and no clear end in sight to higher interest rates, treasury departments must be forward-thinking to protect balances and promote business resiliency. Counterparty risk management is not a one-and-done activity but rather a mindset that must be continually reinforced by implementing and following best practices. By monitoring the financial health of banking partners, assembling a strong and diverse banking group, and understanding the counterparty risk facing key treasury service vendors, healthcare organizations can help ensure that any impacts from unanticipated events that could disrupt treasury services are mitigated or avoided. In the process, they also are likely to form a stronger and more diverse network of banking partners that will serve them well throughout the business cycle.

Counterparty Risk Policy and Framework

Best-in-class counterparty risk management includes 5 primary activities:

- Analyze risks: Complete a comprehensive catalog of underlying operational risks associated with the disruption of core banking services.

- Create a framework: An organization should maintain parameters for diversifying counterparty risk exposure with safeguards and action items as the environment changes.

Sample framework parameters include the following:- No more than 50% of operating liquidity should be concentrated with a single financial institution

- Deposits caps, i.e., $XXmm cap for tier 1 banks, $Xm deposit cap for tier 2 banks (tiering comes from weighted scoring of counterparty risk metrics)

- No more than 75% of operating liquidity can be sole bank risk (on-balance sheet deposits)

- Evaluate solutions: Review tools available for automatically managing operating liquidity across multiple banking providers and deposit vehicles

- Contingency planning: Should there be a disruption to core banking services, the organization should have defined policies and procedures for maintaining operational support for critical business activities (payroll, accounts payable, cash positioning, etc.)

- Monitor and report: On a regular basis, review and report to senior stakeholders the counterparty risk measurements and take prudent actions to maintain the health of your overall liquidity ecosystem.