In the News

What happened in healthcare recently—and what we think about it.

- Healthcare props up U.S. jobs gains: report. Healthcare accounted for nearly all of August’s employment gains, according to a U.S. government analysis published this week. The Bureau of Labor Statistics report found that the field added approximately 31,000 jobs last month—about 13,000 new jobs in ambulatory care and about 9,000 new jobs each in hospitals and residential care. Without healthcare, the national job market would have been flat, as manufacturing, wholesale trade and government employment either stagnated or declined. The overall economy added just 22,000 jobs while the unemployment rate rose to 4.3%.

- The Gist: The data underscore the outsized role of healthcare in sustaining the labor market and, by extension, the economy. Hospitals remain one of the few reliable sources of job growth in the United States, highlighting their central role in economic stability and status as an economic “safe harbor.” About one in six private-sector jobs in the United States, totaling 23.5 million, are in health services. The steady demand for staff reflects the ongoing need for hospital services, even as other industries retrench. Still, reduced Medicaid funding could mean less money for hospitals, while tougher immigration policies could shrink the labor pool and drive pressure on wages. While the sector remains a stabilizing force in local economies, hospitals will need to be proactive in managing workforce challenges, balancing recruitment and retention with financial sustainability.

- Renown, Kaiser announce joint venture. Kaiser Permanente and Renown Health are forming a joint venture to launch a combined insurance plan and outpatient care network in northern Nevada, under the name Kaiser Permanente Nevada. The plan, announced Wednesday and pending regulatory approval, will see Kaiser acquiring a majority stake in Renown’s not-for-profit Hometown Health. Enrollment for the insurance plan begins during 2026’s open enrollment period, targeting employers and residents in the region. The venture also will build ambulatory care sites in and around Reno, supplementing Renown’s existing primary care infrastructure. Renown will continue to operate independently in many respects, maintaining its current insurance lines and care networks.

- The Gist: This move signals a continuing shift in M&A strategy suggested earlier this summer when Ascension acquired AMSURG: not-for-profit systems are moving beyond hospital-centric, incremental growth to creative deals that diversify revenue and expand reach. The trend suggests future competition will hinge less on inpatient scale and more on ownership of higher-margin outpatient services. In this instance, Kaiser Permanente expands into a new market and creates a tighter integration of insurer and outpatient provider. This hybrid model expands reach without engaging in full consolidation. It’s a different flavor of M&A—a complicated, nuanced model that focuses on specific business units. In the affected market, competitive pressure may grow, as hospitals outside this partnership may need to adapt or partner similarly to avoid losing patients, especially employer-insured populations. The bottom line: hospitals must prepare for a changing landscape where insurance-provider alignment, outpatient expansion and value metrics count more than ever.

- Covid drops out of top 10 causes of death. The U.S. death rate from covid has dropped to pre-pandemic levels, new data indicate. According to provisional data from the Centers for Disease Control and Prevention (CDC), the death rate fell by 3.8% in 2024, with the overall rate declining from 750.5 per 100,000 people in 2023 to 722 per 100,000 last year. This is the lowest the country’s death rate has been since the disease emerged in 2019, when the CDC reported a national death rate of 715.2 deaths per 100,000 people. That rate shot up by 16.8% in 2020 to 835.4 deaths per 100,000. According to the report, the nation’s leading causes of death remain the same: heart disease, cancer and unintentional injury.

- The Gist: Hospitals are likely to feel relief from the diminished covid burden: fewer severe covid cases mean less strain on ICU capacity, fewer isolation demands and potentially lower emergency service surges. This doesn’t mean hospitals can relax; critics say that new restrictions on the covid vaccine could lead to a spike in severe illnesses. Nevertheless, the CDC numbers are a positive development and contain more good news: life expectancy is rising and drug overdose fatalities hit a 5-year low. Hospitals should consider how this shift might affect funding, resource allocation and staffing models as covid patient load may ease while other health needs grow.

Plus—what we’ve been reading.

- Social media mental health warnings. Published in July by NPR News, this story outlines Minnesota’s plan to require mental health warning labels on social media platforms starting next July. The law mandates pop-up messages asking users to acknowledge that prolonged use of social media can affect their mental health, particularly given its links to depression, anxiety, suicidal ideation and eating disorders. The initiative follows blocked efforts in other states that sought age verification and platform bans for minors. Minnesota’s approach instead mirrors warning labels used for tobacco and alcohol. Platforms also will be required to provide access to resources like the 988 crisis hotline. The technology industry has pledged to challenge the law, the first in the nation, in court.

- The Gist: The impact of social media use on mental health is well-documented, and the former U.S. Surgeon General Vivek Murthy called for warning labels on social media platforms to be implemented last year. Minnesota’s mental health warning labels could signal an important shift: treating social media exposure as modifiable health behavior. However, there has been significant pushback from the technology industry, which has opposed legislation and regulation. If successful and replicated elsewhere, systems may see gradual relief on behavioral health capacity but also rising pressure to engage in digital literacy and develop prevention programs. For hospitals and health systems, it could nudge demand upstream, to reduce adolescent mental health crises that drive emergency visits and strain pediatric behavioral health services. The burden of adolescent mental health may be shifting—just not away from hospitals.

Graphic of the Week

A key insight illustrated in infographic form.

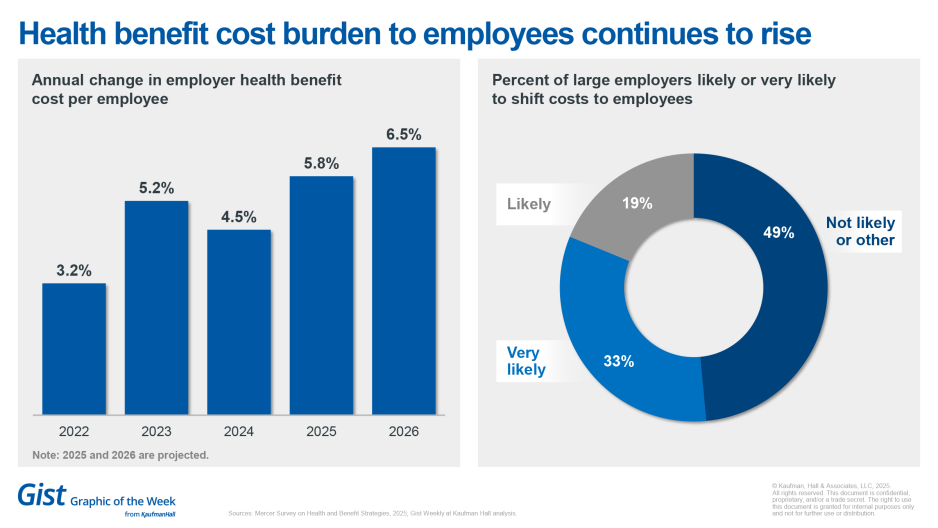

The rising cost of providing benefits to employees

More than half of large employers intend to reduce benefits or shift costs to employees to control overall health plan costs, according to new data from Mercer. Employers estimate benefit plan costs would increase 9% if they took no action to control costs, Mercer found. The 2025 Mercer Survey on Health and Benefit Strategies also found that 51% of large employers say they are likely or very likely to shift costs to employees for their 2026 plans. It also found that health benefit costs to employees rose by 4.5% in 2024 and predicted a 5.8% increase for 2025 and 6.5% in 2026, including an 8.4% increase in specialty drug cost per employee in 2024. These higher costs follow a decade of annual cost increases averaging around 3% (except for a pandemic-related blip in the trend in 2021). Mercer found that inflation is no longer the main driver of rising healthcare costs, pointing to deeper issues for plan sponsors; instead, a growing workforce shortage fueled by an aging population and health system consolidation are intensifying price pressures.

This Week at Kaufman Hall

What our experts are saying about key issues in healthcare.

Hospital and health systems are currently facing looming Medicaid reimbursement cuts and other external pressures. And their leaders must be able to study, understand and adapt to successfully navigate a challenging operating environment.

In a new blog, Ken Kaufman explores insights on leadership and adaptability from longtime NFL backup quarterback Josh Johnson—and how healthcare leaders can apply his career lessons to make difficult decisions.

On Our Podcast

The Gist Healthcare Podcast—all the headlines in healthcare policy, business and more, in 10 minutes or less every other weekday morning.

The podcast is on hiatus until next week. We will return with the latest healthcare business and policy news, including a new study that finds that fewer than one in three adolescents with opioid use disorder received substance use disorder treatment. That’s coming up on Wednesday, September 17.

To stay up to date, be sure to tune in every Monday, Wednesday and Friday morning. Subscribe on Apple, Spotify, Google or wherever podcasts are available.

Best regards,

The Gist Weekly team at Kaufman Hall