Hospital and health system transactions

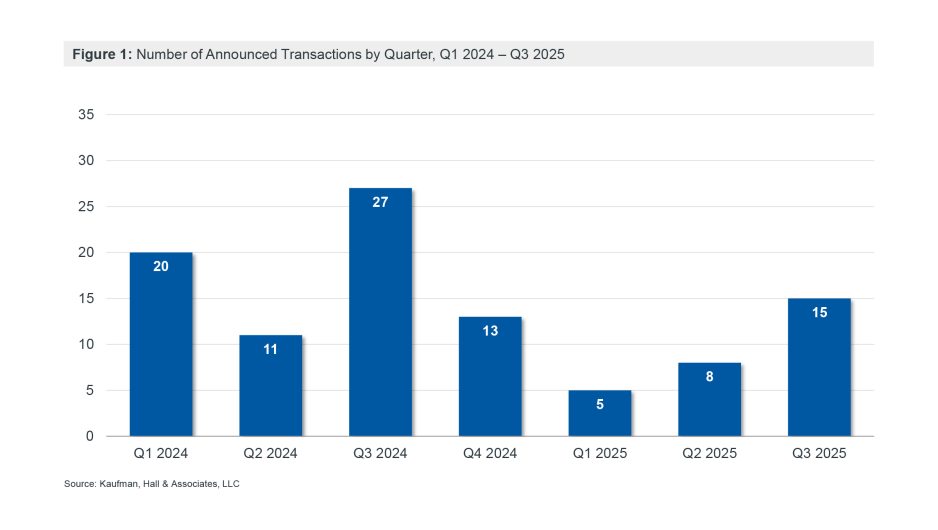

Following a modest uptick in hospital and health system M&A activity in Q2 2025, with eight announced transactions, Q3 continued to trend upwards, with 15 transactions announced—an activity level more in line with historical observations. This trend suggests that policy clarity following passage of the One Big Beautiful Bill in July is beginning to (re)shape transaction strategy.

Continuing trends that we reported in our year-end 2024 report, eight of the 15 transactions were divestitures (53% of announced Q3 transactions) and eight involved a financially distressed party (also 53% of announced Q3 transactions). These data points reflect an ongoing realignment in transitioning or relatively less attractive market models, as well as continued financial and operational headwinds for the industry. At the same time, Q3 saw the first two mega mergers of 2025, and a return to more robust figures for total transacted revenue and seller size.

In addition to the hospital and health system activity that remains the focus of this report, we will also highlight some of the capability-driven partnership activity occurring in broader service offerings that continues to gain traction as organizations seek to diversify operations and expand service offerings, in part through increasing collaboration.

Overview of Q3 activity

With 15 announced transactions in Q3 2025, hospital and health system M&A activity is showing a recovery from the lower levels recorded in Q1 (five announced transactions) and Q2 (eight announced transactions). This activity level suggests momentum toward a continued uptick through year’s end (Figure 1).

Figure 1: Number of Announced Transactions by Quarter, Q1 2024 – Q3 2025

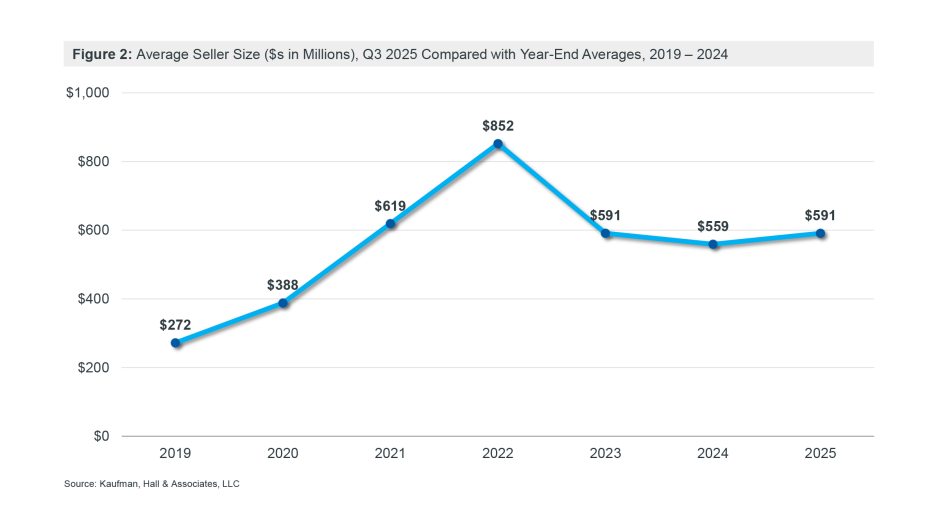

The announcement of the first two mega mergers of the year in Q3 helped bring the average seller size for the quarter to approximately $591 million—comparable to year-end figures for 2023 and 2024 (Figure 2)—reflecting a strong recovery in deal size and renewing energy in the market.

Figure 2: Average Seller Size ($s in Millions), Q3 2025 Compared with Year-End Averages, 2019 - 2024

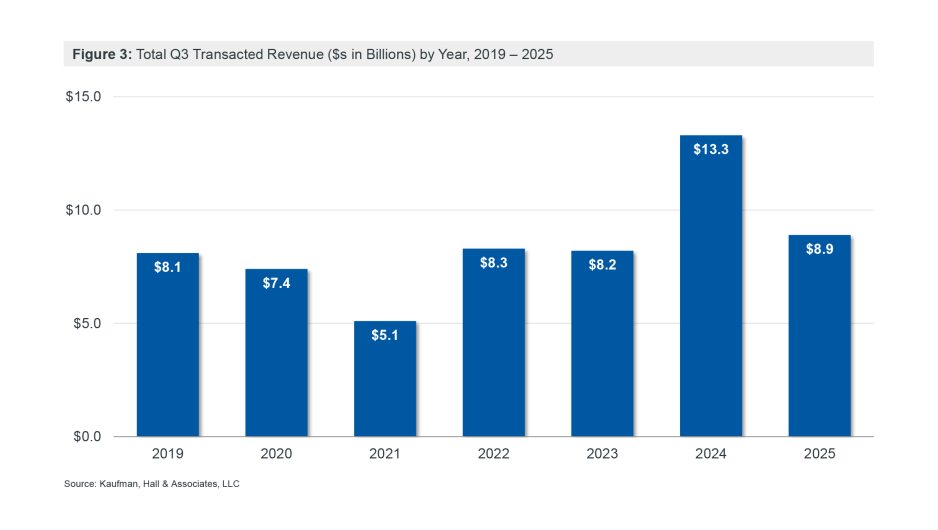

Combined, higher transaction volume and greater average seller size resulted in a total of $8.9 billion in transacted revenue for Q3 (Figure 3), more than six times the $1.4 billion in transacted revenue announced in Q2.

Figure 3: Total Q3 Transacted Revenue ($s in Billions) by Year, 2019 – 2025

The larger organization or acquirer in every single one of the 15 announced transactions was a not-for-profit organization, including five academically affiliated acquirers and two governmentally owned acquirers. Four of the targets were (then) for-profit organizations; of the remaining 11 not-for-profit targets, two were religiously affiliated, one was academically affiliated, one was both academically and religiously affiliated and two were governmentally owned.

Q3 highlights

A cautious recalibration in the wake of policy change

Since the onset of the Covid-19 pandemic, the M&A landscape has moved through alternating cycles of freeze and thaw. Activity stalled with the uncertainty and volatility of the pandemic and then began to reemerge in 2023 and 2024. Uncertainty around the financial impacts of a new administration prompted another slowdown that began to appear in Q4 2024 and reached its low point in Q1 2025.

With the One Big Beautiful Bill now enacted, market participants have greater visibility from which to (re)calibrate strategic initiatives. We expect the various forms of partnership exhibited in this quarter to continue. These include larger-scaled organizations seeking capability and competency-based affiliation models; sizable stand-alone organizations reassessing their long-term future; and, for some distressed organizations, a swift pursuit of long-term sustainable partners/acquirers. While sentiment and conditions for strategic partnerships seem to be improving, we also expect some continued volatility around transaction levels as the new reality of recent policy actions by the federal government and their impacts on reimbursement are vetted.

Heightened selectivity

Opportunities with sellers that have annual revenues in excess of $1 billion remain in the mix, but with only two mega mergers announced through Q3, we may be seeing a move toward heightened selectivity among super-regional and national systems. These systems may be seeking larger, market-focused acquisitions relative to more targeted small-to-mid-size acquisitions.

Meanwhile, mid-size regional systems remain active, and transactions appear to be highly situation-dependent and strategic. For-profit systems remain focused on portfolio realignment.

Portfolio realignment

While this quarter saw a rebound in hospital-to-hospital transactions, we are also seeing continued growth in capability-building and realignment transactions. In these deals, health systems pursue strategies to optimize offerings outside their core business areas through partnerships with skilled operators in areas such as outpatient care, labs, urgent care and health plan management. Examples from Q3 include:

- An announced joint venture between Renown Health and Kaiser Permanente around Renown’s health insurance arm, Hometown Health.

- The planned joint venture between Baylor Scott & White and Geode Health to increase access to outpatient mental health services.

- An announced agreement between Corewell Health and Quest Diagnostics to enter into a joint venture that will expand access to laboratory services in Michigan.

- Sanford Health’s planned acquisition of Lewis Drug, to enhance access to essential healthcare services.

These transactions are defining a new and clear direction: M&A activity is expanding to include partnerships primed for strategic growth, even outside of the traditional service footprint of health systems.

Looking forward

Healthcare M&A is in transition. Buyers and sellers are recalibrating as new clarity around federal policy and reimbursement impacts takes hold; this new clarity is reshaping strategy and reframing opportunities. Transaction activity is regaining momentum, but the real story may lie in a new direction for hospital and health system M&A as organizations seek resilience and growth by investing beyond the hospital. Q3 signals suggest that 2026 could mark the beginning of a more active and refocused era of healthcare transactions as organizations translate strategy into execution.

Co-authors:

Kris Blohm, Managing Director and Mergers & Acquisitions Practice Co-Leader, kris.blohm@kaufmanhall.com

Courtney Midanek, Managing Director and Mergers & Acquisitions Practice Co-Leader, courtney.midanek@kaufmanhall.com

Anu Singh, Managing Director, anu.singh@kaufmanhall.com

Rob Gialessas, Senior Vice President, rob.gialessas@kaufmanhall.com

Chris Peltola, Senior Vice President, chris.peltola@kaufmanhall.com

Additional contributors:

Nick Bidwell, Managing Director, nick.bidwell@kaufmanhall.com

Nick Gialessas, Managing Director, nick.gialessas@kaufmanhall.com

Nora Kelly, Managing Director, nora.kelly@kaufmanhall.com

Eb LeMaster, Managing Director, eb.lemaster@kaufmanhall.com

For media inquiries, please contact Haydn Bush at haydn.bush@vizientinc.com.