Introduction

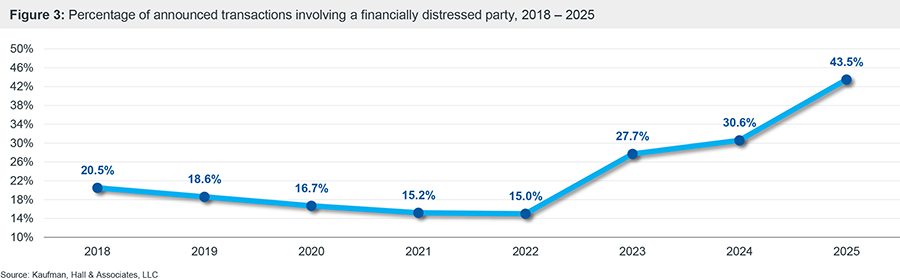

Last January, our year-end report on 2024 hospital and health system transactions noted that, while there were signs of industry stabilization, there was also clear evidence of ongoing financial distress. The percentage of 2024 announced transactions involving a financially distressed party hit a record high of 30.6%.

That story continued through 2025. While all three rating agencies (Moody’s, Fitch and S&P) had issued stable or neutral outlooks for not-for-profit hospitals and health systems in 2025 (and have maintained those outlooks for 2026), financial distress continued to be a persistent driver of transaction activity throughout the year, with the percentage of transactions involving a financially distressed party hitting a new record high of 43.5%. [1]

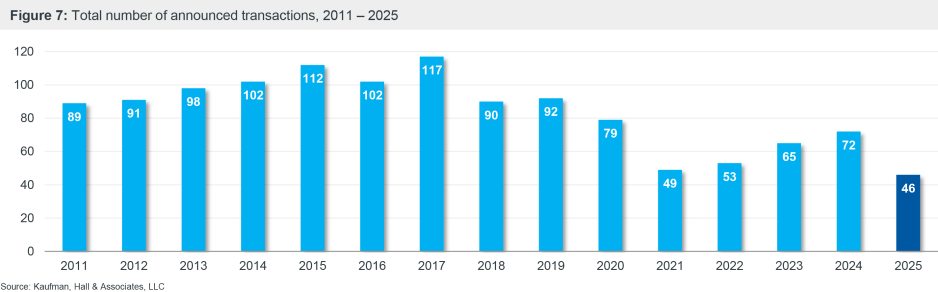

A new challenge to M&A activity for 2025 emerged with the arrival of the current administration in Washington, DC. A range of legislative and policy actions—including the implementation of wide-ranging tariffs and passage of H.R.1 (also known as the One Big Beautiful Bill) on July 4, 2025—introduced new uncertainty on expense costs, reimbursement rates and insurance coverage (both in the ACA exchange markets and the Medicaid program). Uncertainty led to a significant cooling of M&A activity in the first half of 2025, with the number of announced transactions in Q1 and Q2 reaching record lows. While still relatively low by historical standards, activity began to rebound in Q3 and Q4.

Some of the most interesting activity in 2025 occurred outside the hospital and health system transactions covered in this report. Health systems made big moves in ambulatory care, behavioral health and laboratory services through acquisitions, divestitures and partnerships.

The Year in Numbers

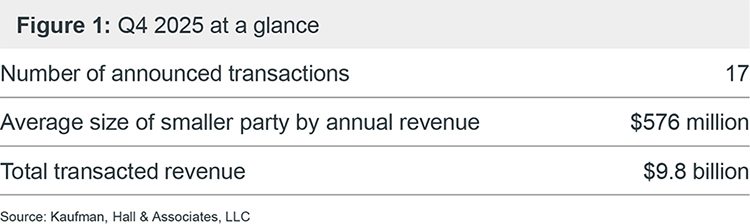

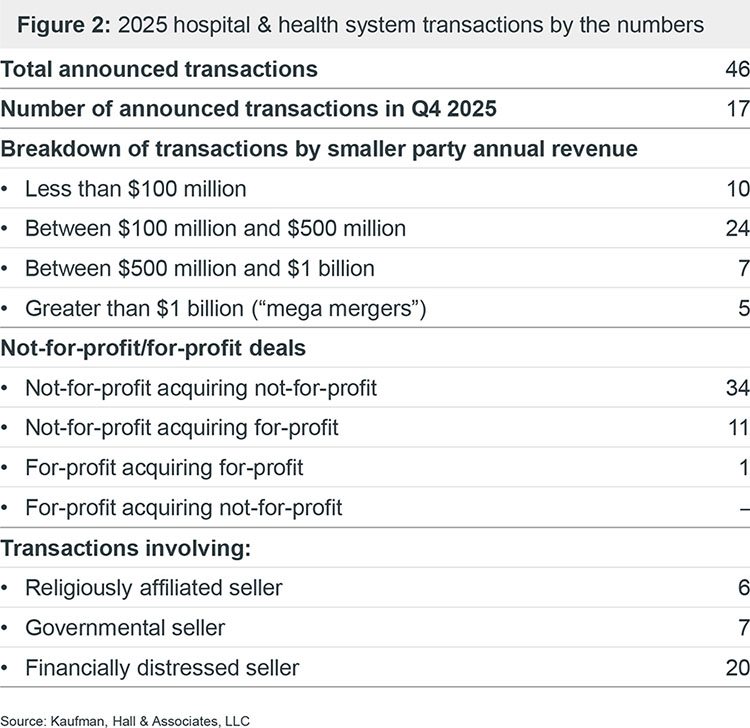

- Transaction activity grew in Q4 2025, with 17 announced transactions, including four “mega mergers” (transactions in which the annual revenue of the smaller party exceeds $1 billion). Following a subdued first half of the year, this activity level suggests that M&A activity is beginning to return to levels more consistent with recent historical averages (Figure 1).

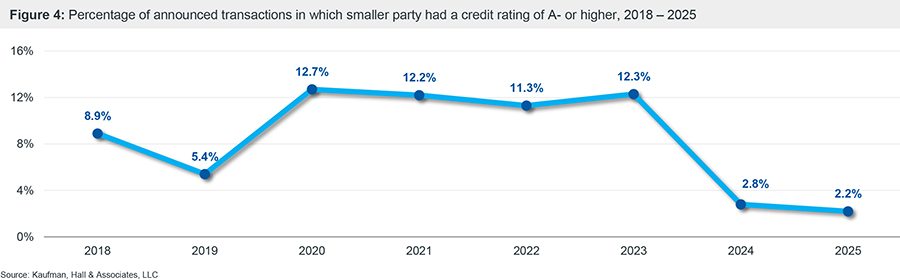

- Financial distress persisted—and even intensified—as a driver of transactions in 2025, with the percentage of transactions involving a financially distressed party reaching a new high of 43.5% (Figure 3). Financial distress was also reflected in the percentage of announced transactions in which the smaller party had a credit rating of A- or higher. That percentage fell from 12.3% in 2023, to 2.8% in 2024, to 2.2% in 2025 (Figure 4).

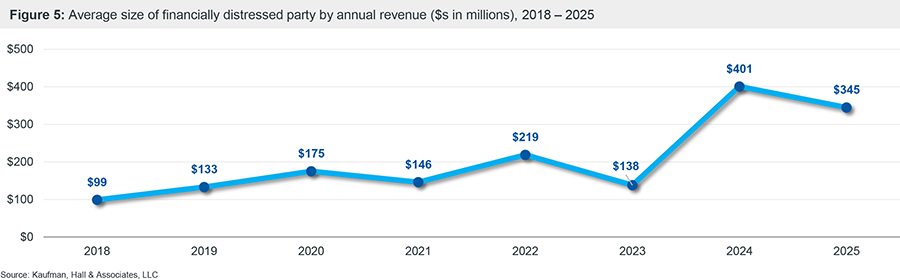

- The size of the seller in financially distressed transactions remained high, at $345 million (Figure 5). While slightly below last year’s figure of $401 million, this year’s figure is still high compared to recent historical averages and suggests that financial distress is affecting not only community hospitals, but also mid-sized and large health systems.

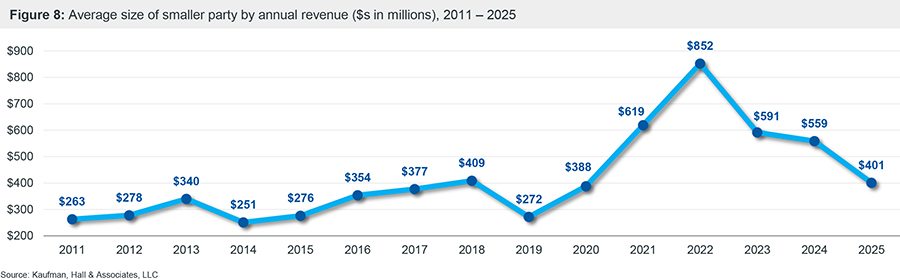

- The low number of transactions (Figure 7), combined with a continuing decrease in the size of the smaller party since 2022 (Figure 8), resulted in the lowest figure for total transacted revenue—$18.5 billion—in recent history (Figure 9). More than half of that figure, $9.8 billion, came from Q4 transactions.

- For-profit organizations were the seller in 11 transactions in 2025 but were the acquirer in only one transaction (Figure 2). This is a signal of the financial challenges facing hospitals in the current environment and illustrates a shift in for-profit entities’ investments to other healthcare services sub-sectors or an exit in general.

M&A Trends in 2025

Two trends were the primary drivers of hospital and health system M&A activity in 2025: persistent financial challenges, concentrated in smaller independent hospitals, and initial uncertainty surrounding the policy and legislative agenda of the Trump administration.

From policy uncertainty to normalization

With the inauguration of President Trump in January 2025, hospital and health systems faced new levels of uncertainty as a flurry of executive orders and a new legislative agenda brought into question the cost of supplies, grant funding from executive agencies and coverage and reimbursement under government healthcare programs, particularly Medicaid.

The impact of these changes came into clearer focus as the year progressed, and with the passage of H.R.1 in July 2025, hospitals and health systems gained a better understanding of the path ahead. While that path is certainly rocky, hospitals and health systems began to gain clarity on H.R.1’s impacts to their financial position and strategic direction. With better clarity, we observed a turnaround in what had been a significant chill in M&A activity in Q1 and Q2 of 2025, with 15 transactions announced in Q3 and 17 announced in Q4.

Persistent financial distress as a transaction driver

Financial distress remained a primary driver of transaction activity in 2025, with 43.5% of announced transactions—a record high percentage—involving financially distressed organizations. Transactions involving financially distressed organizations have been climbing steadily since 2022, when only 15% of transactions involved a financially distressed organization, and this trend is likely to continue into 2026.

Closed or shuttered facilities sold exclusively through real estate transactions were excluded from this analysis. While methodologically consistent with prior reports, the exclusion of these transactions means that the full extent of market stress is likely understated, particularly in rural and underserved communities, underscoring the fragility that persists beneath headline stabilization metrics.

Government involvement and the “soft landing” trend

State governments played an increasingly active role in hospital and health system transactions in 2025, particularly those involving distressed or bankruptcy-related situations. Rather than limiting involvement to regulatory oversight, states increasingly acted as facilitators, funders or policy enablers to ensure continuity of care and prevent hospital closures.

States have taken very different approaches to hospital and health system M&A activity. According to an analysis by Duane Morris, nineteen states have certificate of public advantage (COPA) laws that seek to immunize proposed mergers from antitrust enforcement, while other states have enacted pre-merger notification and waiting period requirements for healthcare transactions that enable more time for state scrutiny of proposed transactions. But even states that have sought more scrutiny of healthcare M&A transactions are taking a more conciliatory approach when a risk of hospital closure threatens community access to needed healthcare services.

A few examples in recent years include:

- Massachusetts, which intervened directly in brokering agreements to sell Steward Health Care hospitals after Steward declared bankruptcy.

- Connecticut, which earlier this year passed a law implementing an emergency certificate of need process to expedite state approval of a transfer of ownership when a hospital declares bankruptcy; this process was used, for example, to approve Hartford HealthCare’s acquisition of two hospitals from bankrupt Prospect Medical Holdings.

- New York, which announced a Health Care Safety Net Transformation Program in October 2025, including investments of over $2.6 billion dollars in six new partnerships between safety net hospitals and other healthcare organizations. The announcement from Governor Kathy Hochul’s office stated that the investments are intended “to improve the quality of care provided by these safety net hospitals and stabilize their operations for long-term sustainability to ensure that all New Yorkers have access to high quality care.” One example: the merger of Maimonides Health with NYC Health + Hospitals, supported by a $2.2 billion state grant.

Collectively, these actions reflect a growing “soft landing” approach in which public-sector priorities like access, workforce stability and community impact play a central role in shaping transaction outcomes.

Shifting buyer/seller dynamics

Buyer and seller dynamics in 2025 reflected continued movement away from independence among mid-sized systems. Organizations in the $500–$750 million annual revenue range, as well as some approaching the $1 billion “mega merger” threshold, increasingly pursued partnerships as a strategic response to financial and operational pressures.

Throughout the year, most transactions were led by not-for-profit acquirers, while for-profit acquisition activity remained extremely limited. Only one transaction involved a for-profit acquirer; in contrast, for-profit organizations were the seller in 11 of the year’s 46 announced transactions. The lack of activity by for-profit organizations as acquirers in hospital transactions is another signal of the financial challenges that face hospital services today.

Looking Forward

Looking forward to 2026, we anticipate:

- Non-acute and capability-based partnerships. Throughout the year, our quarterly reports commented on partnership activity beyond hospital and health system transactions, as health systems increasingly pursue non-acute and capability-based partnerships. Examples include Ascension’s acquisition of AMSURG, noted in our Q2 report, and an announced joint venture between Corewell Health and Quest Diagnostics to expand access to laboratory services in Michigan, described in our Q3 report. We expect continued interest in these partnerships in the year ahead as health systems look beyond traditional inpatient services for new growth opportunities.

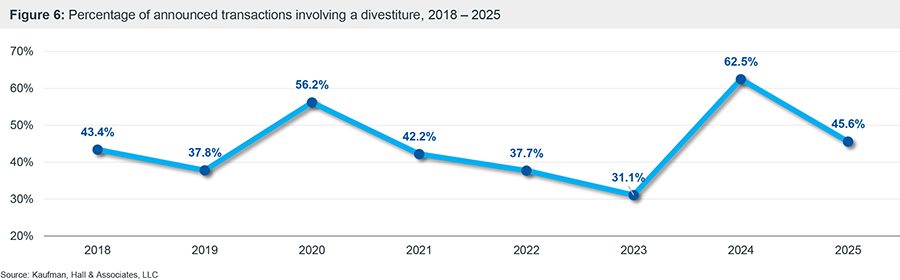

- Ongoing portfolio rationalization. The percentage of transactions involving a divestiture remained high in 2025 at 45.6% (Figure 6). We expect large and national systems, particularly for-profit operators and Catholic systems, to continue divesting non-core assets, based on a growing realization that scale alone is no longer a sufficient growth or margin strategy, particularly without scale at the market or regional level.

- Persistent financial headwinds. Uncertainty surrounding the extension of enhanced ACA subsidies beyond 2026 and the anticipated impacts of H.R.1 beginning in 2027 will continue to weigh on strategic planning and capital deployment decisions. As these impacts begin to materialize in the form of growing numbers of uninsured patients, financial pressures will continue. As a result, we predict that the high percentage of transactions involving financially distressed organizations that we have seen in recent years will continue.

- Regulatory environment evolution. Although overall transaction volume was low this year, there was little evidence that the federal antitrust authorities were intensifying their scrutiny of hospital and health system transactions. As noted earlier in this report, there are also indications that states may be taking a more conciliatory approach to healthcare transactions, especially in instances where financial distress raises the prospect of a hospital closure. We will be monitoring signs of evolution within the regulatory environment over the coming year.

Co-authors:

Kris Blohm, Managing Director and Mergers & Acquisitions Practice Co-Leader, kris.blohm@kaufmanhall.com

Courtney Midanek, Managing Director and Mergers & Acquisitions Practice Co-Leader, courtney.midanek@kaufmanhall.com

Anu Singh, Managing Director, anu.singh@kaufmanhall.com

Chris Peltola, Senior Vice President, chris.peltola@kaufmanhall.com

Rob Gialessas, Senior Vice President, rob.gialessas@kaufmanhall.com

Additional contributors:

Nick Bidwell, Managing Director, nick.bidwell@kaufmanhall.com

Nick Gialessas, Managing Director, nick.gialessas@kaufmanhall.com

Nora Kelly, Managing Director, nora.kelly@kaufmanhall.com

Eb LeMaster, Managing Director, eb.lemaster@kaufmanhall.com

For media inquiries, please contact Haydn Bush at haydn.bush@vizientinc.com.

[1] Financially distressed transactions are those in which a party has cited, or publicly available information has enabled us to infer, an element of financial distress as a transaction driver.

[2] This total does not include transactions that were announced and subsequently canceled in calendar year 2025. As a result, the year-end total may not match the combined totals announced in our 2025 quarterly reports.