Before we get to the news…this week did hold some non-healthcare news that will affect the field, including off-year elections and the U.S. Supreme Court hearing arguments about President Trump’s use of an emergency law to impose tariffs. And, of course, today is Day 38 of the federal government shutdown—making it the longest shutdown in U.S. history. But, there remain no concrete signs of the shutdown nearing an end, so we are tracking other stories. So…

In the News

What happened in healthcare recently—and what we think about it.

- Joint Commission updates hospital performance goals. Nurse advocacy organizations are praising the Joint Commission’s new National Performance Goals, a set of standards that will replace the Joint Commission’s familiar National Patient Safety Goals starting next year. The new initiative, called “Accreditation 360: The New Standard,” includes nurse staffing as a component of patient safety, including the requirement that Critical Access Hospitals have a nurse on duty when they have at least one inpatient. The Joint Commission says the new standards aim to streamline accreditation standards and align them with federal quality and safety expectations. By tying nurse staffing to patient safety and quality, the Joint Commission said it recognizes the importance of team-based care, while a spokesperson for the American Hospital Association said the goals reflect existing practices that hospitals routinely follow.

- The Gist: The shift appears to represent less a wholesale rewrite and more a modernization of existing requirements. But it is unclear the extent to which the new standards reflect the growth of advanced practice providers in modern medical care. Regardless, systems should review their quality and safety procedures to ensure they align with the new structure and demonstrate active oversight of staffing. While the total number of individual standards will shrink, the expectations for performance evidence will not. Surveyors may look more closely at how organizations use data to track progress, and how staffing metrics are integrated into daily operations and workforce planning.

- Medicare to cover obesity drugs; prices slashed. The Trump administration has announced a deal with drugmakers Eli Lilly and Novo Nordisk to make GLP-1 and related weight-loss drugs more broadly available. List prices for the drugs (including Ozempic, Wegovy and Zepbound), which retail well above $1,000 per month, will drop by as much as 74%. The drugs will also be covered for some Medicare beneficiaries. While Medicare covers GLP-1s when used for diabetes treatment, most people using them for weight loss pay out of pocket. The agreement is part of the administration’s negotiations with major drugmakers to lower domestic drug costs with a policy known as “most favored nation” pricing. The announcement was made Thursday.

- The Gist: GLP-1s may suppress hunger, but there is apparently considerable appetite for the drugs in the healthcare market. Eli Lilly’s Zepbound (for weight loss) and Mounjaro (for diabetes) are now the top-selling drugs worldwide, underscoring how quickly the obesity-treatment market has exploded. Financially, the stakes are sky-high, as Pfizer’s recent antitrust lawsuit against Novo Nordisk and Metsera demonstrates. For hospitals and health systems, the growing availability of effective weight-loss pharmacotherapy means systems must adapt not only clinically but operationally. As therapies gain wider coverage and prices plummet, expect changes in patient volume and case-mix: fewer extreme obesity-related complications may show up in surgical or acute-care settings over time. Pharmacy and therapeutics committees may face pressure to update formularies. And reimbursement and coding landscapes may shift: if Medicare and other payers broaden access, hospitals must confront questions about who pays, how outcomes are measured and how care delivery models adjust.

- FDA moves to fast-track ‘biosimilar’ medications. In other pharmaceutical news, the Food and Drug Administration (FDA) announced a new effort to accelerate the approval of “biosimilar” drugs — lower-cost versions of complex biologic therapies used to treat cancer, autoimmune disorders and other serious conditions. The agency last week released draft guidance that would allow developers to rely more heavily on laboratory and analytical data rather than human clinical trials to prove biosimilarity. Health Secretary Robert F. Kennedy Jr. said the change is intended to bring affordable options to market faster, a move that could lower drug costs. The approval pathway for biosimilars was established by Congress in 2010 to promote competition in markets dominated by high-cost biologics; the FDA has approved 76 biosimilars to treat conditions such as cancer, rheumatoid arthritis, diabetes, Crohn’s disease and osteoporosis.

- The Gist: Faster approval of biosimilar medications should help lower prices. But the announcement comes as the FDA faces renewed scrutiny over its internal stability and credibility. The agency has suffered a string of senior staff departures and internal disputes, raising questions about the FDA’s consistency and reliability at a time when its decisions carry enormous weight. The biosimilar push could offer meaningful financial relief for hospitals, particularly in oncology and specialty pharmacy, where biologics drive significant cost growth. But the uncertainty surrounding the FDA’s leadership and direction may complicate how hospitals plan for and adopt new therapies. Institutional trust in the agency’s rigor and predictability is fundamental to clinical and purchasing decisions. If that trust wavers, hospitals could face harder calls about which drugs to stock and when to transition to lower-cost alternatives.

Plus—what we’ve been reading.

- New promise of treatment for Huntington’s disease. This article, published in late September in The New York Times, reports encouraging early results from a clinical trial of an experimental gene therapy for Huntington’s disease, a rare inherited disorder that progressively destroys nerve cells in the brain. The therapy, known as AMT-130, is designed to silence the gene that drives the disease’s decline in motor and cognitive function. In the clinical study, patients receiving a higher dose showed about a 75% slower progression of symptoms over three years compared with those on standard care. The treatment involves a promising but potentially risky neurosurgical procedure to deliver the therapy directly into targeted brain regions. While the study remains small and follow-up continues, the findings suggest that researchers may be inching closer to changing the outlook for a condition that has long defied treatment.

- The Gist: For hospitals and health systems, developments like this signal a gradual but profound shift in how care may be delivered and financed. Gene therapies are pushing some medical treatments toward one-time, high-cost interventions that can dramatically alter long-term outcomes. Delivering these treatments will require surgical and inpatient expertise and durable systems for follow-up, data tracking and payer coordination. The financial implications are equally complex, because traditional reimbursement models are poorly suited to single-dose therapies priced in the millions of dollars. Even if AMT-130 remains years from approval, health systems will need to start planning for a new category of care in which scientific innovation outpaces existing infrastructure, policy and payment frameworks.

Graphic of the Week

A key insight illustrated in infographic form.

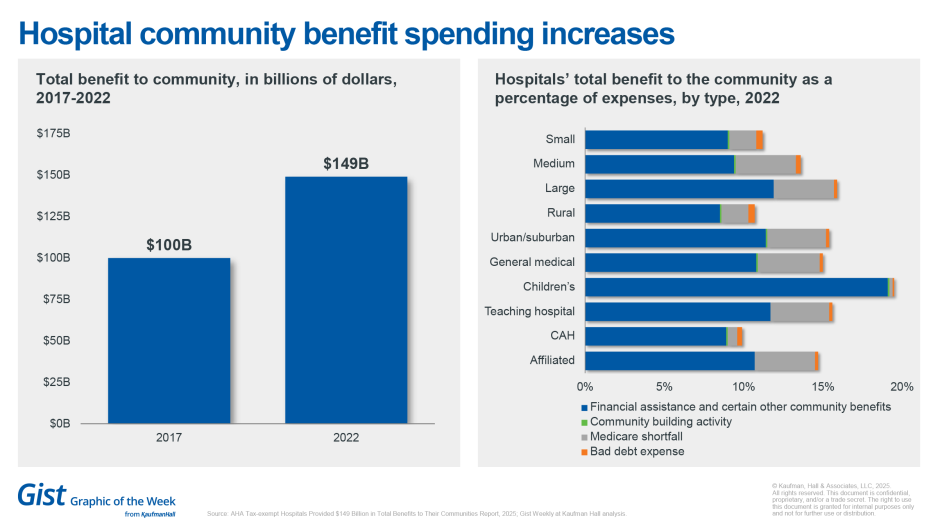

New AHA data quantify hospitals’ benefit to communities

Tax-exempt hospitals provided nearly $150 billion in total community benefits in 2022, marking a nearly 50% increase from 2017, according to new data from the American Hospital Association. These benefits represented roughly 15.1% of total expenses for tax-exempt hospitals in 2022, up from 13.8% in 2017. Of that total, approximately $65 billion (about 6.6% of expenses) was directed toward financial assistance and unreimbursed costs from Medicaid, Children’s Health Insurance Programs and other means-tested government programs. Beyond direct financial assistance, the report notes hospitals and health systems invested in community health programs, professional education, research and subsidized essential services such as trauma and neonatal care. The data derive from IRS filings combined with expense data from AHA’s hospital annual survey. The expenditures serve as a counterpoint to scrutiny over not-for-profit hospitals’ tax-exempt status.

This Week at Kaufman Hall

What our experts are saying about key issues in healthcare.

Hospital outpatient revenue has grown nearly twice as fast as inpatient revenue over the past three years—elevating the imperative for thoughtful, data-informed ambulatory strategies.

A new blog explores how ambulatory strategies that integrate governance, growth planning and operational efficiency can drive enterprise performance and protect market share at a watershed moment for care delivery.

On Our Podcast

The Gist Healthcare Podcast—all the headlines in healthcare policy, business and more, in 10 minutes or less every other weekday morning.

Hospitals are seeing steady progress in surgical safety and survival, according to new data from Vizient and the American Hospital Association. Complications such as severe bleeding and respiratory failure have declined significantly since 2019. Coming up Monday, JC is joined by Chris DeRienzo, M.D., chief physician executive and senior vice president for the American Hospital Association, to talk more about hospitals’ continued focus on data, teamwork and patient-centered innovation.

To stay up to date, be sure to tune in every Monday, Wednesday and Friday morning. Subscribe on Apple, Spotify, Google or wherever podcasts are available.

Best regards,

The Gist Weekly team at Kaufman Hall