Hello, and welcome back to this week’s edition of the Gist Weekly. As always, we immensely appreciate your continued readership and invite you to forward this email to friends and colleagues—please encourage them to subscribe.

In the News

What happened in healthcare recently—and what we think about it.

- CBO releases budgetary, enrollment impacts of One Big Beautiful Bill. On Wednesday, the non-partisan Congressional Budget Office (CBO) released a report on the estimated budgetary impacts of the One Big Beautiful Bill, which was passed by the House of Representatives on May 22. CBO estimated that as is, the bill would lead to 10.9 million people losing coverage, with 7.8 million of those losing Medicaid coverage. The analysis also found that the bill would cost the healthcare sector $1 trillion through 2034. These estimated coverage losses are separate from other CBO analyses, which found that about another 4.2 million people would lose coverage if enhanced Affordable Care Act (ACA) subsidies are not extended and 900,000 more people would lose coverage if the exchange enrollment window is shortened, as proposed by the Centers for Medicare & Medicaid (CMS) earlier this year. The bill has now made its way to the Senate, where markups have begun.

- The Gist: This bill represents an immense loss for coverage after recent lows in the national uninsured rate. The CBO now projects the final version of the House-passed bill projects will result in more people losing coverage than previously estimated, with 10.9 million instead of 8.6 million to lose coverage by 2034, a reflection of late changes made to the bill. However, the bill has met some resistance from moderates and more conservative Republicans. Sen. Josh Hawley (R-MO) rejects the extent of the Medicaid cuts, a reminder of the Republicans’ transformed base. Sens. Ron Johnson (R-WI) and Rand Paul (R-KY) as well as Trump ally Elon Musk are frustrated with the bill and stated that the cuts are insufficient. Some House members have also expressed regret for their previous support of the bill now that they have read the full text. As the bill currently stands, it faces an uphill battle as President Trump pressures lawmakers to have a final version on his desk by July 4.

- Fifth Circuit Court of Appeals to rehear Texas Medical Association’s No Surprises Act case. The 5th Circuit Court of Appeals voted to rehear the Texas Medical Association’s (TMA) case against part of the implementation of the No Suprises Act last Friday. TMA and other providers argued that the way the government calculated the qualifying payment amount (QPA) used when providers and payers cannot agree on payment for out-of-network services and go to the independent dispute resolution (IDR) process favors payers. The plaintiffs assert that payers set QPAs artificially low since ghost rates, or rates for services that are not in actuality provided, are included. This artificially low QPA, providers argue, could lead to arbiters siding with payers. In October 2024, the 5th Circuit originally ruled in favor of the Department of Health and Human Services regarding this part of the QPA calculation after the government appealed a lower court’s ruling.

- The Gist: While the case still needs to be reheard, this is an unexpected legal win for providers. Rehearings are rarely approved by appellate courts, leaving many wondering what issues the 5th Circuit judges saw with the panel’s previous ruling on the IDR process. The No Surprises Act has been legally challenged, particularly aspects of the IDR process, throughout its implementation, earning legal outcomes which have generally favored providers. The inclusion of ghost rates in QPAs was disappointing for providers, as providers do not prioritize negotiating rates for services they do not provide. The IDR process has been much more utilized than the government initially expected, leaving critical provider payments in the balance. Needless to say, providers will be watching the outcome of this case very closely.

- Epic customers connect to TEFCA. Epic announced that more than 1,000 hospitals and 22,000 clinics on its electronic health records (EHR) platform were connected to the Trusted Exchange Framework and Common Agreement (TEFCA). TEFCA was established under the 21st Century Cures Act and is meant to improve interoperability between providers. This news follows Epic’s announcement in March that more than 2,000 hospitals and 50,000 clinics were live or about to be live on TEFCA. Epic aims to have all its customers live on TEFCA by the end of the year.

- The Gist: Increased adoption of TEFCA is a huge win for healthcare consumers and represents a significant step forward for the prolonged efforts to improve healthcare interoperability. Restarting a new healthcare record every time one changes providers is burdensome for patients and could hopefully one day become a problem of the past. While there has been momentum to improve healthcare interoperability since 2004 and even more so with the passage of both the ACA and the Cures Act, regulatory hurdles have made integrating such disparate information challenging. As the EHR leader by market share, involving Epic in this process is an important step in improving participation— and the momentum could continue should Oracle’s TEFCA application be approved.

Plus—what we’ve been reading.

- GLP-1 formulary change spurs growing physician and patient concern. Published in last month in The New York Times, this article describes the role of pharmacy benefit managers (PBMs) in drug coverage decisions and highlights the latest formulary decision by Caremark, one of the nation’s largest benefit managers. Caremark recently excluded Zepbound in favor of Wegovy despite manufacturer- and non-manufacturer-sponsored clinical trials demonstrating greater weight loss with Zepbound and clear physician preference that both drugs be made available for patients. The article shares the stories of several patients affected by the formulary change who express concern, stating PBMs are “forcing patients to switch medications against their will without medical justification to less effective medications.” Meanwhile a PBM spokesperson argues this is what “PBMs do best: compete clinically similar products against one another, and choose the option that delivers the lowest net cost for [their] clients.”

- The Gist: Caremark’s decision is one of hundreds of drug exclusions made by PBMs in recent years—one analysis found that such exclusions have grown 11-fold from 2014 through 2022. The sharp rise in PBM exclusions has led to patient and provider frustration with PBMs’ impact on medical treatment decisions. PBMs are also facing growing pressure in Washington and at the state level. At the same time, PBMs are fulfilling a role that many employers demand: helping them manage rising drug costs. In fact, many employers—and Medicare—do not offer GLP-1 drugs for weight loss at all, given their high cost and uncertain long-term value. Employers who do cover these drugs may prefer PBMs to limit options to the lowest net-cost alternative. It’s also worth noting that the Caremark exclusion applies only to some patients, and not to diabetes patients, for whom these drugs were originally FDA-approved. The unique dynamics of the GLP-1 market and the battle for quality drive the future of the market. Formulary changes could potentially set the stage for a new front of competition centered around cost, coverage and long-term employer commitment.

Graphic of the Week

A key insight illustrated in infographic form.

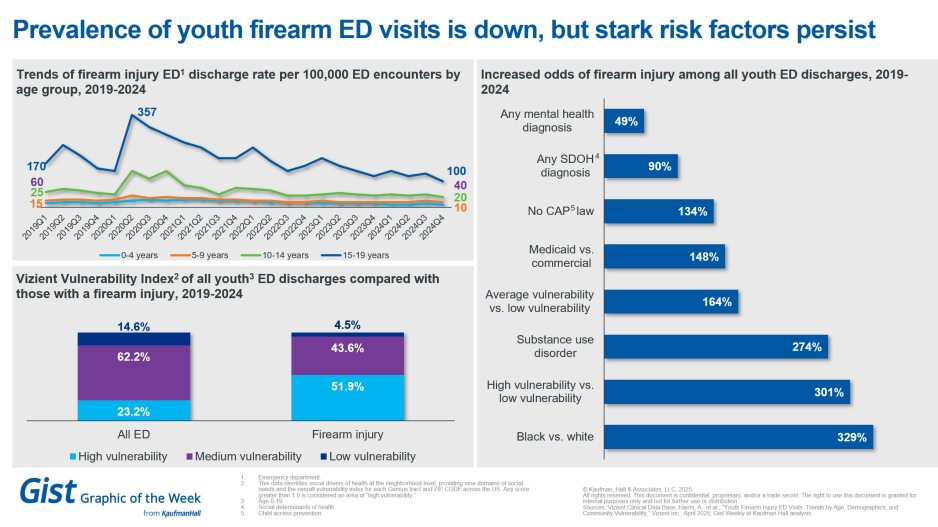

Demographics behind youth firearm ED visits

In honor of National Gun Violence Awareness Day today, this week’s graphic features data from the Vizient Clinical Data Base on 33.3 million pediatric emergency department (ED) discharges between 2019 and 2024. After peaking early in the pandemic, youth firearm injury ED visits were down across all age groups in 2024. However, significant disparities exist. Patients with firearm injuries are more likely to have higher Vizient Vulnerability Index scores or be more affected by social needs or obstacles that influence their health than the average pediatric ED patient. Additionally, these types of injuries are more likely to happen to a youth who lives in a state without child access prevention laws, has Medicaid coverage rather than commercial coverage or has a substance use disorder. Most starkly, a black child is more than 3 times more likely than a white child to experience this kind of ED encounter. Firearm injuries are the leading cause of death among U.S. children and teens. Understanding the social determinants at play is key to future public health strategies addressing this issue.

This Week at Kaufman Hall

What our experts are saying about key issues in healthcare.

Identifying and executing a focused and deliberate strategy to navigate the complicated waters of today’s healthcare environment is essential for long-term success. All too often, though, organizations and their leaders get mired in operational, tactical and administrative details as their planning efforts unfold—and fail to ask the questions that can shed insight on their biggest challenges and chart their future strategic direction.

In a new Strategy Spotlight blog, Ryan Gish emphasizes the need to understand the internal and external forces that shape an organization’s strategy. He defines four broad strategic cohorts, each one of which poses a unique set of strategic questions. These cohorts can help shed light on where organizations stand within both their individual markets and in the context of their national competition and can help shape the key strategic questions that will inform their planning efforts.

On Our Podcast

The Gist Healthcare Podcast—all the headlines in healthcare policy, business, and more, in ten minutes or less every other weekday morning.

This Monday, big cuts in federal healthcare spending could be on the horizon, notably to Medicaid. Modern Healthcare's Michael McAuliff returns to the podcast to discuss the reconciliation bill that has been dubbed the One Big Beautiful Bill Act of 2025. That bill is currently getting marked up in the Senate after narrowly being passed by the House late last month.

To stay up to date, be sure to tune in every Monday, Wednesday, and Friday morning. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

Thanks for reading! We’ll see you next Friday with a new edition. In the meantime, check out our Gist Weekly archive if you’d like to peruse past editions. We also have all of our recent “Graphics of the Week” available here.

Best regards,

The Gist Weekly team at Kaufman Hall