In the News

What happened in healthcare recently—and what we think about it.

- Healthcare companies deliver high-performing Q3. Publicly traded healthcare companies delivered their best-performing quarter in more than four years in the third quarter of 2025, according to an analysis published last week. More healthcare companies outperformed their earnings expectations than did companies in 11 other industries, the analysis found. Higher new and specialty drug use, including weight loss drugs, as well as robust hospital utilization were among the contributors. Large for-profit health providers saw particularly strong profits in the third quarter. Insurers experienced a mix of stability and strain across their markets, according to senior analysts. Molina Healthcare and Oscar Health, with significant business selling Affordable Care Act (ACA) plans, reported earning misses in part due to higher-than-expected medical costs.

- The Gist: Publicly traded healthcare companies are demonstrating resilience in economic and political uncertainty, reinforcing the industry’s position as a cornerstone of the broader economy. Despite growing unemployment, the healthcare field provided about a one-third of new U.S. jobs last month, leading the nation in job growth. This suggests that despite the widening gap in performance of hospitals and health systems across the nation, the industry as a whole is on the path to recovery following Covid-19 and post-pandemic challenges. S&P Global’s recent stable outlook for the industry in 2026 signals further confidence in the sector’s recovery.

- Affordability crisis deepens. More than 165 million people with employer-sponsored plans will experience rising premiums next year, according to an analysis published by Mercer last month. As employer-based insurance rates increase, employers will likely pass on these rising medical costs, driven in part by high-cost drugs like GLP-1s, to employees, according to the Mercer survey. The survey echoes findings from a report published in October. Most people with group coverage are expected to see a 6-7% premium increase, representing the largest increase in health costs in 15 years, more than double the inflation rate, at a time when approximately half of adults are worried about affording their healthcare, according to a poll published last month. The poll, by West Health-Gallup, also found that concerns about prescription drug costs have climbed steadily and that about 1 in 3 adults reported delaying or skipping medical care over the last year because they could not afford it.

- The Gist: Healthcare coverage is getting more expensive. Employees who depend on employer-based coverage will navigate increased premium costs next year, and if enhanced ACA premium tax credits expire, may not have more affordable alternatives through the ACA marketplace. For employees who rely on ACA marketplace coverage, affording healthcare will be especially challenging. Concerns about affordability may be a prelude to higher uninsurance rates and more uncompensated care. As unaffordability worries hit a high since 2021, delayed and skipped medical care may result.

- Medicare star rating overhaul proposed. Medicare has proposed to scale back a dozen quality measures in Medicare Advantage star ratings, according to a proposed rule published this week. The proposal would halt a planned Biden-era equity incentive program that offered enhanced rewards for improving outcomes for low-income and disabled enrollees. The proposed changes would eliminate 12 quality metrics—including claim denial response and customer service—and retain the current bonus system favoring consistent performance across measures. These changes, along with a new depression screening measure, adjustments to risk scoring and steps to allow easier midyear plan switching if providers leave networks, could cost taxpayers $13 billion over a decade and could take effect in 2027.

- The Gist: Star ratings hold tremendous importance for Medicare Advantage plans, which use them to negotiate payments, and their members, who rely on them to differentiate variability in plan quality. Ratings fell post-pandemic while Covid-19 criteria were sunset and as methodology changed, creating instability. The proposed changes mark the administration’s initial steps to reshape the privatized Medicare market, affecting dominant players like UnitedHealthcare, Aetna and Humana, which have sued over star rating downgrades. The proposed rule aims to remove a metric on call centers, one of the metrics about which Humana and UnitedHealthcare recently sued. While removing equity incentives may lift some plans' ratings, fewer metrics overall could reduce star ratings for most, leading to overall shifts in rankings that might mirror historical performance.

Plus—what we’ve been reading.

- Aging out of coverage. A recent New York Times article outlines the health insurance crisis facing young Americans as they age out of eligibility for parental coverage. The ACA requires plans to allow dependents to remain on family insurance until age 26, but new economic realities are creating challenges. Originally written assuming that most 26-year-olds would transition to their own employer-based coverage, this provision now meets a labor market in which over 30% of young adults work in roles that provide little to no coverage. With 15% of 26-year-olds uninsured—the highest rate among any age group—many cannot afford marketplace plans and don’t qualify for Medicaid; those with high-deductible or limited-network employer plans risk severe debt if something goes wrong.

- The Gist: Young adults navigate a fragmented transition from parental insurance coverage amid policy uncertainty. They have few affordable options. Many 26-year-olds report they do not understand marketplace plans requirements and the financial burden of high-deductible plans. With ACA marketplace premium enhanced tax credits set to expire, the stories of delayed or disruption in physical and mental healthcare, combined with the burden of medical debt, could rise. Providers may feel the impact of reduced volumes and increased utilization of emergency and uncompensated care.

Graphic of the Week

A key insight illustrated in infographic form.

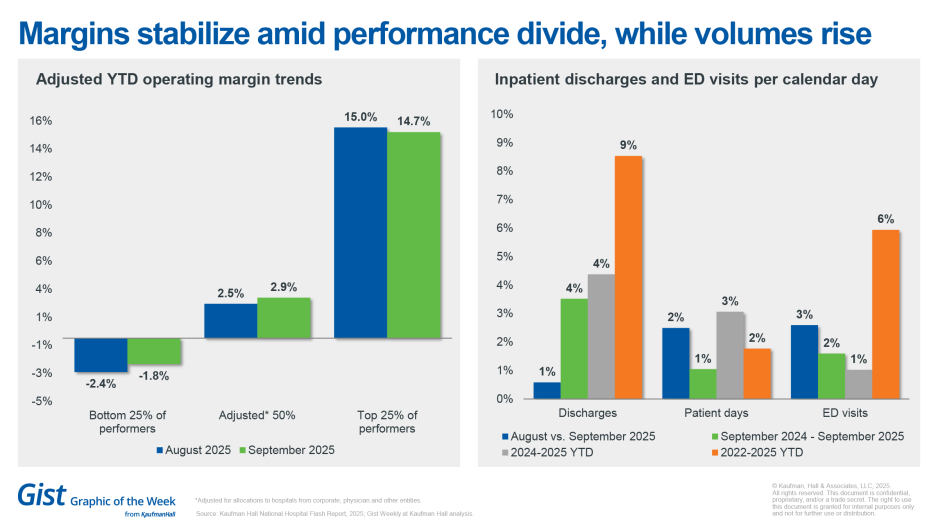

Margins stabilize amid performance divide, while volumes rise

The most recent National Hospital Flash Report highlights stabilizing hospital margins, with a persistent gap in hospital performance, according to September 2025 data. Year to date margins range from 14.7% for hospitals performing at the top quartile to -1.8% at the lowest quartile, with the 50th percentile at approximately 2.9% when adjusted for the allocations to hospitals from corporate, physician and other entities.

September saw also month-over-month and year-over-year increases in inpatient discharges, patient days and emergency department visits. With patient volumes moderately increasing year over year, the ability of hospitals to manage patient throughput efficiently is more important than ever.

This Week at Kaufman Hall

What our experts are saying about key issues in healthcare.

Site-neutral payment policies may significantly affect reimbursement rates, revenue streams and competitive positioning—realities that health systems must urgently prepare for.

The latest Payer Perspectives blog dives into the strategic implications of current and potential future site neutral payment policies for providers and payers, including shifts in negotiations, site of care and cost structures—and what leaders should be planning for now.

On Our Podcast

The Gist Healthcare Podcast—all the headlines in healthcare policy, business and more, in 10 minutes or less every other weekday morning.

On Monday, November 17, we heard the second half of host J. Carlisle Larsen’s conversation with the American Hospital Association’s Chris DeRienzo about a recent study done in partnership with Vizient that found hospitals are seeing progress in surgical safety and survival.

This Monday, Kristine Lee, M.D., associate executive director of Virtual Medicine, Technology and Innovation at The Permanente Medical Group, joins us to talk about a pilot for ambient AI scribes. The Permanente Medical Group began piloting a program in 2023; the results are in, and the impact on physician workload is striking. Dr. Lee walks us through what the evaluation revealed.

To stay up to date, be sure to tune in every Monday, Wednesday and Friday morning. Subscribe on Apple, Spotify, Google or wherever podcasts are available.

Thanks for reading! We’ll see you next Friday with a new edition. In the meantime, check out our Gist Weekly archive for past editions. We also have all of our recent Graphics of the Week available here.

Best regards,

The Gist Weekly team at Kaufman Hall