In 2023, we published an article that described how various industry pressures had accelerated an evolution of laboratory businesses—with particular impacts on lab businesses owned by health systems—and noted an uptick in the number of lab transactions. This uptick has focused largely on the sale or joint venture of a health system’s “inreach/outreach” business, representing the testing that is collected outside of the hospital in settings such as physician offices and ambulatory facilities.

Because inreach/outreach lab tests are not tied to an inpatient or outpatient encounter, they are charged on a per test basis. Large, national lab operators have built scale in the inreach/outreach lab business, enabling them to reduce their fixed costs per test and establish efficiencies that have led to very competitive pricing and put health system-based inreach/outreach businesses at risk. This was one of the main drivers we identified in 2023 behind health systems’ inreach/outreach lab business divestitures or joint ventures with a national lab operator.

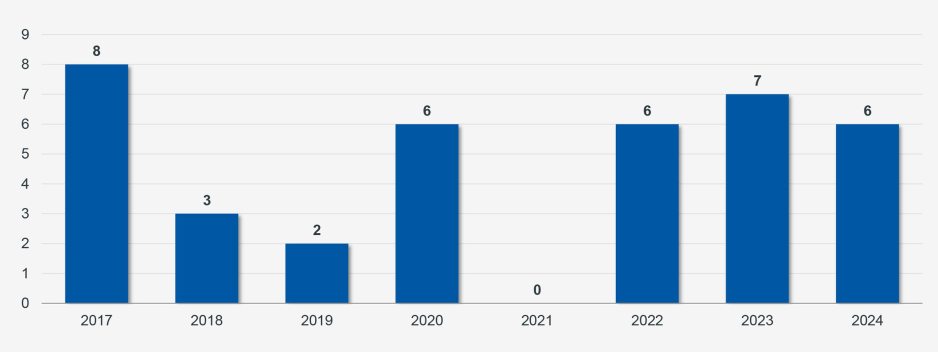

Since our 2023 article, we have seen sustained momentum in lab transactions (Figure 1). National lab operators have continued to aggressively seek opportunities to build scale and have accumulated significant financial reserves to fund transactions. We believe this is driving strong valuations for inreach/outreach lab divestitures and joint ventures, as well as competitive terms associated with health system lab partnerships of all types.

Figure 1: Lab Transactions, 2017 - 2024

On the health system side, even organizations with strong financial profiles are strategically evaluating their portfolio of assets and considering how a divestiture of their inreach/outreach lab business could free up capital that could be re-allocated to other core operations. Based on our conversations with health system leaders, we anticipate further acceleration of lab transactions through the rest of 2025 and into 2026.

Factors accelerating health system inreach/outreach lab transactions

Any combination of the following factors have prompted discussions—and ultimately a decision—on the value of divesting an inreach/outreach lab business among health system leadership:

- Price pressures and lower cost competition. The scale of national lab operators and their sole focus on testing enables them to add additional capacity at a very low cost, as we noted in a recent Modern Healthcare [1] This is putting health system labs under pressure as vendors and insurers redirect volumes to the lower-cost competition. Sale of the inreach/outreach lab business may allow a health system to pass down the lower costs of testing to patients and consumers following the transaction, resulting in a lower cost of care for patients.

- Clinical lab workforce shortages. The clinical lab workforce is aging; in a 2023 press release, the Medical and Public Health Laboratory Coalition predicted a more than 20% retirement rate within the next five years. [2] At the same time, about 24,200 openings for clinical lab technologists and technicians are projected each year, on average, over the next decade. [3] These dynamics are further straining health system lab operations and even profitability and accelerating consolidation.

- Revenue cycle challenges. As health systems put their focus on larger inpatient and outpatient claims, they often face high rates of denials and write-offs on smaller claims from their inreach/outreach lab business, further straining the profitability of health systems’ inreach/outreach businesses.

- Accelerating cost pressures. As part of federal policy shifts and tariffs, cost pressures will likely mount, and anatomic and clinical labs are likely to see the most significant supply cost increases. [4]

- Strategic reallocation of resources. A significant amount of time, scale and capital investment may be required to keep up with the competition and optimize the performance of an inreach/outreach lab business. By monetizing this asset through a sale, health systems can redirect time and resources to more core areas of their business.

Questions to consider in evaluating a potential lab transaction

As health system leaders evaluate potential opportunities to sell or joint venture on their lab business, there are several questions to consider.

Will the proceeds from an inreach/outreach lab divestiture outweigh a potential loss in profitability if we sell the business?

A first step in evaluating a potential sale is to carefully isolate the contribution margin driven by the inreach/outreach lab business based on variable costs that would be removed upon the sale. Forward-looking projections are also valuable, given current reimbursement and cost dynamics and an increasingly competitive pricing environment for inreach/outreach lab services. Conducting sensitivity analyses on the potential impact of these factors can help determine the overall potential financial impact of the transaction on the health system and assess whether the sale of the inreach/outreach lab business will be financially beneficial.

Does our volume and breadth of testing capabilities position us to be a competitive and low-cost provider in the future?

Continued volume growth, particularly in the inreach/outreach setting, will be required to lower the cost of testing, to mitigate pricing headwinds and to stay competitive with national lab providers. Maintaining a robust, differentiated test menu with sufficient volumes to support higher specialty esoteric testing will also be required for success and efficiency.

How can we effectively mitigate lost volume resulting from sale of the inreach/outreach lab business?

Health systems have several opportunities following a sale to improve the efficiency of their remaining lab business and mitigate the revenue lost from the sale. Systems can focus on internal rationalization efforts, optimizing remaining lab operations by, for example, creating centers of excellence (COEs) with aggregated lab testing at certain hospitals. They can also assess leveraging supply contracts from a chosen national lab partner to obtain lower-cost supplies for the remaining lab volume.

How do we ensure that patient and employee satisfaction and quality of care are not compromised as a result of a sale?

Transaction terms can and should be customized to satisfy the objectives that are most important to the health system. These objectives could include, for example, protecting patient access to lab services, preserving lab turnaround times or other key performance indicators, or ensuring that health system job positions are protected in the transaction. Ensuring that the appropriate terms, protections and preparations are in place for a smooth and successful EMR transition at closing is imperative as well, and has become increasingly critical to maintaining patient, employee and physician satisfaction.

Conclusion: Will transaction activity accelerate?

More of our health system clients are evaluating the go-forward strategy for their inreach/outreach labs. With several transaction processes in motion, and several concurrent strategic and financial inreach/outreach lab assessments in process among other health system clients, we anticipate that transaction activity will accelerate in the near future.

Health systems that are considering the sale of their inreach/outreach lab business should watch these market dynamics closely. They should also begin to evaluate the profitability of their inreach/outreach lab business, what the financial value of that business may be in a transaction, and how they would structure a transaction to achieve their specific objectives and account for the considerations outlined in this article.

Select inreach/outreach lab transactions in which Kaufman Hall served as an advisor