Various industry pressures have accelerated an evolution of laboratory businesses in recent years, with particular impacts on labs owned by health systems. As a result, many systems are considering alternatives for their labs, with an emphasis on outreach labs.

A changing industry

A health system’s outreach lab business includes tests ordered for patients primarily in non-acute settings such as physician practices or skilled nursing facilities. They are not tied to an inpatient or outpatient encounter and are therefore charged on a per test, rather than bundled, basis.

The role of large, national laboratory operators (e.g., LabCorp, Quest Diagnostics, and Sonic) in the outreach lab business has continued to grow. As they have built scale, they have also been able to reduce their fixed costs and establish efficiencies that allow for very competitive pricing. Labs owned by health systems are typically reimbursed at a rate often multiple times higher than the national lab operators, which makes their position more vulnerable in a market with a growing emphasis on consumerism and price transparency. Payers are well aware of these rate differentials and have begun carving out narrow networks that exclude hospital outreach labs.

Health systems face other challenges in the outreach lab business, including the following:

- An already high fixed cost structure is being further pressured by rising salary, benefit, and supply costs, compressing the margin on outreach lab services.

- Future Medicare payment cuts under the Protecting Access to Medicare Act (PAMA) will put additional pressure on margins.

- A focus on population health management and analytics favors the national lab operators, which have large, diverse patient bases that enable more advanced predictive analytics and sophisticated statistical analyses. These companies also have user-friendly reporting capabilities that allow them to utilize information across specific modalities of care or specific populations.

These factors are driving more health systems to seek partnerships that help them accomplish some combination of the following:

- Lower the cost structure of the lab and out-of-pocket costs for their patients

- Tap into a greater degree of capabilities with their lab data

- Increase performance for provider-sponsored health plans

- Streamline their ambulatory lab network

- Monetize outreach programs that have shrinking margins but are currently selling at historically high multiples

Alternatives for health systems

The industry is seeing a notable uptick in lab transactions, which commonly involve outreach platforms but may also include options for inpatient/outpatient lab tests, as further described below.

| Between 2013 and 2021, two health system outreach lab transactions were announced annually, on average. In 2022, activity increased significantly with seven transactions announced, including several with larger scale regional or national health systems. In 2023, an additional two transactions have been already announced through the first quarter. |

An outreach lab transaction involves the sale or joint venture of an organization’s outreach test “business”—including the associated outreach volume and the space and equipment needed to collect the outreach tests—to a national laboratory operator. Neither the laboratory itself nor inpatient and outpatient volumes are included in the transaction. Health systems are pursuing outreach lab transactions today for several reasons:

- There has been a recent “race to scale” among the national lab operators, and competition for health systems’ outreach lab businesses has led to very competitive terms in recent transactions

- Valuation multiples have accelerated significantly, and have generally increased by 150% to 200% over the past few years

- Operational and financial headwinds have made cash even more critical for health systems, and the proceeds from outreach lab transactions allows them to shift resources to core endeavors

There is a not a “one size fits all” transaction model for outreach labs. There is a wide range of collaborative arrangements—including joint ventures and other mutually beneficial partnerships—available for health systems that do not wish to transition their entire outreach platform.

Other alternatives are available that also relate to a health system’s broader inpatient/outpatient lab volumes, either as a stand-alone option or as part of an outreach transaction package. These alternatives include:

- A management services agreement (MSA). MSAs are best for health systems that need assistance with the full management of day-to-day operations of its laboratory business. A national laboratory operator will take over certain testing and management functions for a certain time (e.g., three to five years), transferring the risk of inflating costs and locking in a per-test cost for the term of the agreement. The laboratory operator then leverages its scale, global contracts, operating expertise, and offsite testing capacity, often achieving 10% to 20% savings of addressable costs for the health system. The MSA does not necessarily require management of the entire lab; à la carte options are available to manage certain aspects of the lab.

- A reference agreement. This is a vendor agreement between a health system and a national laboratory operator in which the health system agrees to send most of its higher specialty “send-out” tests to the operator as a “preferred provider” in return for a per-test savings below the existing fee schedule. These agreements are most beneficial for health systems that are sending tests to a wide array of national laboratory operators and could benefit from streamlining their referral process. Reference expenses savings of 10% to 20% are typical, and the health system benefits from easier user interfaces as well.

- A reverse reference agreement. These agreements are used in situations where a national laboratory operator lacks local core laboratory capacity for certain test volumes and agrees to transfer certain tests from the community to a hospital-owned lab that has capacity. These agreements are geography-specific, and they allow the hospital to collaborate on laboratory strategy with a national operator. The types of tests included in the agreement typically depend on the hospital-owned lab’s specialized capabilities and the needs of the national operator.

Health systems that are interested in pursuing these opportunities can begin by considering the questions outlined in the below.

|

Questions for Health Systems Considering Alternative Outreach Lab Strategies

In assessing whether strategic outreach lab alternatives may benefit your health system, consider the following questions:

|

Conclusion: A window of opportunity

Even though health systems face significant headwinds in the outreach laboratory business, there are a range of potentially beneficial options available in the market today to restructure, grow, or monetize that business. Careful assessment of both the challenges and opportunities in the evolving lab landscape can help your organization identify the best path forward.

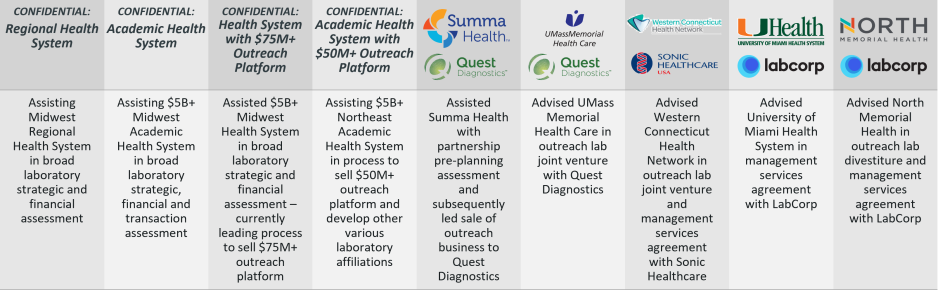

Select Recent Lab Transactions