In the News

What happened in healthcare recently—and what we think about it.

- Healthcare at the center of government shutdown. Congressional leaders and President Trump this week failed to resolve the budget impasse that has led to the first government shutdown since 2019. On Sept. 19, the House of Representatives passed a continuing resolution to fund the government through Nov. 21, but the resolution has failed to gain the necessary bipartisan support in the Senate. Congressional Democrats cite concerns about the expiration of enhanced Advanced Premium Tax Credits and the risk that approved funding could later be rescinded. The shutdown is now in its second week, with no signs of a compromise. In related developments, the Centers for Medicare & Medicaid Services issued updates following the Oct. 1 expiration of certain legislative flexibilities, requiring hospitals in the Acute Hospital Care at Home program to discharge or readmit all inpatients and ending acceptance of new waiver requests. CMS also paused Medicare claims processing for 10 days and reminded providers that some telehealth flexibilities have ended, advising use of Advance Beneficiary Notices when delivering noncovered services.

- The Gist (this Gist is brought to you by the Vizient Government Relations and Public Policy Team): For hospitals, although Medicare and Medicaid payments are mandatory, claims are currently being held (to try and avoid reprocessing at a later date) and staffing reductions may slow even further the eventual processing of those claims. The more immediate impacts on hospitals from the shutdown are because of the expiration, also on Oct. 1, of several health programs and payments. These “extenders” include the delay of Medicaid DSH payment cuts, extensions of the Medicare Dependent Hospital and Low Volume Adjustment programs and flexibilities around Medicare telehealth coverage, among others. Despite past bipartisan support for an extension of these programs, particularly for certain telehealth flexibilities, the likelihood of passing a separate extension of these programs without a full government funding package is slim.

- H-1B visa fee sparks lawsuits, hospital concern. The Trump administration’s new $100,000 fee on H-1B visa petitions has triggered a wave of lawsuits from universities, healthcare organizations and advocacy groups claiming the policy is unlawful and was implemented without proper rulemaking. The lawsuits, filed last week in federal court in San Francisco, seek to block the fee, which applies to new H-1B applications for foreign workers abroad. The White House has defended the move as a way to protect U.S. jobs, but opposition has come from major sectors that rely on international talent, including medicine, education and technology. Major healthcare organizations have urged the administration to exempt healthcare personnel, warning of “catastrophic consequences” for staffing and access to care if the rule stands.

- The Gist: Hospitals that rely on internationally trained physicians, nurses and technicians—especially in rural or medically underserved areas—could face severe recruitment challenges if the fee is allowed to stand. The $100,000 surcharge effectively prices out most residency and fellowship candidates, jeopardizing programs that depend on foreign medical graduates. Even if physicians ultimately gain an exemption, the uncertainty alone could disrupt onboarding and create coverage gaps heading into 2026. Health systems should monitor the lawsuits closely and prepare contingency plans for critical positions, as the legal and political fight over this fee could shape workforce supply for years.

- Qualtrics to acquire Press Ganey Forsta for $6.75 billion. Experience management company Qualtrics will acquire Press Ganey Forsta, the healthcare performance-measurement and patient-experience company, in a $6.75 billion deal that includes debt. The deal was announced Monday and is expected to close in the coming months. The acquisition would give Qualtrics, best known for its enterprise feedback and analytics software, a major foothold in healthcare through Press Ganey’s network of more than 41,000 healthcare organizations. Both companies will continue to operate independently until the transaction closes. Qualtrics said the deal aims to create a unified AI-driven platform for understanding and improving patient, employee and organizational experience, which it described as part of its long-term strategy to deepen vertical expertise in regulated industries.

- The Gist: For hospitals, the acquisition underscores how quickly experience measurement is evolving from surveys to integrated, predictive analytics. Press Ganey dominates the healthcare survey market, and its scores are used widely by hospital marketing departments. Qualtrics’ entry into healthcare suggests that future patient-experience systems will lean heavily on AI and real-time data, requiring hospitals to strengthen their data governance, interoperability and privacy practices. Health systems that can’t keep pace may lose ground in patient loyalty, value-based reimbursement and competitive positioning. As vendors consolidate under larger technology companies, hospitals will need to balance innovation with vigilance over vendor lock-in and data stewardship.

Plus—what we’ve been reading.

- Earlier colorectal cancer screening saves lives. Published in August in The Wall Street Journal, this article traces the impact of updated colorectal cancer screening guidelines, finding that screening younger people led to catching more cases early. In 2018, the American Cancer Society began recommending that people with average risk screen for colorectal cancer starting at age 45, five years earlier than its previous recommendation. The U.S. Preventive Services Task Force followed suit with updated guidelines in 2021. With younger patients now getting screened more, total colorectal cancer screening increased by 62% from 2019 to 2023, and early-stage diagnoses surged in 2021 and 2022. Among adults ages 45 to 49, colorectal cancer rates rose about 1% a year starting in 2004, then jumped 12% a year between 2019 and 2022. Follow-up studies showed that people were more likely to get screened when they were sent stool test kits by mail instead of having to request them, and colonoscopies increased by 8% from 2019 to 2023. Still, screening rates remained unchanged for uninsured people.

- The Gist: While overall colorectal cancer rates have decreased since the early 1990s, rates in younger populations have climbed, with 1 in 10 colorectal cancers occurring in people under 50. Colorectal cancer is on the rise with younger people, for reasons not yet fully understood. Lowering the screening age has expanded the pool of eligible patients, driving sharp increases in screening and early diagnoses for a disease in which survival rates rise dramatically when caught sooner. Expanding eligibility is at least in part about recalibrating screening on par with what updated data show. The challenge ahead is to strike a delicate balance: guarding against the cost of over-screening while refusing to accept under-detection as inevitable.

Graphic of the Week

A key insight illustrated in infographic form.

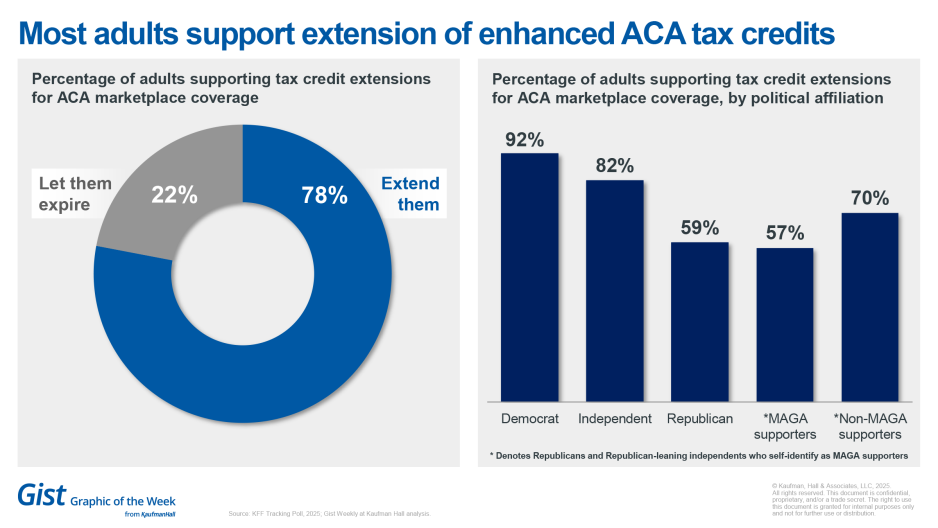

Most U.S. adults want extension of ACA tax credits

As Congress debates extending the enhanced advanced premium tax credits as part of broader spending bill negotiations, a new KFF poll shows overwhelming bipartisan support for keeping them in place, with 78% of adults—including almost all Democrats, an overwhelming majority of independents and three in five Republicans—favoring an extension. These majorities include Republicans and Republican-leaning independent voters who identify as supporters of the “Make America Great Again” (“MAGA”) movement. Yet most Americans remain unaware the credits are expiring, with six in 10 saying they have heard little or nothing about it. If premiums nearly doubled, as could happen if the subsidies are not renewed, seven in 10 marketplace enrollees say they could not afford coverage without major financial strain, and four in 10 say they would drop insurance entirely. While majorities across parties say they would be concerned if millions lost coverage or premiums became unaffordable, two-thirds also express worry about the federal spending needed to maintain the subsidies. If the tax credits lapse, most blame would fall on President Trump and congressional Republicans, though partisan divisions persist over who is most responsible, the poll found.

This Week at Kaufman Hall

What our experts are saying about key issues in healthcare.

While uncertainty in the lead-up to the One Big Beautiful Bill (OBBB) dominated the first half of the year, healthcare leaders must now navigate their organizations forward through the bill’s well-documented healthcare impacts, a topic of several new Kaufman Hall articles:

- Putting health system strategy into action

- Planning for the OBBB’s financial impacts on hospitals

- Rethinking payer-provider relationships after the OBBB

- Rethinking the healthcare workforce in the wake of OBBB

Vizient’s Navigating the OBBB landing page offers timely updates on key OBBB considerations for healthcare leaders, including an umbrella article on the bill's impacts.

On Our Podcast

The Gist Healthcare Podcast—all the headlines in healthcare policy, business and more, in 10 minutes or less every other weekday morning.

Pregnant women have long been left out of drug trials—initially out of well-founded concern over the health of mother and baby, but then it became habit. This Monday, host J. Carlisle Larsen speaks with STAT News reporter Lizzy Lawrence to explain how that exclusion began, why it persists and what it means amid new debate over Tylenol and autism.

To stay up to date, be sure to tune in every Monday, Wednesday and Friday morning. Subscribe on Apple, Spotify, Google or wherever podcasts are available.

Best regards,

The Gist Weekly team at Kaufman Hall