In the News

What happened in healthcare recently—and what we think about it.

- 10 million to lose coverage from One Big Beautiful Bill, CBO says. Approximately 10 million Americans will lose health insurance coverage by 2034 as a result of the newly enacted One Big Beautiful Bill, a new analysis from the Congressional Budget Office found. The law, signed by President Donald Trump July 4, tightens coverage requirements and financing for Medicaid, the health coverage program jointly funded by the federal government and by the states. Overall, the law decreases federal healthcare spending by $1.1 trillion over the next decade, while increasing the nation’s deficit by $3.4 trillion. The law also freezes provider taxes (which most states use to fund a portion of Medicaid) to lower federal spending by $191 billion.

- The Gist: The number of uninsured will grow even more if enhanced tax credits are not extended at the end of 2025. The cuts likely will roll back years of progress in reducing uninsurance in the United States; before the ACA was enacted in 2010, the uninsured rate was 17.8%; by 2023, it had fallen to 9.5%. Providers have weathered numerous disruptions and crises in recent decades, so this is familiar (if uncomfortable) territory for healthcare providers. But unlike past policy shifts, this one lands at a time when many providers have little slack left. Hospitals, already strained by rising costs, shrinking margins and workforce shortages, must now brace for another wave of financial pressure. Leaders have an 18-month window to adapt before meaningful financial impact hits.

- Clinical AI company secures new financing. Aidoc, a clinical AI company specializing in radiology and care coordination, secured $150 million in new financing, backed by General Catalyst, Square Peg Capital and NVentures, Nvidia’s venture capital arm, it was announced Wednesday. Aidoc also added four U.S. health systems—Sutter Health, Hartford HealthCare, Mercy and WellSpan Health—as strategic investors. Aidoc develops AI applications that can be used in radiology, cardiology, cancer, vascular and neurovascular care. The company plans to use the capital to expand its AI operating system (aiOS) into areas such as oncology and cardiology, while continuing development of its foundation model. The company now has raised a total of $370 million.

- The Gist: This funding round underscores growing confidence in AI platforms that go beyond narrow point solutions. By investing in Aidoc, participating health systems are signaling a desire to integrate AI more deeply into clinical workflows across multiple specialties. The emphasis on aiOS, which supports both Aidoc’s own models and third-party AI tools, suggests a shift from standalone applications to infrastructure-level solutions. For hospitals, this reflects a strategic move to scale AI adoption in a centralized, cohesive way. At the same time, it raises the importance of vendor reliability, clinical validation and interoperability.

- ACA premiums projected to spike in 2026. Insurers selling health plans on the Affordable Care Act marketplaces are seeking steep premium hikes for 2026, with proposed increases averaging 17% across 13 states, according to a new analysis from KFF and the Peterson Center on Healthcare. Several major carriers asking for double-digit increases cite rising hospital and drug costs, utilization rebound and the end of pandemic-era subsidies as grounds for the projected increases. In some cases, insurers flagged new price pressures tied to GLP-1 drugs and ongoing labor shortages. State regulators may scale back the requested hikes, but the filings signal a broad pricing reset for ACA plans. The higher rates could affect up to 24 million Americans who receive insurance through marketplaces and result in lower enrollment in ACA marketplaces, leaving a risk pool of less healthy individuals.

- The Gist: If these rates are approved—or even partially so—millions of enrollees could face sharp premium increases in an election year when healthcare affordability is already a flashpoint. Many consumers have become insulated from true costs thanks to enhanced subsidies, but those supports are temporary and the political appetite for extension may be waning. Payers, for their part, are squeezed by higher-than-expected utilization and rising costs for specialty drugs and are taking heat for their prior authorization policies. For hospitals and systems, the rate hikes underscore that payers are unlikely to absorb cost growth without passing it along. Expect tougher contract negotiations, heightened scrutiny on cost trends and more pressure on providers to show value in an increasingly price-sensitive market.

Plus—what we’ve been reading.

- A home birth, shaped by shifting trust. Published in July by NPR, this story profiles a family of devout Georgia Catholics preparing for the birth of their 9th child who have opted for a home birth with a midwife licensed in another state. Accustomed to using conventional medical care, the Alger parents describe their growing mistrust in institutions, citing conflicts with school vaccine policies, personal experiences navigating healthcare and broader concerns about maternal outcomes in their state. The article traces their shift away from traditional healthcare into care options once considered unconventional. It also highlights stalled policy efforts like the Perinatal Workforce Act and the Maternal Health Blueprint, and outlines inconsistencies in state licensure standards that leave some midwives as unrecognized healthcare providers in Georgia and other states.

- The Gist: The Algers’ story reflects the strain of broader trends, such as pronatalist policies unfolding alongside rural hospital closures, high maternal mortality rates and perinatal workforce shortages. As patient trust wanes and perinatal infrastructure lags, more families are navigating away from traditional systems into expanded care networks. At the same time, new policies like baby savings accounts and in vitro fertilization subsidies point to a potential future of more births and attendant demographic changes. Without parallel investment in infrastructure, that demand may drive more use of lower-acuity birth settings and alternative care options, increasing competition for hospitals and health systems. Adapting to this landscape will require not only more resources and workforce policy development, but also a reconsideration of how we meet patients where they are, even if that is outside the hospital.

Graphic of the Week

A key insight illustrated in infographic form.

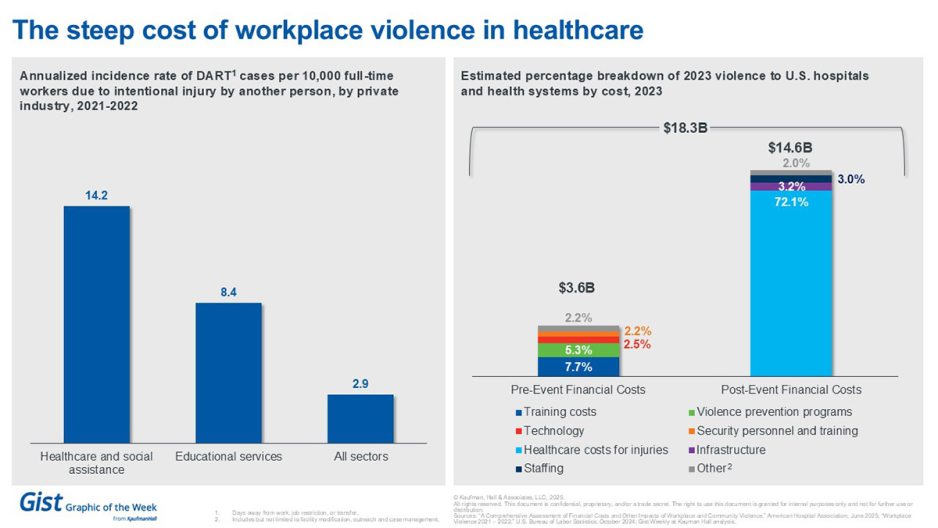

The steep cost of workplace violence in healthcare

This week’s graphic features data from an American Hospital Association (AHA) report about violence in the healthcare workplace. As measured by days away from work, job restriction or transfer due to intentional injury caused by another person, the workplace violence rate in healthcare was nearly 5 times as high as the general rate in all sectors in 2021—2022. And it’s costly; in 2023 hospitals and health systems spent approximately $14.6 billion after violent events, nearly three-quarters of which went to direct costs to treat injuries. The AHA report highlights the magnitude of violence as a public health problem; its authors hope to inform policy and research efforts to address violence impacting U.S. hospitals and the healthcare system.

This Week at Kaufman Hall

What our experts are saying about key issues in healthcare.

Many payer contracts lack the visibility, predictability and recourse mechanisms organizations need, leading to denials and lost revenue.

A new article by Jim Sabolik, Gina Simmons and Martin Kelley digs into how sharper contracting terms combined with enterprise‑wide internal coordination can dramatically cut denials. One key insight: aligning all relevant departments around contract provisions and payer requirements enables earlier intervention and reduces avoidable denials.

On Our Podcast

The Gist Healthcare Podcast—all the headlines in healthcare policy, business and more, in 10 minutes or less every other weekday morning.

Last Monday, we heard the first part of host J. Carlisle Larsen’s conversation with BayCare Health System’s Chief Nurse Executive Trish Shucoski and Rocky Hauch, an advanced nursing educator for the system, about their successful nurse wellbeing pilot being rolled out to all 16 BayCare hospitals.

This Monday, we listen to the conclusion of their conversation in which they discuss the impact the pilot had on patient care and the potential for expanding the program to other support staff.

To stay up to date, tune in every Monday, Wednesday and Friday morning. Subscribe on Apple, Spotify, Google or wherever podcasts are available.

Thanks for reading! We’ll see you next Friday with a new edition. In the meantime, check out our Gist Weekly archive if you’d like to review past editions.

Best regards,

The Gist Weekly team at Kaufman Hall, a Vizient company