On Thursday President Trump announced a new healthcare policy initiative, The Great Healthcare Plan, consisting of four principles: “lower drug prices, lower insurance premiums, hold big insurance companies accountable and maximize price transparency.” The Gist Weekly team is reviewing the plan and we’ll have more on future developments. In the meantime…

In the News

What happened this week in healthcare—and what we think about it.

- ACA enrollment drops nationwide, but not everywhere. National Affordable Care Act (ACA) marketplace enrollment has declined, the Centers for Medicare & Medicaid Services reported this week. As open enrollment closed this week, early data suggest that 22.8 million consumers enrolled for 2026 individual market health insurance coverage. That’s down from 24.2 million last year as of Jan. 3, according to CMS. Analysts suggest this is largely due to higher costs, especially as the ACA enhanced tax premiums expired Dec. 31; premiums have more than doubled in some instances. But the declines were not seen everywhere: Texas reported higher enrollment numbers than last year, surpassing last year’s enrollment and marking a 6.5% annual increase at a comparable point in the enrollment cycle. Texas is one of six states to exceed last year’s enrollment.

- The Gist: Many experts predicted that the expiration of the ACA premium enhanced tax credits would likely lead to unaffordable, increased premiums for many Americans. However, the impact of enrollment changes will be at least in part state-dependent, especially for non-expansion states. The number of Texans who enrolled in ACA coverage, as in previous years, is second only to Florida. Both states never expanded Medicaid under the ACA, limiting enrollment among low-income people who would otherwise qualify for government health coverage in other states. Final enrollment data and potential new enhanced tax credits will provide further clarity on what to expect in the years ahead.

- New York City nurses go on strike. Nearly 15,000 nurses went on strike in New York City this week. It is one of the largest healthcare strikes in history, and the second major nursing strike in just three years for New York City. Nurses are seeking what they call enforceable staffing ratios, higher pay and stronger workplace safety precautions. The nurses appear to enjoy the support of many local politicians. The strike is causing significant disruption, including cancellation of elective procedures, hospital transfers and ambulance diversion. Thousands of temporary nurses have been hired.

- The Gist: A prolonged labor action is bound to affect care in the nation’s largest city. It comes as the United States continues to face a severe nursing shortage. In 2022, the Health Resources and Services Administration projected a shortage of 78,610 full-time registered nurses in 2025. While the nursing workforce is expected to expand by 6% over the next decade, federal authorities still anticipate a shortage of more than 60,000 full-time RNs in 2030. This could potentially lead to strikes becoming more commonplace, and there may not be a sufficient workforce to provide temporary coverage if that happens. As always, hospitals should prepare in advance to maintain operations.

- AI companies release new healthcare products. OpenAI and Anthropic released new AI healthcare tools last week. Open AI announced ChatGPT Health, a consumer-facing product, and ChatGPT for Healthcare aimed for hospitals, clinicians and administrators. Meanwhile, Anthropic released its own suite of tools, Claude for Healthcare, which is also aimed at industry use. ChatGPT Health access has a waitlist for users and early adopters of OpenAI for Healthcare have begun to pilot the offering, which provides support with documentation, prior authorization and operational workflows. Anthropic’s consumer-facing tools and HIPAA-ready industry products are already accessible to their subscribers and health organization clients.

- The Gist: AI is here to stay, and it is already entrenched in healthcare. OpenAI and Anthropic’s entrances in the healthcare market were expected and address pressing needs for both consumers and healthcare organization clients. AI tools will continue to meet the moment as patients seek health information and hospitals and clinicians seek ways to automate routine tasks. Healthcare organizations will look to AI providers’ organizational strategies and consider how their tools meet regulatory and safety requirements. Even so, we remain far from understanding the true return on investment of AI adoption in healthcare.

Plus—what we’ve been reading.

- How will the Trump drug-pricing deals affect actual prices? Published earlier this month in Politico, this article takes a deep dive into voluntary drug-pricing agreements the Trump administration has struck with major pharmaceutical companies. Proponents say these agreements could pay off over time, because one component is to push other wealthy countries to pay more for drugs and pressure drugmakers to use some of those profits to lower prices in the United States. The deals generally apply to Medicaid and cash-pay pricing or direct-to-consumer purchases through the TrumpRx platform that is still in the works. However, these agreements are unlikely to deliver immediate savings for most Americans, the authors say. They do not address the way most commercially insured patients pay for prescriptions today; most U.S. patients get their medications through private insurance with co-pays and co-insurance tied to list prices. The voluntary and confidential nature of these agreements, with details still opaque, leave policy experts questioning how durable and extensive the savings will be.

- The Gist: Patients and hospitals may feel the effects of these agreements differently, which could reshape pharmaceutical dynamics over time. If manufacturers concede price cuts in Medicaid and cash-pay channels, they may seek margin recovery elsewhere, and hospitals are a familiar pressure point. That could show up as tighter contract terms or more aggressive pricing on infused and specialty drugs, which dominate hospital spend. Hospitals should plan for volatility in drug availability and pricing, as manufacturers respond strategically to these voluntary deals. In practical terms, this means pharmacy cost management remains a governance issue, requiring alignment among supply chain, finance and clinical leadership. The takeaway: hospitals should expect complexity, not relief, and plan accordingly.

Graphic of the Week

A key insight illustrated in infographic form.

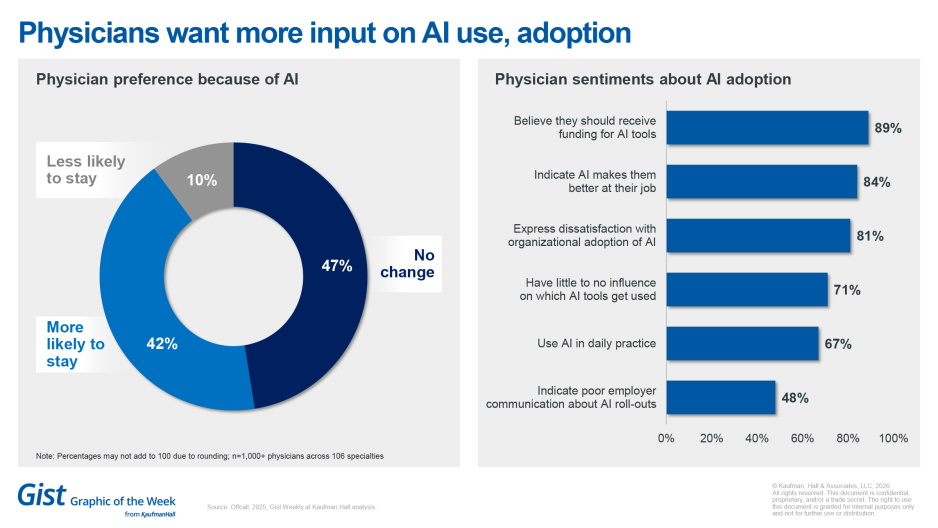

Physicians want more input on AI use and adoption

Physician sentiment about AI has been mixed. A recent survey from Offcall, an online service in which physicians can see pay data and compare job offers, concludes that most physicians use AI and want more of it; but more than 80% of them are dissatisfied with current offerings, particularly with the speed of adoption, communication about deployment and the level of influence physicians have in what tools get used. The survey also found that most physicians are also here to stay; only 10% of physicians indicate they are less likely to practice medicine because of AI. Hospitals and organizations employing physicians may fare better if they include their doctors in their AI decision-making.

This Week at Kaufman Hall

What our experts are saying about key issues in healthcare.

Policy-related uncertainty led to a significant cooling of hospital and health system M&A activity in the first half of 2025, with the number of announced transactions in Q1 and Q2 reaching record lows. While still relatively low by historical standards, activity began to rebound in Q3 and Q4.

Kaufman Hall’s year-end M&A report explores the transition in activity from uncertainty to continued momentum – and the big moves health systems made in ambulatory care, behavioral health and laboratory services through acquisitions, divestitures and partnerships.

On Our Podcast

The Gist Healthcare Podcast—all the headlines in healthcare policy, business and more, in 10 minutes or less every other weekday morning.

The Gist Healthcare Podcast is off on Monday, Jan. 19, in observance of Martin Luther King Jr. Day. We’ll be back on Wednesday with a new report about the drop in organ donation and its link to public mistrust.

To stay up to date, be sure to tune in every Monday, Wednesday and Friday morning. Subscribe on Apple, Spotify, Google or wherever podcasts are available.

Thank you for reading! Please stay tuned for next week and check out our Gist Weekly archive for past editions. We also have our recent Graphics of the Week available here.

The Gist Weekly team at Kaufman Hall