Hello, and welcome to this week’s edition of the Gist Weekly. We’re grateful for your continued readership. Feel free to forward this email to friends and colleagues and encourage them to subscribe!

In the News

What happened in healthcare recently—and what we think about it.

- Feds pull the plug on mRNA vaccine programs. The federal government is shutting down $500 million worth of mRNA vaccine projects, including contracts with Moderna, Pfizer and others, it was announced Tuesday. Health and Human Services Secretary Robert F. Kennedy Jr. said the decision follows a review that questioned how well mRNA vaccines work for viruses like Covid-19 and the flu. As a result, 22 contracts are being canceled and no new mRNA proposals will be funded. The government says it will focus instead on traditional vaccine technologies, which it says are more stable and better suited to fighting respiratory illnesses.

- The Gist: Billed as a safety move, this is a major pivot away from a technology on which U.S. healthcare providers have come to rely. Unlike traditional vaccines, which can take years to develop and test, mRNA shots can be made within months and quickly altered—offering healthcare providers a faster way to respond to emerging viruses. But that speed may now be harder to come by. If a new Covid variant or flu strain hits, health systems could face delays in getting vaccines or fewer clinical options altogether. The shift casts doubt on other mRNA-based innovations, like cancer vaccines or gene therapies. The move adds an additional layer of ambiguity to an already uncertain future for hospitals trying to plan and prepare for future disease outbreaks.

- Health systems consider their moves as payers retreat. Health systems are considering growing their insurance arms as major national insurers scale back in the face of rising costs, Medicaid funding cuts and stricter oversight, a newly published analysis suggests. With insurers in apparent retreat, leaders of major systems or integrated delivery networks may see an opportunity to capture market share and gain more control over care and revenue. Talks are ramping up as systems explore buying or selling provider-sponsored health plans, analysts say. With commercial competition intensifying, many believe now is the time to act.

- The Gist: Owning a health plan gives systems more control over patient care and revenue flow. But it also ups the financial stakes. Taking on insurance brings risk, and some systems have buckled under high operating costs, regulatory burdens and trouble keeping patients in-network. While some systems are using integrated models to lower emergency department visits and boost wellness checks, others have retreated from full insurance offerings in favor of leaner direct-to-employer models. The broader bet is that integrated care can reduce costs, improve outcomes and navigate a market facing more uninsured patients and tighter margins. But success will require disciplined execution, smarter referrals and a real appetite for, or at least a tolerance for, risk. As Medicare Advantage becomes more constrained and Medicaid rolls tighten, provider-sponsored plans may become a lifeline, or a liability.

- Gates Foundation pledges to support women’s health. The Gates Foundation on Monday announced a $2.5 billion investment in women's health research and development by 2030, more than tripling its previous efforts. The initiative targets areas historically neglected in health research, such as preeclampsia, menopause, heavy menstrual bleeding and endometriosis. The funding will support more than 40 innovations, including AI‑enhanced ultrasound tools. The pledge also aims to address the imbalance in which only about 1% of non‑cancer health research targets female‑specific conditions.

- The Gist: As Food and Drug Administrator Commissioner Marty Makary recently bluntly declared, mainstream women’s care remains underfunded and under‑researched. While this may be a case of a private foundation stepping into the breach as the federal government pulls back from its historical support for health research, the Gates Foundation has long been interested in public health internationally. For U.S. health systems, this presents both a challenge and an opportunity: engaging in women‑focused trials, early diagnostics and treatments could fill gaps in care and set institutions apart. Those that partner with universities, other research institutions and/or startups may accelerate treatments in areas like gynecology and maternal health. This may be the spark needed to close a research gap that has persisted for decades.

Plus—what we’ve been reading.

- Lonely brains look different. Published this month by Penn Today, this article explores NASA-funded research on the neurological toll of isolation, using data from crews deployed at Antarctica’s Concordia station. University of Pennsylvania researchers found that brain cell volume shrank after prolonged isolation, although most changes reversed within six months. These findings reflect patterns found in long-duration astronauts, reinforcing that isolation can trigger structural brain change. The research demonstrates that isolation is a primary driver of neurological stress, leading to brain decline; this impact, combined with weak social ties, can compound a negative effect on the elderly and people with mental health disorders.

- The Gist: As many as half of Americans suffer from loneliness, a growing crisis of connection and social isolation. Clinicians warn that loneliness and social isolation drive clinical risk, particularly for depression, anxiety and cognitive decline. Despite omnipresent digital connections, Americans are more socially isolated than ever. The U.S. Surgeon General in 2023 labeled loneliness an epidemic and equated its health impact to smoking nearly a pack of cigarettes a day. The cost to health systems is both clinical and financial: lonely patients tend to present later, stay longer and recover more slowly. This affects readmission, throughput, outcomes and workforce burnout, and erodes margin. Ending loneliness requires re-examining the social fabric that fosters and sustains relationships for patients of all ages.

Graphic of the Week

A key insight illustrated in infographic form.

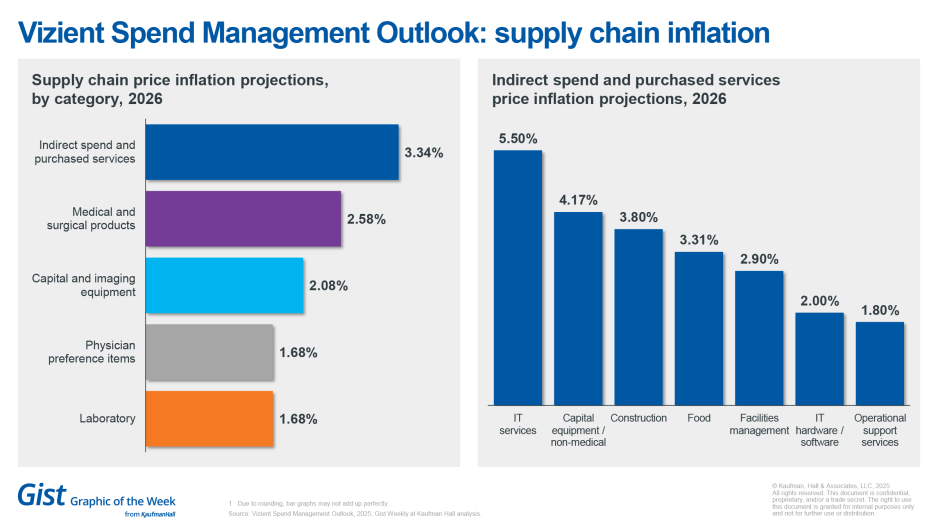

Insights from the Vizient Spend Management Outlook

This week’s graphic features data from Vizient’s Summer 2025 Spend Management Outlook, which provides a forward-looking analysis of product cost inflation for the 2026 calendar year. The outlook forecasts a 3.35% increase in pharmaceutical prices in 2026, with healthcare providers seeing increased usage in GLP-1 therapies, specialty medications and high-cost cell and gene therapies. Supply chain prices in products, materials and services are projected to rise 2.41%, led by indirect spend and purchased services at 3.34%. Of the indirect spend and purchased services category, IT services and capital equipment/non-medical (such as HVAC and furniture) are the leading areas forecast for inflation. The Outlook identifies ongoing market challenges, including the evolving impact of tariffs; established tariffs as of April were considered in the projections for supply chain categories outside of pharmacy.

This Week at Kaufman Hall

What our experts are saying about key issues in healthcare.

The growing loss that hospitals are incurring employing their physicians raises serious doubts about the sustainability of traditional employment models.

A new article by Matthew Bates and Kristofer Blohm examines other pathways health systems can take to maintain access and alignment without the full cost burden. They find that alternatives like partnerships with value-based care MSOs, collaborations with FQHCs, or joint venture/MSO structures can offer financial relief while preserving strategic relationships and physician autonomy.

On our Podcast

The Gist Healthcare Podcast—all the headlines in healthcare policy, business and more, in 10 minutes or less every other weekday morning.

Last Monday, we listened to the first part of host J. Carlisle Larsen’s conversation with Coalition for Health AI CEO Dr. Brian Anderson about his organization’s recent partnership with the Joint Commission to develop best practices and guidance for healthcare systems’ use of artificial intelligence tools in healthcare settings.

This Monday, we hear the conclusion of their chat where they talk more about possible challenges between stakeholders within the healthcare and AI technology industries as they work to establish best practices.

To stay up to date, be sure to tune in every Monday, Wednesday and Friday morning. Subscribe on Apple, Spotify, Google or wherever podcasts are available.

Thanks for reading! We’ll see you next Friday with a new edition. In the meantime, check out our Gist Weekly archive if you’d like to review past editions. We also have all of our recent Graphics of the Week available here.

Best regards,

The Gist Weekly team at Kaufman Hall