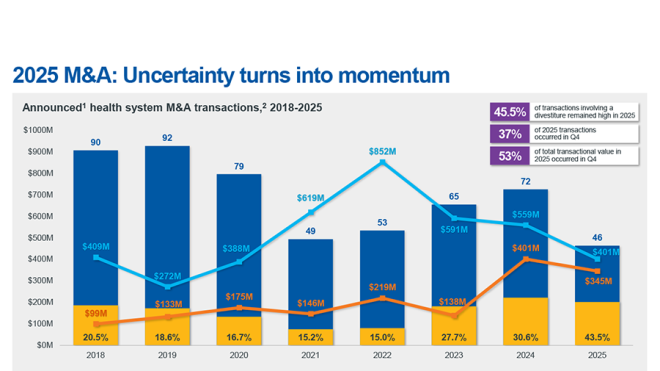

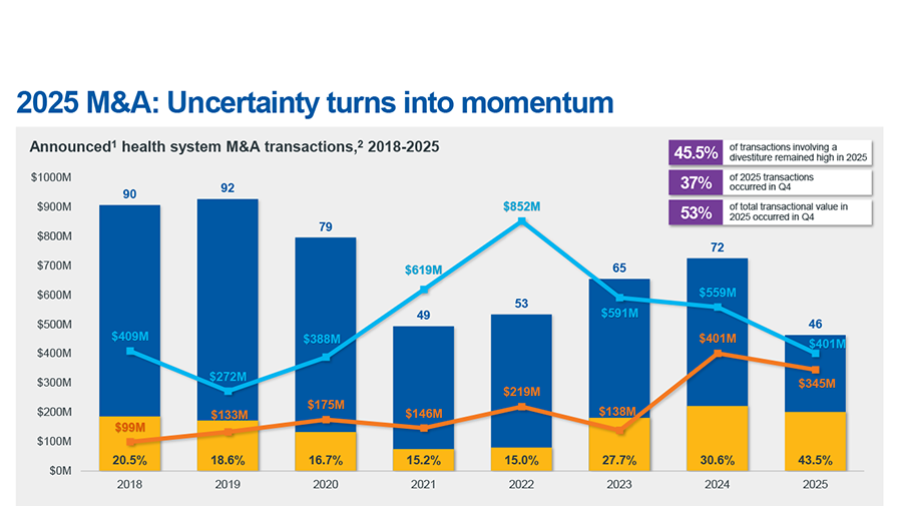

Healthcare merger and acquisition (M&A) activity slowed considerably to start 2025. Kaufman Hall’s M&A report for the first quarter of this year identified only 5 hospital and health system transactions, reflecting malaise in all industries both domestically and globally. The level of activity picked up a bit in the second quarter—to 8 total—but it remains sluggish. The enduring ambiguity surrounding reimbursement, federal and state health policy changes, and economic unease creates uncertainty. Life is always turbulent in U.S. healthcare, but we are facing a uniquely challenging moment of persistent turmoil across financial, regulatory and operational dimensions.

It is likely that this uncertainty has contributed to the slowdown in M&A activity and other affiliations and partnerships. We understand why health systems might hold off. Amid leadership fatigue and ongoing disruption, it’s reasonable that many systems have slowed or frozen strategic initiatives. Organizations have wanted to wait until the dust settles.

But here’s the problem: the dust will never settle. There has never been a truly stable era in healthcare, and the last five years have underscored this. Unpredictability is the new normal.

Bold leadership matters most when navigating periods of instability. Uncertain environments often widen the gap between winners and stragglers—which is why, even in difficult times, some organizations always seem to pull the right strings.

This is why it’s important to distinguish between caution and inaction. Inaction is not neutral. It is a strategic choice, sometimes a costly one. Understanding why decision paralysis sets in, and how leading organizations are steering through it, can help health systems avoid costly delays and instead pursue long-term strength.

Strategic paralysis is real, and risky

Health systems tend to move slowly under the best of circumstances. But, perhaps ironically, chaotic times tend to be when high-performing systems make bold moves.

This might seem counterintuitive. Financial constraints, clinical demands, regulatory scrutiny and market pressures pull leadership teams in competing directions. This often results in an extended cycle of analysis, which transforms into hesitation.

Yet the longer organizations wait, the more likely it is that others will seize the moment. Competitors move first into a growth market. New entrants make a surprise move to fill a gap. Strategic hesitation creates an opportunity for someone else.

The desire to “wait for clarity” is understandable. But it’s fundamentally flawed. Uncertainty creates discomfort; the challenge is to grow comfortable with that discomfort. Delay driven by fear or disjointed governance can become its own form of failure. So, transformation isn’t something to delay until the environment settles. It’s something to pursue because the environment won’t settle.

Adopt a strategy of transformation with conviction

Let us be clear: we are not advocating M&A be pursued hastily. Confidence does not mean recklessness. It means commitment to a growth and transformation strategy rooted in the specific demands of each individual market or region and in durable principles that apply across market conditions.

The transaction isn’t the point. Proactive planning may or may not result in a deal. Whether it does or not, health systems must bolster a well-informed executive team and board to develop and implement a practical, active approach to both incremental and transformational moves.

They also must engage in focused scenario planning exercises. A genuine scenario planning exercise, which considers local market conditions, recent policy changes (e.g., Medicare site neutrality, Medicaid work requirements) and financial planning, is an essential component of any serious M&A consideration.

Health systems can anchor their M&A and partnership strategies in three core areas:

- Enhance liquidity: Large systems may explore monetizing non-core assets, while smaller and mid-size organizations may benefit from aligning with a partner that has a more resilient balance sheet and is better equipped to absorb future shocks.

- Improve margin: Value can come through acquiring accretive businesses, divesting underperforming assets or establishing joint ventures with focused operators that bring scale and expertise to specialized services. Oftentimes, margin accretion is not instantaneous. Rather, it is realized after synergistic integration and years of continuous execution.

- Build long-term resiliency: M&A should not only solve near-term challenges but also position organizations for future strength—through access to capital, advanced technologies, key talent and service line capabilities. Determining what capabilities you will need 3 to 5 years from now and securing those capabilities today is a hallmark of high-performing organizations.

These principles do not change with the political cycle or economic outlook. They are the foundation of a strategy of conviction—one that looks past near-term ambiguity and toward long-term advantage.

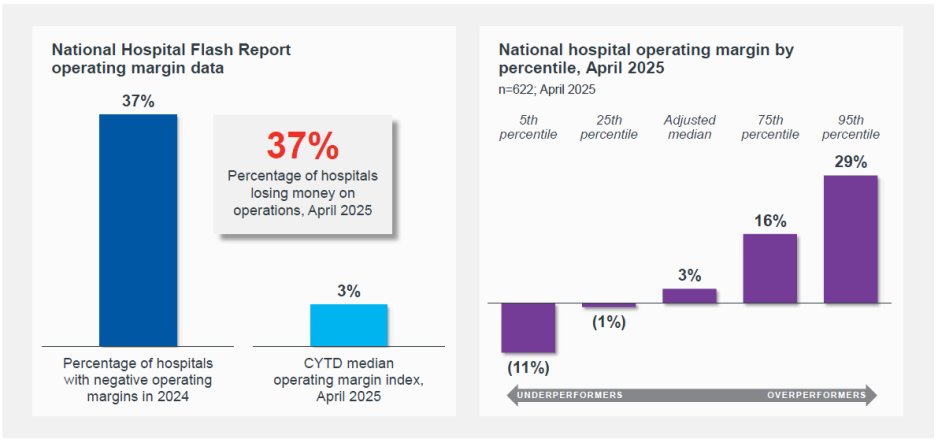

Figure 1: The numbers behind hospital operating margins

Reframe the M&A mindset

Too often, systems wait until they are forced to partner—after a leadership transition, after financial distress or after market share has eroded. By then, strategic options are limited, and the likelihood of a successful outcome is diminished.

A stronger approach is to be proactive. M&A, affiliations and partnerships should be pursued not as a last resort, but to expand opportunity. That means engaging early, building relationships before distress sets in and actively exploring alignment pathways while options are still on the table.

Critically, systems must stop viewing clarity as a prerequisite for action. Opportunity windows are always narrow. Buyers that act decisively will secure the most attractive assets—and those that wait will find a shrinking field of options. Conversely, smaller hospitals or systems that are holding out for the “right time” might find opportunities disappear if they don’t look ahead thoughtfully.

Lead forward

A final point: deal announcements, as captured in the Kaufman Hall quarterly M&A report, are a lagging indicator. There are early indications that transactions are being considered; many of these have not yet been publicly announced. The fact that the market doesn’t yet know about these conversations does not mean they’re not taking place.

Uncertainty isn’t going away; but neither are the pressures that require action. Forward-looking systems aren’t waiting for conditions to stabilize. They are moving deliberately toward strategic partnerships that position them for long-term relevance and resilience.

No strategy guarantees success. But choosing to wait, in hopes of perfect clarity, nearly guarantees missed opportunities—and relative underperformance compared with more proactive peers. Ultimately, leadership is the differentiator; organizations must critically assess their own situations, separate real risks from background noise and act decisively despite shifting conditions.

The time is never perfect. That’s why now may be the perfect time to act.