Merger and acquisition activity in the third quarter of 2021 looked much like Q2: A lower total number of transactions compared with pre-pandemic historical activity, but a notably high level of total transacted revenue and average seller size by revenue, driven in part by regional health system partnerships and divestitures of hospitals outside of core regional markets.

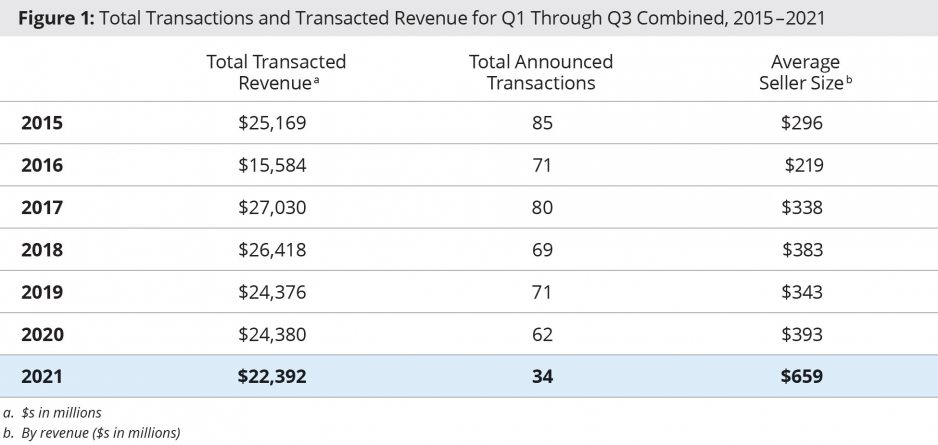

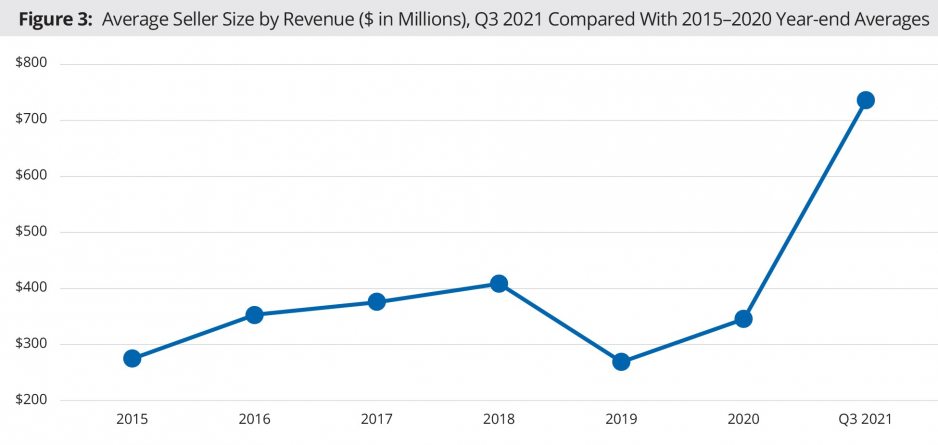

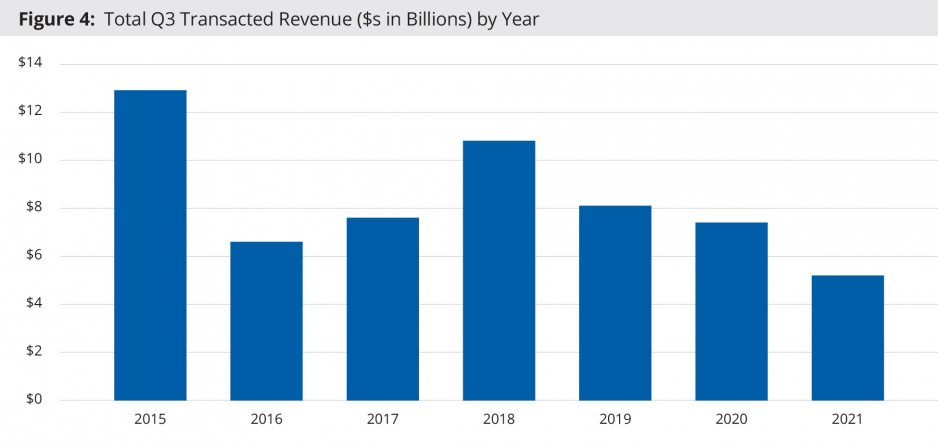

A total of 7 transactions involving 20 hospitals were announced in Q3. Total transacted revenue for the quarter was $5.2 billion; combined with Q1 and Q2, total transacted revenue for 2021 is now at $22.4 billion. Average seller size by revenue year-to-date was $659 million, more than double the average of $329 million over the past six years (2015 – 2020). Of note, the total revenue transacted year-to-date is nearly on par with that of years past, despite only half (or even less) of the total transaction volume. We believe that the trend of high average seller size will continue into Q4 as larger health systems look to partner to overcome adverse effects from the COVID-19 pandemic and seek strategic combinations that broaden their reach.

Two of the most significant Q3 transactions were in the Mountain West. These included:

- The planned merger of Utah-based Intermountain Healthcare and Colorado-based SCL Health. The combined $11 billion system would operate 33 hospitals and provide services in six states, including Colorado, Idaho, Kansas, Montana, Nevada, and Utah.

- HCA’s planned acquisition of five hospitals in Utah from Steward Health Care. The acquisition would add to the eight hospitals HCA already operates in the state. Credit Suisse reports that the five hospitals had approximately $616 million in combined net patient revenue for their most recent reported fiscal years.[1]

In the Chicago area, Edward-Elmhurst Health announced plans to merge with NorthShore University HealthSystem to create a $4+ billion system. The combined system would operate nine hospitals in the city’s northern and western suburbs and create the second largest physician network in Illinois with more than 6,000 employed and independent clinical experts.

Overview of Q3 Activity

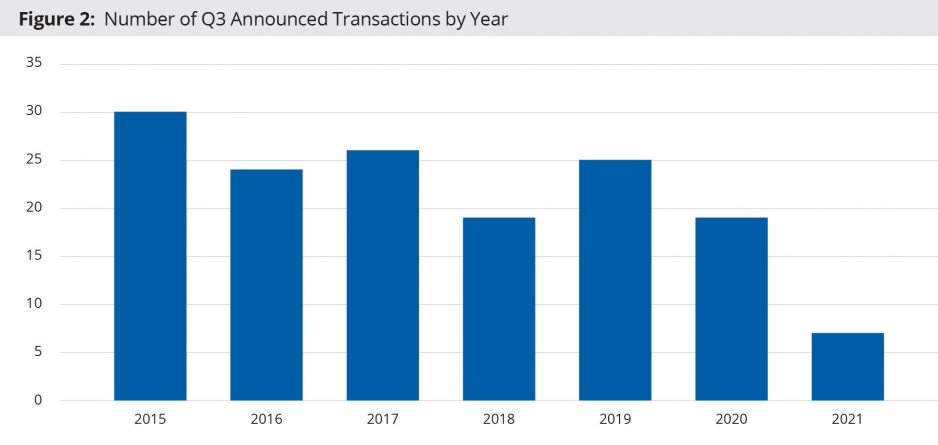

As noted above, the 7 announced transactions for Q3 resulted in activity below pre-pandemic historical averages (Figure 2). As we have seen throughout 2021, the smaller number of transactions is being offset with a high percentage of transactions with seller revenues in excess of $500 million. Two of the transactions in Q3 (Intermountain Healthcare/SCL Health and NorthShore/Edward-Elmhurst) represent “mega-mergers,” in which the smaller partner or seller has average annual revenues in excess of $1 billion.

Average seller size by revenue for Q3 2021 was $736 million, more than double the $346 million year-end average for 2020 (Figure 3). Total transacted revenue for the quarter was $5.2 billion, lowest among historical third quarter figures (Figure 4) but still consistent with historical levels.

For-profit health systems were the acquirer in 3 of the 7 announced transactions and religiously sponsored systems were the acquirer in 1. Other not-for-profit systems were the acquirer in the remaining 3 transactions.

Beyond Hospital and Health System Transactions

The trend we have seen throughout 2021—a smaller number of transactions, but a higher level of large and mega-merger transactions—is one we expect to continue. There are several factors driving this trend:

- Fewer independent hospitals. The number of unaffiliated, independent community hospitals is decreasing. The most recent data from the American Hospital Association, based on its 2019 Annual Survey, indicates that 67% of the 5,141 community hospitals are already part of a system.

- Emphasis on strategic partnerships. Hospitals and health systems have become much more strategic and selective in identifying potential partners, as these reports have noted on several occasions. Both the process of completing a merger and the work of integration that follows the transaction are a heavy lift; organizations are focused on transactions that have a strong strategic rationale to make the effort worthwhile.

- Desire for transformative impact. Health systems increasingly seek a transformative impact from M&A activity—not just the acquisition of another facility, but the addition of new capabilities or access to new markets. In particular, the drivers for many of the larger platform transactions reflect a pursuit of increasing intellectual capital, expanding the base for resources and know-how, and combining complementary capabilities and expertise within a single organization. These pursuits transcend the traditional definitions of scale and market presence and instead reflect the transformative importance of pursuing new business models, thriving on diversification of operations, and succeeding in new models of care.

Beyond this report’s focus on hospital and health system transactions, however, partnership activity remains robust. In the months before the COVID-19 pandemic struck, we commented on significant levels of activity that were occurring outside the realm of traditional hospital and health system mergers. Our M&A activity report for Q3 2019, for example, described an emerging trend in payer-provider partnerships, and our year-end report for 2019 identified a diverse range of partnerships between health systems, payers, physician practices, and digital health companies as a major trend for the year.

This trend appears to be accelerating in the wake of the COVID-19 pandemic. The pandemic has focused attention on new care delivery models—including virtual health and hospital at home—that are less dependent on specific sites of care and alleviate pressures on healthcare facilities that have been pressured by surges in COVID-19 patients. The vulnerabilities of volume-dependent fee-for-service payment models have been exposed, renewing interest in payer-provider partnerships for value-based payment structures. Healthcare inequities have also been brought to the fore, emphasizing the need for creativity and new partnerships to reach underserved populations.

A significant area of focus has been post-acute care partnerships. Health systems have explored creative arrangements to enhance their post-acute care capabilities and footprint to ensure alignment along the continuum of care and to improve quality of care after a patient leaves the hospital, particularly to ensure success within value-based arrangements. In at least one case, the goal is to avoid hospital inpatient stays altogether for certain conditions. Examples include:

- HCA’s acquisition of an 80% stake in Brookdale Senior Living’s home health and hospice business

- A partnership between ProMedica and MetroHealth to develop a skilled nursing and rehabilitation hospital in the Cleveland market

- A partnership between UNC Health and Medically Home Group, Inc., to develop an “acute care at home” program

- WellSpan Health and SpiriTrust Lutheran’s strategic partnership to deliver improved access to home care, hospice, and post-acute skilled care services

More broadly, health system leaders are exploring a wide range of partnerships. Kaufman Hall’s recently released 2021 State of Healthcare Consumerism report notes that many of the executives interviewed for the report “are exploring partnerships or joint ventures with health plans, new healthcare entrants, or retailers—which can help organizations offer new services they may not be able to currently provide on their own.” We use the term “coopetition” to describe organizations that are both potential competitors and collaborators in partnerships to improve access to care. Health systems stand to benefit immensely from partnerships with organizations that have already developed expertise and data in specialized service areas or new care delivery models.

Looking Forward

Much can change in three months. At the end of Q2, with dramatically lower COVID-19 case rates across the country, we hoped that health systems would enjoy a relatively uninterrupted period of stabilization and normalization. Then the Delta variant of the coronavirus emerged, and in many states, hospitals have again been on the front lines in battling the pandemic. The path toward normalization will be longer, but we see continued activity in reframing strategies and partnerships that will enable health systems to focus on their own core strengths—which have been so much on display over the past 18 months—while expanding the services they offer to their communities.

Co-contributors:

Anu Singh, Managing Director and Leader of the Partnerships, Mergers & Acquisitions Practice, asingh@kaufmanhall.com

Kris Blohm, Managing Director, kblohm@kaufmanhall.com

Nora Kelly, Managing Director, nkelly@kaufmanhall.com

Courtney Midanek, Managing Director, cmidanek@kaufmanhall.com

Chris Peltola, Assistant Vice President, cpeltola@kaufmanhall.com

Blake Dorris, Senior Associate, bdorris@kaufmanhall.com

Matthew Santulli, Associate, msantulli@kaufmanhall.com

For media inquiries, please contact Haydn Bush at hbush@kaufmanhall.com.

[1] Rice, A.J., Yong, J., Giovacchini, N.: “HCA Healthcare Expands Presence in Growing Salt Lake City Market.” Credit Suisse, Research Report, Sept. 21, 2021.