In healthcare today, organizations can face opportunities across geographies and sectors, each with their own unique benefits and risks. But like a fruit tree at harvest time, these opportunities can be time sensitive. A reluctance to act, especially in changing market conditions, can mean that a once-ripe opportunity spoils and drops to the ground. The cost can be more than a missed opportunity, if there is erosion of strategic momentum, financial posture or competitive advantage.

Timing is everything

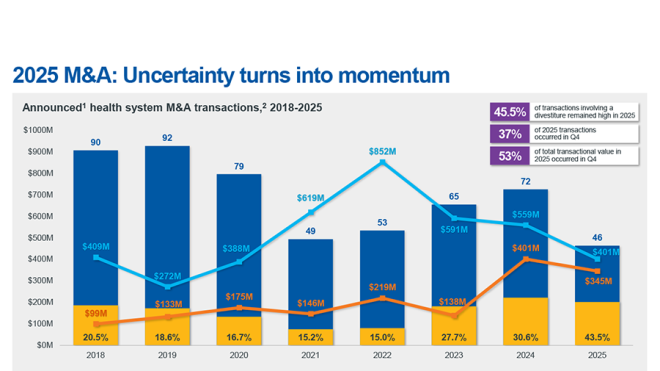

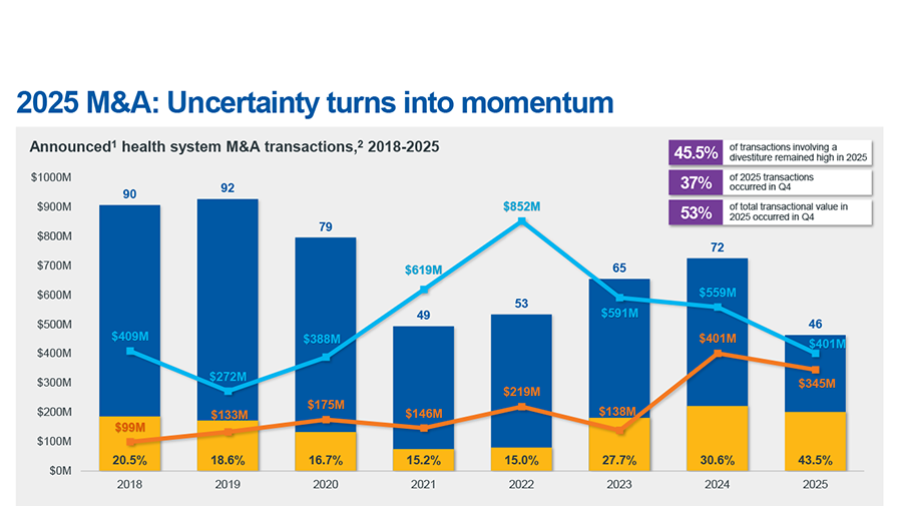

Market conditions are changing, and much like a harvest, timing is critical. The OBBB, signed into law on July 4, 2025, is expected to significantly impact federal healthcare spending over the next decade, exacerbating financial difficulties largely through Medicaid coverage changes, with an estimated 10 million uninsured by 2034 because of the law. The anticipated rise in uninsured patients will pressure providers financially and may make them less attractive M&A partners, especially in states with significant exposure to Medicaid coverage reductions or in markets with a high Medicaid payer mix.

Acquirers are already asking potential targets to reforecast financial projections considering OBBB impact. And in markets that have already undergone considerable consolidation, regulatory pressure can make it more challenging to find a local partner. Getting ahead of these challenges can offer organizations a greater sense of choice as they navigate what’s ahead.

Now is the time to survey the landscape, explore options honestly and strategically reassess organizational resilience and readiness to partner. Organizations that are in a position to move quickly may see more favorable deal terms and options, while late movers risk a weaker position at the negotiation table, especially if market conditions change significantly.

Obstacles to action

Decisive action may be especially difficult for boards and executive teams that are questioning whether they must partner with another organization to ensure long-term sustainability. Action can feel especially difficult as leadership navigates financial sustainability, institutional legacy and risk. Reluctance can stall decisions, especially when community concerns make selling or partnering politically or personally conflicting. Anticipation of community backlash and personal reputation risk without much immediate upside can drive the preference to defer and delay decision-making.

Ambiguity around the decision to sell can be compounded by the fact that the benefits of these decisions may take years to realize. Instead of acting on an opportunity that may mean transitioning the locus of control away from the community, leadership may decide to bet on a more favorable future environment and defer action to the next leadership team.

Yet, a partnership may be necessary to help ensure an organization’s long-term ability to continue serving its community. When it comes to financial viability and long-term sustainability, executives and board leaders, in their role as organizational stewards, must consider whether pursuing a partnership is the most prudent option.

Introducing range of partnership options

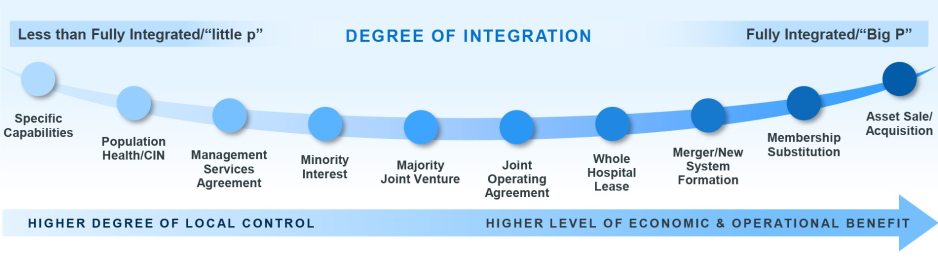

“Big P” partnerships involve a change of control but can provide greater value and stability through full integration . Where that is not desired or impossible due to constraints, organizations may look at other partnership structures which are often more targeted in nature and involve fewer tradeoffs. These “little p” partnerships can offer incremental yet real improvements and efficiencies.

The OBBB is a catalyst for this sort of strategic reassessment, a signal to proactively prepare for what’s ahead. It is not a one-size-fits-all directive to partner or sell. Organizations have a finite runway to plan and fundamentally recalibrate with the changing market environment: refresh financials, weigh strategic options and assess readiness for partnerships to ensure that ripe opportunities don’t fall to the ground.

Practical guidance for leaders:

- Reforecast financials under a range of OBBB scenarios (best case to worst case)

- Regular evaluation of options, sizing the order of magnitude of potential opportunities

- Seed executive and board leadership discussions to avoid crisis paralysis