Before the COVID-19 pandemic struck, the U.S. was already facing a behavioral health crisis. Since the pandemic began last year, the magnitude of that crisis has grown:

- Approximately four in 10 adults in the U.S. have reported symptoms of anxiety disorder, depressive disorder, or both, up from roughly one in 10 in 2019

- For young adults (ages 18 – 24), the numbers are even higher, with 56.2% reporting symptoms of anxiety or depressive disorder

- Behavioral health issues also have had a disproportionate impact on women, communities of color, and essential workers[1]

A recent study of 2017 claims data from just over 21 million commercially insured patients illustrates the pre-pandemic costs of the behavioral health crisis. [2] Focusing on the most costly 10% of those patients—who accounted for 70% of total population healthcare costs—the study found that 56.8% of the high-cost group had a mental health diagnosis, had received mental health services or medications, or had received substance use services or medications.

Despite the correlation between behavioral health conditions and high healthcare costs, the analysis also notes that many individuals with a behavioral health condition receive no behavioral health-specific services or only a nominal amount. This is reflected in the fact that spending on behavioral health for the group of high-cost patients with behavioral health issues was quite low: 5.7% of the group’s total annual healthcare costs, just slightly above the 4.4% of total annual costs across the study population as a whole. The median annual cost of behavioral-health services for the high-cost group was only $95, meaning that more than 50% of the group’s members received less than $8 of behavioral health-specific services per month.

More effective and earlier interventions in behavioral health conditions would likely increase the cost of behavioral health services for the high cost group but would have the potential of driving down overall healthcare costs significantly. The study’s authors estimate that effective integration of behavioral and medical care could drive down excess costs incurred by individuals with behavioral health comorbidities by 9% - 17%, which in 2017 would have totaled between $37.6 billion to $67.8 billion across the U.S.

The behavioral health services dilemma

Health systems and the communities they serve confront a sizable and growing population of individuals who need access to prompt and effective treatments for behavioral health. Community needs and heightened awareness of issues of equity and social justice align behavioral health—which has a disproportionate impact on underserved communities—with the mission of most health systems.

Despite the need, health systems face significant challenges in providing behavioral health services. For example, despite legislative attempts at the state and federal levels to achieve parity between behavioral health services and medical and surgical services for both payment and network adequacy, behavioral health payments still lag behind and out-of-network utilization of behavioral health services remains elevated.[3] Data on psychiatric hospitals from Definitive Healthcare from 2019 on show that not-for-profit psychiatric hospitals struggle to break even, with a median operating margin of 0%. Physician investments in psychiatrists generate limited downstream revenue, which may make health systems more reluctant to devote resources to growing this service line.

Maintaining the status quo—underinvesting in this service line, causing many behavioral issues to go unaddressed or undertreated—carries its own risks:

- For health systems that have partnered with health plans to reduce total cost of care, behavioral health is one of the key areas for early interventions that can reduce higher spending down the road. Failure to spend on behavioral health services may increase the difficulty in addressing total cost of care. For example, unaddressed behavioral health needs translate to heavy utilization of the emergency department by patients with behavioral health needs; the American Hospital Association estimates that approximately one in eight ED visits involves behavioral health conditions.[4]

- For health systems that are not yet on the cost-of-care journey, behavioral health comorbidities can increase length of stay—tying up bed capacity—and other inpatient costs for patients admitted under a primary medical or surgical DRG.[5] Although ED visits and longer length of stay inpatient cases represent revenue, the margin on these services is highly variable across patients; capacity may be better utilized for higher acuity patients, while behavioral health patients would benefit from a more appropriate care setting.

- Health systems seeking to provide patients access to services across the continuum of care risk losing patients for a wider range of services if they cannot address patients’ behavioral health needs.

This is the central dilemma for health systems: The need for more attention to behavioral health is clear; the answer to the question of how best to address that need is not.

Addressing the need for behavioral health services

Some health systems already have robust behavioral health service offerings. For many health systems, however, payment and staffing challenges have proved significant obstacles. Similar to post-acute care, behavioral health also requires specific skillsets and capabilities—including behavioral therapy and counseling skills and the ability to screen for social determinants that can trigger or exacerbate behavioral health issues—that the health system may not have developed. Acute care hospitals designed for short-term stays can struggle with the longer-term needs of patients with psychiatric and other behavioral health conditions.

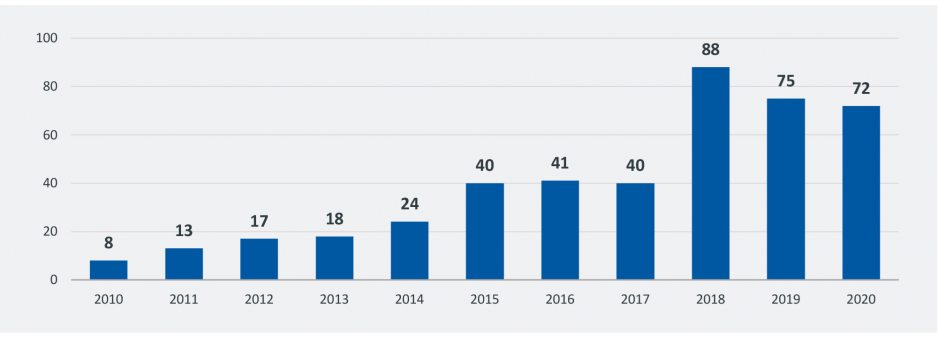

The growing demand for behavioral health services and the push to establish parity between behavioral health and medical and surgical procedures has already triggered significant consolidation among behavioral health providers, with the number of transactions more than doubling between 2017 and 2018 (Figure 1) and staying at an elevated level even during the pandemic year of 2020. As a result, several large and sophisticated behavioral health providers have established a regional or national presence. Many of these providers are investor-owned and have been much more successful in generating a positive margin. For example, Definitive Healthcare’s data on psychiatric hospitals from 2019 on shows that investor-owned hospitals had a median operating margin of 8.0%, compared to the 0% margin for not-for-profit hospitals noted above.

Figure 1: Number of Behavioral Health Transactions by Year

Source: Irving Levin Associates

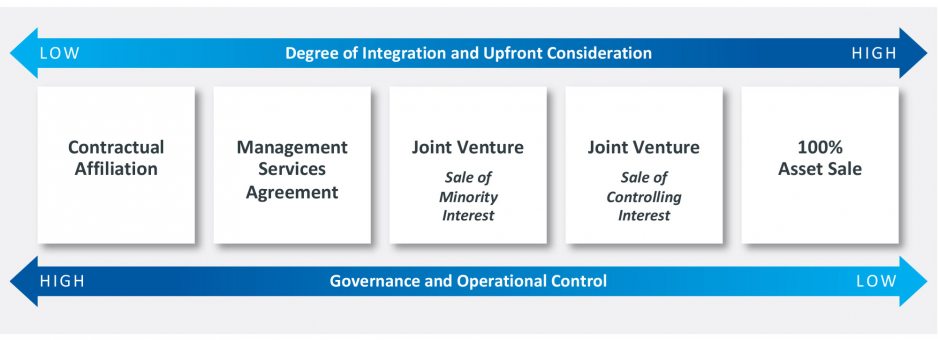

Partnerships with specialized behavioral health providers are growing in number as an effective means for health systems to expand access to enhanced behavioral health services. Partnerships can be structured across a continuum of opportunities (Fig. 2), with the choice of structure driven by, on the one hand, the health system’s desire to maintain governance and operational and clinical control, and on the other, the degree of integration and upfront consideration required by the parties to execute the partnership successfully.

Figure 2: Potential Behavioral Health Partnership Structures

Source: Kaufman, Hall & Associates, LLC

The best structure for any given health system will depend upon the interplay of the factors shown on Figure 2, as well as an assessment of the existing strength of the organization’s behavioral health services, market assessment, and other strategic options. For health systems that already have a strong behavioral health base, seeking growth through investment in additional internal capabilities may be the best choice. For many health systems, however, a partnership structure should be among the strategic alternatives assessed.

Greater awareness of behavioral health needs, declining social stigma for seeking treatment, and the long-term impacts of the pandemic are among the many factors pointing to likely growth in behavioral health demand in the coming years. Now is the time for health systems to consider how they can best meet that demand.

[1] Panchal, N., Kamal, R., Cox, C., Garfield, R.: “The Implications of COVID-19 for Mental Health and Substance Abuse.” Kaiser Family Foundation, Issue Brief, Feb. 10, 2021.

[2] Davenport, S., Gray, T.J., Melek, S.: How Do Individuals with Behavioral Health Conditions Contribute to Physical and Total Healthcare Spending? Milliman Research Report, Aug. 13, 2020.

[3] Melek, S., Davenport, S., Gray, T.J.: Addiction and Mental Health vs. Physical Health: Widening Disparities in Network Use and Provider Reimbursement. Milliman Research Report, Nov. 19, 2019.

[4] American Hospital Association: “Increasing Access to Behavioral Health Care Advances Value for Patients, Providers and Communities.” Trendwatch, May 2019.

[5] Kawatker, A., Knight, T., Moss, R., Hodgkins, P., Haim Erder, M., Nichol, M.: “Impact of Mental Health Comorbidities on Health Care Utilization and Expenditure in a Large U.S. Managed Care Adult Population with ADHD.” Value in Health, vol. 17:6, Sept. 2014.