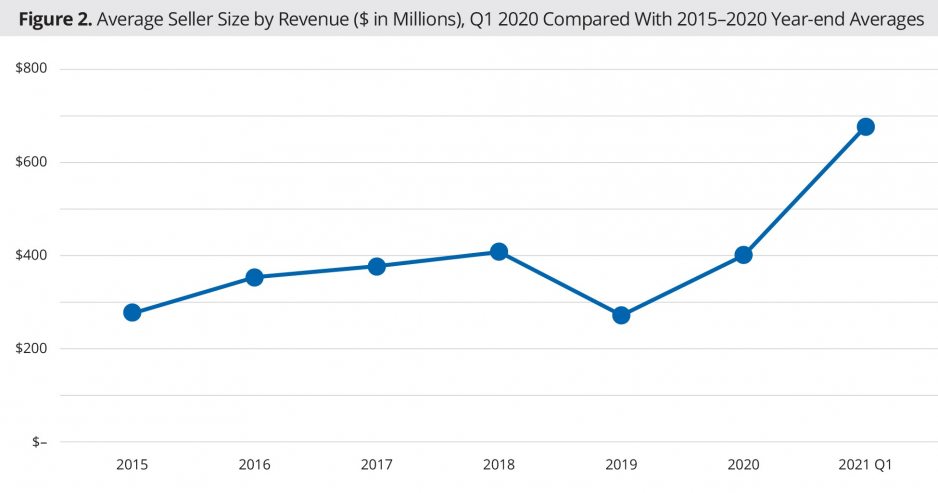

One year ago, Q1 2020 was closing with an emerging awareness of the pandemic that was about to occur. The quarter ended with a relatively high number of announced transactions, but with very few large transactions, leaving average seller size by revenue at just $172 million for the quarter. This year, however, as the pandemic seems closer to being contained, the reverse is true. The number of transactions is down in Q1 2021, but the average size of those transactions is significantly larger. Average seller size by revenue is $676 million, which is the third highest quarterly figure for average seller size we have recorded in the past 10 years (the highest, more than $800 million, was in Q2 2020, the first full quarter of the pandemic, and the second highest, over $700 million, was in Q4 2016). The quarter’s activity includes a major combination of for-profit operators and a significant realignment of hospital ownership in the upper Midwest, which collectively result in a noteworthy number of 72 hospital facilities being transacted in Q1 2021.

The following were among the most significant hospital transactions for Q1 2021:

- OU Health signed a letter of intent to merge with the University of Oklahoma College of Medicine to create a fully integrated academic health system.

- CommonSpirit Health announced the planned sale of 14 hospitals in North Dakota and Minnesota (one tertiary hospital in Bismarck, ND, and 13 critical access hospitals) to Essentia Health.

- UK HealthCare and King’s Daughters Health System announced a joint venture partnership that will expand access to tertiary-level services for residents of eastern Kentucky and southern Ohio.*

- Aspirus Health announced its plan to acquire seven hospitals in central and northern Wisconsin from Ascension Health.*

Overview of Q1 Activity

With 13 announced transactions, activity by transaction volume in Q1 2021 was below recent historical averages (Figure 1). Consistent with observations since the COVID-19 pandemic began, however, the smaller number of transactions is offset by a higher number of “mega” transactions in which the smaller partner or seller has average annual revenues in excess of $1 billion, as well as several transactions with seller revenues between $500 million and $1 billion. The scale of Q1 transactions also led to a high number of hospital facilities—72 total—that were included in the announced transactions.

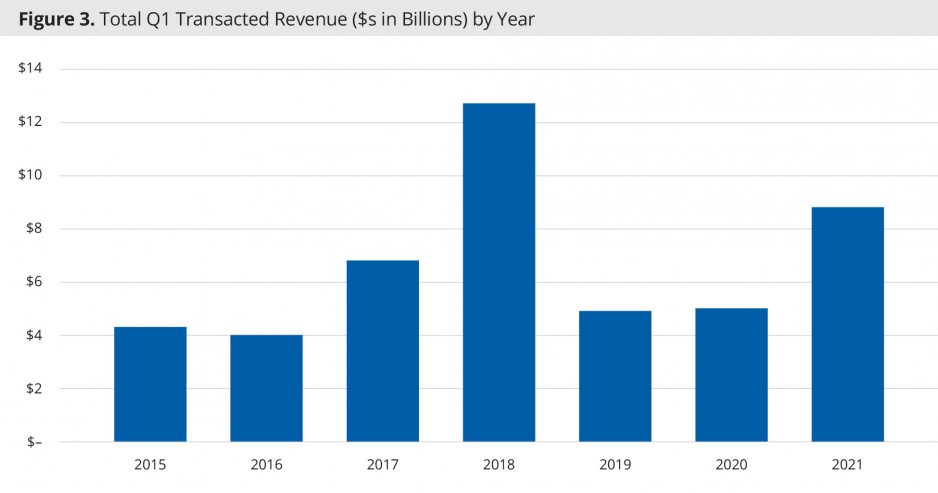

Average seller size by revenue for Q1 2021, $676 million, is well above historical averages for the first quarter and for recent year-end averages (Figure 2) and is the third highest quarterly figure we have recorded in the past decade. The average size of the quarter’s transactions is also reflected in total transacted revenue for the quarter, which at $8.8 billion is second only to Q1 2018 among historical first quarter figures (Figure 3).

For-profit health systems were the acquirer in two of the 13 announced transactions, academics were the acquirer in three, and religiously sponsored systems were the acquirer in two. Other not-for-profit systems were the acquirer in the remaining six transactions.

New Perspectives on Scale

The COVID-19 pandemic has affirmed the importance of transformation and again validated the pursuits of scale, relevance, and intellectual capital that remain evident in nearly all this quarter’s transactions.

Organizations are seeing new value in diversification, whether that be across markets or revenue sources. LifePoint’s reported pursuit of Ardent Health Services would add more densely populated suburban and urban markets in New Mexico, Oklahoma, and Texas to LifePoint’s existing, rural-focused portfolio. In this and similar cases, the market activity involves partnerships with health systems that have an established presence in their local markets.

The decision to partner with health systems that have an established market presence remains a key driver, as another emerging trend is the significance of local market knowledge. While smaller health systems may not have the financial scale of larger multi-state systems, they may have intellectual bandwidth and an understanding of local issues that can be significant advantages. Partnering with these systems can leverage their knowledge and facilitate growth within local markets. CommonSpirit’s and Ascension’s transfer of assets to local systems in the upper Midwest ensures the continued vitality of these assets under the management of a more focused and regionally driven operator. This also allows larger systems with national presence to reallocate their time, capital, and resources to markets that they deem essential to their organization’s future success.

Looking Forward

COVID-19 will have a long-lasting effect on hospitals’ and health systems’ operations and strategy. We anticipate that COVID-19’s impact will continue to influence partnership, merger, and acquisition activity through the remaining quarters of 2021. We have seen, for example, the pandemic’s effect on clarifying the strategic rationale for transactions that had been attempted earlier but are now moving forward in the signing of a definitive agreement between Care New England, Lifespan, and Brown University to form an integrated academic health system in Rhode Island, a transaction that has been contemplated for several years.[1] OU Health and the University of Oklahoma College of Medicine have announced their intention to pursue a similar initiative in Oklahoma, making “a once virtual partnership…very real.”[2] Reevaluation of the strategic rigor of past, present, and future partnership opportunities will continue in response to new market dynamics.

Co-contributors:

Anu Singh, Managing Director and Leader of the Partnerships, Mergers & Acquisitions Practice, asingh@kaufmanhall.com

Kris Blohm, Managing Director, kblohm@kaufmanhall.com

Nora Kelly, Managing Director, nkelly@kaufmanhall.com

Courtney Midanek, Managing Director, cmidanek@kaufmanhall.com

Chris Peltola, Assistant Vice President, cpeltola@kaufmanhall.com

Blake Dorris, Senior Associate, bdorris@kaufmanhall.com

For media inquiries, please contact Haydn Bush at hbush@kaufmanhall.com.

*Kaufman Hall served as a strategic advisor in the UK HealthCare/King’s Daughters Health System and Aspirus Health/Ascension Health transactions.

[1] Lifespan: “Lifespan and Care New England Sign Definitive Agreement to Merge and Create, with Brown University, an Integrated Academic Health System, Together for a Healthier Rhode Island.” Press release, Feb. 23, 2021. https://www.lifespan.org/news/lifespan-and-care-new-england-sign-definitive-agreement-merge-and-create-brown-university

[2] The University of Oklahoma: Message from the Office of the President, March 9, 2021. https://www.ou.edu/web/news_events/articles/news_2021/a-message-from-president-harroz-ou-and-hospital-partner-announce-merger-intent