Trending in Healthcare Treasury and Capital Markets is a biweekly blog providing updates on changes in the capital markets and insights on the implications of industry trends for Treasury operations, authored by Kaufman Hall Managing Director Eric Jordahl.

We took another look at year-to-date healthcare debt issuance and here are the results as of April 22: tax-exempt healthcare issuance is down 58% versus the same period last year and the current issuance level is 38% of full year 2020; taxable healthcare issuance is down 15% versus the same period last year and the current issuance level is 26% of full year 2020. Funds flows continue to remain favorable so even as rates have moved higher, transactions that are coming to market are seeing very good execution. Tax-exempt rates remain relatively favorable but absolute rates across all markets are still compelling.

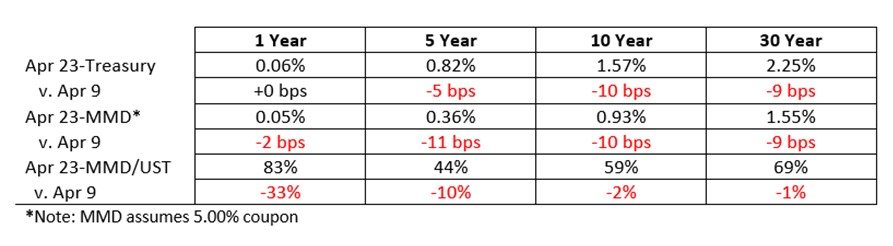

SIFMA reset this week at 0.06%, which is approximately 54% of 1-Month LIBOR and represents no change from the April 7 reset.

Enterprise Portfolio Management

Over the past months we have advanced the point of view that COVID-driven business model disruptions make it essential for every healthcare organization to focus on resiliency. We have also advanced the idea that resiliency is ultimately dependent on how resources are positioned to respond to a diversified set of claims that source from a variety of internal and external factors.

An important question is what constitutes resiliency? One part of resiliency must be a sustainable mission and a strategy and operating infrastructure to support that mission. Another part must be a financial infrastructure that can generate the margins needed to accumulate the internal and external resources needed to capitalize the mission. And a third part must be financial reserves that can support ongoing capital formation and shelter the mission during periods of margin dislocation and disruption. Under this umbrella, sustained resiliency is about continuously refining the interplay between mission, margin, and stability. Everyone working in not-for-profit healthcare finance has heard the phrase “no margin, no mission” but the companion phrase is “no resiliency, no mission.” The three objectives have always been interdependent, but it takes something like COVID to highlight the resiliency imperative.

One way to view a healthcare company is as a leveraged portfolio of assets, some of which are operating and some of which are financial. Regardless of type, each of these assets has its own risk-return profile that determines whether they are accretive or dilutive to the cause of financial resiliency. But the competing consideration is strategy, because every healthcare company is a mission-driven operating enterprise first. Mission-advancing resiliency sits at the intersection of operations and balance sheet and achieving it requires effectively blending strategic and asset management.

An example is the portfolio of real estate assets that sits on a typical healthcare balance sheet. There is a lot of money tied up in real estate assets and a lot of money searching for an entry point into healthcare real estate financing channels, which drives a continuous evolution in financing structures and a variety of interesting transaction opportunities. For the most part, real estate portfolios are managed on a transactional basis—there is an initial lease-versus-buy financial analysis, followed by an assessment of lease structures, followed by the execution of a trade. If the objective is just optimizing the balance sheet real estate vertical, then this progression might produce a good result; but if the objective is resiliency, then the more helpful perspective is to view each real estate component as both an operating (or mission) asset as well as a financial resource. This angle means that the portfolio management decision becomes grounded in two perspectives:

- Strategy (Mission) Contribution: Is this an asset that is imperative to control in order to advance mission-strategy or is it marginal?

- Operating Contribution: Could the financial resources trapped inside this asset make a stronger resiliency contribution by being redeployed in a different operating or financial asset?

Whether involving real estate or any other asset class, every asset management action should be grounded in answering “what is the right transaction?” Get this answer right, and it becomes easier to answer tactical questions like “what is the best transaction?” and “what is the best execution channel and team?” Our perspective is that the right transaction is the one that best positions resources (assets) to advance enterprise resiliency. This lens may cause you to hold assets you thought you might monetize or to monetize those you thought you might hold; it might also cause you to choose to use internal resources or long-term debt to capitalize a real estate asset that you were initially expecting to lease. Like every asset pool, each real estate asset sits inside a portfolio of common assets, which sit inside the total portfolio of assets that is a healthcare company. Using the lens of resiliency or sustainable mission puts trade decisions like lease-versus-buy under a different, and more appropriate, light.

We recently launched a website focused on healthcare real estate that can be accessed here, but remember that this logic extends to every operating or balance sheet asset and then to operating service lines as well. Healthcare’s future state will see mission needs expanding and escalating margin pressures, which means that a major differentiator will be how effectively you position your company’s total portfolio of resources.