We are heading into the holiday lull, but markets will continue to be buffeted by a host of competing events. Markets careen from one risk to another and key volatility indicators—like the VIX Index—are elevated. Perhaps we are on the cusp of sustained volatility but for the moment fixed income markets including Treasuries and municipals keep chugging along, offering borrowers great pricing, terms, and transaction execution.

|

1 Year |

5 Year |

10 Year |

30 Year |

|

|

Dec. 3 – Treasury |

0.26% |

1.13% |

1.35% |

1.69% |

|

v. Nov. 19 |

0.16% |

1.20% |

1.54% |

1.91% |

|

Dec. 3 – MMD* |

0.15% |

0.60% |

1.03% |

1.48% |

|

v. Nov. 19 |

0.15% |

0.61% |

1.09% |

1.54% |

|

Dec. 3 – MMD/UST |

57.69% |

53.10% |

76.30% |

87.57% |

|

v. Nov. 19 |

-36.1% |

2.3% |

5.5% |

6.9% |

|

*Note: MMD assumes 5.00% coupon |

||||

SIFMA reset this week at 0.05%, which is approximately 48% of 1-Month LIBOR and represents a one basis point adjustment versus the November 17 reset.

A Long Strange Trip

On Monday, November 22, President Biden answered one important question when he announced that he will nominate Jerome Powell for a second term as Chairman of the Federal Reserve (a choice that is expected to clear the Senate confirmation hurdle). During congressional testimony on Tuesday, November 30, Mr. Powell signaled that escalating concerns around inflation will lead the Fed to accelerate its wind-down in asset purchases and potentially the initiation of any 2022 increases in the Fed Funds rate. At the same time the Omicron variant looms—will it be another major blow to our economy and healthcare system, or will it be something we can get through without more business model disruption? Questions get answered—Powell will be the Fed Chair over these next critical four years and the inflation we all have been dealing with is something other than transitory—but it never feels like we get much closer to clarity.

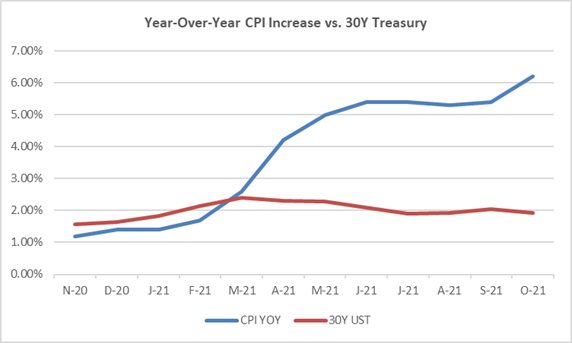

I keep thinking about how the modern capital markets work. The chart below paints a picture of accelerating year-over-year increases in the Consumer Price Index (as a proxy for inflation) versus 30-year U.S. Treasury rates. From November 2020 to October 2021, annual CPI increases moved from 1.2% to 6.2% and Treasuries moved from 1.57% to 1.93%. Change the start of the measurement period to March 2021 and CPI moved from 2.60% to 6.20% while 30-year Treasury rates fell 48 basis points from a 2.41% start point; and over this same March to October period the 30-year Treasury less Effective Fed Funds curve flattened from 235 basis points to 186.

Why are long-term investors shrugging off irrefutable warnings about what has traditionally been the top risk to any fixed income investor? The answer seems to be that everyone is more afraid of COVID—and its potential for further economic disruption—than inflation or anything else. Treasuries remain the global risk haven that investors run to in moments of elevated fear and dislocation. As noted above, last Tuesday the Fed chair shared his concerns over both inflation and the Omicron variant; the market response on the day was a sell-off in stocks and a rally in Treasuries. If COVID is King Kong and inflation is Godzilla, Kong is winning and will likely keep winning until time and events help us figure out how to live with COVID as endemic.

Two other factors that may be contributing to this dynamic include:

- Investors believe inflation is transitory. This is the idea that the inflationary pressures are the product of stimulus driving demand paired with supply chain dislocations. Eventually these two things will moderate, and inflation will slow, even if the price gains remain in place for an extended period. In this scenario the longer-term issue isn’t inflation so much as the adverse credit implications of a sustained higher cost structure.

- There is so much capital in the system that investors must remain invested, almost regardless of what happens with inflation and real returns. The darker side of this is the idea that the Fed holds all the power and will manufacture whatever result it wants; so, the only option is to stay in the game, take whatever is given in each moment, and dollar cost average into whatever comes next.

At some point the bias of the rates markets will shift, and it seems this will be the best sign that investors believe COVID has transitioned from uncertainty to risk (or from unmanageable to manageable). It also seems logical that if the Fed accelerates a transition to tighter monetary policy, they will be doing so with the thesis that inflation is now the greater threat. The work in front of healthcare providers is understanding the consequences of this shift and what it means for financial performance, credit position, and resiliency. And the time to start this work is now.

When COVID first hit we thought it would move through three stages: crisis (a monetary event) to stabilization (a credit event) to normalization. For most of COVID as crisis, monetary policy has been a tailwind helping us to get through business model dislocation; but stabilization requires a view that COVID is endemic (or otherwise resolved) so that attention can shift to addressing the credit and economic (inflationary) implications of both the crisis and the crisis response. The Fed effectively monetized COVID, and stabilization requires unwinding all that liquidity (which is complicated by the fact that we haven’t unwound the Fed’s monetization of the 2008 credit crisis). The hole is deep, especially if normal is pre-2008.

One of the stanzas in the Grateful Dead’s iconic song Truckin’ is “sometimes the lights all shining on me; other times I can barely see; lately it occurs to me; what a long, strange trip it’s been.” Pretty much captures the last 2 years—and the trip isn’t over.

Markets tend to shut down as we approach year-end. We expect to send out one more email this year (December 18) and then take a break until mid-January 2022.

Trending in Healthcare Treasury and Capital Markets is a biweekly blog providing updates on changes in the capital markets and insights on the implications of industry trends for Treasury operations, authored by Kaufman Hall Managing Director Eric Jordahl.