Hospitals and health systems are first and foremost healthcare providers. However, they have also accumulated substantial real estate holdings, making them some of the largest property owners and most sought-after tenants in their communities. Without dedicating meaningful attention to real estate strategy, you may find that your organization’s owned and leased real estate assets are not aligned with strategic goals, nor are they efficiently deployed, structured, or financed.

In the wake of the coronavirus pandemic, hospitals and health systems face a critical imperative to optimize resource deployment. Moreover, the possibility of long-term changes in care delivery and workforce deployment may have a significant impact on the size and composition of the real estate portfolio. It is essential that you devote the same strategic focus and analytical rigor to your organization’s real estate that you apply elsewhere within the enterprise.

How the real estate industry views healthcare

Real estate market participants—including investors, brokers, developers, designers, and property managers—are sophisticated organizations increasingly focused on your real estate portfolio to generate their revenues and investment returns. Hospitals and health systems are creditworthy tenants with predictable needs, expensive capital projects, long time horizons, and specific location requirements. Healthcare real estate is considered a highly desirable investment alternative and relatively stable market sector compared to retail, office, or hospitality assets. As a result, this sector of the real estate market has attracted many experienced participants. Are you dedicating sufficient resources to develop and execute a real estate strategy that serves your own interests rather than the interests of others?

A strategic real estate framework that supports your organization’s goals

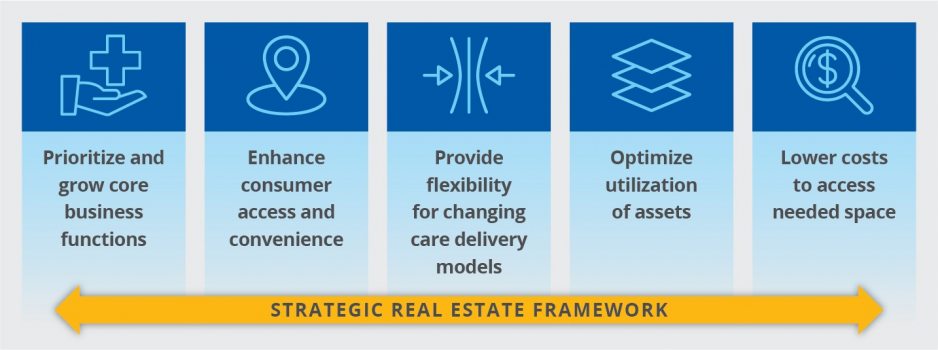

A strategic real estate framework must align with your organization’s core business functions and support its strategic, operational, and financial goals. This framework should:

- Prioritize and grow core business functions by accounting for competitive dynamics in the market, ensuring that your organization is positioned to grow market share for its core services in existing and new locations.

- Enhance consumer access and convenience by identifying locations that are easy for consumers to access and convenient to major work, leisure, or residential centers.

- Provide flexibility for changing care delivery models by considering the adaptability of sites for new care delivery models as your organization seeks to strike the correct balance between virtual and in-person care.

- Optimize utilization of assets by facilitating efficient deployment of services to lower-cost sites of care and assessing real estate portfolio opportunities within a context that balances your organization’s strategic, operational, and financial needs.

- Lower costs to access needed space by evaluating the wide range of real estate ownership, leasing, and financing options through a process that accounts for the comparative acquisition or carrying costs of portfolio opportunities.

An effective real estate framework enables you to conduct a cohesive assessment that considers the extent to which the current portfolio aligns with your organization’s strategic, operational, and financial goals. This systematic assessment can identify opportunities to consolidate, divest, or monetize portfolio elements that are not central to the organization’s core business functions as well as gaps in the portfolio that the organization needs to address. With this assessment in place, your analysis can go deeper, determining optimal geographic reach, market positioning, and financing structures for current and prospective properties in the organization’s portfolio. You also can assess the impact of potential actions on the operational, financial, and capital position of the organization and its strategic initiatives.

What do you need to do now?

Hospitals and health systems must elevate the attention they give to their real estate holdings or risk losing the initiative to external real estate market participants. Equally important is the use of an independent advisor—one who is agnostic to portfolio strategy and transaction structure, size, or outcomes—to assist in the development of a strong, objective framework for identifying and evaluating portfolio opportunities. The real estate portfolio should be given an equal footing within a comprehensive framework of strategic resource allocation that focuses on how all your organization’s financial resources (i.e. cash flow, cash, debt capacity) are best deployed given the realities confronting the business across operations, strategy, capital, and financing channels.

Decisions about the real estate portfolio are often long term, costly, and difficult to unwind. A well-developed strategic framework for real estate enables you to make independent and objective assessments of opportunities, optimize use of organizational resources, pursue improved returns on invested capital, and align the real estate portfolio with your organization’s strategic, operational, and financial goals.