This report describes key impacts of transformative change in the healthcare marketplace, including continued growth of “mega mergers,” increasing diversity of partnerships, transactions across the continuum of care, and enterprise performance strategies. Transformative pressures on legacy hospitals and health systems intensified in 2019.

2019 Trends: 4 Key Takeaways for M&A

1. Disruption driven by new entrants to the healthcare marketplace took shape

CVS Health launched the first of its HealthHUB locations early in 2019 and by June had announced plans to expand the HealthHUB concept to 1,500 more locations. In September, Walmart opened the first of its “Walmart Health” locations in suburban Atlanta, a 10,000-square-foot facility described as a “super center for basic healthcare services,” including primary care, dental care, and behavioral health.

2. Demands for friction-free, convenient, and transparent experiences influenced consumer preferences

Kaufman Hall research on consumer preferences in 2019 found that only 36% of parents would choose their child’s primary care physician for a minor illness or injury, and 72% of these parents would opt for an alternative option if they had to wait more than one day for an appointment. Although only a small percentage of parents had tried a video visit with a care provider, 80% of those who had done so would do so again.

3. The government moved on several fronts to increase transparency and decrease disparities in payment

The Centers for Medicare & Medicaid Services (CMS) built site-neutral payment policies into its 2019 Outpatient Prospective Payment System (OPPS) final rule. Although this rule was successfully challenged in court, site-neutral payments were again included in the 2020 OPPS final rule. A final rule on price transparency published in November 2019 will require hospitals and health systems to offer “consumer friendly” price information by 2021 on approximately 300 shoppable services.

4. Insurers, risk managers, and employers sought to change the high and inconsistent costs of legacy providers

Health insurer Anthem has changed payment policies to reduce the costs of emergency care and hospital-based lab and imaging tests. In September, Amazon launched an Amazon Care pilot for its employees, combining virtual visits with in-home nurse follow-up visits to reduce utilization of emergency room and urgent care visits. Walmart, a leader in the use of center-of-excellence models for high-cost surgical procedures, introduced initiatives designed to steer associates to high-quality imaging centers and to preferred clinicians identified by data on the appropriateness, effectiveness, and cost efficiency of the care provided.

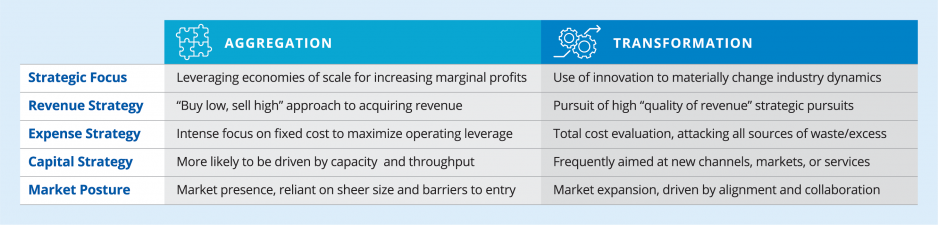

These pressures are influencing partnership, merger, and acquisition activity among healthcare organizations in multiple ways. The emphasis is shifting from aggregation to transformation as legacy hospitals and health systems focus on the changes required to succeed in healthcare’s new bases of competition.

Figure 1: From Aggregation to Transformation

Source: Kaufman, Hall & Associates, LLC

Mega Mergers

The continued growth in mega mergers (transactions in which the smaller partner in the transaction has annual revenues exceeding $1 billion) is driven by the strategic focus, revenue focus, and market posture factors described in Figure 1.

- Strategic focus. In many instances, mergers between large systems are driven by complementary capabilities. The strength of one partner’s clinical capabilities, for example, may be complemented by the other partner’s health plan capabilities. This can change the dynamic in both partners’ markets.

- Revenue driver. As health systems face increasing competition from national companies with revenues that dwarf even the largest health systems, seeking partners with high-quality revenue streams helps build competitive strength.

- Market posture. As opportunities diminish in a health system’s home market, expansion to new markets can bring desired growth opportunities.

The merger between Michigan-based Beaumont Health and Ohio-based Summa Health, announced in July 2019, illustrates the influence of these drivers:2

- Complementary capabilities. Beaumont has strong specialty clinical programs, while Summa owns health insurer SummaCare.

- Financial strength. Both systems are coming to the merger from a position of financial strength. Although Summa had experienced financial difficulties in prior years, it has executed a financial turnaround under its current CEO.3

- Competitive position. SummaCare’s insurance capabilities will enhance Beaumont’s competitive position in Michigan, supporting risk-based and direct-to-employer contracting and putting Beaumont on an equal footing with other health systems in the state that own insurance plans. With Beaumont’s backing, Summa Health can also expand into additional geographies in Ohio beyond its home market of Akron, where population growth has been stagnant.4

Kaufman Hall anticipates continued interest in combining large systems that bring complementary capabilities to the partnership, open opportunities for expansion into new markets, and strengthen revenues as health systems prepare to compete on a new basis of competition.

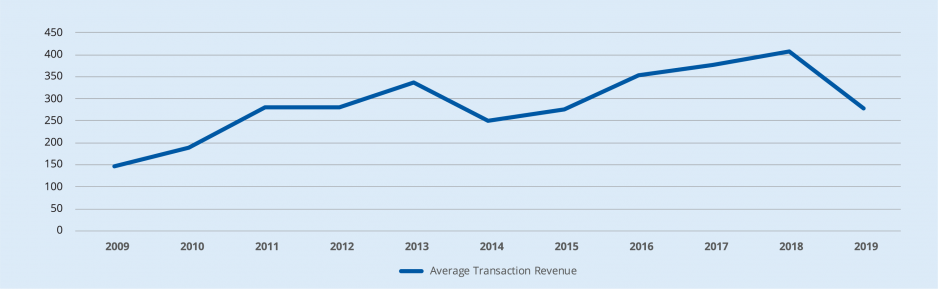

Figure 3: Average Seller Size by Revenue, 2009 - 2019

Source: Kaufman, Hall & Associates, LLC

Diversity in Partnerships

Our 2018 M&A in Review report predicted increasing competition to control healthcare’s “front door.” This prediction held true in 2019, with a diverse range of partnerships among payers, health systems, physician practices, and digital health companies intended to enhance consumers’ ease and convenience in accessing healthcare services.

Significant drivers of these partnerships include the following factors (as described in Figure 1):

- Strategic focus. New healthcare competitors are seeking to attract consumers early in their healthcare journey, when they can have the most influence over the consumer’s path forward. Without a strategy to compete in this space, legacy hospitals and health systems risk disintermediation.

- Capital strategy. As healthcare services increasingly move outside the hospital’s walls, capital strategy is focusing on building additional consumer access points and lower cost sites of care.

- Market posture. A strategy focused on enhanced consumer access and convenience provides the platform for expanding services and growing market share. Growth of a digital platform can enable expansion of services well beyond traditional geographic markets.

These partnerships often have unique attributes or structures tailored to the needs of the parties and their markets. Representative examples from the past year include:

Payer-provider partnerships

In Kaufman Hall’s M&A Quarterly Activity Report for the third quarter of 2019, we highlighted the trend toward payer-provider partnerships designed to create efficiencies for the consumer by providing better care coordination, offering one-stop access to a range of healthcare services, or reducing administrative hassles between payer and provider. An example is a new joint venture between Blue Cross and Blue Shield of Minnesota and North Memorial Health in the Minneapolis-St. Paul market, announced in June 2019, which will assume ownership of North Memorial’s 20 primary and specialty care clinics. A goal of the joint venture is “removing confusion from the equation” as consumers try to understand and navigate the complexities of healthcare.5

Partnerships with physician practices

Health systems have been building physician networks for many years, but new partners are also seeking alliances with physician practices. New physician practice models are also appearing to address specific consumer demands. For example, house-call provider Heal, which employs 120 doctors and nurses, announced in December 2019 a partnership with a joint venture between Sutter Health and Aetna in northern California. The partnership is designed to offer more convenient care options for the joint venture’s health plan members.6

Partnerships with digital health companies

Health systems are adding digital capabilities to facilitate online scheduling and virtual clinical visits through partnerships with digital health companies. In October 2019, for example, the Cleveland Clinic and digital health company American Well announced formation of a new joint venture, named The Clinic, “to provide broad access to comprehensive and high-acuity care services via telehealth.”7

Consumer demand for access and convenience will continue to act as a powerful driver of partnerships intended to transform industry dynamics and reduce or eliminate fragmentation and friction for the consumer.

Predictions for M&A Trends in 2020: Looking Forward

Kaufman Hall expects many of the trends from 2019 to carry forward into 2020, including the following:

Competition to control healthcare’s “front door"

When we commented on this trend in our 2018 year-end report, the competitive threat from new market entrants was still largely speculative. The shape of the new bases of competition that these new entrants are pursuing came into clearer view this year, as national chains such as CVS Health and Walmart launched pilot efforts to attract consumers as they enter the healthcare system, and then quickly announced plans to expand these pilot efforts. With existing footprints in markets across the country, these new entrants could quickly reshape market dynamics.

New combinations across healthcare verticals

Partnerships between healthcare organizations that historically have operated separately, or even in opposition to one another, will continue to grow as health plans, health systems, and physician practices seek new ways to provide better consumer experiences. Partnerships with organizations that bring strong digital and retail capabilities to legacy healthcare organizations will also continue to grow.

Continued growth of regional health systems

Despite a few instances of planned large-system mergers that failed to close in 2019, we believe that interest in combining systems that have both financial strength and complementary capabilities and areas of expertise will continue. Increasing competition from national retailers and tech giants with revenues and capital resources that far exceed not-for-profit healthcare systems will continue to act as a powerful driver, as will the need to find growth with new services and in new markets.

An emphasis on increased reach within existing markets

The continuum-of-care transactions and partnerships commented on earlier in the report are examples of health systems’ interest in expanding the depth of services they provide to consumers in their markets. Health systems will continue to seek partnerships that provide more consumer touchpoints and position the health system as a comprehensive source for consumers’ healthcare needs.

Kaufman Hall also anticipates increased use of alternative capital structures for partnerships and acquisitions, including:

- Minority interest structures are an option for independent hospitals and health systems that wish to seek additional capital or access to intellectual support or new clinical services without relinquishing organizational control. A minority investment from a larger system can provide capital or operational support while giving the larger system enhanced market access in partnership with the smaller system. A recent example is the agreement between Geisinger Health System and Evangelical Community Hospital, finalized in February 2019.18

- Sale/leaseback structures can free up “trapped assets” in health system facilities and provide organizational flexibility as care continues to migrate outside of traditional inpatient settings. Steward Health System has been an industry leader in pursuing these structures, with investments from Medical Properties Trust (MPT) for $1.25 billion in 2016 and $1.4 billion in 2017. In 2019, MPT made additional acquisitions of health system real property interests, including a sale-leaseback transaction with St. Luke’s Health System for seven hospitals in the Kansas City area.19

The new bases of competition are compelling legacy hospitals and health systems to pursue transformative change. New approaches to partnerships, mergers, and acquisitions will be integral to this effort.

Read through other M&A Reports