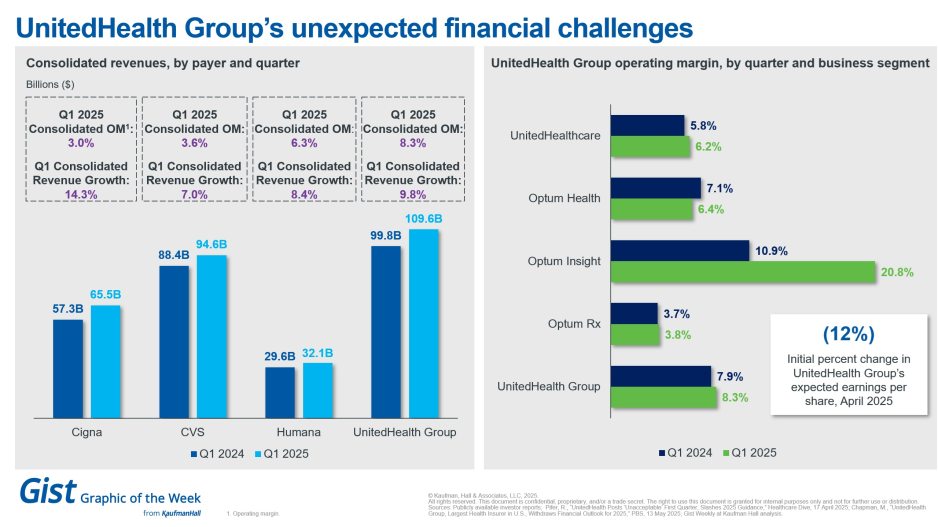

This week’s graphic highlights UnitedHealth Group’s recent financial difficulties—which the large healthcare conglomerate did not fully anticipate. Compared with the first quarter of a year ago, UHG’s operating margins at the start of 2025 are up across the board, led by health data and analytics unit Optum Insight; and, like other major commercial payers, its consolidated revenues also are higher than they were at the start of 2024. Nevertheless, UHG shook financial markets in late April when it reported lower-than-expected first-quarter earnings, plunging its stock price more than 20% in one day. High utilization in its Medicare Advantage business and unforeseen changes in its Optum Health unit hurt the company. The losses caught Wall Street, and the healthcare field, by surprise because UHG is nation’s most vertically integrated payer. The fallout continued this month as CEO Michael Witty abruptly resigned in mid-May, citing “personal reasons,” and suspended its 2025 guidance. It appears that UHG is re-learning an old lesson: it’s difficult, quarter after quarter, to derive profit from healthcare. Payers and pharmacy benefit managers are facing increased federal and public scrutiny; but while UHG failed to project its medical cost headwinds accurately compared with other payers, the company still has significant assets to leverage should the waters remain choppy.