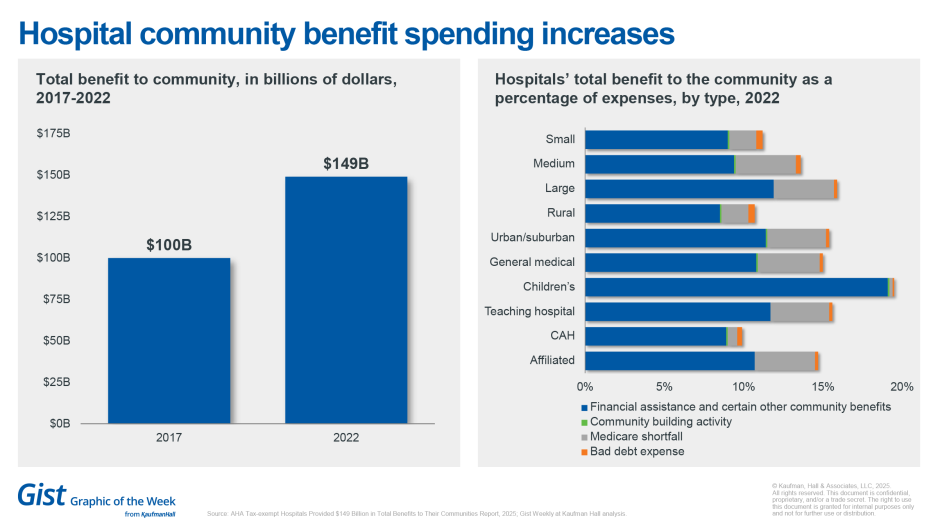

Tax-exempt hospitals provided nearly $150 billion in total community benefits in 2022, marking a nearly 50% increase from 2017, according to new data from the American Hospital Association. These benefits represented roughly 15.1% of total expenses for tax-exempt hospitals in 2022, up from 13.8% in 2017. Of that total, approximately $65 billion (about 6.6% of expenses) was directed toward financial assistance and unreimbursed costs from Medicaid, Children’s Health Insurance Programs and other means-tested government programs. Beyond direct financial assistance, the report notes hospitals and health systems invested in community health programs, professional education, research and subsidized essential services such as trauma and neonatal care. The data derive from IRS filings combined with expense data from AHA’s hospital annual survey. The expenditures serve as a counterpoint to scrutiny over not-for-profit hospitals’ tax-exempt status.