On Dec. 22, 2017, President Trump signed legislation that reduces the top marginal corporate tax rate from 35 percent to 21 percent. This move may significantly increase the cost of capital for hospitals—and play a strong role in their capital-funding decisions going forward. In recent years, borrowing rates for tax-exempt healthcare organizations decreased significantly and remained near historic lows. However, a lower corporate tax rate makes it less appealing for investors to own tax-exempt bonds.

This bulletin focuses on the impact of the law on direct purchase arrangements and other variable rate debt structures for healthcare.

How Prevalent Is Bank Debt Financing in Healthcare?

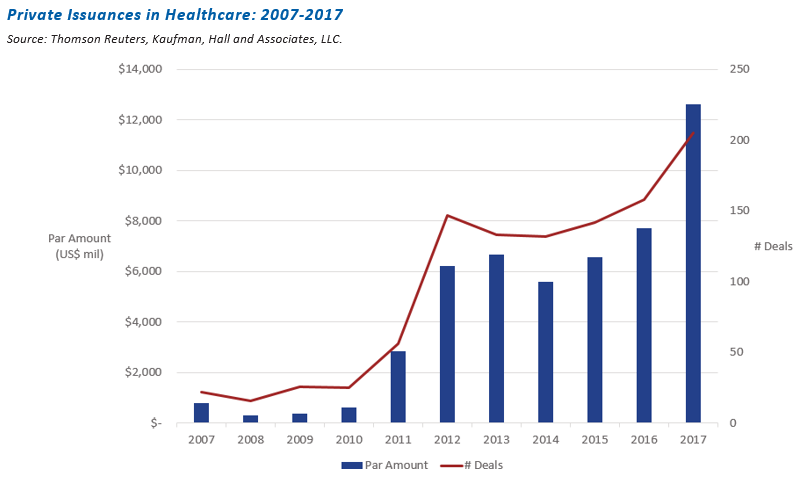

In the past 10 years, hospitals have increasingly borrowed directly from banks to achieve an efficient financing path and to reduce their exposure to potentially volatile variable rate debt alternatives. The exhibit below illustrates how direct-purchase arrangements have grown as a source of capital funding for hospitals in the past decade.

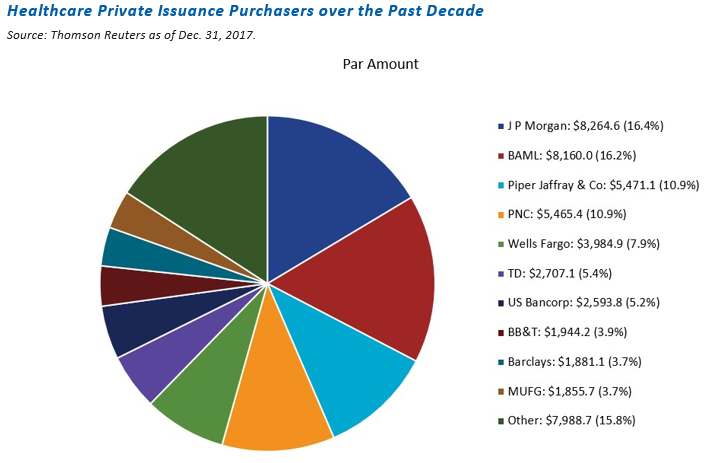

Virtually all banks purchase qualified private activity bonds, including tax-exempt bonds, and have been active healthcare lenders. A partial list appears below.

Will My Direct Purchase Be Affected?

Bank direct purchase loans have, in recent years, increasingly given lenders the right to increase rates in response to tax policy changes. Many borrowers with existing direct-lending arrangements have previously agreed to marginal tax-rate adjustments, thus absorbing the risk of a lower corporate tax rate of the lender. It is reasonable to expect these changes to take effect with requisite notice provisions (if prior notice is required):

- Where banks have the option to change the cost structure of the loan in response to changes in tax policy, our expectation is that banks will exercise their rights under these provisions

- As banks reach out to hospital leaders to discuss their intent to change the cost structure of a loan, hospital leaders should again become intimately familiar with the language in their organization’s loan documents and should quickly determine what questions they might have

- Bank lending documents have evolved over time and may vary by client and by product; hospital leaders should engage experienced healthcare financial advisors in a detailed review of the relevant transaction documents

- It may also be necessary to consult with bond or tax counsel regarding the tax implications of a change to the rate structure of your organization’s direct-purchase arrangement

How Can I Determine the Maximum Impact on My Organization?

A review of the hospital’s bank placement contracts will spell out the calculations and related impact. Some transaction documents require a stepped-up rate based on a Margin Rate Factor which was set at 1.53846 when the corporate tax rate was 35%. In this way, the incremental cost to the bank of a reduced corporate tax rate will be passed on to borrowing hospitals.

For example, the rate will increase by the factor derived from the following formula:

[1 minus 0.21] x [1.53846] = 1.21538

In other words, hospital leaders can multiply the hospital’s current rate by 1.21538 to calculate the hospital’s

index rate.

How Might Variable Rate Demand Bonds and Other Debt Structures Be Affected?

This is evolving. We do not anticipate that bank pricing for hospital letters of credit—whether new or existing—in support of Variable Rate Demand Bonds (VRDBs) will be materially or immediately affected. Less clear is whether the Security Industries and Financial Markets Association (SIFMA) Index itself will begin to trade at a higher percentage of One-Month London Interbank Offered Rate (1M LIBOR). If so, the increased cost associated with bank-direct purchases discussed above may more or less equal the increased cost of SIFMA-based VRDBs. The impact on tax- exempt floating-rate note pricing also remains to be seen.

Will Banks Continue to Lend to Hospitals?

This, too, is evolving. We anticipate that banks will continue to put their balance sheets to work and will continue to offer direct loans to healthcare organizations on a tax-exempt and taxable basis. The impact of the tax reform law on future decisions regarding underlying cost calculations likely will evolve as conditions in the banking and healthcare sectors change.

Factors that likely will be considered in determining overall debt instruments, costs, and conditions include:

- Credit ratings of banks as well as healthcare organization borrowers

- Bank cost of funds and the bank’s expectations for returns

- Details of comprehensive commercial arrangements with the lending bank

What Next Steps Should Hospitals Consider?

As hospital leaders anticipate an increase in the cost of bank-purchased capital—now or in the future—they should take the following steps:

- Evaluate any notice provisions in existing bank contracts. Look for language that spells out when adjustments prompted by changes in tax policy will take effect. Then, consider all other options to determine whether to explore new financing approaches or stay the course at the adjusted rate, until term expiration.

- Consider employing a broad analytical framework to evaluate the potential for increased cost related to variable-rate bonds and loans. For example, Kaufman Hall’s Enterprise Resource Allocation model articulates the role of enterprise resources (e.g., projected cash flows, invested assets, debt portfolio, debt capacity) as an integrated supporting mechanism to the strategic financial plan. Our approach combines deep expertise with proprietary software, data, and analytics.

- Consult with your treasury and capital markets advisor about the implications of the new tax law for your organization. As the cost of capital rises for tax-exempt borrowers seeking new funding, establishing a short- term and long-term strategy with expert guidance is critical to the organization’s success.