Inflation pressures aren’t easing in 2025. Economic uncertainty, pharmacy and indirect spend are driving cost surges that squeeze margins and complicate strategic investment — particularly where reimbursement remains tight. At the same time, the shift of lower-acuity care to outpatient settings is leaving hospitals with moderate inpatient volume growth (+3%, Sg2 IP Forecast 2025–2030) driven by higher acuity, alongside rising outpatient demand (+10%, Sg2 OP Forecast 2025–2030). Both trends further intensify resource needs and add to financial pressure.

But that doesn’t mean healthcare executives should panic. Here’s a look at actionable insights that can be implemented now to support budgeting and system-wide financial planning.

Supply chain: Disruptions and adjusting for risk

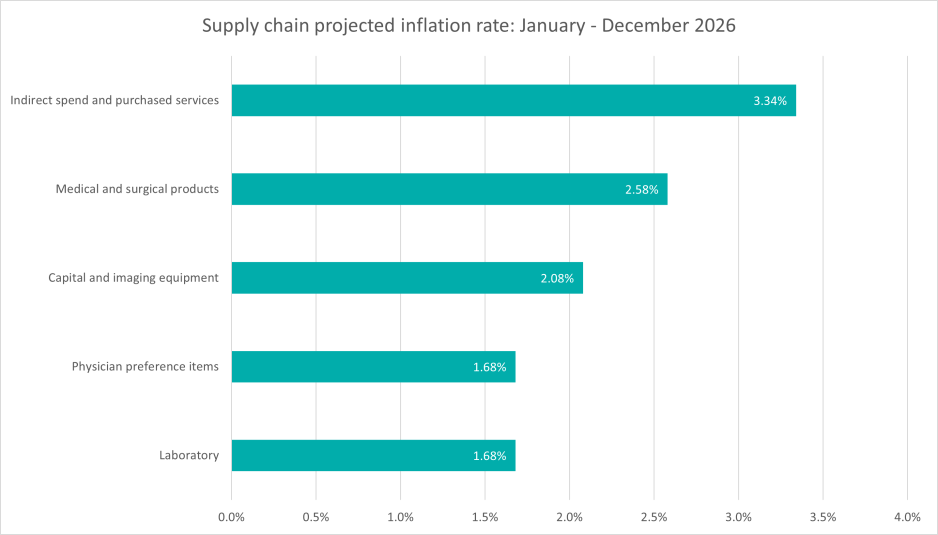

Total supply chain inflation for 2026 is projected at 2.41% — 0.1% higher than cited in the January Spend Management Outlook due to higher inflation in categories such as surgical supplies, non-medical capital equipment and IT services.

There also continues to be volatility in global trade and supply chain conditions. Rising raw material costs — driven by supply constraints, increased global demand and geopolitical instability — are contributing to elevated prices across many healthcare categories. Freight expenses also remain above historical norms due to labor shortages, fuel cost variability and lingering disruptions at key shipping hubs. These pressures, combined with wage growth in the manufacturing and service sectors and ongoing uncertainty around tariff policy, are contributing to sustained cost escalation across supply chain categories.

Katie Korte, vice president, strategy and program lead, Vizient Reserve, outlines the biggest risks to supply assurance and the strategies most effective in mitigating them — highlighting why collaboration between suppliers and providers is essential for long-term resilience.

Strategies:

- Evaluate purchasing strategies. Consider a supplier’s resiliency strategy to mitigate potential disruptions (e.g. global trade issues, natural disasters, etc.) in addition to acquisition price. Implement data-driven inventory management. Use predictive analytics and real-time inventory tracking systems to anticipate demand surges and optimize stock .

- Establish and monitor lead times from suppliers and vendors, while proactively managing supply risk.

- Strengthen communication and collaboration among supply chain, the operating room and the cath lab to monitor inventory types and procedural volumes.

- Ensure timely communication of inventory changes to responsible stakeholders and end-users.

- Establish regional supply coordination and mutual aid agreements. Collaborate with nearby healthcare facilities to share inventory data and redistribute essential supplies during disruptions.

Additional resources: |

Pharmacy: A high stakes cost center at 3.35%

While the summer 2025 Spend Management Outlook projection for pharmacy is lower than previous editions, pharmacy is still the top inflationary driver with a projected 3.35% increase — posing major risks to operating margins.

Key contributors:

- The rapid uptake of GLP-1 medications (e.g., tirzepatide) for metabolic and obesity-related conditions is driving significant increases in utilization and pharmacy spend.

- Growth in high-cost therapies — especially in autoimmune, inflammatory, oncology and cell and gene therapy — is fueling upward pressure on average drug prices. Because these agents are expensive per dose, even modest price increases or increased utilization push overall inflation. The Sg2 Impact of Change forecasts that within oncology, immune effector cell therapies alone are projected to grow nearly 11% over the next five years across the inpatient and outpatient settings, further intensifying upward pressure on overall drug inflation.

- Factors like price reductions mandated by the Inflation Reduction Act, biosimilar competition and projected declines in some high-use inpatient medications are partially countering inflation.

- More medication administration is shifting from inpatient to outpatient settings, changing reimbursement, markup and pricing dynamics.

- Possible overutilization or missed opportunities to use lower-cost, clinically appropriate alternatives can also be a contributor.

Strategies:

- Optimize formularies to promote cost-effective alternatives such as biosimilars, generics and therapeutic equivalents while maintaining clinical efficacy.

- Use data-driven tools to identify high-cost drug trends, monitor prescribing behaviors and forecast budget impacts — enabling proactive interventions and contract negotiations.

- Leverage Vizient’s Drug Budget Forecast Report to apply projected drug-spend trends to your organization’s purchasing patterns, supporting more accurate and informed budget planning.

- Use Vizient’s Supply Analytics to gain real-time visibility into market pricing and category benchmarks, helping teams spot potential savings, evaluate sourcing options, and strengthen contracting decisions.

- Use insights from Vizient’s Clinical Data Base to compare utilization across major categories—such as pharmacy, laboratory, and imaging—with peer organizations. This helps identify variation in the use of high-cost resources (e.g., medications) and assess opportunities for efficiencies, including shifting appropriate drug administration from inpatient to outpatient settings to support potential cost savings, etc.

- Use Sg2’s Impact of Change Forecast to model emerging utilization shifts, refine strategic plans and anticipate budget pressures.

- Integrate pharmacists into clinical teams to guide evidence-based prescribing, streamline use of high-cost therapies and ensure appropriate utilization across care settings.

Additional resources: |

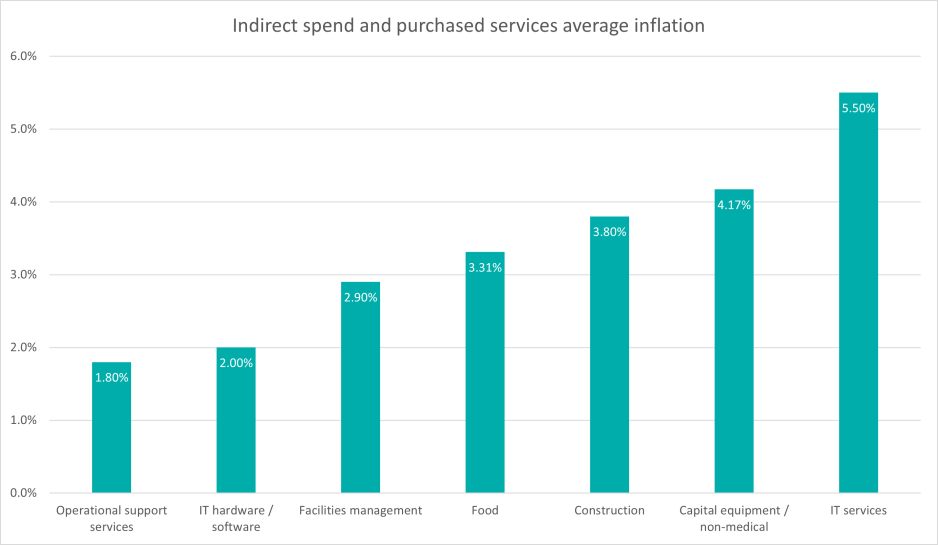

Indirect spend: Hidden but not insignificant

Indirect spend — which includes non-clinical goods and services such as security, food , information technology and construction — accounts for approximately 25% of a hospital’s total expenses. Despite its significant impact on health system budgets, indirect spend is often managed in silos, leading to fragmented procurement processes, limited visibility and missed opportunities for cost savings. At a 3.34% inflation rate, indirect spend is second only to pharmacy — an ideal space to focus financial strategies.

Key contributors:

- IT services: The 1.6% increase in inflation from the last edition reflects healthcare’s continued investment in AI, digital infrastructure, cybersecurity and emerging technologies to support clinical and operational transformation.

- Capital equipment: Driven by rising material, freight and tariff costs across HVAC, facility infrastructure and furniture categories, non-medical capital equipment is intensifying operational cost pressures and forcing tougher trade-offs in capital planning.

- Construction: The rise in construction is shaped by three primary forces: escalating labor costs driven by persistent workforce shortages, sustained inflation in construction materials and prolonged lead times for products and equipment.

- Food services: Tariffs and economic uncertainty, the rising demand for specialized nutrition and demographic and sector-specific growth (such as senior living) are driving inflation.

- Rising patient acuity: Higher-acuity populations typically require more intensive non-clinical support — such as enhanced environmental services, greater dietary customization, increased IT system demands for monitoring and documentation, and expanded facility needs — which can amplify indirect spend pressures across multiple support-service categories.

Strategies:

- Be proactive with procurement and standardize practices to ensure consistency and reduce variability and waste.

- Explore category-specific benchmarks and cost baselines to make informed decisions for your hospital or health system.

- Think critically about how to manage capital more strategically while maintaining momentum on critical infrastructure projects.

Additional resources: |

The future of healthcare requires more than cost containment — it demands proactive planning, stronger interdepartmental alignment and real-time data visibility. Organizations that harness these capabilities will be better positioned to navigate inflationary pressures, protect margins and sustain long-term financial resilience.

Here’s how healthcare executives can plan for inflationary pressures:

|