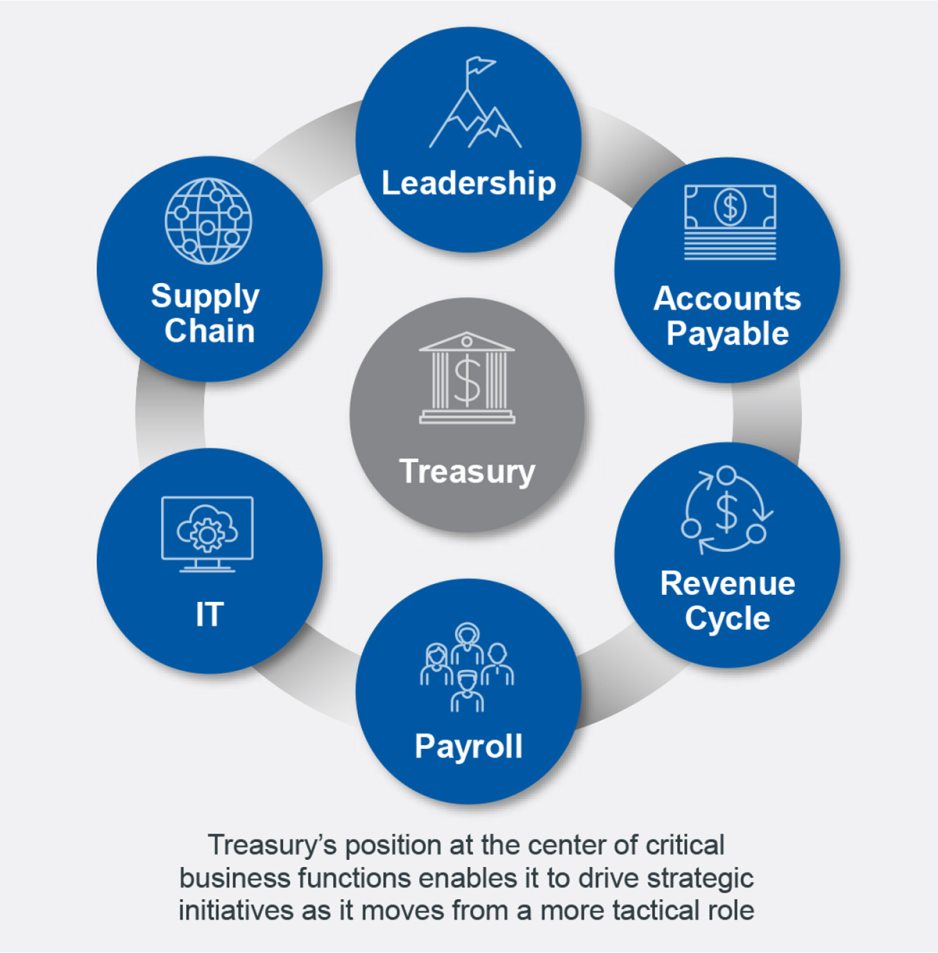

The role of Treasury in healthcare is changing. Once primarily viewed as the department that moved cash and managed bank accounts, Treasury has become the conduit for moving financial information across the organization. As health systems invest in technology modernization, Treasury’s visibility into cash, liquidity and capital positions it at the center of the financial technology (fintech) ecosystem.

Figure 1. Treasury at the center of the fintech ecosystem: Treasury’s work sits at the intersection of nearly every financial activity in a health system.

This daily cross-functional interaction affords Treasury its unique vantage point to align data, strengthen processes and build the foundation for a modern financial ecosystem.

Maximizing value of this vantage point starts with right-sizing Treasury technology and grounding modernization in three guiding principles that ensure investments translate into real ROI:

- Understanding your organization’s unique needs

- Determining what is needed today and what may be needed tomorrow

- Articulating value

Understand your organization’s unique needs

Many healthcare organizations share a common challenge: years of incremental growth combined with mergers/acquisitions and underinvestment in technical architecture have created a patchwork of tools, manual workflows and localized expertise.

Understanding current needs starts with asking:

- How is cash tracked today?

- How accurate are forecasts?

- Where do reconciliations break down?

These questions inform technology strategy that enables Treasury to unify systems, elevate insights and drive financial and operational performance across the organization. For many organizations, this strategy centers on the Treasury Management System (TMS)—but not every organization requires the same structure and level of investment.

Determine what is needed today—and what may be needed tomorrow

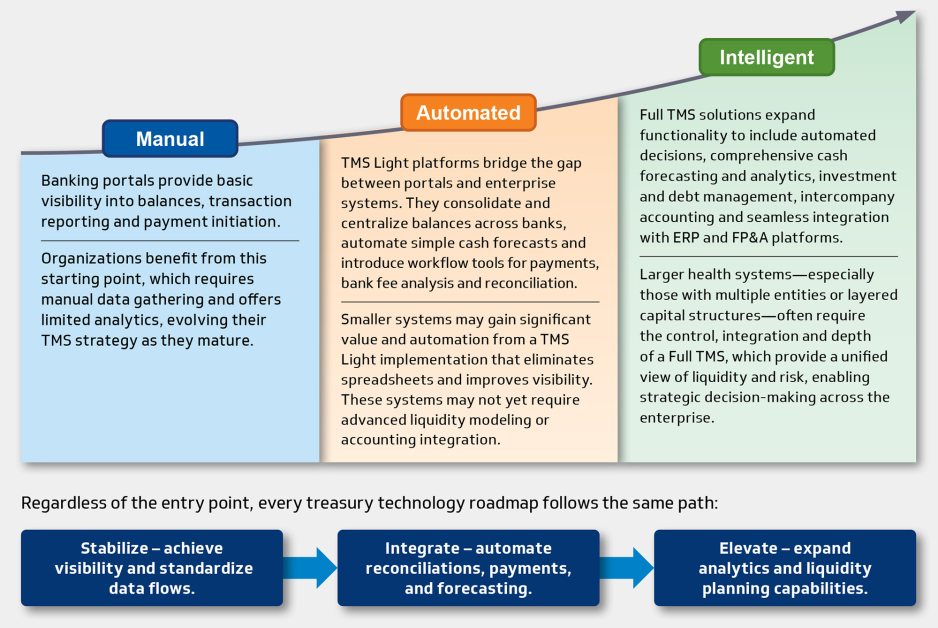

Finance leaders may see TMS implementation and assume enterprise-level cost and functional disruption. But in reality, the shift centers on moving from manual, disconnected systems and workflows toward a streamlined, automated flow of financial information. This advancement is driven by the intentional and aligned application of transformational technology, realized through incremental evolution.

Figure 2. Treasury technology exists along a scalable spectrum of sophistication: Banking Portals, TMS Light and Full TMS. Each step builds on the one before it, adding graduated capabilities and enhanced features.

Transitioning to the appropriate level of treasury technology requires data integrity, process discipline and cost effectiveness rather than immediacy. Technology that delivers the correct data to the right people at the right moment, with appropriate effort and proper controls in place, should be achieved.

As adoption of artificial intelligence and robotic process automation accelerate Treasury’s technological evolution, Treasury’s role within the fintech ecosystem continues to expand. These emerging technologies, including the proliferation of cloud-based platforms and broader API connectivity, will continue to transform how financial data is exchanged and managed, increasing governance expectations. As these forces accelerate, Treasury-first modernization becomes a strategic advantage, standardizing data for enterprise resource planning consolidation and building connectivity that the rest of Finance can leverage.

Articulate value and the ability to drive ROI

With Treasury’s central position across functions and disparate technology solutions, the right TMS is among the most transformative investment a Treasury function can make. Creating transformational change becomes less about the availability of continuous, real-time data, which can be costly and inefficient with very few Treasury decisions truly requiring that level of immediacy. Instead, investment in technology is increasingly shifting to the ability to access “right-time” data that is refreshed and made available to match the rhythm of operational, strategic and governance decisions. Systems therefore must demonstrate ROI, both financially and in terms of efficiency and insight generation.

As organizations seek to understand the ROI made available through the successful deployment of a TMS technology solution, six areas of focus emerge:

- Improved reporting and visibility – centralized dashboards that illustrate enterprise cash positions at the right time

- Increased interest income – optimizing cash utilization through automated sweeps and informed investment decisions

- Reduced bank fees – automated fee analysis that identifies contract variances and savings opportunities

- FTE optimization – replacing manual reconciliation efforts and report-building with automated workflows, freeing staff for more strategic work

- Reduced risk – controlled payment workflows, automated entitlement management and consistent segregation of duties

- Standardized operations – consistent cash positioning and forecasting processes across all entities and accounts

These benefits directly translate to measurable results. KPIs include faster month-end closings, higher yield on cash and reduced exposure to fraud and error. They enable Treasury to function as a steward of an organization’s financial resources, spending less time compiling data and more time mobilizing it for actionable insights.

A clear business case and robust selection framework emphasizing well-defined success metrics before implementation are key to defining ROI.

These metrics should include a variety of KPIs that help evaluate and monitor implementation, adoption and value capture including:

- Operational KPIs such as straight-through-processing rate, forecast-to-actual accuracy and manual journal reduction.

- Financial KPIs such as yield enhancement, fee recovery and reduced borrowing costs.

- Strategic KPIs such as reporting timeliness, liquidity visibility and user adoption.

By linking these metrics to cost and value, Treasury can communicate ROI in a language that resonates with Finance leadership and boards. The result is a technology roadmap that stresses accountability.

The Road Ahead

To implement or upgrade a TMS is to enable improved decision-making across Finance. A well-sequenced, Treasury-first roadmap aids the organization in standardizing connectivity, reducing manual effort and delivering insights that improve working capital, funding strategies and long-term planning.

Treasury modernization constructs the foundation for Finance’s broader digital transformation. By understanding organizational needs, choosing the right level of technology maturity and clearly demonstrating value through a thoughtful ROI evaluation, Treasury can evolve from a transactional function to an enterprise integrator.