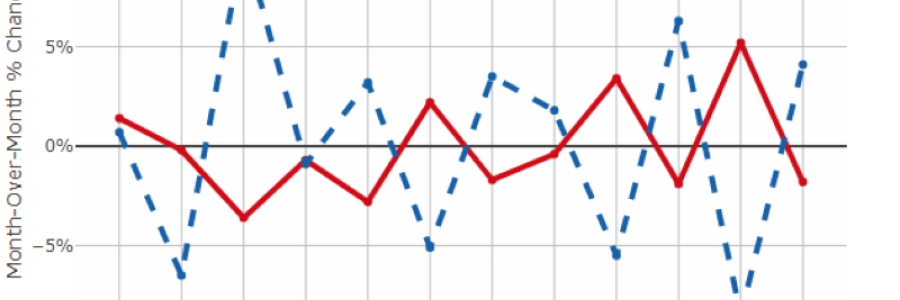

Profitability

Hospitals nationwide closed 2019 with an uptick in margin results for the month of December, following significant declines in November. Operating Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) Margin rose 136.9 basis points (bps) year over year, and Operating Margin increased 171.8 bps. Month over month, Operating EBITDA Margin increased 173.4 bps, while Operating Margin rose 208.7 bps.

Multiple factors contributed to the increases, including higher volumes and revenues, despite increases in Bad Debt and Charity care and mixed performance on expenses. By size, the largest hospitals with 500 beds or more were the only ones to perform below budget for the month. Even so, the cohort saw its first year-over-year Operating EBITDA Margin increase in six months.

Volume

U.S. hospitals saw volume increases to close the year in December, after experiencing declines in November. Operating Room (OR) Minutes saw the most significant year-over-year increases at 5.7%, while Emergency Department (ED Visits) saw the most significant month-over-month increases at 11.3%.

Discharges increased 0.4% year over year and 4.1% month over month, but was the only volume metric to perform below budget expectations. Adjusted Discharges rose 2.3% year over year and 3.8% month over month, while Adjusted Patient Days increased 3.8% year over year and 3.7% month over month. Average Length of Stay (LOS) saw modest increases both year over year and month over month.

Revenue

Revenue performance for December was somewhat mixed, with increases and decreases across Net Patient Service Revenue (NPSR) per Adjusted Patient Day and Inpatient/Outpatient (IP/OP) Adjustment Factor, and across-the-board increases in NPSR per Adjusted Discharge and Bad Debt and Charity as a Percent of Gross.

NPSR per Adjusted Discharge was up 3.3% year over year and 1.2% month over month, performing 1.0% to budget—mirroring similar patterns in Adjusted Discharges. NPSR per Adjusted Patient Day fell slightly -0.6% year over year, but increased slightly 0.2% month over month, falling -3.8% below budget expectations, despite across-the-board increases in Adjusted Patient Days.

Expense

Hospitals nationwide saw expenses increase year over year across most metrics in December, but decrease month over month. Total Expense per Adjusted Discharge rose 0.8% year over year, but fell -1.8% month over month. Labor Expense per Adjusted Discharge rose 1.3% year over year, but fell -1.9% month over month. Full-Time Equivalents (FTEs) per Adjusted Occupied Bed (AOB) were down -4.0% year over year and -1.5% month over month.

Non-Labor Expense per Adjusted Discharge rose 0.7% year over year, but fell -1.7% month over month. Drug Expense per Adjusted Discharge saw the biggest year-over-year increase at 9.7%, while Supply Expense per Adjusted Discharge was up 6.2% year over year.

Non-Operating

The U.S. and China agreed in December to sign phase one of a trade deal, alleviating some uncertainty in financial markets. Labor markets weakened as the U.S. added only 145,000 jobs for the month, compared to 266,000 in November, and unemployment remained steady at 3.5%.

The U.S. manufacturing sector continues to decline with a fifth straight negative monthly reading. The sector lost 12,000 jobs in December, finishing 2019 with a net gain of 46,000 compared to 264,000 in 2018. Gross Domestic Product (GDP) grew at an annualized rate of 2.1% and was expected to remain steady through the end of 2019, compared to 2.5% at the end of December 2018. While the consumer sector remains a strong buffer, overall growth has seen consistent, gradual declines.