From the Gist Weekly team at Kaufman Hall

We’re happy to be back this week for another edition. Please sign up to receive Gist Weekly directly in your inbox (nearly) each week.

In the News

What happened in healthcare recently—and what we think about it.

- Walgreens’ VillageMD exits the Florida market. Walgreens announced this week that it will be shutting down all of its Florida-based VillageMD primary care clinics. Fourteen clinics in the Sunshine State have already closed, with the remaining 38 expected to follow by March 15. This move comes in the wake of a $1B cost-cutting initiative announced by Walgreens executives last fall, which included plans to shutter at least 60 VillageMD clinics across five markets in 2024. Last month VillageMD exited the Indiana market, where it was operating a dozen clinics. Despite downsizing its primary-care footprint, Walgreens says it remains committed to its expansion into the healthcare delivery sector, having invested $5.2B in VillageMD in 2021 and purchased Summit Health-CityMD for $9B through VillageMD in 2023.

- The Gist: Having made significant investments in provider assets, Walgreens now faces the difficult task of creating an integrated and sustainable healthcare delivery model, which takes time. Unlike long-established healthcare providers who feel more loyal to serving their local communities, nontraditional healthcare providers like Walgreens can more easily pick and choose markets based on profitability. While this move is disruptive to VillageMD patients in Florida and the other markets it’s exiting, Walgreens seems to be answering to its investors, who have been dissatisfied with its recent earnings.

- Two big health insurer mergers called off. Last week, both Indianapolis, IN-based Elevance Health’s $2.5B planned acquisition of Baton Rouge-based Blue Cross and Blue Shield of Louisiana (BCBSLA) and a proposed merger between Long Beach, CA-based SCAN Group and Portland-based CareOregon were shelved, due in part to opposition from state-level officials. Elevance, the large for-profit insurer previously known as Anthem, initiated its purchase of nonprofit BCBSLA in January 2023 but paused its pursuit in September, amid concerns from Louisiana stakeholders. It then submitted a new acquisition bid in December before withdrawing its latest request for regulatory approval last week. The SCAN-CareOregon merger, which was announced in December 2022 and would have created a $6.8B Medicare Advantage (MA) and Medicaid insurer called HealthRight Group with a footprint in five states, was likewise met with skepticism from public officials, including Oregon’s Medicaid Advisory Committee, which recommended against the merger.

- The Gist: It's notable that public officials in states as different as left-leaning Oregon (which has also recently established more active healthcare market oversight) and more-conservative Louisiana were key players in stopping these deals. Faced with headwinds, these two sets of insurers voluntarily opted to withdraw their merger applications, although BCBSLA shared in its statement that it remains interested in finding “a strong partner to help position [it] for a vibrant future.” Continuing to pursue scale will be vital to many health insurers in order to compete with current market heavyweights, but they’ll have to convince both state officials and local stakeholders of the value provided by these mergers.

- CMS finalizes DSH cuts for some hospitals. On Tuesday, the Centers for Medicare and Medicaid Services (CMS) published a final rule redefining how disproportionate share hospital (DSH) payments are determined. Hospitals used to calculate their Medicaid shortfalls based on the costs and payments associated with all of their Medicaid-eligible patients, even if some of those patients used a different primary payer. Prompted by Congress to address this issue in 2021, CMS is now limiting the scope of Medicaid shortfall to only patients for whom Medicaid is their primary payer. The rule exempts safety-net hospitals providing care to the highest percentages of low-income patients, defined as those in the 97th percentile of inpatient days treating Medicare SSI (Social Security Income) recipients. This change is expected to amount to an $8B annual reduction in DSH payments over the next four years. Congress has repeatedly delayed the implementation of these cuts, which are now set to go in effect on March 8, 2024.

- The Gist: Though the formula for calculating appropriate DSH payments has always been complex, the point of the program is to provide additional support to hospitals caring for underserved, low-income populations. This $8B cut may be targeted at hospitals with slightly better payer mixes, but it will be felt heavily by many safety-net providers reliant on the payments, especially in today’s challenging financial operating environment where over 40 percent of hospitals are still losing money on operations.

Plus—what we’ve been reading.

- Questioning the value of the annual physical. Published this week in TheWall Street Journal, this piece explores how traditional, annual physicals are not necessarily serving all patients effectively. Though most primary care providers (PCPs) recommend annual exams, there is growing evidence that routine wellness visits aren’t as beneficial to long-term health as many patients may believe. These visits remain important for chronic condition management and preventative screenings, but regular exams in asymptomatic patients have not been shown to reduce mortality or cardiovascular events. Rather than suggesting that patients and providers do away with regular physicals, the article describes how some primary care organizations are evolving the visit to be more lifestyle-centric, less frequent, or even virtual-first, with the goal of increasing its benefit to different categories of patients while also mitigating PCP shortages.

- The Gist: Health systems and medical groups may be able to attract more consumers—especially those who consider themselves young and healthy—by having a range of options for patients to engage with providers in a way that they feel is more flexible and helpful to their current needs. It’s also possible that spending less time on annual physicals for younger, healthier people could ease the strain on primary care access, especially in geographies with provider shortages. But continuing to engage these individuals in establishing a healthcare home is still important, especially amid an increase in cancer and other chronic disease diagnoses in younger people.

Graphic of the Week

A key insight illustrated in infographic form.

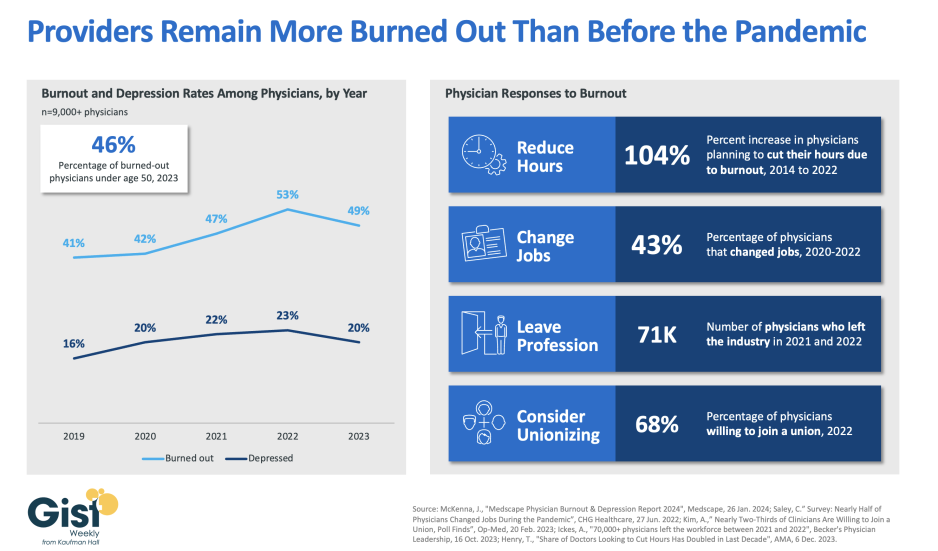

Physician burnout persisting above pre-pandemic levels

In this week’s graphic, we highlight new data from the 2024 Medscape Physician Burnout & Depression Report on the sustained high rates of physician burnout. In 2023, nearly half of physicians reported feeling burned out, and a fifth reported feeling depressed. Although this does represent a drop from 2022’s peak, physicians remain more distressed than they were before the pandemic. These numbers reveal some of the toll that the continued labor shortages, financial challenges, and payment changes of the past few years have taken on providers. In response to feeling burned out, an increased number of physicians say they are planning to cut their hours and over a third say they actually have changed jobs. Many have left the industry all together and the majority now say they are willing to join a union. Health systems have long prioritized addressing provider burnout, but tighter operating margins have heightened both the challenge and the importance of helping to relieve it. Continuing to find solutions to reduce administrative tasks, enhance team-based care models, and empower providers in decision-making processes are as important as ever for provider organizations today.

On the Road

What we’re learning from our work in the real world. This week from Ken Kaufman, Managing Director and Chair, at Kaufman Hall.

The most important elements of emotional IQ for healthcare leaders today

At a recent dinner with my good friend and colleague Dave Blom, the former President and CEO of Ohio Health, he and I discussed the difficulties of leading and managing complex healthcare organizations in the post-Covid era. We agreed that the leadership issues that matter most right now center around the ability of executives to possess and demonstrate an authentic emotional IQ. Taking care of patients—in fact, taking care of communities—is not only managerially complicated but also emotionally testing. Success cannot be achieved by technical and clinical excellence alone; rather, it must be built on a platform of an emotional IQ that is supported, valued, and shared by the entire organization.

The below list is what Dave and I settled on as the most important elements of emotional IQ for healthcare leaders today, and we think that leadership teams that fully embrace these behaviors unlock a higher level of organizational trust, as well as corporate and managerial integrity.

--Empathy. A leader needs to understand and share the feelings of his or her entire organization, as well as understand the difference between sympathy and empathy: sympathy is a passive emotion while empathy is an active emotion. A leader with empathy not only notes the problem but immediately moves to be of help at either the personal or organizational level, whichever is required.

--Vulnerability. Historically, executive leadership, especially in corporate situations, has been trained and encouraged not to show emotion or weakness. But organizations are changing, and the composition of the today’s workforce is different. The patient care process is emotional in and of itself, and daily operational interactions demand a different kind of leadership—a leadership that is comfortable with both emotion and weakness.

--Humility. Executives who show humility are willing to ask for help, and don’t insist on everything being done their way; they are quick to forgive and are known for their patience. Humility supports a collaborative and cooperative leadership model, which has at its core a heavy dose of decentralization and delegation.

What other key components of emotional IQ would you add to this list? How is your organization deliberately developing more emotionally intelligent leaders? I welcome you to reach out to share and discuss.

On Our Podcast

Gist Healthcare Daily—All the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

Last Monday, host J. Carlisle Larsen spoke with Dan Diamond, national health reporter for The Washington Post, about his recent article examining an alleged $2B Medicare fraud scheme involving a significant increase in claims for intermittent urinary catheters.

This coming Monday, we’ll revisit JC’s conversation with Steven Lane, MD, Chief Medical Officer for data sharing platform Health Gorilla, where they discuss consumers’ concerns about the privacy of their health data.

And be sure to tune in every weekday morning to stay abreast of the day’s biggest healthcare news. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

If you’re reading this, you’ve made it to the end—and are therefore probably one of our most faithful readers. We greatly appreciate that, and look forward to being back in touch next week!

Best regards,

The Gist Weekly team at Kaufman Hall