From the Gist Weekly team at Kaufman Hall

Please sign up to receive Gist Weekly directly in your inbox (nearly) each week.

In the News

What happened in healthcare recently—and what we think about it.

- Biden targets prescription drug costs in proposed budget. Following last week’s State of the Union address, President Biden released his proposed $7.3T budget for fiscal year 2025. Many of its healthcare priorities focus on lowering prescription drug costs for consumers, including calls to extend the $35-per-month cap on a month’s supply of insulin to the commercial insurance market, limit annual out-of-pocket prescription drug costs to $2K for all Americans, and expand the Inflation Reduction Act’s Medicare drug price negotiation program to 50 drugs per year. Medicare, having submitted its initial offer to drugmakers in February, is currently negotiating the first 10 selected drugs, with new prices expected to go in effect in 2026.

- The Gist: Though this budget faces a very uncertain future in a politically divided Congress, especially in an election year, it signals that the healthcare priorities of a potential second Biden term would be focused on increasing healthcare affordability for consumers. One of the administration’s biggest achievements to this end—empowering Medicare to negotiate drug prices—is underway with full participation from the manufacturers of the 10 initial drugs chosen, even as the drug industry continues to try to stop the negotiation process through judicial challenges.

- FDA approves Wegovy to reduce cardiovascular risk. Last Friday, the Food and Drug Administration (FDA) approved Novo Nordisk’s GLP-1 weight-loss drug Wegovy (semaglutide) to treat cardiovascular disease in adults who are overweight. The FDA based its decision on the results, released last year, of a large clinical trial that showed the drug reduced the risk of heart attacks, strokes, and cardiovascular deaths by 20 percent among non-diabetic overweight adults with established cardiovascular disease. These results are similar to a previous study that found Wegovy’s sister drug Ozempic, also made by Novo Nordisk, reduced the risk of adverse cardiac events by 26 percent in adults with type 2 diabetes. Ozempic received FDA approval for cardiovascular risk reduction in 2020.

- The Gist: Expanding Wegovy’s label cuts against the argument that weight loss medications are solely “lifestyle” drugs, which some insurers and employers have been using to deny coverage. The approval is expected to broaden the drug’s market, though the Centers for Medicare and Medicaid Services is still reviewing the FDA’s action, and demand for Wegovy is already outpacing supply. The revolutionary potential—and regulatory approval—of this drug class is only expected to grow; earlier this month Novo Nordisk released highly anticipated clinical trial results showing that Ozempic cut the risk of kidney-disease related events in diabetic patients by 24 percent.

- Arkansas state law protecting 340B contract pharmacies upheld. On Tuesday, the 8th US Circuit Court of Appeals ruled against the pharmaceutical industry after its PhRMA (The Pharmaceutical Research and Manufacturers of America) trade group sued to prevent Arkansas from requiring drug manufacturers to distribute discounted drugs to 340B contract pharmacies. The judge’s decision, seen as a win for hospitals, affirmed state authority to establish regulations on top of the federal 340B law, which does not actually reference contract pharmacies. A Louisiana law similar to Arkansas’ is currently being challenged.

- The Gist: This ruling could encourage other states to pass laws protecting 340B contract pharmacy discounts. Contract pharmacy sales have swelled in recent years, prompting at least 20 major drug manufacturers to refuse to provide 340B discounts for drugs dispensed through contract pharmacies. This issue is currently the subject of myriad lawsuits as courts have issued conflicting rulings.

Plus—what we’ve been reading.

- The promise and pitfalls of AI-generated clinical summaries. Published this week in Stat, this piece describes the challenges health systems face when evaluating the ability of generative AI to summarize medical records. Though large language models are capable of improving the readability of patient communications like discharge summaries, they may make errors of omission or “hallucinations” (inserting details not found in the patient record). AI governance committees at provider organizations are grappling with how best to assess the accuracy, safety, and effectiveness of these tools, which will likely require developing new work protocols to ensure human review of their output.

- The Gist: Offering to reduce physician paperwork and burnout, AI-generated clinical summaries are one of the most promising, early-adoption use cases of generative AI tools. Many hospitals are already piloting AI-powered tools that summarize patient charts. However, gains in provider efficiency cannot come at the expense of compromising clinical accuracy, especially in clinical summarization, “when a single missing word could mean the difference in a diagnosis.” AI tools will only be able to deliver on their potential once providers have trust in their output.

Graphic of the Week

A key insight illustrated in infographic form.

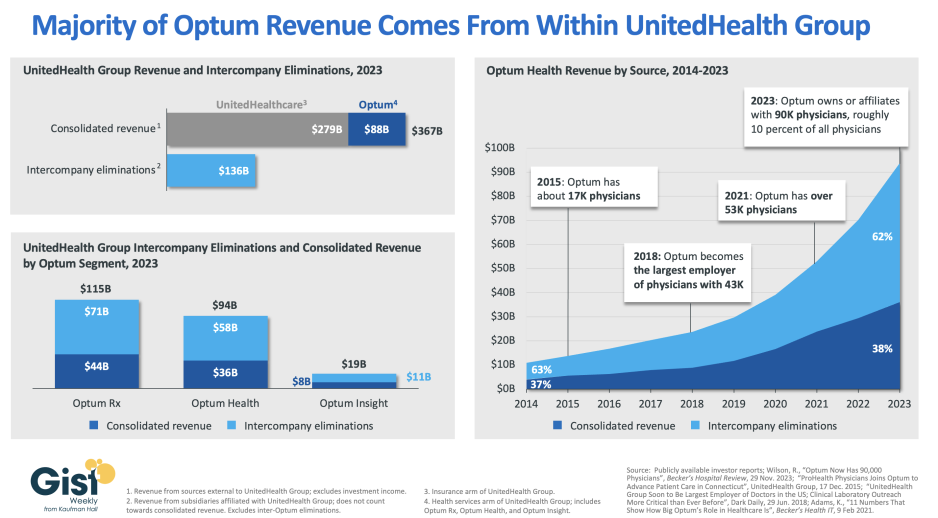

The model vertically integrated payer

In this week’s graphic, we take a closer look at UnitedHealth Group (UHG)’s 2023 financials to show the success of its vertical integration strategy. The company reported $367B in consolidated revenue in 2023, earning more than three quarters of that from its UnitedHealthcare insurance arm. While its Optum health services arm—which includes Optum Rx, Optum Health, and Optum Insight—earned $88B of consolidated revenue, an additional $136B of revenue from its insurance arm was redirected into its Optum businesses in the form of intercompany eliminations. This figure, up 26 percent from last year, represents over 60 percent of Optum’s total revenue. These payments from UnitedHealthcare to Optum allow UHG to retain profit-capped insurance revenue by shifting it to other divisions, driving increased profitability for the overall enterprise. Optum Health, UHG’s provider arm, has been a particular focus of recent growth. Over the last decade, it has become the nation’s largest employer of physicians, and the division now owns or affiliates with at least 90K physicians, roughly 10 percent of all US physicians. It has increased its earnings over eightfold since 2014, consistently earning the majority of its revenue from UHG’s insurance arm. This reflects a key aspect of UHG’s provider acquisition strategy: targeting provider assets in markets where UnitedHealthcare insurance plans are dominant.

On the Road

What we learned from our work in the real world. This week from Dawn Samaris, Managing Director, at Kaufman Hall.

Improving skilled nursing facility (SNF) relationships

“If I could fix one thing with a snap of my finger,” a hospital CEO recently told me, “I’d double the capacity of skilled nursing facilities in our market. All these patients, just sitting in bed, waiting for discharge, are really hurting our length of stay.” Many health system leaders I work with have expressed similar frustrations around reducing inpatient average length of stay, and they often point to delayed post-acute discharges as a key driver of the problem. SNF bed counts and staffing levels took a big hit during COVID, but, as this CEO went on to say: “Of course, capacity is not our only concern. Managed care approvals, especially for our Medicare Advantage patients, are also making it much harder for us to discharge patients.”

With this challenging backdrop, health systems must continue to focus on areas that they can control. These include ensuring that their inpatient discharge processes are optimized and that there is a sufficient supply of SNF beds available to receive patients being discharged. The latter, in particular, lends new urgency to the familiar topic of SNF partnership options. In many markets, health systems are realizing the need to contribute financial, staffing, or other resources to secure expedited placement privileges, or even dedicated bed capacity, at partner SNFs. Is your health system currently exploring options for preferred provider relationships with SNFs? I’d be happy to discuss the pros and cons of various SNF strategies, along with how to make the business case for partnership—please reach out.

On Our Podcast

Gist Healthcare Daily—All the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

Last Tuesday, we heard the second half of host J. Carlisle Larsen’s conversation with Celina Cunanan, Chief Diversity, Equity & Belonging Officer at University Hospitals in Cleveland, about how the system’s educational outreach initiatives support efforts to diversify its talent pipeline.

This Monday, JC speaks with Zachary Fleitman, founder and CEO of talent pipeline management platform WorkUp Health, which provides health systems—including University Hospitals—with a customizable app to help them track and evaluate the impact of their youth outreach initiatives.

And be sure to tune in every weekday morning to stay abreast of the day’s biggest healthcare news. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

Thanks again for your time this week, we know how busy you are and really appreciate your readership. We’ll see you next week!

Best regards,

The Gist Weekly team at Kaufman Hall