From the Gist Weekly team at Kaufman Hall

We appreciate all of our subscribers, old and new, and encourage you to share this blog with colleagues and friends—be sure to tell them to subscribe as well!

In the News

What happened in healthcare recently—and what we think about it.

- Kaiser Permanente’s Risant Health closes Geisinger acquisition. On Tuesday, roughly a year after first sharing its intent, Kaiser Permanente (KP) announced that it has acquired Danville, PA-based health system Geisinger. Kaiser Foundation Hospitals, part of KP, launched Risant Health in April 2023 as a subsidiary company to accelerate the adoption of value-based care by acquiring not-for-profit health systems. Through Risant, KP is providing Geisinger, a ten-hospital integrated system with a 600K-member health plan, with at least $2B to support its hospital operations and more than $200M to expand its health plan and research capabilities. Geisinger will continue operating under its own brand and control. Its CEO, Jaewon Ryu, will become the first CEO of Risant Health, which plans to add at least four more not-for-profit health systems to its portfolio over the next five years to reach around $30-35B in total revenue.

- The Gist: Risant offers Kaiser Permanente a flexible growth path toward a nationwide network that does not depend on its traditional model of fully integrated care. Although already the nation’s largest health system by revenue, KP’s size still pales in comparison to the that of UnitedHealth Group or CVS Health. To compete at scale, KP is aiming to group together a network of like minded value-based health systems into a national care platform.

- Optum plans to acquire Steward Health Care’s physician group. Last week, UnitedHealth Group (UHG)’s Optum division filed an agreement with Massachusetts regulators to buy Stewardship Health, a network of more than 1.7K physicians affiliated with Dallas, TX-based Steward Health Care, for an undisclosed sum. Amid ongoing financial difficulties, Steward—a 33-hospital, for-profit health system with a footprint in Massachusetts and eight other states—recently released a six-point plan to shore up its operations, which included the planned sale of its physician assets. Pending state and federal antitrust review, Optum and Steward hope to close the deal in Q2 of 2024.

- The Gist: This is an interesting move for Optum, which acquired Massachusetts-based physician groups Reliant Medical Group and Atrius Health in recent years, but to date has been focused on acquiring independent physician groups that are not affiliated with health systems. It comes on the heels of the Oregon Health Authority granting emergency approval for Optum to purchase the Corvallis Clinic in Corvallis, Oregon. Meanwhile, Intermountain Health shuttered its southwest Idaho-based Saltzer Health earlier this week after it failed to find a buyer for the physician group. These activities reflect a broader upheaval in the physician practice space, as many medical groups are facing difficult post-pandemic operating environments—sparked by inflation and exacerbated by the recent Change cyberattack—and more health systems are reexamining the value derived from their provider subsidies, which have risen seven percent per provider since 2021.

- Major payers starting to cover Wegovy for Medicare beneficiaries with heart conditions. As first reported by the Wall Street Journal, CVS Health, Elevance Health, and Kaiser Permanente have decided to cover the popular weight-loss drug Wegovy in their Medicare Part D drug benefit plans for beneficiaries with cardiovascular conditions. Elevance, operator of many Blue Cross and Blue Shield plans, has also said it will extend this coverage to its commercial members. The insurers’ decisions follow the Food and Drug Administration (FDA)’s announcement last month that it approved Wegovy to treat cardiovascular disease in overweight adults, and subsequent guidance from the Centers for Medicare and Medicaid Services that anti-obesity medications that receive FDA approval for an additional indication can be considered a Part D drug for that specific use. Novo Nordisk, Wegovy’s manufacturer, said it is working with state Medicaid agencies to reach coverage agreements as well.

- The Gist: After initially delaying coverage decisions due to cost (Wegovy lists at about $1,350 per month), major health insurers now appear to be changing their tune. These moves will greatly expand access to Wegovy for patients who would struggle to obtain insurance coverage for weight-loss purposes alone. Importantly, this recent CMS guidance does not compel insurers to cover Wegovy or other anti-obesity drugs that may be FDA approved for other indications in the future. But beneficiaries may now shop around for plans that cover Wegovy for more indications, creating competitive pressures for more payers to include the drug in their formularies to attract and retain members.

Plus—what we’ve been reading.

- How to evaluate growth opportunities like an investor. Published last week in the Harvard Business Review, this piece argues that due diligence, a corporate practice traditionally left to M&A evaluations, can serve as a useful tool for identifying a company’s key growth opportunities. Although it can be a significant undertaking, the practice of assessing an organization as if it were exploring a merger can aid the identification of targeted areas for revenue growth, value creation, and cost reduction. The article’s authors suggest that crafting a “deal thesis,” as an investor would—a plan for investment, cost cuts, commercial actions, and organizational change—can produce a sizeable near-term increase in the value of an organization.

- The Gist: Although most healthcare organizations practice various forms of internal assessment, the power of the “due diligence playbook” comes from its emphasis on starting with a blank slate: asking what a new owner could and should do with your organization’s specific assets. With the industry undergoing a significant competitive transition, every health system—not just those exploring M&A opportunities—would benefit from examining its assets with fresh eyes. There’s no reason to assume that service lines and investments that once served a system well will continue to do so going forward. Instead, individual business lines should support and advance the organization’s goal of increasing enterprise value while furthering mission.

Graphic of the Week

A key insight illustrated in infographic form.

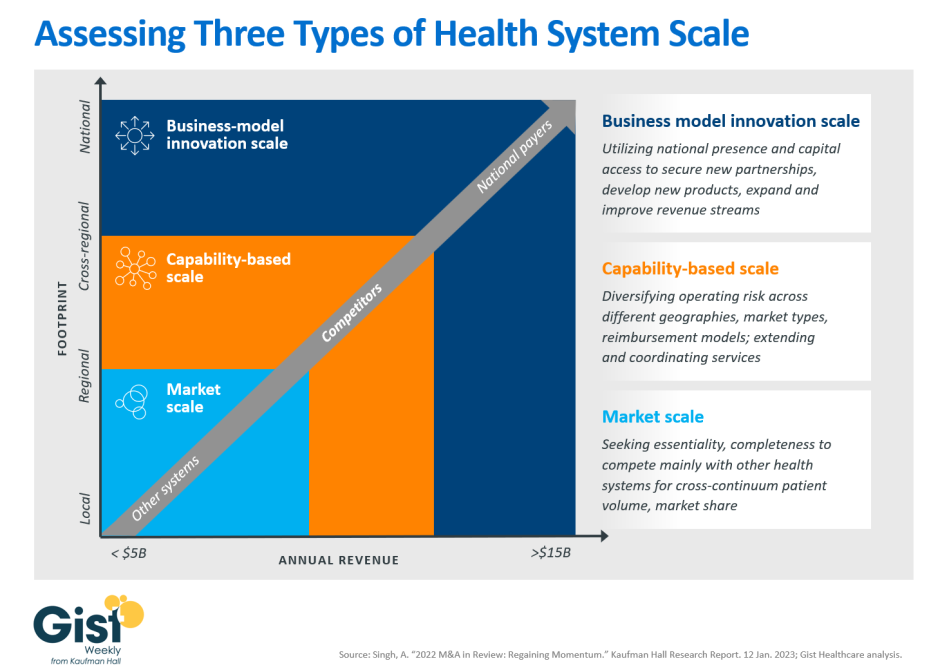

Reassessing the advantages of scale

Following this week’s news of Kaiser Permanente’s Risant Health subsidiary closing its acquisition of Geisinger, the graphic below provides a framework for thinking about health system scale. Hospitals have pursued in-market mergers to increase their essentiality and better compete with neighboring health systems for patient volume and market share. Today, with many of these mergers subject to heightened antitrust scrutiny, more health systems are exploring potential partners outside of their region. Many of the systems involved in the growing number of “mega mergers” announced over the past few years are looking to secure new or complementary capabilities, including extending and coordinating services, as well as diversify their operating risk across different geographies, market types, and reimbursement models. Beyond capability-based scale, health systems with enough of a national presence and significant capital resources may be able to unlock business model innovation scale. This scale may allow them to expand and improve revenue streams, fully redesign care delivery, and secure national partnerships for things like manufacturing their own supplies. Systems with this kind of scale can shift their competition focus beyond other health systems to for-profit healthcare disruptors, one of the goals Kaiser Permanente stated it has for Risant. However, even health systems that have achieved this level of scale are still much smaller than the disruptors against which they are attempting to compete.

On the Road

What we learned from our work in the real world. This week from Courtney Midanek, Managing Director, at Kaufman Hall.

Evaluating new strategies in a changed operating environment

While working with a health system leadership team to update its five-year strategic plan, I was impressed by the candor of its CEO when she said: “We almost need to start from scratch on this one. We’re living in a different world now and need to think differently.” Five years ago, a system like this—one with average margins and reasonable access to capital—would most likely try to stay the course and search for incremental growth opportunities. Instead, as this CEO went on to say, “Everything should be on the table—mergers, partnerships, divesting service lines, finding new revenue sources. If we don’t make bolder moves in the next few years, we may not make it.”

Health systems nationwide have reached an inflection point. The strongest performers are aggressively investing capital, forging new partnerships, and making strategic acquisitions, while the weakest performers are still in survival mode, mired in their day-to-day operations. When it comes to their future, it's important for the many systems in the middle to reject binary thinking: either merging or staying independent. Instead, they should explore and evaluate the increasing range of strategic options available to them, including comprehensive service line integration and new joint venture opportunities on the ambulatory side. Time is of the essence, and creative partnerships may offer the best chance of success in a changing environment. If your organization wants to discuss what kinds of partnerships may be right for you, please reach out.

On Our Podcast

Gist Healthcare Daily—All the headlines in healthcare policy, business, and more, in ten minutes or less every weekday morning.

Last Wednesday, host J. Carlisle Larsen spoke with Jennifer Wagner, Director of Medicaid Eligibility and Enrollment at the Center on Budget and Policy Priorities, about what we’ve learned from the last year of Medicaid redeterminations and how that may inform future Medicaid policy.

This upcoming Monday and Tuesday, we revisit JC’s conversation from last fall with Glen Tullman, CEO of employee healthcare navigation company Transcarent. In that two-part discussion, they talk more about Transcarent’s partnerships with major health systems across the country, as well as about how employer-sponsored healthcare coverage may change in the future.

And be sure to tune in every weekday morning to stay abreast of the day’s biggest healthcare news. Subscribe on Apple, Spotify, Google, or wherever fine podcasts are available.

Thanks for taking the time to read another week’s news and analysis. We’ll see you back here next Friday! In the meantime, if you’d like to peruse past editions of the Gist Weekly, please visit our archive.

Best regards,

The Gist Weekly team at Kaufman Hall