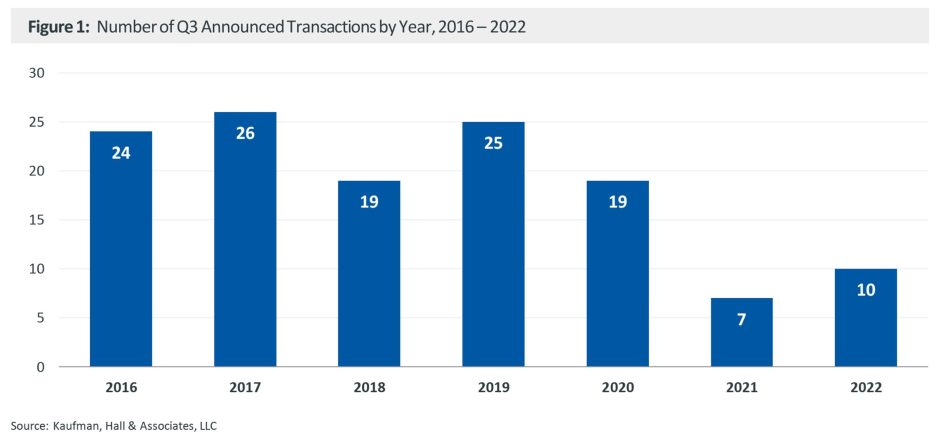

M&A activity between hospitals and health systems in Q3 2022 remained low, with 10 announced transactions, but comparable to slower activity in Q3 2021, which had seven announced transactions.

This quarter saw two transactions that met our definition of “mega” transaction (with smaller party annual revenues in excess of $1 billion). Mega transactions typically are strategic in nature, but financial/capital structure interests drove the two Q3 mega transactions. The two transactions were:

- Pure Health’s $500 million minority equity investment in Ardent Health Services[1]

- A transaction involving the sale by Medical Properties Trust, Inc., of nine hospitals and two related medical office buildings in California, Indiana, Nevada, and Pennsylvania to Prime Healthcare pursuant to a tenant purchase option

The largest strategic transaction in Q3 was UChicago Medicine’s acquisition of a controlling interest in AdventHealth’s Great Lakes Region.

Overview of Q3 Activity

The 10 announced transactions in Q3 2022 were slightly below the numbers we saw in Q1 and Q2. They were consistent, however, with the recent trend of activity running below historical, pre-pandemic levels and above the seven announced transactions in Q3 2021 (Figure 1).

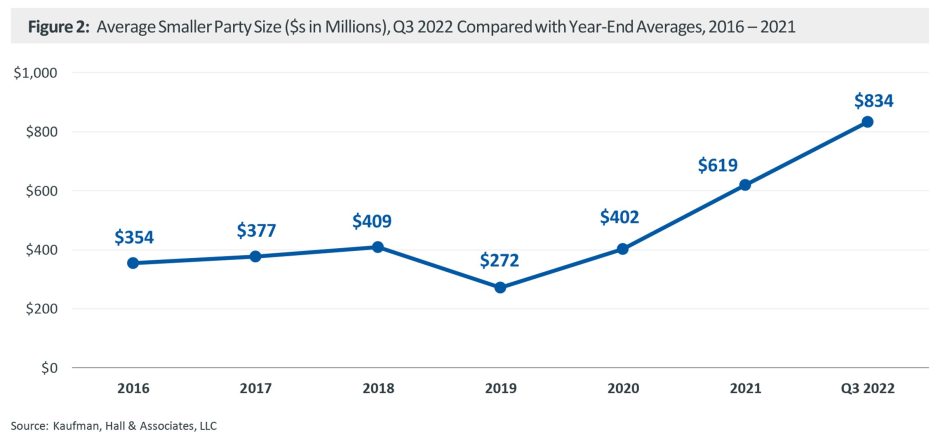

The size of the Q3 announced transactions generated an average smaller party size of $834 million, above the 2021 year-end average of $619 million (Figure 2).

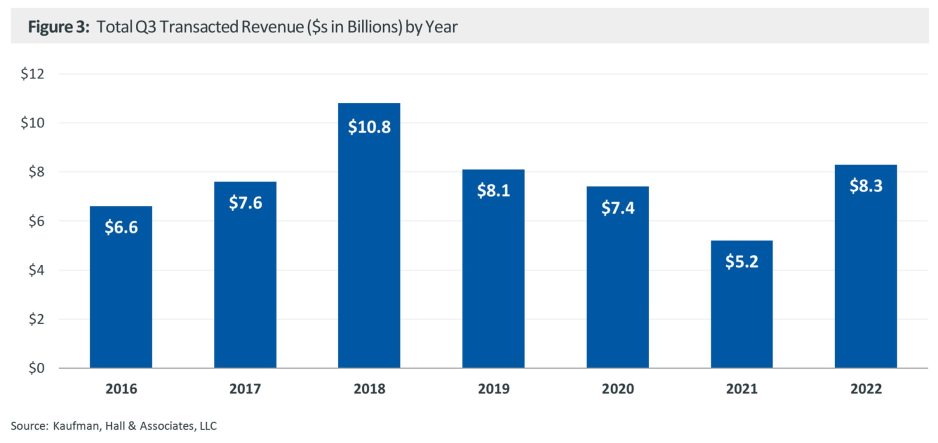

Total transacted revenue was $8.3 billion, above the $5.2 billion recorded in Q3 2021.

In two of the 10 announced Q3 transactions, the acquirer was a for-profit health system. In four transactions, there was an academic/university-affiliated acquirer and there was a religiously affiliated acquirer in one transaction. Other not-for-profit health systems were the acquirer in the remaining three transactions.

Spotlight on the For-Profit Sector

The for-profit sector has been the source of one of the most significant trends we have observed over the past year: portfolio realignment. In our 2021 year-end report, for example, we commented on several transactions involving for-profit sellers that signaled a trend toward rebalancing portfolio holdings to concentrate on core assets and markets. That trend toward portfolio realignment continued into Q1 of this year, when the percentage of transactions involving a for-profit seller reached an all-time high of 58%.

This quarter again saw interesting movement in the for-profit sector. In West Virginia, Community Health Systems (CHS) continued the trend of for-profit systems selling specific, stand-alone assets with its announced intention to sell Greenbrier Valley Medical Center to Vandalia Health. Vandalia Health is itself a new entity formed in September 2022 by the merger of Charleston Area Medical Center Health System and Mon Health; the acquisition of Greenbrier Valley will extend the new system’s geography into eastern West Virginia as it pursues a regional growth strategy.

In September, Pure Health—based in the United Arab Emirates (UAE)—announced its intention to acquire a $500 million minority equity investment in Ardent Health Services, a 30-hospital, for-profit health system with locations in six states. This investment represents a new type of capital provider in the U.S. market, where private equity firms have typically invested in specialty service providers or hospital management companies. Pure Health, a subsidiary of Alpha Dhabi Holding—is the largest healthcare platform in the UAE. The focus of the investment includes the opportunity to exchange healthcare knowledge across significantly different geographies. Pure Health’s CEO, Farhan Malik, said the deal represents an effort “to build relationships with leading U.S. healthcare providers to leverage the highest standards and best clinical practices to provide an unrivalled healthcare experience for patients in the UAE.”

Given the current volatile interest rate environment, we anticipate that systems (both for-profit and not-for-profit) will be focusing heavily on their capital structures, which may spur more financially driven transactions.

Looking Forward

Portfolio realignment and focused regional growth are among the trends we expect to continue, as hospitals and health systems focus on building depth and breadth of services within core markets. We also anticipate continued growth in partnership models that can offer new sources of capital and new capabilities as organizations emerge from an extremely challenging financial year and refocus on strategic growth opportunities.

Co-contributors:

Anu Singh, Managing Director and Leader of the Partnerships, Mergers & Acquisitions Practice, asingh@kaufmanhall.com

Kris Blohm, Managing Director, kblohm@kaufmanhall.com

Nora Kelly, Managing Director, nkelly@kaufmanhall.com

Courtney Midanek, Managing Director, cmidanek@kaufmanhall.com

Chris Peltola, Assistant Vice President, cpeltola@kaufmanhall.com

Blake Dorris, Assistant Vice President, bdorris@kaufmanhall.com

Matthew Santulli, Senior Associate, msantulli@kaufmanhall.com

For media inquiries, please contact Haydn Bush at hbush@kaufmanhall.com

[1] Consistent with prior reports, our methodology includes minority control/equity investments in our reported announced transactions. In this case, Ardent Health Services’ annual revenue of $4.9 billion was included in our Q3 2022 metrics, including average seller size by revenue and total transacted revenue for the quarter.

[2] Kaufman Hall served as exclusive transaction advisor to Vandalia Health.