Hospital and Health System Transactions

In the final quarter of 2022, we noted an uptick in transaction activity with 17 announced transactions. That activity level was almost matched in Q1 2023, with 15 announced transactions. The trend toward larger transaction size was maintained, with the average size of the seller, or smaller party, just below the historic high reached in 2022. Total transacted revenue for the quarter was also near historic highs.

One mega merger (a transaction in which the smaller party has annual revenues in excess of $1 billion) was announced in Q1 2023: the combination of New Mexico-based Presbyterian Health Services and Iowa-based UnityPoint Health. This transaction is also another example of a recent trend toward cross-regional partnerships, discussed in greater detail below.

Operational and financial headwinds are increasingly cited as a factor in announced transactions, and we predict that these pressures may prompt a new wave of transaction activity. Partnerships that transcend geography--focused on expanding or enhancing capabilities--are continuing. For-profit health systems remain focused on portfolio realignment efforts, with several significant hospital sales among this quarter’s transactions.

Overview of Q1 Activity

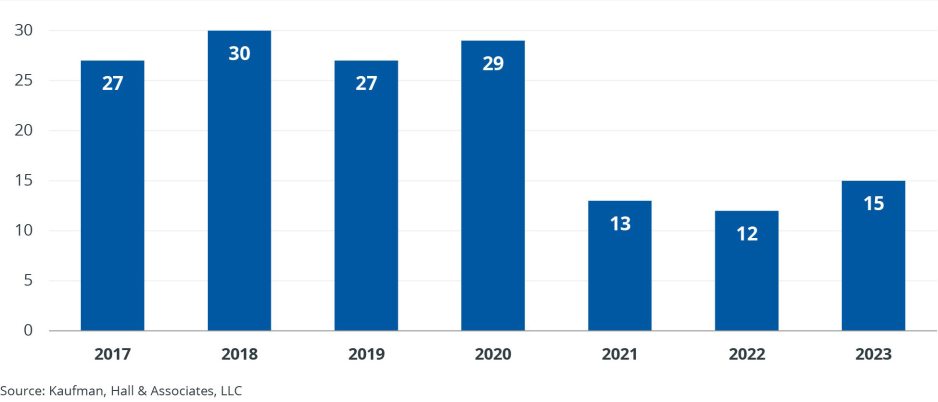

With 15 announced transactions, Q1 2023 was just below the post-pandemic high of 17 announced transactions in Q4 2022 (Figure 1).

Figure 1: Number of Q1 Announced Transactions by Year, 2017 – 2023

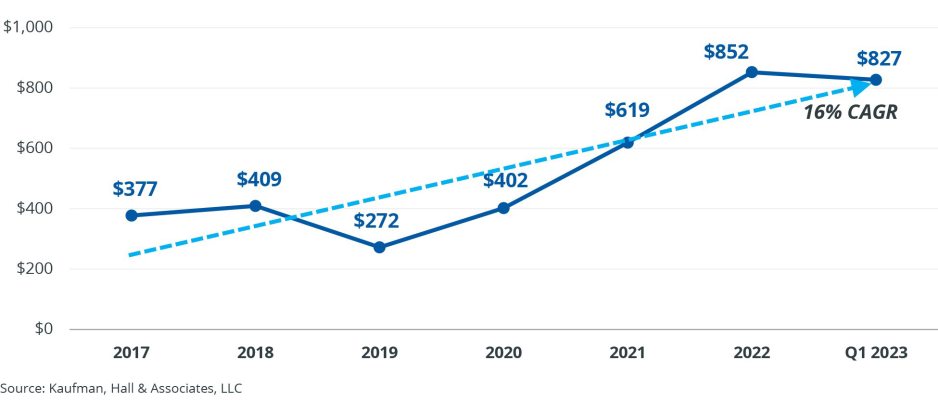

The average size of the seller or smaller party in Q1 announced transactions, as measured in annual revenues, remained very high at $827 million, just below the historic 2022 year-end average of $852 million (Figure 2).

Figure 2: Average Seller Size ($s in Millions), Q1 2023 Compared with Year-End Averages, 2017 – 2022

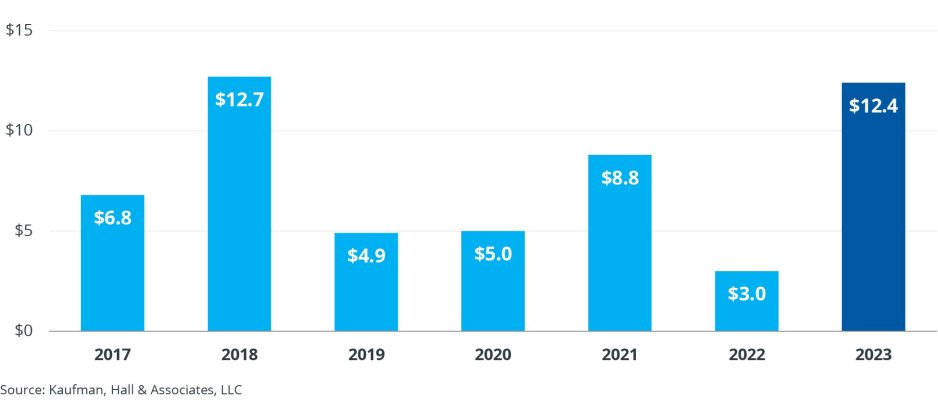

Similarly, total transacted revenue for the quarter also was near historic highs at $12.4 billion, just below the Q1 record of $12.7 billion set in 2018 (Figure 3).

Figure 3: Total Q1 Transacted Revenue ($s in Billions) by Year, 2017 – 2023

In 14 of the 15 announced Q1 transactions, the acquirer was a not-for-profit health system. Of these 14, three were academic/university-affiliated and five were religiously affiliated organizations.

A New Wave of Mergers

Before the COVID-19 pandemic struck in 2020, smaller independent hospitals and health systems were pursuing partnership opportunities to ensure their continued strategic and financial viability in an environment where high fixed costs, downward pressure on payments, and increasing competition for outpatient services were creating an increasingly difficult operating environment.

These pressures have only intensified over the past three years. The stress on frontline staff during the peak of the pandemic prompted early retirements and moves to contract or non-clinical positions, driving up labor demand, and therefore, costs. Inflationary pressures drove up non-labor expenses as well. Volumes in key service areas—including emergency department admissions and inpatient surgical procedures—remain below pre-pandemic levels. Investment losses in a volatile market have limited opportunities to mitigate negative operating margins, which more than half of the hospitals providing data for Kaufman Hall’s National Hospital Flash Report are experiencing. The movement of procedures to more competitive outpatient markets has continued.

What is increasingly clear is that a new type of post-pandemic activity is taking shape, as mid-sized regional health systems seek partners while they remain in a position of financial strength, with some looking to balance their desire to influence local healthcare delivery with utilizing the capabilities and resources of larger health systems. This trend is reflected in the rapidly increasing size of the smaller party in M&A transactions over the past few years and the number of transactions where the smaller party has between $250 million and $750 million in annual revenues.

The new realities of the operating environment also appear in announcements of new transactions. The CEO and president of Flagler Health+, which announced a merger with UF Health in Florida, noted that the system was “facing new and evolving industry headwinds” and needed “access to additional resources” to support key community-focused service lines, including behavioral health and women’s health.[1] Singing River Health System in coastal Mississippi cited similar reasons, particularly related to capital capacity to support required strategic system-wide investments, in announcing its decision to merge with Louisiana-based Franciscan Missionaries of Our Lady (FMOL) Health System.[2]

As health systems adapt to a new environment of razor-thin—and for many organizations, negative—operating margins, we anticipate that this new wave of mergers will continue.

Cross-Regional Partnerships

Health systems are increasingly moving beyond the traditional constraints of geography to find partners. Examples from 2022 included the merger of Advocate Aurora Health, based in Illinois and Wisconsin, with Atrium Health, based in North Carolina, and the merger of Utah-based Intermountain Health with SCL Health, based in Colorado. This quarter, New Mexico-based Presbyterian Healthcare Services and Iowa-based UnityPoint Health announced their intention to merge. We fully expect this type of activity to continue and even intensify.

These transactions typically involve large, regional health systems. While the traditional rationale of pursuing opportunities for savings as the partners centralize and combine administrative functions may apply, the main drivers are broader in nature. First, a heightened level of “micro” market regulatory scrutiny makes expanding market presence within a health system’s existing service area more challenging and, as a result, diversification of revenue and pursuit of growth has been driven by broader geographic pursuits. Even more evident in the largest system transactions is the intent to combine, expand, and optimize complementary capabilities. Presbyterian Health Services, for example, has longstanding experience with a provider-based health plan, and UnityPoint’s CEO noted in an interview with Modern Healthcare that this experience could help it bolster its Medicare Shared Savings Program and accountable care organization offerings.[3]

In the same article, Presbyterian Healthcare Services’ CEO noted that recent adverse changes in the operating environment are structural, not cyclical. The need to think beyond traditional boundaries to seize opportunities for greater efficiencies and enhanced capabilities will remain compelling in the months and years ahead.

For-Profit Portfolio Realignment

A trend that we have been tracking since 2017—the realignment of for-profit health system portfolios—showed continued strength in Q1 2023, particularly for hospitals that are, and have historically been, high financial and operational performers:

- Community Health System announced the sale of two North Carolina hospitals (Lake Norman Regional Medical Center and Davis Regional Medical Center) to Novant Health,[4] and the sale of Plateau Regional Medical Center in West Virginia to Vandalia Health.[5]

- Steward Health Care announced the sale of its Utah care sites, including five hospitals and more than 35 medical group clinics, to CommonSpirit Health/Centura Health.[6]

- Tenet Health announced that John Muir Health would become the sole owner of San Ramon Regional Medical Center, buying out Tenet’s 51% ownership stake (John Muir acquired a 49% ownership stake in 2013).[7]

These sales represent for-profit health systems’ ongoing efforts to focus their resources on core markets with good growth potential. For-profit systems are facing the same operational and financial headwinds as not-for-profit systems, and these headwinds are affecting decisions on which assets should remain in the portfolio.

Looking Forward

A majority of hospitals and health systems have endured negative operating margins for more than a year, according to data from Kaufman Hall’s National Hospital Flash Report. As organizations seek a path to long-term sustainability in this new environment, we anticipate that partnerships between health systems will be an important component of that effort.

Select Recent Transactions in Which Kaufman Hall Served as an Advisor

Kaufman Hall served as an advisor in eight of the 15 transactions announced in Q1 2023. Examples of recently announced or completed transactions on which we advised include:

- Memorial Hospital and Health Care Center/Deaconess Health System (sell-side advisor)

- Novant Health/Lake Norman Regional Medical Center & Davis Regional Medical Center (CHS) (buy-side advisor)

- Vandalia Health/Plateau Medical Center (CHS) (buy-side advisor)

- Centura & CommonSpirit/Steward (buy-side advisor)

- Sparrow/University of Michigan Health (sell-side advisor)

- Flagler Health+/UF Health (sell-side advisor)

- Franciscan Missionaries of Our Lady Health System/Singing River Health System (buy-side advisor)

- Presbyterian Health Services/UnityPoint Health (facilitation advisor)

Co-contributors:

Anu Singh, Managing Director and Leader of the Partnerships, Mergers & Acquisitions Practice, asingh@kaufmanhall.com

Kris Blohm, Managing Director, kblohm@kaufmanhall.com

Nora Kelly, Managing Director, nkelly@kaufmanhall.com

Courtney Midanek, Managing Director, cmidanek@kaufmanhall.com

Rob Gialessas, Vice President, rgialessas@kaufmanhall.com

Chris Peltola, Vice President, cpeltola@kaufmanhall.com

Blake Dorris, Assistant Vice President, bdorris@kaufmanhall.com

Matthew Santulli, Assistant Vice President, msantulli@kaufmanhall.com

For media inquiries, please contact Haydn Bush at hbush@kaufmanhall.com

[1] Macdonald, D.: “Flagler Health+ Says ‘Evolving Industry Headwinds’ Led to Planned Merger with UF Health,”Jacksonville Daily Record, Feb. 3, 2023. Flagler Health+: “Flagler Health+ Announces Plans to Join UF Health, Elevate and Expand Health Care Services,” Press release, Feb. 2, 2023.

[2] Duchmann, H.: “Franciscan Health System Acquiring Three Mississippi Hospitals.”Greater Baton Rouge Business Report, March 29, 2023.

[3] Kacik, A.: “Presbyterian Healthcare Services, UnityPoint Health Announce Merger.”Modern Healthcare, March 2, 2023.

[4] Muoio, D.: “Community Health Systems Sells 2 North Carolina Hospitals to Novant Health for $320 Million.”Fierce Healthcare, Feb. 28, 2023.

[5] Keenan, S.: “Agreement Inked for Plateau Medical Center Acquisition.”The Register-Herald, Jan. 12, 2023.

[6] Centura Health: “Centura Health to Acquire Utah Care Sites from Steward Health Care.” Press release, Feb. 15, 2023.

[7] Gamble, M.: “Tenet to Sell California Hospital.”Becker’s Hospital Review, Jan. 11, 2023.